Alberta

Low emissions, Indigenous-owned Cascade Power Project to boost Alberta electrical grid reliability

The Cascade Power Project. Photo courtesy Kinetcor

From the Canadian Energy Centre

By Will Gibson

New 900-megawatt natural gas-fired facility to supply more than eight per cent of Alberta’s power needs

Alberta’s electrical grid is about to get a boost in reliability from a major new natural gas-fired power plant owned in part by Indigenous communities.

Next month operations are scheduled to start at the Cascade Power Project, which will have enough capacity to supply more than eight per cent of Alberta’s energy needs.

It’s good news in a province where just over one month ago an emergency alert suddenly blared on cell phones and other electronic devices warning residents to immediately reduce electricity use to avoid outages.

“Living in an energy-rich province, we sometimes take electricity for granted,” says Chana Martineau, CEO of the Alberta Indigenous Opportunities Corporation (AIOC) and member of the Frog Lake First Nation.

“Given much of the province was dealing with -40C weather at the time, that alert was a vivid reminder of the importance of having a reliable electrical grid.”

Cascade Power was the first project to receive funding through the AIOC, the provincial corporation established in 2020 to provide loan guarantees for Indigenous groups seeking partnerships in major development projects.

So far, the AIOC has underwritten more than $500 million in support. This year it has $3 billion available, up from $2 billion in 2023.

In August 2020 it provided a $93 million loan guarantee to the Indigenous Communities Consortium — comprised of the Alexis Nakota Sioux Nation, Enoch Cree Nation, Kehewin Cree Nation, O’Chiese First Nation, Paul First Nation, and Whitefish (Goodfish) Lake First Nation — to become equity owners.

The 900-megawatt, $1.5-billion facility is scheduled to come online in March.

“It’s personally gratifying for me to see how we moved from having Indigenous communities being seen as obstacles to partners in a generation,” says Martineau.

The added capacity brought by Cascade is welcomed by the Alberta Electrical System Operator (AESO), which is responsible for the province’s electrical grid. =

“The AESO welcomes all new forms of generation into the Alberta marketplace, including renewables, thermal, storage, and others,” said Diane Kossman, a spokeswoman for the agency.

“It is imperative that Alberta continue to have sufficient dispatchable generation to serve load during peak demand periods when other forms of generation are not able to contribute in a meaningful way.”

The Cascade project also provides environmental benefits. It is a so-called “combined cycle” power facility, meaning it uses both a gas turbine and a steam turbine simultaneously to produce up to 50 per cent more electricity from the same amount of fuel than a traditional facility.

Once complete, Cascade is expected to be the largest and most efficient combined cycle power plant in Alberta, producing 62 per cent less CO2 than a coal-fired power plant and 30 per cent less CO2 than a typical coal-to-gas conversion.

“This project really is aligned with the goals of Indigenous communities on environmental performance,” says Martineau.

The partnership behind the power plant includes Axium Infrastructure, DIF Capital Partners and Kineticor Resource Corp. along with the Indigenous Communities Consortium.

The nations invested through a partnership with OPTrust, one of Canada’s largest pension funds.

“Innovation is not just what we invest in, but it is also how we invest,” said James Davis, OPTrust’s chief investment officer.

“The participation of six First Nations in the Cascade Power Project is a prime example of what is possible when investors, the government and local communities work together.”

Alberta

Alberta Emergency Alert test – Wednesday at 1:55 PM

Minister of Public Safety and Emergency Services Mike Ellis issued the following statement on the upcoming Alberta Emergency Alert test:

“On Nov. 19, 2025, Alberta will take part in a scheduled test of the National Public Alerting System. At 1:55 p.m., an Alberta Emergency Alert test will be issued across multiple channels including television, radio, wireless devices, websites, social media, the Alberta Emergency Alert mobile app and directly to compatible cellphones across the province.

“While alert interruptions can be inconvenient, these tests are essential. They help us identify and resolve technical issues, ensuring the system functions properly when it matters most. Regular testing, typically held in May and November, is a key part of keeping Albertans informed during real emergencies such as tornadoes, wildfires, floods and Amber Alerts.

“To stay connected, I urge all Albertans to download the Alberta Emergency Alert app, which delivers critical warnings directly to your phone. To receive alerts, your mobile device must be compatible, connected to an LTE 4G network or higher, or connected to Wi-Fi with the app installed. If your phone is on silent, the alert will still appear but may not produce sound.

“This test is also a valuable opportunity to talk with your household, friends and coworkers about emergency preparedness. Questions to ask:

- Do you have an emergency kit with enough supplies for at least 72 hours?

- Have you included essentials like water, non-perishable food, flashlights, batteries and a first aid kit?

- Do you have copies of important documents and a list of emergency contacts?

- Is your kit stored in an easy-to-access location and does everyone know where it is?

“Preparedness doesn’t have to be complicated. Simple steps like having an emergency plan and essential supplies can make a big difference to protect yourself and your household.”

Related information

Alberta

Carney government’s anti-oil sentiment no longer in doubt

From the Fraser Institute

The Carney government, which on Monday survived a confidence vote in Parliament by the skin of its teeth, recently released a “second tranche of nation-building projects” blessed by the Major Projects Office. To have a chance to survive Canada’s otherwise oppressive regulatory gauntlet, projects must get on this Caesar-like-thumbs-up-thumbs-down list.

The first tranche of major projects released in September included no new oil pipelines but pertained largely to natural gas, nuclear power, mineral production, etc. The absence of proposed oil pipelines was not surprising, as Ottawa’s regulatory barricade on oil production means no sane private company would propose such a project. (The first tranche carries a price tag of $60 billion in government/private-sector spending.)

Now, the second tranche of projects also includes not a whiff of support for oil production, transport and export to non-U.S. markets. Again, not surprising as the prime minister has done nothing to lift the existing regulatory blockade on oil transport out of Alberta.

So, what’s on the latest list?

There’s a “conservation corridor” for British Columbia and Yukon; more LNG projects (both in B.C.); more mineral projects (nickel, graphite, tungsten—all electric vehicle battery constituents); and still more transmission for “clean energy”—again, mostly in B.C. And Nunavut comes out ahead with a new hydro project to power Iqaluit. (The second tranche carries a price tag of $58 billion in government/private-sector spending.)

No doubt many of these projects are worthy endeavours that shouldn’t require the imprimatur of the “Major Projects Office” to see the light of day, and merit development in the old-fashioned Canadian process where private-sector firms propose a project to Canada’s environmental regulators, get necessary and sufficient safety approval, and then build things.

However, new pipeline projects from Alberta would also easily stand on their own feet in that older regulatory regime based on necessary and sufficient safety approval, without the Carney government additionally deciding what is—or is not—important to the government, as opposed to the market, and without provincial governments and First Nations erecting endless barriers.

Regardless of how you value the various projects on the first two tranches, the second tranche makes it crystal clear (if it wasn’t already) that the Carney government will follow (or double down) on the Trudeau government’s plan to constrain oil production in Canada, particularly products derived from Alberta’s oilsands. There’s nary a mention that these products even exist in the government’s latest announcement, despite the fact that the oilsands are the world’s fourth-largest proven reserve of oil. This comes on the heels on the Carney government’s first proposed budget, which also reified the government’s fixation to extinguish greenhouse gas emissions in Canada, continue on the path to “net-zero 2050” and retain Canada’s all-EV new car future beginning in 2036.

It’s clear, at this point, that the Carney government is committed to the policies of the previous Liberal government, has little interest in harnessing the economic value of Canada’s oil holdings nor the potential global influence Canada might exert by exporting its oil products to Asia, Europe and other points abroad. This policy fixation will come at a significant cost to future generations of Canadians.

-

Agriculture2 days ago

Agriculture2 days agoFederal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

-

Indigenous15 hours ago

Indigenous15 hours agoTop constitutional lawyer slams Indigenous land ruling as threat to Canadian property rights

-

Daily Caller2 days ago

Daily Caller2 days ago‘Holy Sh*t!’: Podcaster Aghast As Charlie Kirk’s Security Leader Reads Texts He Allegedly Sent University Police

-

Daily Caller14 hours ago

Daily Caller14 hours agoDemocrats Explicitly Tell Spy Agencies, Military To Disobey Trump

-

Addictions1 day ago

Addictions1 day agoActivists Claim Dealers Can Fix Canada’s Drug Problem

-

Alberta1 day ago

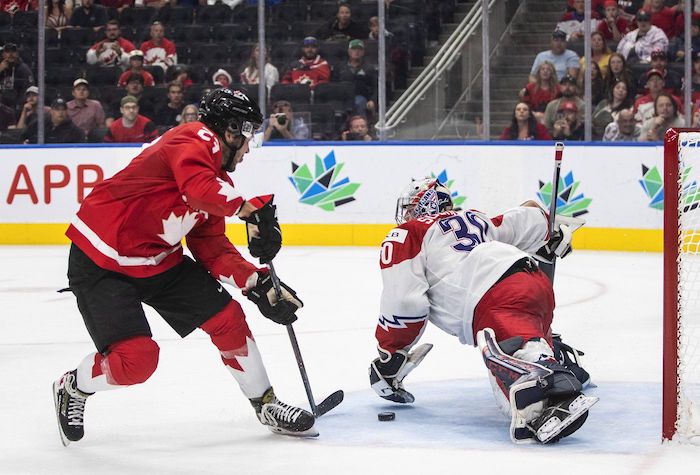

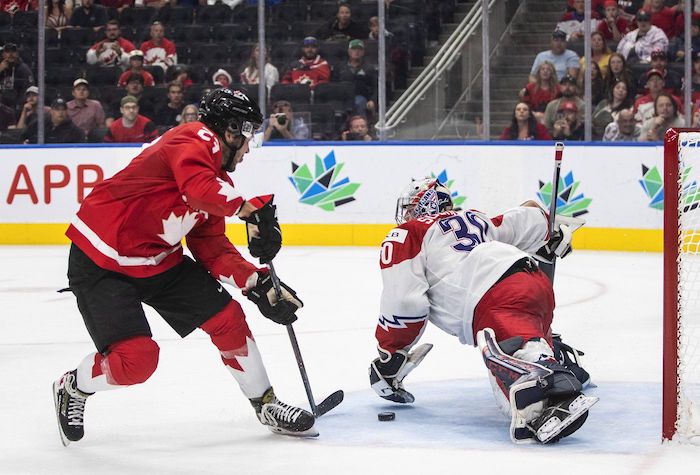

Alberta1 day agoEdmonton and Red Deer to Host 2027 IIHF World Junior Hockey Championship

-

Alberta1 day ago

Alberta1 day agoAlbertans choose new licence plate design with the “Strong and Free” motto

-

Crime2 hours ago

Crime2 hours ago‘Modern-Day Escobar’: U.S. Says Former Canadian Olympian Ran Cocaine Pipeline with Cartel Protection and a Corrupt Toronto Lawyer