Business

Investing In A Pandemic World

Investing In A Pandemic World

Launching an investment column in the midst of the biggest economic meltdown in investment history is a peculiar thing to do, and yet, here we are. Actually, the timing may be excellent: given the parameters and objectives of this column – how not to invest, as much as how to invest – what better time to wade in? If you’re a seasoned investor, the past few months most likely have you huddled in the basement under the stairs, sucking your thumb and rocking back and forth. The market has been pounded, and justifiably so – the strategy of governments to contain COVID-19 involves essentially shutting down large sectors of the economy. One can easily surmise that industries like tourism, air travel, etc. will be in big trouble; the problem is determining how far the rot goes – if an airline fails, or many of them, what industries does it take down with it? In a highly interconnected world, the answers are not clear.

Rather than panic and throw in the towel though (as some investors appear to have done), it is wise to stop hyperventilating if you can and consider the landscape without the lens of panic. First, the pounding in the stock market simply erased the extraordinary gains made in the past several years. As of writing, the S&P 500 Index ETF (exchange traded fund, which invests in a basket of stocks that mirrors the S&P 500 companies on behalf of individuals) is now back at a level of two years ago. Today’s data point might look like a disaster relative to the value of the portfolio 4 months ago, but that paper gain to the end of 2019 was a bit suspect anyway and most expected a market correction of some kind. Not quite like this one of course, but of some kind.

Second, governments around the world now have an arsenal of tools with which to stabilize economies. Or, more like they have a variety of smaller tools and one really big one: a great big freaking printing press to crank out money and shovel into the economy’s engines. There are many arguments as to why this is a bad idea in the long run, and they may all be right, but over the past few decades these strategies have become the norm. Government-led monetary tinkering, on ever-larger scales, saved the financial world in the 2008-9 Great Recession by flooding the world with bank-stabilizing money, and that success convinced those central bankers that this tool has no practical limits. The world is now so interlinked and dependent on central bankers’ policies that shouting about how they will destroy the financial world eventually is like a dog barking at a car. We need to think and act as though these policies aren’t going away. Because they’re not.

Governments, in this consumption-based world, can see the perils of allowing huge swathes of the global economy to perish. We may sneer = at a consumer-based culture, but we wet our pants when we consider the alternative. We need to learn to do things as cleanly as possible, but nowhere in the world does anyone want to see tourism grind to a halt, or people stop buying automobiles, or cosmetics, or any other mainstay of our economy.

As a result, those central banks and governments won’t let it happen. They will pump in money, and they will ease restrictions as soon as possible to get things back to work. It is a challenging time to consider putting money in the stock market (if you’re lucky enough to have some, and a job to boot), but some great companies are on sale in a huge way now. We can see, for example, that anything to do with the food/medicine/distribution systems is of critical importance. Given the fact that governments will print money to shove at anything the general population can’t live without, it is safe to assume those sectors will pull through. Same as natural gas and other industrially-critical materials – the whole climate change narrative has been stuffed in a trunk for the time being. No one wants to face next winter with a natural gas industry that’s gone out of business.

There is of course risk that the markets would continue to fall, based on the fact that there is so much uncertainty in the world with respect to demand erosion and recovery timing. But if the big blue-chip companies that provide our industrial lifelines go defunct and irreparably damage your portfolio, well, we’ll all have much bigger problems to worry about.

For more stories, visit Todayville Calgary

Business

There’s No Bias at CBC News, You Say? Well, OK…

It’s been nearly a year since I last wrote about the CBC. In the intervening months, the Prescott memo on bias at the BBC was released, whose stunning allegations of systemic journalistic malpractice “inspired” multiple senior officials to leave the corporation. Given how the institutional bias driving problems at the BBC is undoubtedly widely shared by CBC employees, I’d be surprised if there weren’t similar flaws embedded inside the stuff we’re being fed here in Canada.

Apparently, besides receiving nearly two billion dollars¹ annually in direct and indirect government funding, CBC also employs around a third of all of Canada’s full time journalists. So taxpayers have a legitimate interest in knowing what we’re getting out of the deal.

Naturally, corporate president Marie-Philippe Bouchard has solemnly denied the existence of any bias in CBC reporting. But I’d be more comfortable seeing some evidence of that with my own eyes. Given that I personally can easily go multiple months without watching any CBC programming or even visiting their website, “my own eyes” will require some creative redefinition.

So this time around I collected the titles and descriptions from nearly 300 stories that were randomly chosen from the CBC Top Stories RSS feed from the first half of 2025. You can view the results for yourself here. I then used AI tools to analyze the data for possible bias (how events are interpreted) and agendas (which events are selected). I also looked for:

- Institutional viewpoint bias

- Public-sector framing

- Cultural-identity prioritization

- Government-source dependency

- Social-progressive emphasis

Here’s what I discovered.

Story Selection Bias

Millions of things happen every day. And many thousands of those might be of interest to Canadians. Naturally, no news publisher has the bandwidth to cover all of them, so deciding which stories to include in anyone’s Top Story feed will involve a lot of filtering. To give us a sense of what filtering standards are used at the CBC, let’s break down coverage by topic.

Of the 300 stories covered by my data, around 30 percent – month after month – focused on Donald Trump and U.S.- Canada relations. Another 12-15 percent related to Gaza and the Israel-Palestine conflict. Domestic politics – including election coverage – took up another 12 percent, Indigenous issues attracted 9 percent, climate and the environment grabbed 8 percent, and gender identity, health-care worker assaults, immigrant suffering, and crime attracted around 4 percent each.

Now here’s a partial list of significant stories from the target time frame (the first half of 2025) that weren’t meaningfully represented in my sample of CBC’s Top Stories:

- Housing affordability crisis barely appears (one of the top voter concerns in actual 2025 polls).

- Immigration levels and labour-market impact.

- Crime-rate increases or policing controversies (unless tied to Indigenous or racialized victims).

- Private-sector investment success stories.

- Any sustained positive coverage of the oil/gas sector (even when prices are high).

- Critical examination of public-sector growth or pension liabilities.

- Chinese interference or CCP influence in Canada (despite ongoing inquiries in real life).

- The rest of the known galaxy (besides Gaza and the U.S.)

Interpretation Bias

There’s an obvious pattern of favoring certain identity narratives. The Indigenous are always framed as victims of historic injustice, Palestinian and Gazan actions are overwhelmingly sympathetic, while anything done by Israelis is “aggression”. Transgender representation in uniformly affirmative while dissent is bigotry.

By contrast, stories critical of immigration policy, sympathetic to Israeli/Jewish perspectives, or skeptical of gender medicine are virtually non-existent in this sample.

That’s not to say that, in the real world, injustice doesn’t exist. It surely does. But a neutral and objective news service should be able to present important stories using a neutral and objective voice. That obviously doesn’t happen at the CBC.

Consider these obvious examples:

- “Trump claims there are only ‘2 genders.’ Historians say that’s never been true” – here’s an overt editorial contradiction in the headline itself.

- “Trump bans transgender female athletes from women’s sports” which is framed as an attack rather than a policy debate.

And your choice of wording counts more than you might realize. Verbs like “slams”, “blasts”, and “warns” are used almost exclusively describing the actions of conservative figures like Trump, Poilievre, or Danielle Smith, while “experts say”, “historians say”, and “doctors say” are repeatedly used to rebut conservative policy.

Similarly, Palestinian casualties are invariably “killed“ by Israeli forces – using the active voice – while Israeli casualties, when mentioned at all, are described using the passive voice.

Institutional Viewpoint Bias

A primary – perhaps the primary job – of a serious journalist is to challenge the government’s narrative. Because if journalists don’t even try to hold public officials to account, then no one else can. Even the valuable work of the Auditor General or the Parliamentary Budget Officer will be wasted, because there will be no one to amplify their claims of wrongdoing. And Canadians will have no way of hearing the bad news.

So it can’t be a good sign when around 62 percent of domestic political stories published by the nation’s public broadcaster either quote government (federal or provincial) sources as the primary voice, or are framed around government announcements, reports, funding promises, or inquiries.

In other words, a majority of what the CBC does involves providing stenography services for their paymasters.

Here are just a few examples:

- “Federal government apologizes for ‘profound harm’ of Dundas Harbour relocations”

- “Jordan’s Principle funding… being extended through 2026: Indigenous Services”

- “Liberal government announces dental care expansion the day before expected election call”

Agencies like the Bank of Canada, Indigenous Services Canada, and Transportation Safety Board are routinely presented as authoritative and neutral. By contrast, opposition or industry critiques are usually presented as secondary (“…but critics say”) or are simply invisible. Overall, private-sector actors like airlines, oil companies, or developers are far more likely to be criticized.

All this is classic institutional bias: the state and its agencies are the default lens through which reality is filtered.

Not unlike the horrors going on at the BBC, much of this bias is likely unconscious. I’m sure that presenting this evidence to CBC editors and managers would evoke little more than blank stares. This stuff flies way below the radar.

But as one of the AI tools I used concluded:

In short, this 2025 CBC RSS sample shows a very strong and consistent left-progressive institutional bias both in story selection (agenda) and in framing (interpretation). The outlet functions less as a neutral public broadcaster and more as an amplifier of government, public-sector, and social-progressive narratives, with particular hostility reserved for Donald Trump, Canadian conservatives, and anything that could be construed as “right-wing misinformation.”

And here’s the bottom line from a second tool:

The data reveals a consistent editorial worldview where legitimate change flows from institutions downward, identity group membership is newsworthy, and systemic intervention is the default solution framework.

You might also enjoy:

Is Updating a Few Thousand Readers Worth a Half Million Taxpayer Dollars? |

||||||

|

||||||

| Plenty has been written about the many difficulties faced by legacy news media operations. You might even recall reading about the troubled CBC and the Liberal government’s ill-fated Online News Act in these very pages. Traditional subscription and broadcast models are drying up, and on-line ad-based revenues are in sharp decline. | ||||||

|

Agriculture

Supply Management Is Making Your Christmas Dinner More Expensive

From the Frontier Centre for Public Policy

By Conrad Eder

The food may be festive, but the price tag isn’t, and supply management is to blame

With Christmas around the corner, Canadians will be heading to the grocery store to pick up the essentials for a tasty Christmas feast. Milk and eggs to make dinner rolls, butter for creamy mashed potatoes, an assortment of cheeses as an appetizer, and, of course, the Christmas turkey.

All delicious. All essential. And all more expensive than they need to be because of a longstanding government policy. It’s called supply management.

Consider what a family might purchase when hosting Christmas dinner. Two cartons of eggs, two cartons of milk, a couple of blocks of cheese, a few sticks of butter, and an eight-kilogram turkey. According to Agriculture and Agri-Food Canada and Statistics Canada, that basket of goods costs a little less than $80.

Using price premiums calculated in a 2015 University of Manitoba study, Canada’s supply management system is responsible for $16.69 to $20.48 of the cost of that Christmas dinner. That’s a 21 to 26 per cent premium Canadian consumers pay on those five staples alone. Planning on making a yogurt dip or serving ice cream with dessert? Those extra costs continue to climb.

Canadians pay these premiums for poultry, dairy and eggs because of how Canada’s supply management system works. Farmers must obtain government-issued production quotas that dictate how much they’re allowed to produce. Prices are set by government bodies rather than in an open market. High tariffs block imports and restrict competition from international producers.

The costs of supply management are significant, amounting to billions of dollars every year, yet they are largely hidden, spread across millions of households’ grocery bills. Meanwhile, the benefits flow to a small number of quota-holding farmers. Their quotas are worth millions of dollars and help ensure profitable returns.

These farmers have every incentive to lobby, organize and defend the current system. Wanting special protection is one thing. Actually being given it is another. It is the responsibility of elected officials to resist such demands. Elected to represent all Canadians, politicians should unapologetically prioritize the public interest over any special interests.

Yet in June 2025, Parliament did the opposite. Rather than solve a problem that costs Canadians billions each year, members of Parliament from every party, Liberal, Conservative, Bloc, NDP and Green, unanimously approved Bill C-202, further entrenching the system that makes grocery bills more expensive at a time when families can least afford it. Bill C-202 prohibits Canada from offering any further market access concessions on supply-managed sectors in future trade negotiations.

This decision is even more disappointing when we consider what other nations have already accomplished. Australia and New Zealand demonstrate that removing supply management is not only possible but beneficial.

Australia operated a dairy quota system for decades before abolishing it in 2000. New Zealand began dismantling its dairy supply management regime in 1984 and completed the process in 2001. Both countries found that competitive markets provided their citizens with the access to goods they needed without the hidden costs. If these countries could eliminate supply management, so can Canada.

As the government scrambles to combat the rising cost of living, one of the simplest and most effective solutions continues to be ignored. Eliminating supply management. Removing the quotas, the price controls and the tariffs would allow market competition to do what it does across every other product category. It delivers choice, quality and affordability.

As Canadians gather for Christmas dinner, the feast may be delicious, but it will once again be more expensive than it needs to be. That is the cost of supply management, and Canadians should no longer have to bear it.

Conrad Eder is a policy analyst at the Frontier Centre for Public Policy.

-

Business2 days ago

Business2 days agoGeopolitics no longer drives oil prices the way it used to

-

Business2 days ago

Business2 days agoArgentina’s Milei delivers results free-market critics said wouldn’t work

-

Business1 day ago

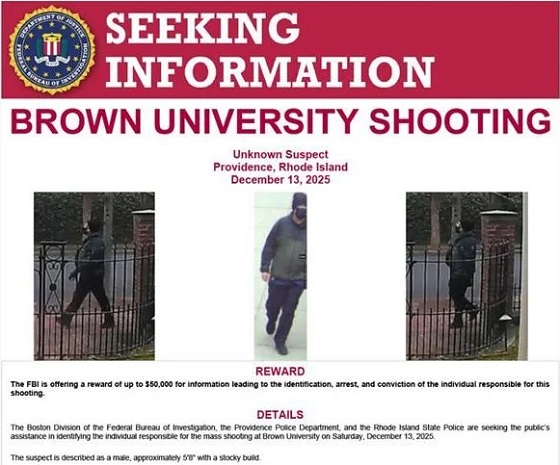

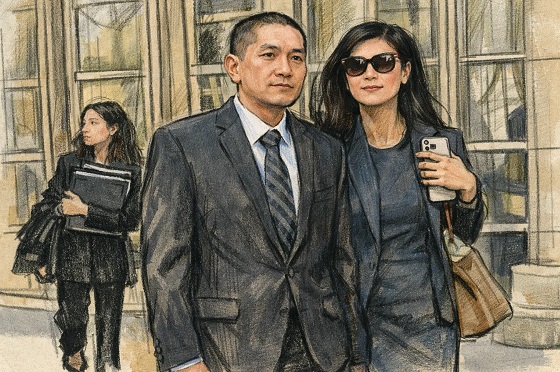

Business1 day agoDeadlocked Jury Zeroes In on Alleged US$40 Million PPE Fraud in Linda Sun PRC Influence Case

-

Daily Caller2 days ago

Daily Caller2 days agoEx-FDA Commissioners Against Higher Vaccine Standards Took $6 Million From COVID Vaccine Makers

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoCanadian university censors free speech advocate who spoke out against Indigenous ‘mass grave’ hoax

-

Business21 hours ago

Business21 hours agoTaxing food is like slapping a surcharge on hunger. It needs to end

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy protester appeals after judge dismissed challenge to frozen bank accounts

-

International1 day ago

International1 day agoOttawa is still dodging the China interference threat