Uncategorized

Newly empowered House Dems pass funding plan without wall

WASHINGTON — On their first day in the majority, House Democrats have passed a plan to re-open the government without funding President Donald Trump’s promised border wall.

The largely party-line votes Thursday night came after Trump made a surprise appearance at the White House briefing room, pledging to keep up the fight for his signature campaign promise.

House Speaker Nancy Pelosi said Trump and Senate Republicans should “take yes for an answer” and approve the border bill, which was virtually identical to a plan the Senate adopted on a voice vote last month.

“We’re not doing a wall. Does anyone have any doubt that we’re not doing a wall?” Pelosi told reporters at a news conference Thursday night.

Pelosi, who was elected speaker earlier Thursday, also took a shot a Trump, calling his proposal “a wall between reality and his constituents.”

Trump strode into the White House briefing room Thursday — the 13th day of the partial government shutdown —and declared that “without a wall you cannot have border security.” He then left without taking questions from reporters.

The appearance came hours after the new Congress convened, with Democrats taking majority control of the House and returning Pelosi to the speakership after eight years of GOP control. The Democratic legislation to re-open the government without funding the wall is going nowhere in the Senate, where Republicans want Trump’s endorsement before voting on a funding package.

Trump is demanding billions of dollars to build his wall along the U.S. border with Mexico, which the Democrats have refused.

Asked if she would give Trump $1 for a wall to reopen the government, Pelosi said: “One dollar? Yeah, one dollar. The fact is a wall is an immorality. It’s not who we are as a nation.”

Congressional leaders from both parties met with Trump at the White House Wednesday, but failed to make progress during their first sit-down in weeks. The White House has invited the leaders back Friday for another round of talks that officials have suggested might be more successful now that Pelosi has been sworn in.

Reporters were told Thursday that White House Press Secretary Sarah Huckabee Sanders would be holding a hastily called late afternoon briefing. Instead, out walked Trump, flanked by members of the unions that represent border patrol and immigration enforcement agents. It was his first time delivering remarks at the briefing room podium.

“You can call it a barrier, you can call it whatever you want,” Trump said. “But essentially we need protection in our country. We’re going to make it good. The people of our country want it.”

Trump said his meeting with the union officials had long been planned and just happened to come at “a very opportune time.” He also claimed his refusal to budge was winning praise, telling reporters, “I have never had so much support as I have in the last week over my stance for border security.”

Polls show a majority of Americans oppose the border wall, although Republicans strongly support it.

White House and Department of Homeland Security officials have spent recent days trying to make a public and private case that the situation at the border has reached a “crisis” situation that demands more money than Democrats have offered.

Trump tweeted an ominous video Thursday with images of what appeared to be migrants trying to rush the border and clashing with law enforcement, beneath the words “crisis at the border,” ”drugs” and “crime.” The video concludes with footage of Trump at the border along with audio from one of his rallies in which he vows to build his promised border wall and the crowd chants “Build the wall!”

The Democratic package to end the shutdown includes a bill to temporarily fund the Department of Homeland Security at current levels — with $1.3 billion for border security, far less than Trump has said he wants— through Feb. 8 as bipartisan talks would continue. It was approved, 239-192.

Democrats also approved a separate measure to fund the departments of Agriculture, Interior, Housing and Urban Development and others closed by the partial shutdown, at levels Senate Republicans had largely agreed to last year. The bill, which would provide money through the end of the fiscal year Sept. 30, was approved, 241-190, with several House Republicans joining Democrats.

The White House has rejected the Democratic package.

“Why not fully fund the Department of Homeland Security? Why doesn’t the Pelosi bill do that?” said White House

Senate Democratic Leader Chuck Schumer urged Majority Leader Mitch McConnell to put the House Democratic package on the Senate floor and send it to the president, saying it would show Trump “the sweet light of reason.”

McConnell has dismissed the idea as a “total nonstarter” and a waste of time.

But some Republican senators appeared open to at least part of the Democrats’ proposal.

“I’m not saying their whole plan is a valid plan, but I see no reason why the bills that are ready to go and on which we’ve achieved an agreement should be held hostage to this debate over border security,” said Sen. Susan Collins, R-Maine.

“Congress needs to take further action on border security, but that work should be done when the government is fully open,” added Sen. Cory Gardner, R-Colo.

Trump has said the partial shutdown, which began Dec. 22, will last “as long as it takes” to get the funding he wants.

The White House said Trump made calls Thursday to the family of Cpl. Ronil Singh, the Newman, California, police officer shot to death during a Dec. 26 traffic stop. The suspected shooter is a Mexican man accused of living in the U.S. illegally. Republicans have seized on the case to call for tougher border security.

___

Associated Press writers Lisa Mascaro, Laurie Kellman, Kevin Freking, Alan Fram and Mary Clare Jalonick contributed to this report.

Matthew Daly, Catherine Lucey And Jill Colvin, The Associated Press

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Business1 day ago

Business1 day agoCanada Hits the Brakes on Population

-

Crime13 hours ago

Crime13 hours agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

International2 days ago

International2 days agoBondi Beach Shows Why Self-Defense Is a Vital Right

-

Crime2 days ago

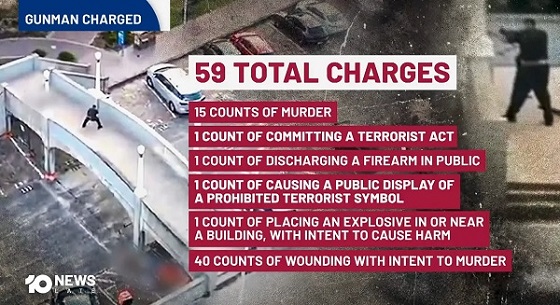

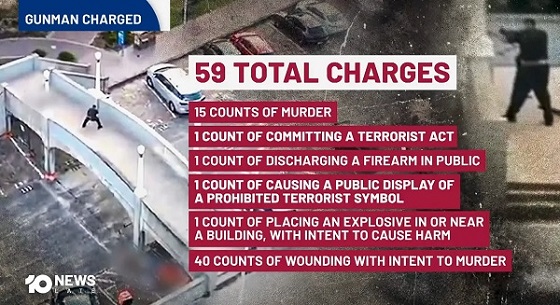

Crime2 days agoBondi Beach Survivor Says Cops Prevented Her From Fighting Back Against Terrorists

-

International2 days ago

International2 days agoHouse Rejects Bipartisan Attempt To Block Trump From Using Military Force Against Venezuela

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoCanada Lets Child-Porn Offenders Off Easy While Targeting Bible Believers

-

Crime2 days ago

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat