Alberta

New court application alleges Dr. Deena Hinshaw withheld information

News release from The Justice Centre for Constitutional Freedoms

CALGARY: The Justice Centre says a court application has been filed to compel Dr. Deena Hinshaw to re-attend court for further cross-examination in the constitutional challenge to her lockdown orders. The application alleges that Dr. Hinshaw knowingly withheld evidence from the court regarding her knowledge of the dangers and harms of forced masking on children. The Application is brought jointly by Leighton Grey, Q.C. – on behalf of the Justice Centre for Heights Baptist Church, Northside Baptist Church, Erin Blacklaws, and Tory Tanner – and Jeffrey Rath, counsel for Rebecca Ingram. A court hearing is scheduled for Friday, August 26, 2022, to reopen the case based on new evidence.

The application also requests that the Court require Dr. Hinshaw to produce all of her recommendations to the Kenney government related to her own Covid lockdown orders, as well as to require Dr. Hinshaw to answer all questions which were previously objected to by counsel for the government of Alberta on the basis of Cabinet Confidentiality.

Dr. Hinshaw was cross-examined in the court challenge to her health orders on April 4-7, 2022. Since her cross-examination, in July 2022, documents which Premier Jason Kenney’s cabinet had previously claimed confidentiality over were ordered released to the public by the Honourable Justice Dunlop, on July 13, 2022, in a separate, unrelated court case CM vs. Alberta. The now-public documents contain a memo generated by the Premier’s office, sent to both Premier Kenney and Dr. Hinshaw, regarding lack of evidence to justify forced public masking and the dangers to children from such orders. The Alberta government failed to disclose the existence of these documents in the Ingram case.

According to the Application, the Alberta government-generated memo states that:

- There is insufficient direct evidence of the effectiveness of face masks in reducing transmission of Covid in educational settings;

- That there are harmful effects of mask wearing on children; and

That masks can:

- Disrupt learning;

- Interfere with children’s social development;

- Interfere with children’s emotional development;

- Interfere with children’s speech development;

- Impair verbal and non-verbal communication;

- Impair emotional signalling; and

- Impair facial recognition.

During her cross-examination in April, Dr. Hinshaw was specifically asked whether she was aware of any evidence of harms to elementary school children from being compelled to wear masks. Dr. Hinshaw answered this question before the court in April in the negative. The Application contends Dr. Hinshaw’s answers to this line of questions were false, and that she failed to disclose her knowledge of the harms to children from forced masking.

The application asserts that it is clear that there were a significant number of studies in Dr. Hinshaw’s possession or control which in fact did show evidence of harm to children from forced masking. Dr. Hinshaw’s health orders required forced public masking, including masking of elementary-aged children in all schools.

The government filed a written brief on August 12, 2022, in the CM Case. Contrary to their position and evidence in the Justice Centre case, in that brief, they argue that the CMOH orders were essentially policy decisions and not medical ones. At paragraph 81 they state: “the CMOH, the Public Health Act s. 29 and all resulting orders were cogs in a much larger machine.”

“The Canadian provinces and the country as a whole have been under authoritarian-style rule by health officials for over two years”, states Marty Moore, lawyer at the Justice Centre. “The ongoing scrutiny by the courts of the constitutionality of health official’s unprecedented power remains of the utmost importance to Canadians.”

Alberta

Albertans have contributed $53.6 billion to the retirement of Canadians in other provinces

From the Fraser Institute

By Tegan Hill and Nathaniel Li

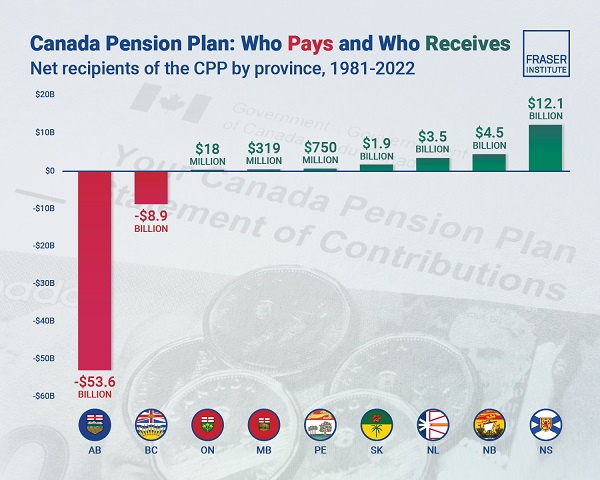

Albertans contributed $53.6 billion more to CPP then retirees in Alberta received from it from 1981 to 2022

Albertans’ net contribution to the Canada Pension Plan —meaning the amount Albertans paid into the program over and above what retirees in Alberta

received in CPP payments—was more than six times as much as any other province at $53.6 billion from 1981 to 2022, finds a new report published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Albertan workers have been helping to fund the retirement of Canadians from coast to coast for decades, and Canadians ought to know that without Alberta, the Canada Pension Plan would look much different,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Understanding Alberta’s Role in National Programs, Including the Canada Pension Plan.

From 1981 to 2022, Alberta workers contributed 14.4 per cent (on average) of the total CPP premiums paid—Canada’s compulsory, government- operated retirement pension plan—while retirees in the province received only 10.0 per cent of the payments. Alberta’s net contribution over that period was $53.6 billion.

Crucially, only residents in two provinces—Alberta and British Columbia—paid more into the CPP than retirees in those provinces received in benefits, and Alberta’s contribution was six times greater than BC’s.

The reason Albertans have paid such an outsized contribution to federal and national programs, including the CPP, in recent years is because of the province’s relatively high rates of employment, higher average incomes, and younger population.

As such, if Alberta withdrew from the CPP, Alberta workers could expect to receive the same retirement benefits but at a lower cost (i.e. lower payroll tax) than other Canadians, while the payroll tax would likely have to increase for the rest of the country (excluding Quebec) to maintain the same benefits.

“Given current demographic projections, immigration patterns, and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into it than Albertan retirees get back from it,” Hill said.

Understanding Alberta’s Role in National Programs, Including the Canada Pension Plan

- Understanding Alberta’s role in national income transfers and other important programs is crucial to informing the broader debate around Alberta’s possible withdrawal from the Canada Pension Plan (CPP).

- Due to Alberta’s relatively high rates of employment, higher average incomes, and younger population, Albertans contribute significantly more to federal revenues than they receive back in federal spending.

- From 1981 to 2022, Alberta workers contributed 14.4 percent (on average) of the total CPP premiums paid while retirees in the province received only 10.0 percent of the payments. Albertans net contribution was $53.6 billion over the period—approximately six times greater than British Columbia’s net contribution (the only other net contributor).

- Given current demographic projections, immigration patterns, and Alberta’s long history of leading the provinces in economic growth and income levels, Alberta’s central role in funding national programs is unlikely to change in the foreseeable future.

- Due to Albertans’ disproportionate net contribution to the CPP, the current base CPP contribution rate would likely have to increase to remain sustainable if Alberta withdrew from the plan. Similarly, Alberta’s stand-alone rate would be lower than the current CPP rate.

Tegan Hill

Director, Alberta Policy, Fraser Institute

Alberta

Alberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

From the Alberta Institute

Axe Alberta’s Industrial Carbon Tax

Aside from tariffs, carbon taxes have been the key topic of the election campaign so far, with Mark Carney announcing that the Liberals would copy the Conservatives’ long-standing policy to axe the tax – but with a big caveat.

You see, it’s misleading to talk about the carbon tax as if it were a single policy.

In fact, that’s what the Liberals would like you to think because it helps them hide all the other carbon taxes they’ve forced on Canadians and on the Provinces.

Broadly speaking, there are actually four types of carbon taxes in place in Canada:

- A federal consumer carbon tax

- A federal industrial carbon tax

- Various provincial consumer carbon taxes

- Various provincial industrial carbon taxes

Alberta was actually the first jurisdiction anywhere in North America to introduce a carbon tax in 2007, when Premier Ed Stelmach introduced a provincial industrial carbon tax.

Then, as we all know, the Alberta NDP introduced a provincial consumer carbon tax in 2017.

The provincial consumer carbon tax was short-lived, as the UCP repealed it in 2019.

But, unfortunately, the UCP failed to repeal the provincial industrial carbon tax at the same time.

Worse, by then, the federal Liberals had introduced a federal consumer carbon tax and a federal industrial carbon tax as well!

Flash forward to 2025, and the political calculus has changed dramatically.

Mark Carney might only be promising to get rid of the federal consumer carbon tax, but Pierre Poilievre is promising to get rid of both the federal consumer carbon tax and the federal industrial carbon tax.

This is a clear opportunity, and yesterday, Scott Moe jumped on it.

He announced that Saskatchewan will also be repealing its provincial industrial carbon tax.

Saskatchewan never had a provincial consumer carbon tax, which means that, within just a few weeks, people in Saskatchewan could be paying ZERO carbon tax of ANY kind.

Alberta needs to follow Saskatchewan’s lead.

The Alberta government should immediately repeal Alberta’s provincial industrial carbon tax.

There’s no excuse for our provincial government to continue burdening our industries with unnecessary costs that hurt competitiveness and deter investment.

These taxes make it harder for businesses to thrive, grow, and create jobs, especially when other provinces are taking action to eliminate similar policies.

Premier Danielle Smith must act now and eliminate the provincial industrial carbon tax in Alberta.

If you agree, please sign our petition calling on the Alberta government to Axe Alberta’s Industrial Carbon Tax today:

After you’ve signed, please send the petition to your friends, family, and wider network, so that every Albertan can have their voice heard!

– The Alberta Institute Team

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre refuses to bash Trump via trick question, says it’s possible to work with him and be ‘firm’

-

International2 days ago

International2 days agoVice President Vance, Second Lady to visit Greenland on Friday

-

Community1 day ago

Community1 day agoSupport local healthcare while winning amazing prizes!

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoVoters should remember Canada has other problems beyond Trump’s tariffs

-

Daily Caller2 days ago

Daily Caller2 days agoCover up of a Department of Energy Study Might Be The Biggest Stain On Biden Admin’s Legacy

-

2025 Federal Election16 hours ago

2025 Federal Election16 hours agoFool Me Once: The Cost of Carney–Trudeau Tax Games

-

Addictions15 hours ago

Addictions15 hours agoShould fentanyl dealers face manslaughter charges for fatal overdoses?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre to let working seniors keep more of their money