Fraser Institute

New Prime Minister Carney’s Fiscal Math Doesn’t Add Up

From the Fraser Institute

By Jason Clemens and Jake Fuss

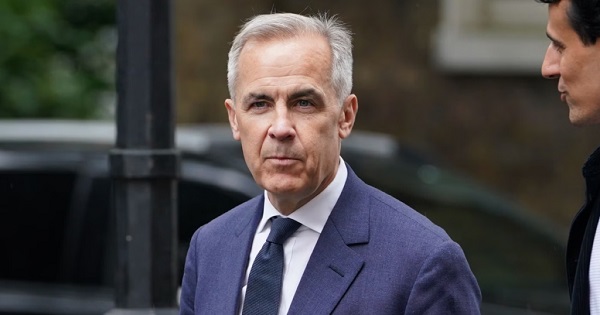

For the first time in Canada’s history, the Prime Minister has never sought or won a democratic election in any parliament. Mark Carney’s victory to replace Justin Trudeau as the leader of the Liberal Party means he is now the Prime Minister. Carney’s resume and achievements make him one of the most accomplished prime ministers ever. Still, there are a number of basic questions about Carney’s fiscal and economic math that Canadians need to consider carefully as we enter an election.

Carney’s accomplishments should be recognized. He has a bachelor’s degree in economics from Harvard and both a masters and doctoral degrees in economics from Oxford University. He spent over a decade at Goldman Sachs, a leading US-based financial firm then left to take up senior positions at both the Bank of Canada and later the Department of Finance. He became the Governor of the Bank of Canada in 2007 and then the Governor of the Bank of England in 2012. After his tenure at the Bank of England, Carney took up a number of private sector posts including chairman at Brookfield Asset Management, a major Canadian company.

Despite these obvious accomplishments and a deep CV, Carney’s proposed fiscal policies pose a number of serious questions.

Carney self-characterizes as a pragmatist and someone who will bring the Liberal Party back to the political centre after having been pushed to the left by former prime minister Justin Trudeau. Even former prime minister Jean Chrétien, one of the country’s most electorally successful prime ministers called for the party to move back to the centre.

Specifically, Carney said he would “cap” the size of the federal government workforce and reduce federal spending through a review of program spending as was done in 1994-95. He also indicated that the operating budget would be balanced within three years. He criticized the current government for spending too much and not investing enough, and for missing spending targets and violating its own fiscal guardrails. The implication of all these policies is that the role of the federal government will be rolled back with reductions in spending and federal employment, and reducing regulations. In many ways, these policies mirror those of former prime minister Chrétien.

However, there are numerous statements by Carney that seem to contradict these policies, or at the very least, water them down significantly. Consider, for instance, that Carney has indicated there will be no cuts to transfers to provincial governments (19.8 per cent of budget spending), no reductions in the income-transfers to individuals and families (25.8 per cent), and the government doesn’t determine interest charges on its debt (another 9.7 per cent). So, Carney has already taken over half the federal budget off the table for reductions.

It’s not clear whether he would reduce what’s referred to as “Other Transfers” which includes support for EV programs and investment incentives. This represents 17.9 per cent of the current budget. And if you read any of Carney’s climate-related initiatives, it appears this category of spending will actually increase, not decrease. Moreover, Carney stated he won’t touch some transfers such as the national dental care and pharmacare programs.

The major remaining category of federal spending is “operating expenses”, which includes the costs of running more than 100 government departments, agencies and Crown corporations. It’s expected to reach $130.6 billion this year and represents 23.4 per cent of the federal budget. But again, Carney has only committed to “capping” the federal workforce despite significant growth since 2015 and then review programs. Unless he’s willing to actually reduce federal employment and/or challenge existing contracts with the civil service, it’s not clear how he can find meaningful savings in the short term.

Recall that the expected deficit this year is $42.2 billion and to balance the budget over the next three years, Carney needs to find roughly $30 billion in savings. (Some of the deficit reduction is expected to come from economic growth, which increases government revenues).

However, this ignores the pressure on the federal government to markedly and quickly increase defense spending. A recent analysis estimated that the federal government would have to increase defense spending in 2027-28 by $68.8 billion to meet its NATO commitment, which is what President Trump is demanding. This single measure of spending could materially derail the new prime minister’s commitment to a balanced budget within three years.

But Carney has complicated the nation’s finances by committing to separating operating spending from capital spending. The former are annual spending requirements like salaries and wages to federal employees, income transfers to people through programs like EI and Old Age Security, and transfers to the provinces for health and social programs. Carney has committed to balancing the revenues collected for these purposes against spending.

However, he wants to remove anything that is deemed an “investment” or “capital”. That means spending on infrastructure like roads and ports, defense spending on equipment, and energy projects.

While Carney has committed to only running a “small deficit” on such spending, the commitment is eerily similar to Trudeau’s commitment in 2015 to run “small deficits” for just “three years” and the budget will balance itself through economic growth. The total federal gross debt has increased from $1.1 trillion when Trudeau took office in 2015 to an estimated $2.3 trillion this year.

The clear risk is that a Carney government will simply reduce spending in the operating budget and move it to the capital budget, thus balancing the latter while still piling up government debt.

Clarity is required from the new prime minister with respect to: 1) What operating expenses does he plan to reduce (or perhaps more generally is open to reducing) over the next three years to reach a balanced operating budget? 2) What specific commitment is Carney making on defense spending over the next three years? 3) What current spending will the new prime minister move or potentially move from the budget to his new capital budget? And finally, 4) What measures will be taken if revenues don’t materialize as expected and/or spending increases more than planned to ensure a balanced operating budget in three years?

Until greater clarity and details are provided, it’s hard, even near impossible, to know the extent to which the new prime minister is pragmatically offering a plan for more sustainable government finances versus playing politics by promising everything to everyone.

Business

Residents in economically free states reap the rewards

From the Fraser Institute

A report published by the Fraser Institute reaffirms just how much more economically free some states are compared with others. These are places where citizens are allowed to make more of their economic choices. Their taxes are lighter, and their regulatory burdens are easier. The benefits for workers, consumers and businesses have been clear for a long time.

There’s another group of states to watch: “movers” that have become much freer in recent decades. These are states that may not be the freest, but they have been cutting taxes and red tape enough to make a big difference.

How do they fare?

I recently explored this question using 22 years of data from the same Economic Freedom of North America index. The index uses 10 variables encompassing government spending, taxation and labour regulation to assess the degree of economic freedom in each of the 50 states.

Some states, such as New Hampshire, have long topped the list. It’s been in the top five for three decades. With little room to grow, the Granite State’s level of economic freedom hasn’t budged much lately. Others, such as Alaska, have significantly improved economic freedom over the last two decades. Because it started so low, it remains relatively unfree at 43rd out of 50.

Three states—North Carolina, North Dakota and Idaho—have managed to markedly increase and rank highly on economic freedom.

In 2000, North Carolina was the 19th most economically free state in the union. Though its labour market was relatively unhindered by the state’s government, its top marginal income tax rate was America’s ninth-highest, and it spent more money than most states.

From 2013 to 2022, North Carolina reduced its top marginal income tax rate from 7.75 per cent to 4.99 per cent, reduced government employment and allowed the minimum wage to fall relative to per-capita income. By 2022, it had the second-freest labour market in the country and was ninth in overall economic freedom.

North Dakota took a similar path, reducing its 5.54 per cent top income tax rate to 2.9 per cent, scaling back government employment, and lowering its minimum wage to better reflect local incomes. It went from the 27th most economically free state in the union in 2000 to the 10th freest by 2022.

Idaho saw the most significant improvement. The Gem State has steadily improved spending, taxing and labour market freedom, allowing it to rise from the 28th most economically free state in 2000 to the eighth freest in 2022.

We can contrast these three states with a group that has achieved equal and opposite distinction: California, Delaware, New Jersey and Maryland have managed to decrease economic freedom and end up among the least free overall.

What was the result?

The economies of the three liberating states have enjoyed almost twice as much economic growth. Controlling for inflation, North Carolina, North Dakota and Idaho grew an average of 41 per cent since 2010. The four repressors grew by just 24 per cent.

Among liberators, statewide personal income grew 47 per cent from 2010 to 2022. Among repressors, it grew just 26 per cent.

In fact, when it comes to income growth per person, increases in economic freedom seem to matter even more than a state’s overall, long-term level of freedom. Meanwhile, when it comes to population growth, placing highly over longer periods of time matters more.

The liberators are not unique. There’s now a large body of international evidence documenting the freedom-prosperity connection. At the state level, high and growing levels of economic freedom go hand-in-hand with higher levels of income, entrepreneurship, in-migration and income mobility. In economically free states, incomes tend to grow faster at the top and bottom of the income ladder.

These states suffer less poverty, homelessness and food insecurity and may even have marginally happier, more philanthropic and more tolerant populations.

In short, liberation works. Repression doesn’t.

Alberta

Alberta Next Panel calls for less Ottawa—and it could pay off

From the Fraser Institute

By Tegan Hill

Last Friday, less than a week before Christmas, the Smith government quietly released the final report from its Alberta Next Panel, which assessed Alberta’s role in Canada. Among other things, the panel recommends that the federal government transfer some of its tax revenue to provincial governments so they can assume more control over the delivery of provincial services. Based on Canada’s experience in the 1990s, this plan could deliver real benefits for Albertans and all Canadians.

Federations such as Canada typically work best when governments stick to their constitutional lanes. Indeed, one of the benefits of being a federalist country is that different levels of government assume responsibility for programs they’re best suited to deliver. For example, it’s logical that the federal government handle national defence, while provincial governments are typically best positioned to understand and address the unique health-care and education needs of their citizens.

But there’s currently a mismatch between the share of taxes the provinces collect and the cost of delivering provincial responsibilities (e.g. health care, education, childcare, and social services). As such, Ottawa uses transfers—including the Canada Health Transfer (CHT)—to financially support the provinces in their areas of responsibility. But these funds come with conditions.

Consider health care. To receive CHT payments from Ottawa, provinces must abide by the Canada Health Act, which effectively prevents the provinces from experimenting with new ways of delivering and financing health care—including policies that are successful in other universal health-care countries. Given Canada’s health-care system is one of the developed world’s most expensive universal systems, yet Canadians face some of the longest wait times for physicians and worst access to medical technology (e.g. MRIs) and hospital beds, these restrictions limit badly needed innovation and hurt patients.

To give the provinces more flexibility, the Alberta Next Panel suggests the federal government shift tax points (and transfer GST) to the provinces to better align provincial revenues with provincial responsibilities while eliminating “strings” attached to such federal transfers. In other words, Ottawa would transfer a portion of its tax revenues from the federal income tax and federal sales tax to the provincial government so they have funds to experiment with what works best for their citizens, without conditions on how that money can be used.

According to the Alberta Next Panel poll, at least in Alberta, a majority of citizens support this type of provincial autonomy in delivering provincial programs—and again, it’s paid off before.

In the 1990s, amid a fiscal crisis (greater in scale, but not dissimilar to the one Ottawa faces today), the federal government reduced welfare and social assistance transfers to the provinces while simultaneously removing most of the “strings” attached to these dollars. These reforms allowed the provinces to introduce work incentives, for example, which would have previously triggered a reduction in federal transfers. The change to federal transfers sparked a wave of reforms as the provinces experimented with new ways to improve their welfare programs, and ultimately led to significant innovation that reduced welfare dependency from a high of 3.1 million in 1994 to a low of 1.6 million in 2008, while also reducing government spending on social assistance.

The Smith government’s Alberta Next Panel wants the federal government to transfer some of its tax revenues to the provinces and reduce restrictions on provincial program delivery. As Canada’s experience in the 1990s shows, this could spur real innovation that ultimately improves services for Albertans and all Canadians.

-

Haultain Research1 day ago

Haultain Research1 day agoSweden Fixed What Canada Won’t Even Name

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoUS Under Secretary of State Slams UK and EU Over Online Speech Regulation, Announces Release of Files on Past Censorship Efforts

-

Business1 day ago

Business1 day agoWhat Do Loyalty Rewards Programs Cost Us?

-

Business14 hours ago

Business14 hours agoLand use will be British Columbia’s biggest issue in 2026

-

Business11 hours ago

Business11 hours agoStripped and shipped: Patel pushes denaturalization, deportation in Minnesota fraud

-

Energy2 hours ago

Energy2 hours agoRulings could affect energy prices everywhere: Climate activists v. the energy industry in 2026

-

Digital ID58 mins ago

Digital ID58 mins agoThe Global Push for Government Mandated Digital IDs And Why You Should Worry

-

Energy14 hours ago

Energy14 hours agoWhy Japan wants Western Canadian LNG