Energy

Navigating New Political Currents: How the U.S. Election Could Impact Canadian Energy – Resource Works

From EnergyNow.ca

By Resource Works

More News and Views From Resource Works Here

As Stewart Muir, CEO of Resource Works, attends the annual Pacific North West Economic Region (PNWER) conference in Whistler this week, the unexpected news that President Joe Biden won’t be on the November 5 presidential ballot sent shockwaves through the policy and trade discussions.

For policy wonks like those I’m gathered with in Whistler this week, could there be a better gift than the conundrums unleashed over the past week onto the U.S. political landscape?

The rise of Donald Trump and the potential presidential candidacy of Kamala Harris conjure up a staggering range of possibilities. When it comes to trade, international relations, and the future of the foundational natural resource sectors that unify the ten sub-national jurisdictions making up PNWER, this is what everyone is going to be talking about..

With Trump securing the Republican nomination last week, Canadian energy producers were left pondering what his potential return to the White House might mean for their industry. Like a wildcatter drilling an exploratory well, Trump’s energy policies promise both gushers of opportunity and dry holes of risk for our oil and gas sector.

On the upside, his pledge to unleash American energy production could boost overall demand and prices, indirectly benefiting Canadian exporters. His promised regulatory reforms may also grease the wheels for new pipelines and LNG terminals, easing the flow of our energy products southward. It’s enough to make an Albertan oilman shed a tear of joy into his Stampede pancakes.

But before we break out the champagne (or perhaps a nice Canadian ice wine), consider the potential downsides. Trump’s “America First” trade policies and tariff threats loom like storm clouds on the horizon for Canadian exporters. His vow to gut environmental regulations faster than you can say “EPA” could leave Canadian producers at a competitive disadvantage, burdened by our quaint commitment to responsible production practices.

Yet in this potential regulatory race to the bottom, I spy an opportunity as golden as the fields of Saskatchewan canola. By doubling down on our world-class environmental and safety standards, Canadian energy could position itself as the responsible choice in global markets.

Picture it: “Canadian crude – now with 50% less guilt!” We could be the Tesla of fossil fuels, if you will.

Of course, there’s a risk in tooting our own sustainability horn too loudly. Trump isn’t known for his fondness of perceived criticism, and antagonizing him could lead to retaliatory tariffs faster than you can say “covfefe.” We’ll need to navigate this terrain as carefully as a pipeline through the Rockies.

On the other hand, if Kamala Harris, Biden’s preferred successor, retakes the White House, the landscape will look markedly different. Harris is likely to continue the Biden administration’s focus on climate action and clean energy. This could mean stronger support for renewables, potentially benefiting Canadian sectors involved in green technology and clean energy exports. However, stricter environmental regulations and a push for rapid decarbonization might challenge traditional oil and gas industries.

A Harris administration might prioritize cross-border collaboration on climate initiatives, providing opportunities for joint projects in carbon capture and storage (CCS), hydrogen development, and renewable energy. This could foster closer ties and create a more integrated North American energy market focused on sustainability.

Bloomberg reports that while Harris wouldn’t be likely to make major shifts to the direction Biden charted on climate change, her opposition to offshore drilling and fracking suggests her signature move as president could be bringing fierce oil industry antagonism to the White House. As California attorney general, she brought lawsuits against energy companies, prosecuted a pipeline company over an oil leak and investigated Exxon Mobil Corp. for misleading the public about climate change.

Yet, such a focus on environmental standards could also mean increased scrutiny and regulatory hurdles for Canadian energy projects seeking to enter the U.S. market. Canadian producers will need to balance compliance with high environmental standards while remaining competitive.

In either scenario, navigating the U.S. political landscape will require strategic adaptability from Canadian energy producers. Trump’s potential return could mean deregulation and a push for fossil fuel dominance, while a Harris presidency could emphasize clean energy and environmental collaboration.

And for anyone lamenting the potential Trump threat to renewables growth, remember the number one test for The Donald: “Can I make money off it?” From Texas to Alberta, solar is a huge growth opportunity in the “and more” rather than the “and/or” category of energy opportunities that are creating investor profits. There’s no reason for him to fire opportunities like those.

Speaking of careful navigation, let’s ponder the electric vehicle conundrum. If Trump follows through on scrapping EV mandates, Canada may find itself stuck between a Chevy Bolt and a hard place. Do we follow suit and risk our climate goals, or forge ahead solo and risk becoming an automotive island? It’s enough to make one long for the simpler days of the horse and buggy.

But fear not, dear reader. For in the potential pairing of a Trump presidency and a Pierre Poilievre prime ministership, I see a silver lining as shiny as a freshly polished oil rig. Their aligned views on energy could usher in a new era of continental cooperation, turning the 49th parallel into a veritable pipeline of mutual prosperity. If current trends of market-driven decarbonization continue, this would actually be positive for the climate (and yes, I can already hear the chorus of those saying such a thing is impossible).

In the end, navigating the Trump energy landscape will require all the nimbleness of a Fort McMurray worker on an icy road. But with a dash of ingenuity, a sprinkle of diplomacy, and perhaps a generous helping of maple syrup to sweeten the deal, Canadian energy producers may yet find themselves not just surviving, but thriving in the turbulent waters of a potential Trump 2.0 era.

2025 Federal Election

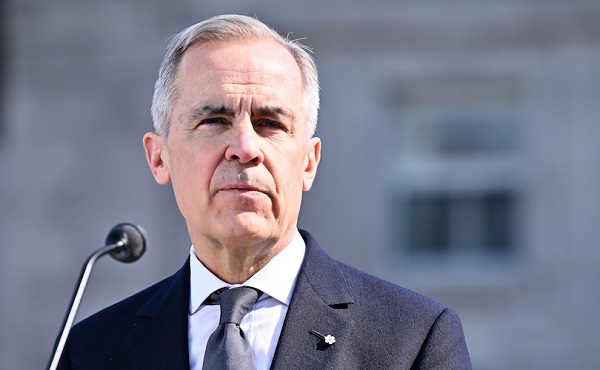

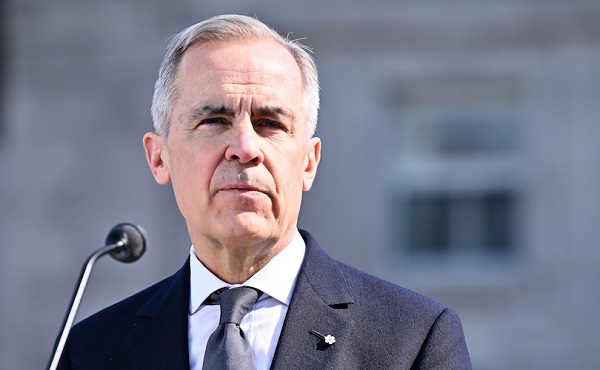

MORE OF THE SAME: Mark Carney Admits He Will Not Repeal the Liberal’s Bill C-69 – The ‘No Pipelines’ Bill

From EnergyNow.Ca

Mark Carney on Tuesday explicitly stated the Liberals will not repeal their controversial Bill C-69, legislation that prevents new pipelines being built.

Carney has been campaigning on boosting the economy and the “need to act forcefully” against President Donald Trump and his tariffs by harvesting Canada’s wealth of natural resources — until it all fell flat around him when he admitted he actually had no intention to build pipelines at all.

When a reporter asked Carney how he plans to maintain Bill C-69 while simultaneously building infrastructure in Canada, Carney replied, “we do not plan to repeal Bill C-69.”

“What we have said, formally at a First Ministers meeting, is that we will move for projects of national interest, to remove duplication in terms of environmental assessments and other approvals, and we will follow the principle of ‘one project, one approval,’ to move forward from that.”

“What’s essential is to work at this time of crisis, to come together as a nation, all levels of government, to focus on those projects that are going to make material differences to our country, to Canadian workers, to our future.”

“The federal government is looking to lead with that, by saying we will accept provincial environmental assessments, for example clean energy projects or conventional energy projects, there’s many others that could be there.”

“We will always ensure these projects move forward in partnership with First Nations.”

Tory leader Pierre Poilievre was quick to respond to Carney’s admission that he has no intention to build new pipelines. “This Liberal law blocked BILLIONS of dollars of investment in oil & gas projects, pipelines, LNG plants, mines, and so much more — all of which would create powerful paychecks for our people,” wrote Poilievre on X.

“A fourth Liberal term will block even more and keep us reliant on the US,” he wrote, urging people to vote Conservative.

Alberta

Energy sector will fuel Alberta economy and Canada’s exports for many years to come

From the Fraser Institute

By any measure, Alberta is an energy powerhouse—within Canada, but also on a global scale. In 2023, it produced 85 per cent of Canada’s oil and three-fifths of the country’s natural gas. Most of Canada’s oil reserves are in Alberta, along with a majority of natural gas reserves. Alberta is the beating heart of the Canadian energy economy. And energy, in turn, accounts for one-quarter of Canada’s international exports.

Consider some key facts about the province’s energy landscape, as noted in the Alberta Energy Regulator’s (AER) 2023 annual report. Oil and natural gas production continued to rise (on a volume basis) in 2023, on the heels of steady increases over the preceding half decade. However, the dollar value of Alberta’s oil and gas production fell in 2023, as the surging prices recorded in 2022 following Russia’s invasion of Ukraine retreated. Capital spending in the province’s energy sector reached $30 billion in 2023, making it the leading driver of private-sector investment. And completion of the Trans Mountain pipeline expansion project has opened new offshore export avenues for Canada’s oil industry and should boost Alberta’s energy production and exports going forward.

In a world striving to address climate change, Alberta’s hydrocarbon-heavy energy sector faces challenges. At some point, the world may start to consume less oil and, later, less natural gas (in absolute terms). But such “peak” consumption hasn’t arrived yet, nor does it appear imminent. While the demand for certain refined petroleum products is trending down in some advanced economies, particularly in Europe, we should take a broader global perspective when assessing energy demand and supply trends.

Looking at the worldwide picture, Goldman Sachs’ 2024 global energy forecast predicts that “oil usage will increase through 2034” thanks to strong demand in emerging markets and growing production of petrochemicals that depend on oil as the principal feedstock. Global demand for natural gas (including LNG) will also continue to increase, particularly since natural gas is the least carbon-intensive fossil fuel and more of it is being traded in the form of liquefied natural gas (LNG).

Against this backdrop, there are reasons to be optimistic about the prospects for Alberta’s energy sector, particularly if the federal government dials back some of the economically destructive energy and climate policies adopted by the last government. According to the AER’s “base case” forecast, overall energy output will expand over the next 10 years. Oilsands output is projected to grow modestly; natural gas production will also rise, in part due to greater demand for Alberta’s upstream gas from LNG operators in British Columbia.

The AER’s forecast also points to a positive trajectory for capital spending across the province’s energy sector. The agency sees annual investment rising from almost $30 billion to $40 billion by 2033. Most of this takes place in the oil and gas industry, but “emerging” energy resources and projects aimed at climate mitigation are expected to represent a bigger slice of energy-related capital spending going forward.

Like many other oil and gas producing jurisdictions, Alberta must navigate the bumpy journey to a lower-carbon future. But the world is set to remain dependent on fossil fuels for decades to come. This suggests the energy sector will continue to underpin not only the Alberta economy but also Canada’s export portfolio for the foreseeable future.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoLiberal MP Paul Chiang Resigns Without Naming the Real Threat—The CCP

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFight against carbon taxes not over yet

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMark Carney refuses to clarify 2022 remarks accusing the Freedom Convoy of ‘sedition’

-

Automotive1 day ago

Automotive1 day agoElectric cars just another poor climate policy

-

Energy1 day ago

Energy1 day agoWhy are Western Canadian oil prices so strong?

-

2025 Federal Election8 hours ago

2025 Federal Election8 hours agoWEF video shows Mark Carney pushing financial ‘revolution’ based on ‘net zero’ goals

-

Break The Needle16 hours ago

Break The Needle16 hours agoWhy psychedelic therapy is stuck in the waiting room