Carbon Tax

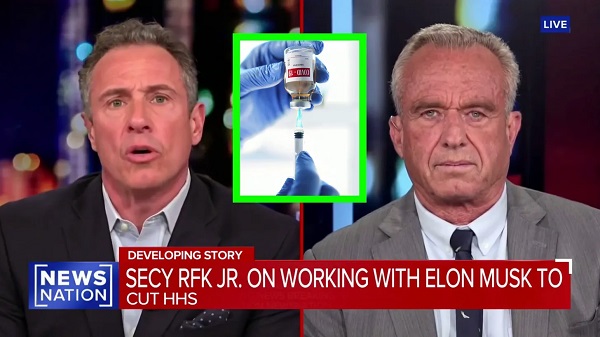

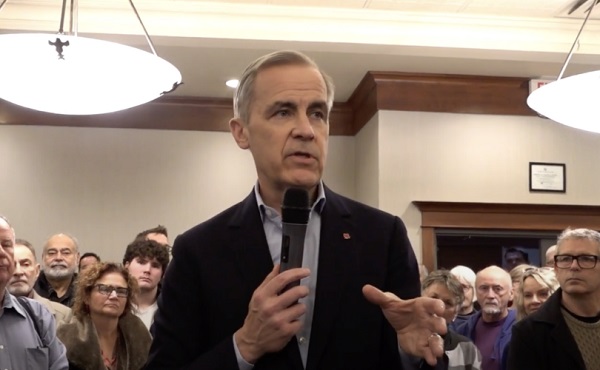

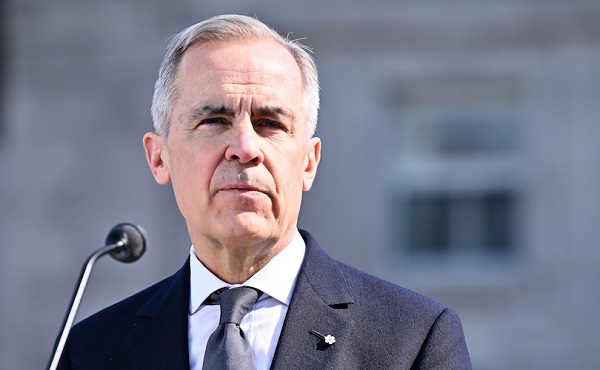

Mark Carney has history of supporting CBDCs, endorsed Freedom Convoy crackdown

From LifeSiteNews

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

World Economic Forum-linked Liberal Party leadership frontrunner Mark Carney has a history of supporting central bank digital currencies, and in 2022 supported “choking off the money” donated to the Freedom Convoy.

In his 2021 book Value(s), Carney said that the “future of money” is a “central bank stablecoin, known as a central bank digital currency or CBDC.”

He noted in his book that such a currency would be similar to current cryptocurrencies such as Bitcoin, but without the private nature afforded to it by its decentralization.

“It is simply untenable in democracies that the core of the monetary system could be based on forms of electronic private money whose creators control large blocks of the currency, like Bitcoin,” he wrote. “Cryptocurrencies are not the future of money.”

Carney noted that a CBDC, if “properly designed,” could serve “all the functions to which private cryptocurrencies and stablecoins aspire while addressing the fundamental legal and governance issues that will, in time, undermine those alternatives.”

Expanding on his worldview in relation to CBDCs, Carney suggested that “fear” can be taken advantage of to shape the future of money.

“With fear on the march, people were willing to surrender to Hobbes’ ‘Leviathan’ such basic rights as the freedom to leave their homes,” he wrote. “And so it is with money. People will support the delegation to independent central banks of the tough decisions that are necessary to maintain the value of money provided the authorities deliver monetary and financial stability.”

Some Canadians are alarmed by the prospect of CBDCs, a fear that only worsened after the Liberals under Prime Minister Justin Trudeau froze hundreds of bank accounts it deemed were importantly linked to the 2022 Freedom Convoy.

During the Freedom Convoy, Carney wrote in an op-ed for the Globe and Mail, “Those who are still helping to extend this occupation must be identified and punished to the full force of the law,” adding that “Drawing the line means choking off the money that financed this occupation.”

Carney is a former head of the Bank of Canada and Bank of England. His ties to globalist groups have led to Conservative Party leader Pierre Poilievre calling him the World Economic Forum’s “golden boy.”

In addition to his comments on CBDCs, Carney has a history of promoting anti-life and anti-family agendas, including abortion and LGBT-related efforts. He has also previously endorsed the carbon tax and even criticized Trudeau when the tax was exempted from home heating oil to reduce costs for some Canadians.

Carney also said last week that he is willing to use all government powers, including “emergency powers,” to enforce his energy plan if elected prime minister.

The Liberal Party of Canada will choose its next leader, who will automatically become prime minister, on March 9, after Prime Minister Justin Trudeau announced that he plans to step down as Liberal Party leader once a new leader has been chosen.

In contrast to Carney, Poilievre has promised that if he is elected prime minister, he would stop any implementation of a “digital currency” or a compulsory “digital ID” system.

When it comes to a digital Canadian dollar, the Bank of Canada found that Canadians are very wary of a government-backed digital currency, concluding that a “significant number” of citizens would resist the implementation of such a system.

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

2025 Federal Election

Fight against carbon taxes not over yet

As the federal government removes the consumer carbon tax, the Canadian Taxpayers Federation is calling on all party leaders to oppose all carbon taxes, including the hidden tax on business.

“Canadians fought hard to force Ottawa to back down on its consumer carbon tax and now the fight moves to stopping the hidden carbon tax on business,” said Franco Terrazzano, CTF Federal Director. “Canadians can’t afford a carbon tax on business that pushes up prices at the gas station and makes it harder for our businesses to compete while they’re already struggling with a trade war.”

Today, the federal government cut the consumer carbon tax rate to $0. This will reduce taxes by about 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

The federal government still imposes an industrial carbon tax on oil and gas, steel and fertilizer businesses, among others.

During the Liberal Party leadership race, Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax and “extend the framework to 2035.”

Just 12 per cent of Canadians believe businesses pay most of the cost of the industrial carbon tax, according to a Leger poll commissioned by the CTF. Meanwhile, 70 per cent said businesses would pass most or some carbon tax costs on to consumers.

Conservative Party Leader Pierre Poilievre said he will “repeal the entire carbon tax law, including the tax on Canadian businesses and industries.”

“Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive,” Terrazzano said. “Canadians know Poilievre will end all carbon taxes and Canadians know Carney’s carbon tax costs won’t be zero.

“Carney owes Canadians a clear answer: How much will your carbon tax cost?”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoLiberal MP Paul Chiang Resigns Without Naming the Real Threat—The CCP

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney refuses to clarify 2022 remarks accusing the Freedom Convoy of ‘sedition’

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFight against carbon taxes not over yet

-

Automotive1 day ago

Automotive1 day agoElectric cars just another poor climate policy

-

Energy1 day ago

Energy1 day agoWhy are Western Canadian oil prices so strong?

-

2025 Federal Election9 hours ago

2025 Federal Election9 hours agoWEF video shows Mark Carney pushing financial ‘revolution’ based on ‘net zero’ goals

-

2025 Federal Election15 hours ago

2025 Federal Election15 hours agoThree cheers for Poilievre’s alcohol tax cut