Canadian Energy Centre

Mexico leapfrogging Canada on LNG and six other global oil and gas megaprojects

By Deborah Jaremko of the Canadian Energy Centre Ltd.

Major investments in countries like the United States, Norway, Qatar and Saudi Arabia are being made to meet world demand

New major oil and gas megaprojects around the world are proceeding amid concern about underinvestment in conventional energy leading to painful supply shortages.

“The energy future must be secure and affordable, as well as sustainable,” said Daniel Yergin, vice-chairman of S&P Global, earlier this year.

“Adequate investment that avoids shortages and price spikes, and the economic hardship and social turbulence that they bring, is essential to that future.”

Even if oil and gas demand growth slows, a cumulative $4.9 trillion will be needed between 2023 and 2030 to prevent a supply shortfall, according to a report by the International Energy Forum and S&P Global Commodity Insights.

Major investments in countries like the United States, Norway, Qatar, Saudi Arabia and Mexico are being made to meet world demand.

Meanwhile, due to regulatory uncertainty and concerns over proposed policies like an emissions cap for oil and gas production, Canada’s vast resources – produced with among the world’s highest standards for environmental protection and social progress – are being left behind.

Here’s a look at just a handful of global oil and gas megaprojects, listed in rising order of development cost.

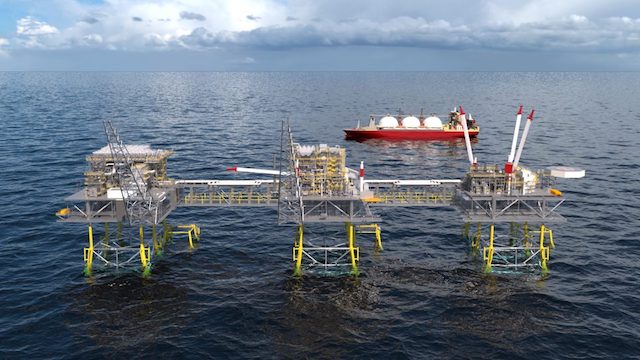

Mexico: Altamira LNG

US$1 billion

New Fortress Energy

Mexico is leapfrogging over Canada to become an LNG exporter.

While Canada’s first LNG export project is expected to start operating in 2025, Mexico’s could come online this August – less than 10 months after Mexico’s government finalized a deal with U.S.-based New Fortress Energy to make it happen.

While relatively small at 1.4 million tonnes of LNG per year (LNG Canada’s first phase will have capacity of 14 million tonnes per year), under Mexico’s agreement the Altamira site is to become an LNG hub.

New Fortress Energy is to deploy multiple same-sized floating LNG units to produce LNG from natural gas transported through TC Energy’s Sur de Texas-Tuxpan pipeline.

An existing LNG import terminal at Altamira is also expected to be converted into a 2.8-million-tonne-per-year export facility.

United States: Willow Oil Project

US$8 billion

ConocoPhillips

The U.S. government granted approval this March for the giant Willow oil project on Alaska’s North Slope to proceed.

The project, owned by ConocoPhillips, is designed to produce 180,000 barrels per day at peak and operate for 30 years. It includes a processing facility, operations centre, and three drilling sites.

The Willow leases are inside the National Petroleum Reserve – Alaska, which was established in 1923 as an emergency oil supply for the U.S. Navy. It is now administered by the U.S. Bureau of Land Management.

Willow would occupy about 385 acres (around half the area of Central Park in New York City) in the northeast portion of the 23-million-acre reserve. It is expected to deliver nearly US$9 billion in government revenue, creating about 2,500 jobs during construction and 300 long-term positions.

ConocoPhillips has yet to make a final investment decision, but is anticipating starting production in 2029, according to the Anchorage Daily News.

United States: Golden Pass LNG

US$10 billion

QatarEnergy, Exxon Mobil

Golden Pass LNG is one of four natural gas export terminals under construction on the U.S. Gulf Coast as the United States continues to build its platform as an LNG powerhouse.

With about 90 million tonnes per year of LNG export capacity today, analysts with Wood Mackenzie expect that if current momentum continues, another 190 million tonnes per year could come online by the end of this decade.

The US$10-billion Golden Pass project owned by QatarEnergy and Exxon Mobil will have three production trains with total export capacity of about 18 million tonnes of LNG per year.

The U.S. began exporting LNG in 2016 and has since built more LNG capacity than anywhere else in the world, according to the U.S. Energy Information Administration.

First LNG exports from Golden Pass are planned for 2024.

Norway: Njord Field Restart

US$29 billion

Wintershall Dea, Equinor, Neptune Energy

Norway has officially reopened a major offshore oil and gas field, with the goal to extend its life beyond 2040 and double its total production.

Nearly US$30 billion in upgrades to the Njord project’s production platform and offloading vessel started in 2016, after nearly 20 years of operations. It was originally only expected to run until 2013, but improvements in recovery technology have opened the door to accessing substantially more resources.

Production restarted in December 2022, just in time to help address Europe’s energy crisis.

“With the war in Ukraine, the export of Norwegian oil and gas to Europe has never been more important than now. Reopening Njord contributes to Norway remaining a stable supplier of gas to Europe for many years to come,” Norway’s oil and energy minister Terje Aasland said in a statement.

The project will drill 10 new wells and tie in two new subsea oil and gas fields, with the work expected to add approximately 250 million barrels of oil equivalent to the European market. Partial electrification of equipment is expected to reduce greenhouse gas emissions.

Qatar: North Field East LNG expansion

Qatar Energy, Shell, TotalEnergies, Eni, Exxon Mobil, ConocoPhillips, Sinopec

US$29 billion

The largest LNG project ever built is underway in Qatar.

State-owned QatarEnergy’s US$29 billion North Field East Expansion will increase the country’s LNG export capacity to 110 million tonnes per year, from 77 million tonnes per year today. Startup is planned in 2025.

A planned second phase of the project will further increase capacity to 126 million tonnes per year.

World LNG demand reached a record 409 million tonnes in 2022, according to data provider Revintiv. It’s expected to rise to over 700 million tonnes by 2040, according to Shell’s most recent industry outlook.

Saudi Arabia: Jafurah Gas Project

US$110 billion

Saudi Aramco

State-owned Saudi Aramco is moving ahead with development of the massive Jafurah gas project, which it says will help meet growing energy demand and provide feedstock for hydrogen production.

First gas from the $110-billion project is expected in 2025, rising to reach two billion cubic feet per day by 2030. That’s about one-third the volume of all the natural gas produced in British Columbia. Saudi Aramco produced 10.6 billion cubic feet of natural gas per day in 2022, or more than half the gas produced in Canada.

Last year the company started construction work on the gas processing facility that is the anchor of the Jafurah project. Aramco is reportedly in talkswith potential partners to back the US$110 billion development.

Russia: Vostok Oil

US$170 billion

Rosneft

Russian state-owned oil company Rosneft continues to barrel ahead with the massive Vostok oil project in the country’s arctic, which Rosneft calls the largest investment in the world.

The US$170 billion project will use the Northern Sea Route to export about 600,000 barrels per day by 2024. Production is expected to increase to two million barrels per day after the second phase. For comparison, Canada’s entire oil sands industry produces about three million barrels per day.

The main problem the energy industry faces is global underinvestment in conventional sources, Rosneft CEO Igor Sechin said earlier this year. He stressed the importance of Vostok’s oil supply for growing Asian economies.

“Vostok Oil project will provide long-term, reliable, and guaranteed energy supplies,” Sechin said.

Two new icebreaker vessels recently helped deliver 4,600 tonnes of cargo including oil pipes for the project to the arctic development sites, the Barents Observer reported.

Canadian Energy Centre

Saskatchewan Indigenous leaders urging need for access to natural gas

Piapot First Nation near Regina, Saskatchewan. Photo courtesy Piapot First Nation/Facebook

From the Canadian Energy Centre

By Cody Ciona and Deborah Jaremko

“Come to my nation and see how my people are living, and the struggles that they have day to day out here because of the high cost of energy, of electric heat and propane.”

Indigenous communities across Canada need access to natural gas to reduce energy poverty, says a new report by Energy for a Secure Future (ESF).

It’s a serious issue that needs to be addressed, say Indigenous community and business leaders in Saskatchewan.

“We’re here today to implore upon the federal government that we need the installation of natural gas and access to natural gas so that we can have safe and reliable service,” said Guy Lonechild, CEO of the Regina-based First Nations Power Authority, on a March 11 ESF webinar.

Last year, 20 Saskatchewan communities moved a resolution at the Assembly of First Nations’ annual general assembly calling on the federal government to “immediately enhance” First Nations financial supports for “more desirable energy security measures such as natural gas for home heating.”

“We’ve been calling it heat poverty because that’s what it really is…our families are finding that they have to either choose between buying groceries or heating their home,” Chief Christine Longjohn of Sturgeon Lake First Nation said in the ESF report.

“We should be able to live comfortably within our homes. We want to be just like every other homeowner that has that choice to be able to use natural gas.”

At least 333 First Nations communities across Canada are not connected to natural gas utilities, according to the Canada Energy Regulator (CER).

ESF says that while there are many federal programs that help cover the upfront costs of accessing electricity, primarily from renewable sources, there are no comparable ones to support natural gas access.

“Most Canadian and Indigenous communities support actions to address climate change. However, the policy priority of reducing fossil fuel use has had unintended consequences,” the ESF report said.

“Recent funding support has been directed not at improving reliability or affordability of the energy, but rather at sustainability.”

Natural gas costs less than half — or even a quarter — of electricity prices in Alberta, British Columbia, Ontario, Manitoba and Saskatchewan, according to CER data.

“Natural gas is something NRCan [Natural Resources Canada] will not fund. It’s not considered a renewable for them,” said Chief Mark Fox of the Piapot First Nation, located about 50 kilometres northeast of Regina.

“Come to my nation and see how my people are living, and the struggles that they have day to day out here because of the high cost of energy, of electric heat and propane.”

According to ESF, some Indigenous communities compare the challenge of natural gas access to the multiyear effort to raise awareness and, ultimately funding, to address poor water quality and access on reserve.

“Natural gas is the new water,” Lonechild said.

Alberta

The beauty of economic corridors: Inside Alberta’s work to link products with new markets

From the Canadian Energy Centre

Q&A with Devin Dreeshen, Minister of Transport and Economic Corridors

CEC: How have recent developments impacted Alberta’s ability to expand trade routes and access new markets for energy and natural resources?

Dreeshen: With the U.S. trade dispute going on right now, it’s great to see that other provinces and the federal government are taking an interest in our east, west and northern trade routes, something that we in Alberta have been advocating for a long time.

We signed agreements with Saskatchewan and Manitoba to have an economic corridor to stretch across the prairies, as well as a recent agreement with the Northwest Territories to go north. With the leadership of Premier Danielle Smith, she’s been working on a BC, prairie and three northern territories economic corridor agreement with pretty much the entire western and northern block of Canada.

There has been a tremendous amount of work trying to get Alberta products to market and to make sure we can build big projects in Canada again.

CEC: Which infrastructure projects, whether pipeline, rail or port expansions, do you see as the most viable for improving Alberta’s global market access?

Dreeshen: We look at everything. Obviously, pipelines are the safest way to transport oil and gas, but also rail is part of the mix of getting over four million barrels per day to markets around the world.

The beauty of economic corridors is that it’s a swath of land that can have any type of utility in it, whether it be a roadway, railway, pipeline or a utility line. When you have all the environmental permits that are approved in a timely manner, and you have that designated swath of land, it politically de-risks any type of project.

CEC: A key focus of your ministry has been expanding trade corridors, including an agreement with Saskatchewan and Manitoba to explore access to Hudson’s Bay. Is there any interest from industry in developing this corridor further?

Dreeshen: There’s been lots of talk [about] Hudson Bay, a trade corridor with rail and port access. We’ve seen some improvements to go to Churchill, but also an interest in the Nelson River.

We’re starting to see more confidence in the private sector and industry wanting to build these projects. It’s great that governments can get together and work on a common goal to build things here in Canada.

CEC: What is your vision for Alberta’s future as a leader in global trade, and how do economic corridors fit into that strategy?

Dreeshen: Premier Smith has talked about C-69 being repealed by the federal government [and] the reversal of the West Coast tanker ban, which targets Alberta energy going west out of the Pacific.

There’s a lot of work that needs to be done on the federal side. Alberta has been doing a lot of the heavy lifting when it comes to economic corridors.

We’ve asked the federal government if they could develop an economic corridor agency. We want to make sure that the federal government can come to the table, work with provinces [and] work with First Nations across this country to make sure that we can see these projects being built again here in Canada.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

Justice2 days ago

Justice2 days agoCanadian government sued for forcing women to share spaces with ‘transgender’ male prisoners

-

Alberta2 days ago

Alberta2 days agoAlberta takes big step towards shorter wait times and higher quality health care

-

Energy2 days ago

Energy2 days agoTrump signs four executive orders promoting coal industry

-

COVID-1923 hours ago

COVID-1923 hours agoFauci, top COVID officials have criminal referral requests filed against them in 7 states

-

MAiD2 days ago

MAiD2 days agoDisability rights panel calls out Canada, US states pushing euthanasia on sick patients

-

Censorship Industrial Complex18 hours ago

Censorship Industrial Complex18 hours agoFormer residential school student refutes ‘genocide’ claims, recalls positive experience