Business

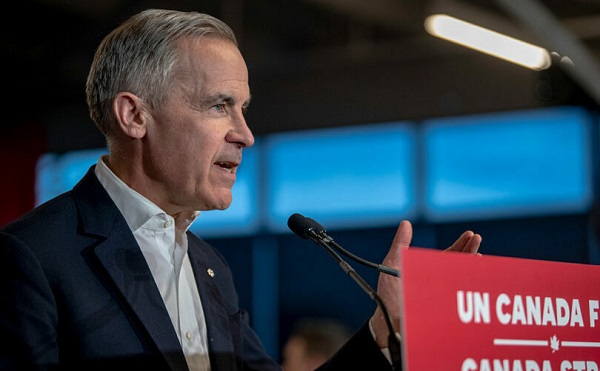

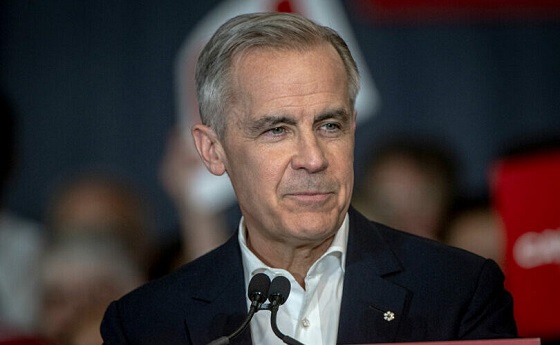

Mark Carney is Planning to Hide His Revised, Sneaky Carbon Tax and This Time, No Rebates

Liberal leadership candidate Mark Carney seems to think giving you a discount code on a new furnace or some extra insulation is the best way to help you with affordability.

And he’s going to pay for the discounts by hitting businesses like fuel refineries and power plants with a hidden carbon tax. Of course, those businesses will just pass on the cost.

Bottom line: You still get hit with that hidden carbon tax when you buy gas or pay your bills.

But it gets worse.

Prime Minister Justin Trudeau at least attempted to give you some of the carbon tax money back through rebates. The Parliamentary Budget Officer consistently made it clear the rebates don’t cover all of the costs. But at least you could spend the money on the things you need most.

But under Carney’s “affordability” plan, you don’t get cash to pay down your credit card or buy groceries. You can only use the credits to buy things like e-bikes and heat pumps.

Here’s how Carney explained it.

“We will have the big polluters pay for climate incentives by developing and integrating a new consumer carbon credit market into the industrial pricing system,” Carney told a Halifax crowd. “While we still provide price certainty for households when they make climate smart choices.”

Translation: Carney would still make Canadians pay, but he’ll only help them with affordability if they’re making “smart” choices.

Sound familiar? This is a lot like the scheme former opposition leader Erin O’Toole ran on. And it ended his political career.

Carney’s carbon tax plan is terrible for two reasons.

First: it’s sneaky. Carney wants to hide the cost of the carbon tax. A powerplant running on natural gas is not going to eat the cost of Carney’s carbon tax; it will pass that expense down to ordinary people who paying the bills.

Second: as anemic as the Trudeau government rebates are, at least Canadians could use the money for the things they need most. It’s cash they can put it towards the next heating bill, or buy a pair of winter boots, or pay for birthday party decorations.

That kind of messy freedom makes some central planning politicians twitchy.

Here’s the thing: half of Canadians are broke and a discount on a new Tesla probably won’t solve their problems.

About 50 per cent are within $200 each month of not being able to make the minimum payments on their bills.

With the cost of groceries up $800 this year for a family of four, people are watching flyers for peanut butter. Food banks have record demand.

Yet, Carney wants Canadians to keep paying the carbon tax while blindfolded and then send thank-you cards when they get a few bucks off on a solar panel they can’t afford.

Clearly the architects of Carney’s plan haven’t spent many sleepless nights worrying about paying rent.

One of Carney’s recent gigs was governor of the Bank of England where he was paid $862,000 per year plus a $449,000 housing allowance.

With ermine earmuffs that thick, it’s hard to hear people’s worries.

About a thousand Canadians recently posted home heating bills online.

Kelly’s family in Northern Ontario paid $134 in the carbon tax for December’s home heating. Lilly’s household bill near Winnipeg was $140 in the carbon tax.

The average Alberta household will pay about $440 extra in the carbon tax on home heating this year.

After the carbon tax is hiked April 1, it will add an extra 21 cents to a litre of gasoline and 25 cents per litre of diesel. Filling a minivan will cost about $15 extra, filling a pickup truck will cost about $25 extra, and a trucker filling a big rig will have to pay about $250 extra in the carbon tax.

Trudeau’s carbon tax data is posted online.

Carney’s carbon tax would be hidden.

Carney isn’t saying the carbon tax is an unfair punishment for Canadians who are trying to drive to work and heat their homes.

He says the problem is “perception.”

“It has become very divisive for Canadians,” Carney told his Halifax crowd about the carbon tax. “It’s the perceptions of the negative impacts of the carbon tax on households, without fully recognizing the positive impacts of the rebate.”

Carney isn’t trying to fix the problem. He’s trying to hide it. And he wants Canadians to be happy with discount codes on “smart” purchases instead of cash.

Kris Sims is the Alberta Director for the Canadian Taxpayers Federation.

Business

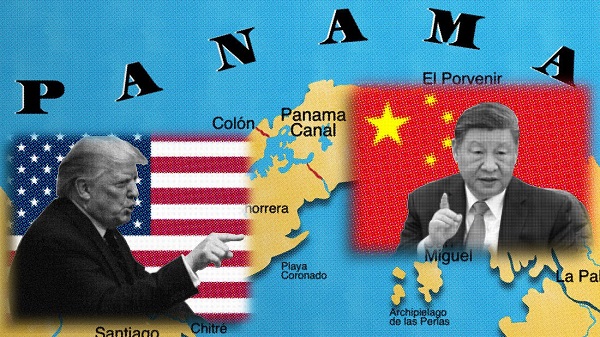

Trump demands free passage for American ships through Panama, Suez

MxM News

MxM News

Quick Hit:

President Donald Trump is pushing for U.S. ships to transit the Panama and Suez canals without paying tolls, arguing the waterways would not exist without America.

Key Details:

-

In a Saturday Truth Social post, Trump said, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

-

Trump directed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the issue, signaling a potential new diplomatic initiative with Panama and Egypt.

-

The Panama Canal generated about $3.3 billion in toll revenue in fiscal 2023, while the Suez Canal posted a record $9.4 billion. U.S. vessels account for roughly 70% of Panama Canal traffic, according to government figures.

Diving Deeper:

President Donald Trump is pressing for American ships to receive free passage through two of the world’s most critical shipping lanes—the Panama and Suez canals—a move he argues would recognize the United States’ historic role in making both waterways possible. In a post shared Saturday on Truth Social, Trump wrote, “American Ships, both Military and Commercial, should be allowed to travel, free of charge, through the Panama and Suez Canals! Those Canals would not exist without the United States of America.”

— Rapid Response 47 (@RapidResponse47) April 26, 2025

Trump added that he has instructed Secretary of State Marco Rubio to “immediately take care of, and memorialize” the situation. His comments, first reported by FactSet, come as U.S. companies face rising shipping costs, with tolls for major vessels ranging from $200,000 to over $500,000 per Panama Canal crossing, based on canal authority schedules.

The Suez Canal, operated by Egypt, reportedly saw record revenues of $9.4 billion in 2023, largely driven by American and European shipping amid ongoing Red Sea instability. After a surge in attacks by Houthi militants on commercial ships earlier this year, Trump authorized a sustained military campaign targeting missile and drone sites in northern Yemen. The Pentagon said the strikes were part of an effort to “permanently restore freedom of navigation” for global shipping near the Suez Canal.

Trump has framed the military operations as part of a broader strategy to counter Iranian-backed destabilization efforts across the Middle East.

Meanwhile, in Central America, Trump’s administration is working to counter Chinese influence near the Panama Canal. On April 9th, Defense Secretary Pete Hegseth announced an expanded partnership with Panama to bolster canal security, including a memorandum of understanding allowing U.S. warships and support vessels to move “first and free” through the canal. “The Panama Canal is key terrain that must be secured by Panama, with America, and not China,” Hegseth emphasized during a press conference in Panama City.

American commercial shipping has long depended on the canal, which reduces the shipping route between the U.S. East Coast and Asia by nearly 8,000 miles. About 40% of all U.S. container traffic uses the Panama Canal annually, according to the U.S. Maritime Administration.

The United States originally constructed and controlled the Panama Canal following a monumental effort championed by President Theodore Roosevelt in the early 20th century. After backing Panama’s independence from Colombia in 1903, the U.S. secured the rights to build and operate the canal, which opened in 1914. Although U.S. control ended in 1999 under the Torrijos-Carter Treaties, the canal remains vital to U.S. trade.

2025 Federal Election

Columnist warns Carney Liberals will consider a home equity tax on primary residences

From LifeSiteNews

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Winnipeg Sun Columnist Kevin Klein is sounding the alarm there is substantial evidence the Carney Liberal Party is considering implementing a home equity tax on Canadians’ primary residences as a potential huge source of funds to bring down the massive national debt their spending created.

Klein wrote in his April 23 column and stated in his accompanying video presentation:

The Canada Mortgage and Housing Corporation (CMHC) — a federal Crown corporation — has investigated the possibility of a home equity tax on more than one occasion, using taxpayer dollars to fund that research. This was not backroom speculation. It was real, documented work.

The Liberals paid a group called Generation Squeeze, led by activist Paul Kershaw, to study how the government could tap into Canadians’ home equity — including their primary residences.

Kershaw, by the way, believes homeowners are “lottery winners” who didn’t earn their wealth but lucked into it. That’s the ideology being advanced to the highest levels of government.

It didn’t stop there. These proposals were presented directly to federal cabinet ministers. That’s on record, and most of those same ministers are now part of Mark Carney’s team as he positions himself as the Liberals’ next leader.

Watch below Klein’s 7-minute, impassionate warning to Canadians about this looming major new tax should the Liberals win Monday’s election.

Klein further adds:

The total home equity held by Canadians is over $4.7 trillion. It’s the largest pool of private wealth in the country. For millions of Canadians — especially baby boomers — it’s the only retirement fund they have. They don’t have big pensions. They have a paid-off house and a hope that it will carry them through their later years. Yet, that’s what Ottawa has quietly been circling.

The Canadian Taxpayer’s Federation has researched this issue and published a report on the alarming amount of new taxation a homeowner equity tax could cost Canadians who sell their homes that have increased in value over the years they have lived in it. It is a shocker!

A Google search on the question, “what is a home equity tax?” returns the response:

A home equity tax, simply put, it’s a proposed levy on the increased value of your home, specifically, on your principal residence. The idea is for Government to raise money by taxing wealth accumulation from rising property values.

The Canadian Taxpayers Federation has provided a Home Equity Tax Calculator Backgrounder to help Canadians understand what the impact of three different types of Home Equity Tax Calculators would have on home owners. The required tax payment resulting from all three is a shocker.

Keep in mind that World Economic Forum policies intend to eventually eliminate all private home ownership and have the state own and control not only all residences, but also eliminate car ownership, and control when and where you may live and travel.

Carney, Trudeau and several other members of the Liberal government in key positions are heavily connected to the WEF.

-

Alberta2 days ago

Alberta2 days agoGovernments in Alberta should spur homebuilding amid population explosion

-

International2 days ago

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

Alberta2 days ago

Alberta2 days agoLow oil prices could have big consequences for Alberta’s finances

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s

-

Business2 days ago

Business2 days agoIt Took Trump To Get Canada Serious About Free Trade With Itself

-

C2C Journal2 days ago

C2C Journal2 days ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

Opinion1 day ago

Opinion1 day agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

2025 Federal Election20 hours ago

2025 Federal Election20 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences