Alberta

Justice Centre for Constitutional Freedoms challenges AMA to debate Alberta COVID-19 Review

Justice Centre President sends an open letter to Dr. Shelley Duggan, President of the Alberta Medical Association

Dear Dr. Duggan,

I write in response to the AMA’s Statement regarding the Final Report of the Alberta Covid Pandemic Data Review Task Force. Although you did not sign your name to the AMA Statement, I assume that you approved of it, and that you agree with its contents.

I hereby request your response to my questions about your AMA Statement.

You assert that this Final Report “advances misinformation.” Can you provide me with one or two examples of this “misinformation”?

Why, specifically, do you see this Final Report as “anti–science and anti–evidence”? Can you provide an example or two?

Considering that you denounced the entire 269-page report as “anti–science and anti–evidence,” it should be very easy for you to choose from among dozens and dozens of examples.

You assert that the Final Report “speaks against the broadest, and most diligent, international scientific collaboration and consensus in history.”

As a medical doctor, you are no doubt aware of the “consensus” whereby medical authorities in Canada and around the world approved the use of thalidomide for pregnant women in the 1950s and 1960s, resulting in miscarriages and deformed babies. No doubt you are aware that for many centuries the “consensus” amongst scientists was that physicians need not wash their hands before delivering babies, resulting in high death rates among women after giving birth. This “international scientific consensus” was disrupted in the 1850s by a true scientist, Dr. Ignaz Semmelweis, who advocated for hand-washing.

As a medical doctor, you should know that science is not consensus, and that consensus is not science.

It is unfortunate that your AMA Statement appeals to consensus rather than to science. In fact, your AMA Statement is devoid of science, and appeals to nothing other than consensus. A scientific Statement from the AMA would challenge specific assertions in the Final Report, point to inadequate evidence, debunk flawed methodologies, and expose incorrect conclusions. Your Statement does none of the foregoing.

You assert that “science and evidence brought us through [Covid] and saved millions of lives.” Considering your use of the word “millions,” I assume this statement refers to the lockdowns and vaccine mandates imposed by governments and medical establishments around the world, and not the response of the Alberta government alone.

What evidence do you rely on for your assertion that lockdowns saved lives? You are no doubt aware that lockdowns did not stop Covid from spreading to every city, town, village and hamlet, and that lockdowns did not stop Covid from spreading into nursing homes (long-term care facilities) where Covid claimed about 80% of its victims. How, then, did lockdowns save lives? If your assertion about “saving millions of lives” is true, it should be very easy for you to explain how lockdowns saved lives, rather than merely asserting that they did.

Seeing as you are confident that the governments’ response to Covid saved “millions” of lives, have you balanced that vague number against the number of people who died as a result of lockdowns? Have you studied or even considered what harms lockdowns inflicted on people?

If you are confident that lockdowns did more good than harm, on what is your confidence based? Can you provide data to support your position?

As a medical doctor, you are no doubt aware that the mRNA vaccine, introduced and then made mandatory in 2021, did not stop the transmission of Covid. Nor did the mRNA vaccine prevent people from getting sick with Covid, or dying from Covid. Why would it not have sufficed in 2021 to let each individual make her or his own choice about getting injected with the mRNA vaccine? Do you still believe today that mandatory vaccination policies had an actual scientific basis? If yes, what was that basis?

You assert that the Final Report “sows distrust” and “criticizes proven preventive public health measures while advancing fringe approaches.”

When the AMA Statement mentions “proven preventive public health measures,” I assume you are referring to lockdowns. If my assumption is correct, can you explain when, where and how lockdowns were “proven” to be effective, prior to 2020? Or would you agree with me that locking down billions of healthy people across the globe in 2020 was a brand new experiment, never tried before in human history? If it was a brand new experiment, how could it have been previously “proven” effective prior to 2020? Alternatively, if you are asserting that lockdowns and vaccine passports were “proven” effective in the years 2020-2022, what is your evidentiary basis for that assertion?

Your reference to “fringe approaches” is particularly troubling, because it suggests that the majority must be right just because it’s the majority, which is the antithesis of science.

Remember that the first doctors to advocate against the use of thalidomide by pregnant women, along with Dr. Ignaz Semmelweis advocating for hand-washing, were also viewed as “advancing fringe approaches” by those in authority. It would not be difficult to provide dozens, and likely hundreds, of other examples showing that true science is a process of open-minded discovery and honest debate, not a process of dismissing as “fringe” the individuals who challenge the reigning “consensus.”

The AMA Statement asserts that the Final Report “makes recommendations for the future that have real potential to cause harm.” Specifically, which of the Final Report’s recommendations have a real potential to cause harm? Can you provide even one example of such a recommendation, and explain the nature of the harm you have in mind?

The AMA Statement asserts that “many colleagues and experts have commented eloquently on the deficiencies and biases [the Final Report] presents.” Could you provide some examples of these eloquent comments? Did any of your colleagues and “experts” point to specific deficiencies in the Final Report, or provide specific examples of bias? Or were these “eloquent” comments limited to innuendo and generalized assertions like those contained in the AMA Statement?

In closing, I invite you to a public, livestreamed debate on the merits of Alberta’s lockdowns and vaccine passports. I would argue for the following: “Be it resolved that lockdowns and vaccine passports imposed on Albertans from 2020 to 2022 did more harm than good,” and you would argue against this resolution.

Seeing as you are a medical doctor who has a much greater knowledge and a much deeper understanding of these issues than I do, I’m sure you will have an easy time defending the Alberta government’s response to Covid.

If you are not available, I would be happy to debate one of your colleagues, or any AMA member.

I request your answers to the questions I have asked of you in this letter.

Further, please let me know if you are willing to debate publicly the merits of lockdowns and vaccine passports, or if one of your colleagues is available to do so.

Yours sincerely,

John Carpay, B.A., LL.B.

President

Justice Centre for Constitutional Freedoms

Alberta

Alberta Emergency Alert test – Wednesday at 1:55 PM

Minister of Public Safety and Emergency Services Mike Ellis issued the following statement on the upcoming Alberta Emergency Alert test:

“On Nov. 19, 2025, Alberta will take part in a scheduled test of the National Public Alerting System. At 1:55 p.m., an Alberta Emergency Alert test will be issued across multiple channels including television, radio, wireless devices, websites, social media, the Alberta Emergency Alert mobile app and directly to compatible cellphones across the province.

“While alert interruptions can be inconvenient, these tests are essential. They help us identify and resolve technical issues, ensuring the system functions properly when it matters most. Regular testing, typically held in May and November, is a key part of keeping Albertans informed during real emergencies such as tornadoes, wildfires, floods and Amber Alerts.

“To stay connected, I urge all Albertans to download the Alberta Emergency Alert app, which delivers critical warnings directly to your phone. To receive alerts, your mobile device must be compatible, connected to an LTE 4G network or higher, or connected to Wi-Fi with the app installed. If your phone is on silent, the alert will still appear but may not produce sound.

“This test is also a valuable opportunity to talk with your household, friends and coworkers about emergency preparedness. Questions to ask:

- Do you have an emergency kit with enough supplies for at least 72 hours?

- Have you included essentials like water, non-perishable food, flashlights, batteries and a first aid kit?

- Do you have copies of important documents and a list of emergency contacts?

- Is your kit stored in an easy-to-access location and does everyone know where it is?

“Preparedness doesn’t have to be complicated. Simple steps like having an emergency plan and essential supplies can make a big difference to protect yourself and your household.”

Related information

Alberta

Carney government’s anti-oil sentiment no longer in doubt

From the Fraser Institute

The Carney government, which on Monday survived a confidence vote in Parliament by the skin of its teeth, recently released a “second tranche of nation-building projects” blessed by the Major Projects Office. To have a chance to survive Canada’s otherwise oppressive regulatory gauntlet, projects must get on this Caesar-like-thumbs-up-thumbs-down list.

The first tranche of major projects released in September included no new oil pipelines but pertained largely to natural gas, nuclear power, mineral production, etc. The absence of proposed oil pipelines was not surprising, as Ottawa’s regulatory barricade on oil production means no sane private company would propose such a project. (The first tranche carries a price tag of $60 billion in government/private-sector spending.)

Now, the second tranche of projects also includes not a whiff of support for oil production, transport and export to non-U.S. markets. Again, not surprising as the prime minister has done nothing to lift the existing regulatory blockade on oil transport out of Alberta.

So, what’s on the latest list?

There’s a “conservation corridor” for British Columbia and Yukon; more LNG projects (both in B.C.); more mineral projects (nickel, graphite, tungsten—all electric vehicle battery constituents); and still more transmission for “clean energy”—again, mostly in B.C. And Nunavut comes out ahead with a new hydro project to power Iqaluit. (The second tranche carries a price tag of $58 billion in government/private-sector spending.)

No doubt many of these projects are worthy endeavours that shouldn’t require the imprimatur of the “Major Projects Office” to see the light of day, and merit development in the old-fashioned Canadian process where private-sector firms propose a project to Canada’s environmental regulators, get necessary and sufficient safety approval, and then build things.

However, new pipeline projects from Alberta would also easily stand on their own feet in that older regulatory regime based on necessary and sufficient safety approval, without the Carney government additionally deciding what is—or is not—important to the government, as opposed to the market, and without provincial governments and First Nations erecting endless barriers.

Regardless of how you value the various projects on the first two tranches, the second tranche makes it crystal clear (if it wasn’t already) that the Carney government will follow (or double down) on the Trudeau government’s plan to constrain oil production in Canada, particularly products derived from Alberta’s oilsands. There’s nary a mention that these products even exist in the government’s latest announcement, despite the fact that the oilsands are the world’s fourth-largest proven reserve of oil. This comes on the heels on the Carney government’s first proposed budget, which also reified the government’s fixation to extinguish greenhouse gas emissions in Canada, continue on the path to “net-zero 2050” and retain Canada’s all-EV new car future beginning in 2036.

It’s clear, at this point, that the Carney government is committed to the policies of the previous Liberal government, has little interest in harnessing the economic value of Canada’s oil holdings nor the potential global influence Canada might exert by exporting its oil products to Asia, Europe and other points abroad. This policy fixation will come at a significant cost to future generations of Canadians.

-

Agriculture2 days ago

Agriculture2 days agoFederal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

-

Daily Caller17 hours ago

Daily Caller17 hours agoDemocrats Explicitly Tell Spy Agencies, Military To Disobey Trump

-

Addictions1 day ago

Addictions1 day agoActivists Claim Dealers Can Fix Canada’s Drug Problem

-

Alberta1 day ago

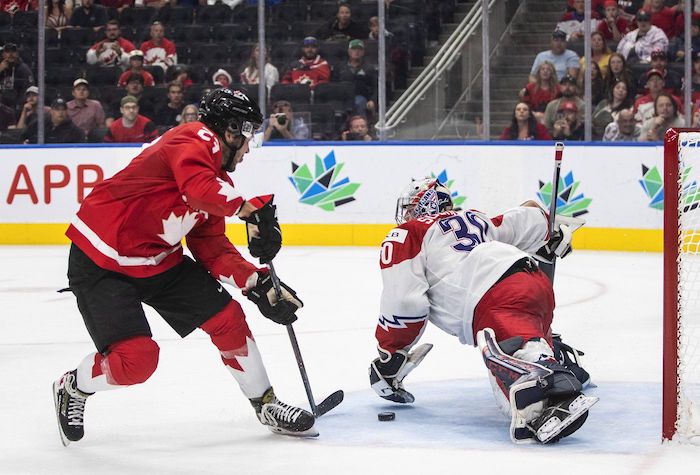

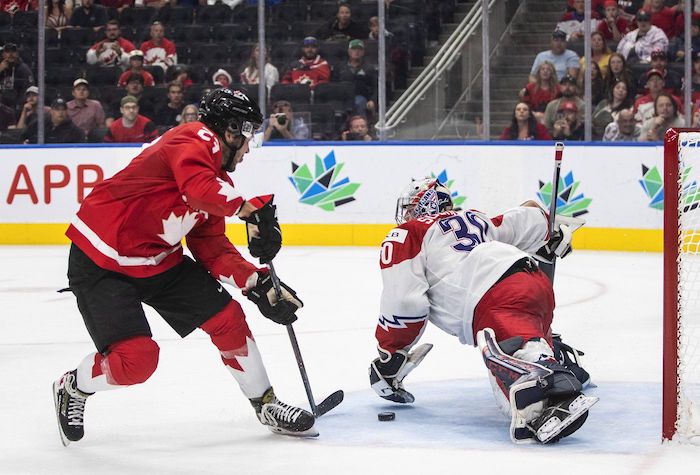

Alberta1 day agoEdmonton and Red Deer to Host 2027 IIHF World Junior Hockey Championship

-

Business24 hours ago

Business24 hours agoClimate Climbdown: Sacrificing the Canadian Economy for Net-Zero Goals Others Are Abandoning

-

Indigenous18 hours ago

Indigenous18 hours agoTop constitutional lawyer slams Indigenous land ruling as threat to Canadian property rights

-

Daily Caller2 days ago

Daily Caller2 days ago‘Holy Sh*t!’: Podcaster Aghast As Charlie Kirk’s Security Leader Reads Texts He Allegedly Sent University Police

-

Uncategorized1 day ago

Uncategorized1 day agoCost of bureaucracy balloons 80 per cent in 10 years: Public Accounts