Alberta

Multi-billion Dow Chemical investment pegs Alberta as a top spot for low carbon plastics production

The announcement Dow will construct the world’s first net-zero carbon emissions ethylene and derivatives complex, in Fort Saskatchewan, Wednesday November 29, 2023.

From the Canadian Energy Centre

By Will Gibson

Net zero petrochemical complex seen as a signpost for future investment in Alberta’s Industrial Heartland

Dow Chemical’s Nov. 28 announcement confirming it will invest $8.8 billion to build a net zero petrochemical complex near Edmonton was close to a decade in the making for Fort Saskatchewan Mayor Gale Katchur.

“Now that they’ve finally announced the project, I’m one of the happiest mayors around,” says Katchur, who was first elected in October 2010.

“What Dow is building will inspire other industries with innovation and technology like this. Dow has been a cornerstone for our community for the past 60 years. This investment ensures they are going to be around for a lot longer.”

The project, which has support from the municipal, provincial and federal governments, will increase Dow’s production of polyethylene, the most widely used plastic in the world.

Welcomed by the community

By capturing and storing carbon dioxide emissions and generating hydrogen on-site, the complex will be the world’s first ethylene cracker with net zero emissions from operations.

“I remember speaking to Dow executives during their regional visit some years back. They were curious about potential public concerns, given the visibility of their visit and the nature of their business,” Katchur says.

“My response was clear: the primary concern in our community is the pace of progress. People here recognize and appreciate the petrochemical industry. We understand the benefits that it brings.”

Competitive advantages

Katchur’s joy is shared by Mark Plamondon, executive director of Alberta’s Industrial Heartland Association, who sees the Michigan-based multinational’s decision as an endorsement of the region’s competitive advantages.

“Dow is a global company and could put their capital anywhere in the world,” says Plamondon, whose group attracts global investment in heavy industry to the 582-square-kilometre region northeast of Edmonton.

“What this demonstrates is Dow can meet both their economic and environmental goals by investing in this region. That sends a real message.”

Bob Masterson, CEO of the Chemistry Industry Association of Canada, sees Dow’s decision to build the facility as a signal of where the industry will make large investments in the future.

“In the short term, you are looking at the province’s largest construction project requiring more than 7,000 high-skill, high-paying jobs for the next seven to 10 years,” says Masterson, whose Ottawa-based group represents chemistry and plastics producers across Canada.

Alberta a top destination for low carbon chemical production

“What Dow’s decision really says is Alberta is a top destination for the chemistry industry to invest. One of the top chemical producers in the world is making this investment in Canada,” he says.

“When you look at the bigger picture, the only real rival for low-carbon investment of this kind is the U.S. Gulf Coast, where you have the same access to natural gas liquids as a feedstock and supportive public policy environment.”

The Industrial Heartland region is particularly attractive for companies looking to invest in low-carbon products, Masterson says.

“Alberta has an abundant low-carbon feedstock in natural gas liquids to produce hydrogen and the geological space to sequester carbon. These natural assets can encourage investment and support low-carbon chemistry industry,” he says.

“One of the largest petrochemical companies on the planet believes it can build a low-carbon chemistry plant based on these assets. Other companies will see they can generate and extract that value out of those resources in a very sustainable and responsible manner.”

Filling space on the Alberta Carbon Trunk Line

In addition to geological and natural resources, the region already possesses critical infrastructure to woo investment in low-carbon production, such as the Alberta Carbon Trunk Line (ACTL), the world’s largest CO2 pipeline.

Dow has signed an agreement with ACTL owner Wolf Midstream to utilize space on the system.

ACTL is the foundation of a hub that captures CO2 from an oil refinery and fertilizer plant and moves it for permanent storage in a nearby depleted oil field.

The pipeline currently transports 1.6 million tonnes of CO2 per year but is built to transport 14.6 million tonnes of CO2 per year.

“The infrastructure is in place already. The trunk line has plenty of surplus capacity to transport additional emissions,” Plamondon says.

“That just adds to the value proposition for potential facilities that are moving to low-carbon production.”

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

COVID-192 days ago

COVID-192 days agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHow Canada’s Mainstream Media Lost the Public Trust

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoReal Homes vs. Modular Shoeboxes: The Housing Battle Between Poilievre and Carney

-

International18 hours ago

International18 hours agoNew York Times publishes chilling new justification for assisted suicide

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPOLL: Canadians want spending cuts

-

John Stossel1 day ago

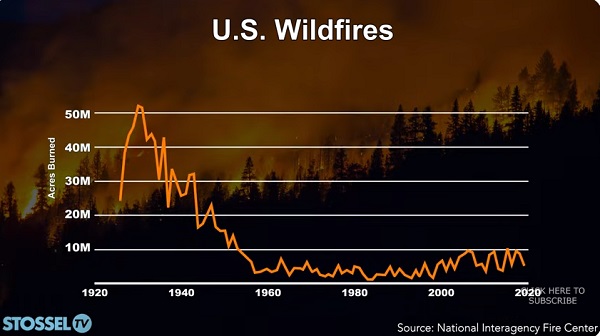

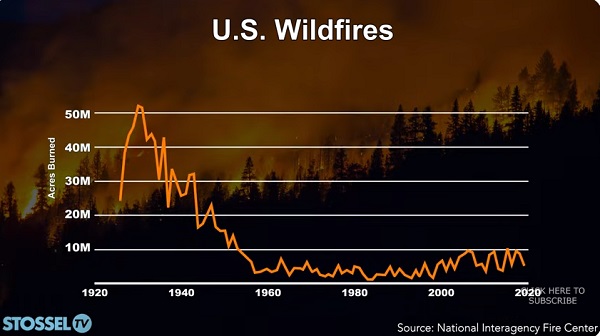

John Stossel1 day agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs