Energy

Next federal government should close widening gap between Canadian and U.S. energy policy

From the Fraser Institute

After accounting for backup, energy storage and associated indirect costs—estimated solar power costs skyrocket from US$36 per megawatt hour (MWh) to as high as US$1,548, and wind generation costs increase from US$40 to up to US$504 per MWh.

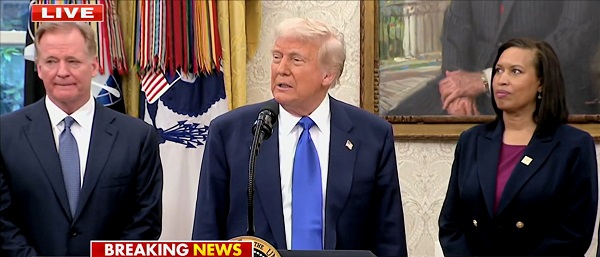

At a recent energy conference in Houston, U.S. Energy Secretary Chris Wright said the Trump administration will end the Biden administration’s “irrational, quasi-religious policies on climate change that imposed endless sacrifices on our citizens.” He added that “Natural gas is responsible for 43 per cent of U.S. electricity production,” and beyond the obvious scale and cost problems, there’s “simply no physical way that wind, solar and batteries could replace the myriad uses of natural gas.”

In other words, as a federal election looms, once again the United States is diverging from Canada when it comes to energy policy.

Indeed, wind power is particularly unattractive to Wright because of its “incredibly high prices,” “incredibly huge investment” and “large footprint on the local communities,” which make it unattractive to people living nearby. Globally, Wright observes, “Natural gas currently supplies 25 per cent of raw energy globally, before it is converted into electricity or some other use. Wind and solar only supply about 3 per cent.”

And he’s right. Renewables are likely unable, physically or economically, to replace natural gas power production to meet current or future needs for affordable, abundant and reliable energy.

In a recent study published by the Fraser Institute, for example, we observed that meeting Canada’s predicted electricity demand through 2050 using only wind power (with natural gas discouraged under current Canadian climate policies) would require the construction of approximately 575 wind-power installations, each the size of Quebec’s Seigneurie de Beaupré wind farm, over 25 years. However, with a construction timeline of two years per project, this would equate to 1,150 construction years. This would also require more than one million hectares of land—an area nearly 14.5 times the size of Calgary.

Solar power did not fare much better. According to the study, to meet Canada’s predicted electricity demand through 2050 with solar-power generation would require the construction of 840 solar-power generation stations the size of Alberta’s Travers Solar Project. At a two-year construction time per facility, this adds up to 1,680 construction years to accomplish.

And at what cost? While proponents often claim that wind and solar sources are cheaper than fossil fuels, they ignore the costs of maintaining backup power to counter the unreliability of wind and solar power generation. A recent study published in Energy, a peer-reviewed energy and engineering journal, found that—after accounting for backup, energy storage and associated indirect costs—estimated solar power costs skyrocket from US$36 per megawatt hour (MWh) to as high as US$1,548, and wind generation costs increase from US$40 to up to US$504 per MWh.

The outlook for Canada’s switch to renewables is also dire. TD Bank estimated that replacing existing gas generators with renewables (such as solar and wind) in Ontario could increase average electricity costs by 20 per cent by 2035 (compared to 2021 costs). In Alberta, electricity prices would increase by up to 66 per cent by 2035 compared to a scenario without changes.

Under Canada’s current greenhouse gas (GHG) regulatory regime, natural gas is heavily disfavoured as a potential fuel for electricity production. The Trudeau government’s Clean Electricity Regulations (CER) would begin curtailing the use of natural gas beginning in 2035, leading largely to a cessation of natural gas power generation by 2050. Under CER and Ottawa’s “net-zero 2050” GHG emission framework, Canada will be wedded to a quixotic mission to displace affordable reliable natural gas power-generation with expensive unreliable renewables that are likely unable to meet expected future electricity demand.

With a federal election looming, Canada’s policymakers should pay attention to new U.S. energy policy on natural gas, and pull back from our headlong rush into renewable power. To avoid calamity, the next federal government should scrap the Trudeau-era CER and reconsider the entire “net-zero 2050” agenda.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Daily Caller

Trump Issues Order To End Green Energy Gravy Train, Cites National Security

From the Daily Caller News Foundation

By Audrey Streb

President Donald Trump issued an executive order calling for the end of green energy subsidies by strengthening provisions in the One Big Beautiful Bill Act on Monday night, citing national security concerns and unnecessary costs to taxpayers.

The order argues that a heavy reliance on green energy subsidies compromise the reliability of the power grid and undermines energy independence. Trump called for the U.S. to “rapidly eliminate” federal green energy subsidies and to “build upon and strengthen” the repeal of wind and solar tax credits remaining in the reconciliation law in the order, directing the Treasury Department to enforce the phase-out of tax credits.

“For too long, the Federal Government has forced American taxpayers to subsidize expensive and unreliable energy sources like wind and solar,” the order states. “Reliance on so-called ‘green’ subsidies threatens national security by making the United States dependent on supply chains controlled by foreign adversaries.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Former President Joe Biden established massive green energy subsidies under his signature 2022 Inflation Reduction Act (IRA), which did not receive a single Republican vote.

The reconciliation package did not immediately terminate Biden-era federal subsidies for green energy technology, phasing them out over time instead, though some policy experts argued that drawn-out timelines could lead to an indefinite continuation of subsidies. Trump’s executive order alludes to potential loopholes in the bill, calling for a review by Secretary of the Treasury Scott Bessent to ensure that green energy projects that have a “beginning of construction” tax credit deadline are not “circumvented.”

Additionally, the executive order directs the U.S. to end taxpayer support for green energy supply chains that are controlled by foreign adversaries, alluding to China’s supply chain dominance for solar and wind. Trump also specifically highlighted costs to taxpayers, market distortions and environmental impacts of subsidized green energy development in explaining the policy.

Ahead of the reconciliation bill becoming law, Trump told Republicans that “we’ve got all the cards, and we are going to use them.” Several House Republicans noted that the president said he would use executive authority to enhance the bill and strictly enforce phase-outs, which helped persuade some conservatives to back the bill.

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller2 days ago

Daily Caller2 days agoBlackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

National1 day ago

National1 day agoLiberal ‘Project Fear’ A Longer Con

-

Censorship Industrial Complex23 hours ago

Censorship Industrial Complex23 hours agoCanadian pro-freedom group sounds alarm over Liberal plans to revive internet censorship bill

-

Crime23 hours ago

Crime23 hours agoTrump supporters cry foul after DOJ memo buries the Epstein sex trafficking scandal

-

Daily Caller23 hours ago

Daily Caller23 hours agoTrump Issues Order To End Green Energy Gravy Train, Cites National Security

-

Daily Caller16 hours ago

Daily Caller16 hours agoUSAID Quietly Sent Thousands Of Viruses To Chinese Military-Linked Biolab