Alberta

New Car-Race Season Blends Memories and Hope

New Car-Race Season Blends Memories and Hope

As these words take shape, one familiar sport is being performed on a regular (not daily) basis in this area. By the end of the weekend, two such adventures will be part of the official record.

Horse racing was first. Auto racing, scheduled Saturday at Castrol Raceway, will be second. A big step, possibly, in the ongoing struggle by addictive fans, sponsors and drivers to preserve an annual summer attraction that once held a lofty place on Alberta’s sports calendar.

Soon, the ongoing dance about when and where for NHL playoffs is expected to end, allowing Edmonton to be named, officially and finally, as a “hub city” with the majority of games to take place at Rogers Centre. After that, we can all hope the sky is the limit for the Canadian Elite Basketball League, top local and area soccer and numerous other long-awaited events.

But, first things (or second things) first.

Ron MacDonell, who holds a lease on the oval at Castrol Raceway near the International Airport, surprised me with his first few words after telephoned for confirmation that the season would begin. “Absolutely,” he howled. “And we’re guaranteed a sellout!!

“The government is allowing us to have 200 spectators (in a facility that regularly has held more than 7,000). If the weather holds up, it will be a great start.”

Aha, the weather. Last year, seven scheduled events were washed out by rain. “Too bad we had so much trouble,” MacDonell moaned. “We were getting better crowds, and we were getting more cars.”

If all goes well, with perfect weather and continued easing of the coronavirus safety requirements, the maximum will be six Saturday race nights. “It’s almost like starting over.”

Such restarts are a big part of Alberta’s auto-racing tradition, topped by the presence of prominent Edmontonian Ron Hodgson, now a member of the Canadian Drag Racing Hall of Fame and the Canadian Auto Racing Hall of Fame. In the 1970s, he teamed with Gordon Jenner and driver Gordie Bonin in winning six NHRA Funny Car medals and two world championships. Gord Beck was another top-level driver to benefit from his association with Hodgson.

More recently, Hodgson and driver Terry Capp carried Alberta’s banner throughout the western U.S., winning major events in Tucson, Bakersfield and other communities. They earned high-profile international recognition. “We could race every week,” Hodgson told me. “We could go to the east, too, but there isn’t enough time.”

Two other sons carried on the tradition: Jeff was a successful sprint-car driver at Castrol Raceway and Ryan, streaking on a quarter-mile drag strip, once owned the world’s fastest time, 268 miles per hour.

Jeff followed in the impressive short-track oval footsteps of Sean Moran, Wade Fleming, Tim Gee and Mark Duperron, among others. Fleming and Moran, first-cousins who operate Central Tire in downtown Edmonton, share the local record for points victories: nine titles each.

“We got along really well on the track, most of the time,” Moran grinned on Friday. “But sometimes we were close to the finish line.”

Wade’s dad, the late sportsman Larry Fleming, was a successful racer for many years before retiring.

Ron Hodgson once owned Castrol Raceway after years as a supporter of Speedway International. After he stepped away last season. Long-time track announcer Gord Craig found it hard to maintain his standard level of optimism. “There is still a pulse – call it a pulse – for racing in Alberta,” he said.

Facilities at Drumheller, Rimbey and elsewhere have been successful at time, “but the sport needs a major boost. In this sport, sponsors always turn out to be people who love the sport and don’t just contribute for business reasons.”

Alberta

Alberta takes big step towards shorter wait times and higher quality health care

From the Fraser Institute

On Monday, the Smith government announced that beginning next year it will change the way it funds surgeries in Alberta. This is a big step towards unlocking the ability of Alberta’s health-care system to provide more, better and faster services for the same or possibly fewer dollars.

To understand the significance of this change, you must understand the consequences of the current (and outdated) approach.

Currently, the Alberta government pays a lump sum of money to hospitals each year. Consequently, hospitals perceive patients as a drain on their budgets. From the hospital’s perspective, there’s little financial incentive to serve more patients, operate more efficiently and provide superior quality services.

Consider what would happen if your local grocery store received a giant bag of money each year to feed people. The number of items would quickly decline to whatever was most convenient for the store to provide. (Have a favourite cereal? Too bad.) Store hours would become less convenient for customers, alongside a general decline in overall service. This type of grocery store, like an Alberta hospital, is actually financially better off (that is, it saves money) if you go elsewhere.

The Smith government plans to flip this entire system on its head, to the benefit of patients and taxpayers. Instead of handing out bags of money each year to providers, the new system—known as “activity-based funding”—will pay health-care providers for each patient they treat, based on the patient’s particular condition and important factors that may add complexity or cost to their care.

This turns patients from a drain on budgets into a source of additional revenue. The result, as has been demonstrated in other universal health-care systems worldwide, is more services delivered using existing health-care infrastructure, lower wait times, improved quality of care, improved access to medical technologies, and less waste.

In other words, Albertans will receive far better value from their health-care system, which is currently among the most expensive in the world. And relief can’t come soon enough—for example, last year in Alberta the median wait time for orthopedic surgeries including hip and knee replacements was 66.8 weeks.

The naysayers argue this approach will undermine the province’s universal system and hurt patients. But by allowing a spectrum of providers to compete for the delivery of quality care, Alberta will follow the lead of other more successful universal health-care systems in countries such as Australia, Germany, the Netherlands and Switzerland and create greater accountability for hospitals and other health-care providers. Taxpayers will get a much better picture of what they’re paying for and how much they pay.

Again, Alberta is not exploring an untested policy. Almost every other developed country with universal health care uses some form of “activity-based funding” for hospital and surgical care. And remember, we already spend more on health care than our counterparts in nearly all of these countries yet endure longer wait times and poorer access to services generally, in part because of how we pay for surgical care.

While the devil is always in the details, and while it’s still possible for the Alberta government to get this wrong, Monday’s announcement is a big step in the right direction. A funding model that puts patients first will get Albertans more of the high-quality health care they already pay for in a timelier fashion. And provide to other provinces an example of bold health-care reform.

Alberta

Alberta’s embrace of activity-based funding is great news for patients

From the Montreal Economic Institute

From the Montreal Economic Institute

Alberta’s move to fund acute care services through activity-based funding follows best practices internationally, points out an MEI researcher following an announcement made by Premier Danielle Smith earlier today.

“For too long, the way hospitals were funded in Alberta incentivized treating fewer patients, contributing to our long wait times,” explains Krystle Wittevrongel, director of research at the MEI. “International experience has shown that, with the proper funding models in place, health systems become more efficient to the benefit of patients.”

Currently, Alberta’s hospitals are financed under a system called “global budgeting.” This involves allocating a pre-set amount of funding to pay for a specific number of services based on previous years’ budgets.

Under the government’s newly proposed funding system, hospitals receive a fixed payment for each treatment delivered.

An Economic Note published by the MEI last year showed that Quebec’s gradual adoption of activity-based funding led to higher productivity and lower costs in the province’s health system.

Notably, the province observed that the per-procedure cost of MRIs fell by four per cent as the number of procedures performed increased by 22 per cent.

In the radiology and oncology sector, it observed productivity increases of 26 per cent while procedure costs decreased by seven per cent.

“Being able to perform more surgeries, at lower costs, and within shorter timelines is exactly what Alberta’s patients need, and Premier Smith understands that,” continued Mrs. Wittevrongel. “Today’s announcement is a good first step, and we look forward to seeing a successful roll-out once appropriate funding levels per procedure are set.”

The governments expects to roll-out this new funding model for select procedures starting in 2026.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHarper Endorses Poilievre at Historic Edmonton Rally: “This Crisis Was Made in Canada”

-

John Stossel21 hours ago

John Stossel21 hours agoGovernment Gambling Hypocrisy: Bad Odds and No Competition

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoBettman Gives Rogers Keys To The Empire. Nothing Will Change

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre Will Bring in ‘One and Done’ Resource Approvals, and Ten Specific Projects Including LNG Canada Phase II

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoElection Security Briefing Confirms CCP-Linked Operation Boosted Carney

-

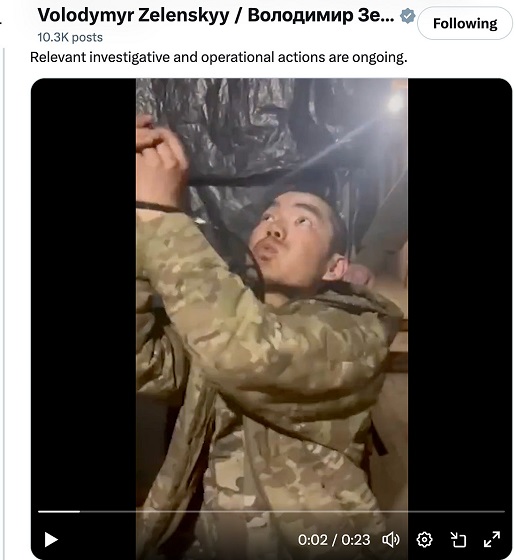

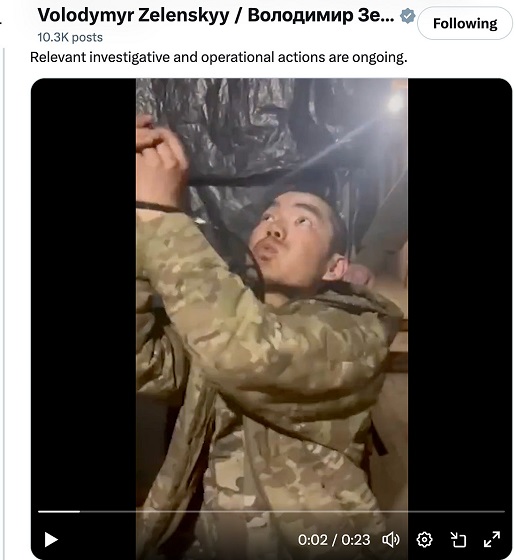

conflict2 days ago

conflict2 days agoZelensky Alleges Chinese Nationals Fighting for Russia, Calls for Global Response

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoWATCH: Massive Crowd for Historic Edmonton Poilievre Rally

-

2025 Federal Election13 hours ago

2025 Federal Election13 hours agoCommunist China helped boost Mark Carney’s image on social media, election watchdog reports