Alberta

Indigenous leaders see progress in 2023 but continue to advocate for national loan guarantee program

Wolf Midstream and its partners in the Northern Lakeland Indigenous Alliance participate in a signing ceremony celebrating a $103 million loan guarantee from the AIOC to obtain a 43% stake in the Access NGL Pipeline System. Photo courtesy AIOC

From the Canadian Energy Centre

By Shawn Logan

“Things are starting to work but self-determination is the ultimate goal.”

When John Desjarlais reflects on 2023, he admits he had feared a growing national tide of Indigenous investment in key energy projects was due to hit a speedbump.

Instead, as a new year approaches, the executive director of the Indigenous Resource Network (IRN) says any doubts have been replaced by optimism that the positive momentum of the last few years will flow into 2024.

“I’m feeling more optimistic now. I’m pleased to see the level of conversation being had with Indigenous leaders,” he said.

“I think there is growing opportunity for Indigenous participation across entire value chains, for board and executive positions, and more meaningful involvement. I think we’re really going to see the needle move in 2024.”

John Desjarlais, executive director of the Indigenous Resource Network in Bragg Creek, Alta. Photo by Dave Chidley for the Canadian Energy Centre

John Desjarlais, executive director of the Indigenous Resource Network in Bragg Creek, Alta. Photo by Dave Chidley for the Canadian Energy Centre

Despite the year’s slow start, Desjarlais said 2023 became something of a bellwether for how the rest of the world views the involvement of First Nations and Métis in Canada’s oil and gas industry.

In April, Desjarlais joined a delegation of Indigenous leaders in Ottawa to meet face-to-face with diplomats from some of the world’s strongest economies. Joined by Haisla Nation Chief Councillor Crystal Smith, First Nations LNG Alliance CEO Karen Ogen and former Enoch Cree First Nation chief Billy Morin, the delegation quickly learned not only was there an appetite for Canadian energy, but for Indigenous knowledge and participation on the critical file.

“Every official had a real desire to really understand Indigenous sentiment around resource development. There was a sincere desire to learn from our perspective,” Desjarlais told the CEC following the meetings with representatives from G7 allies Germany, France, Japan and the United States, as well as Poland and India.

However, while potential international energy partners are intrigued by the potential of relationships with Indigenous energy suppliers, a significant hurdle remains – the need for a national loan guarantee program that would empower more Indigenous ownership in community-transforming projects, particularly oil and gas.

Dale Swampy, president of the National Coalition of Chiefs, is a veteran in the fight for First Nations and Métis to fully benefit from critical resources to directly benefit communities. And he is hopeful there is growing recognition in Ottawa that enabling self-determination is an effective and enduring pathway to prosperity.

“The only way to defeat on-reserve poverty is to create ways to employ people,” he said.

“And the only industry that gives us this opportunity is the natural resources industry.”

Alberta has been a leader in helping open doors to indigenous ownership of major resource projects, launching the Alberta Indigenous Opportunities Corporation (AIOC) in 2019. As the year came to a close, the AIOC announced two more major deals, which will see the total investment backed by the fund to date reach more than $680 million, directly impacting 42 Indigenous groups.

Dale Swampy President National Coalition of Chiefs. Canadian Energy Centre photo

Dale Swampy President National Coalition of Chiefs. Canadian Energy Centre photo

In what marks the second-largest loan guarantee backed by the provincial corporation, 12 Indigenous communities will invest $150 million to obtain 85 per cent ownership in oil and gas midstream infrastructure in the Marten Hills and Nipisi areas of the Clearwater play in Northern Alberta.

While the ink was still drying, two days later another deal saw five First Nations in northwestern Alberta enter into a $20.5 million partnership with NuVista Energy Ltd. for majority ownership of an emissions-reducing cogeneration unit at the Wembley gas plant in the County of Grande Prairie.

The AIOC’s success saw the Alberta government increase its loan guarantee capacity to $2 billion this year, and it’s set to increase it further to $3 billion for the 2024-2025 fiscal year.

Desjarlais’ IRN spent most of 2023 advocating for a federal version of the AIOC, to emulate its success at the national level.

Chief Greg Desjarlais of Frog Lake First Nation signs a historic agreement between Enbridge and 23 First Nation and Métis communities in September 2022. The communities acquired, collectively, an 11.57% non-operating interest in seven Enbridge-operated pipelines in the Athabasca region of northern Alberta for $1.12 billion on September 22, 2022. Photo courtesy Enbridge

Chief Greg Desjarlais of Frog Lake First Nation signs a historic agreement between Enbridge and 23 First Nation and Métis communities in September 2022. The communities acquired, collectively, an 11.57% non-operating interest in seven Enbridge-operated pipelines in the Athabasca region of northern Alberta for $1.12 billion on September 22, 2022. Photo courtesy Enbridge

In its fall financial update, the federal government announced it would unveil a new Indigenous loan guarantee program when it sets its 2024 budget this spring. But there has been no commitment to include oil and gas projects as part of the program.

Desjarlais said the fact a program has been promised is a good first step – now Indigenous leaders need to convince the federal government that imposing restrictions will only impede economic reconciliation.

“It looks like there is a program coming but we have to take a look at the exclusions,” he said.

“What we really want to see is less paternalism. Things are starting to work but self-determination is the ultimate goal.”

Desjarlais said the last few years have seen significant progress when it comes to Indigenous involvement in resource projects.

On the west coast, Indigenous-owned Cedar LNG and Ksi Lisims LNG will be at the vanguard of Canada’s first significant foray into exporting the in-demand fuel for customers in Asia. While several Indigenous communities across western Canada are investing in critical infrastructure like pipelines and carbon capture and storage projects.

For Swampy, that progress is long overdue. And it’s becoming increasingly clear that Indigenous communities no longer want to be reliant on government supports – they want to take control of their own destinies.

“They want to take part in the prosperity that comes with oil and gas, and they want to own it,” he said.

“All we ask is that we be involved when it comes to the question about land and resources. We don’t want to just be part of these consultations, we want to lead projects.”

Alberta

Red Deer Justice Centre Grand Opening: Building access to justice for Albertans

The new Red Deer Justice Centre will help Albertans resolve their legal matters faster.

Albertans deserve to have access to a fair, accessible and transparent justice system. Modernizing Alberta’s courthouse infrastructure will help make sure Alberta’s justice system runs efficiently and meets the needs of the province’s growing population.

Alberta’s government has invested $191 million to build the new Red Deer Justice Centre, increasing the number of courtrooms from eight to 12, allowing more cases to be heard at one time.

“Modern, accessible courthouses and streamlined services not only strengthen our justice

system – they build safer, stronger communities across the province. Investing in the new Red Deer Justice Centre is vital to helping our justice system operate more efficiently, and will give people in Red Deer and across central Alberta better access to justice.”

Government of Alberta and Judiciary representatives with special guests at the Red Deer Justice Centre plaque unveiling event April 22, 2025.

On March 3, all court services in Red Deer began operating out of the new justice centre. The new justice centre has 12 courtrooms fully built and equipped with video-conference equipment to allow witnesses to attend remotely if they cannot travel, and vulnerable witnesses to testify from outside the courtroom.

The new justice centre also has spaces for people taking alternative approaches to the traditional courtroom trial process, with the three new suites for judicial dispute resolution services, a specific suite for other dispute resolution services, such as family mediation and civil mediation, and a new Indigenous courtroom with dedicated venting for smudging purposes.

“We are very excited about this new courthouse for central Alberta. Investing in the places where people seek justice shows respect for the rights of all Albertans. The Red Deer Justice Centre fills a significant infrastructure need for this rapidly growing part of the province. It is also an important symbol of the rule of law, meaning that none of us are above the law, and there is an independent judiciary to decide disputes. This is essential for a healthy functioning democracy.”

“Public safety and access to justice go hand in hand. With this investment in the new Red Deer Justice Centre, Alberta’s government is ensuring that communities are safer, legal matters are resolved more efficiently and all Albertans get the support they need.”

“This state-of-the-art facility will serve the people of Red Deer and surrounding communities for generations. Our team at Infrastructure is incredibly proud of the work done to plan, design and build this project. I want to thank everyone, at all levels, who helped make this project a reality.”

Budget 2025 is meeting the challenge faced by Alberta with continued investments in education and health, lower taxes for families and a focus on the economy.

Quick facts

- The new Red Deer Justice Centre is 312,000 sq ft (29,000 m2). (The old courthouse is 98,780 sq ft (9,177 m2)).

- The approved project funding for the Red Deer Justice Centre is about $191 million.

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

-

2025 Federal Election1 day ago

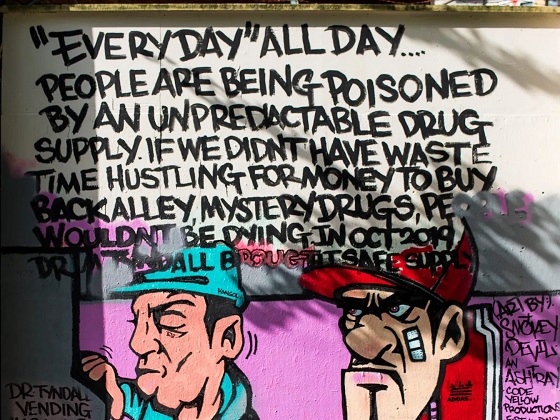

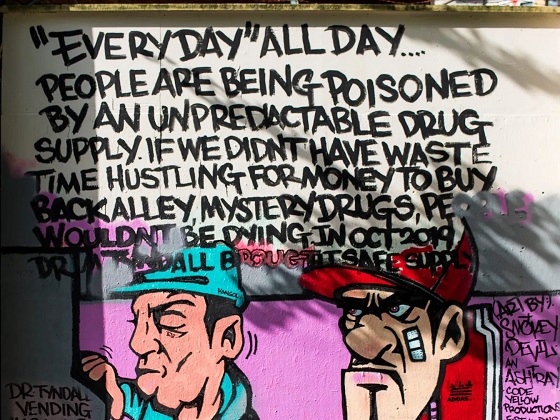

2025 Federal Election1 day agoStudy links B.C.’s drug policies to more overdoses, but researchers urge caution

-

Business2 days ago

Business2 days agoChinese firm unveils palm-based biometric ID payments, sparking fresh privacy concerns

-

International2 days ago

International2 days agoPope Francis Got Canadian History Wrong

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCarney’s Hidden Climate Finance Agenda

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoWhen it comes to pipelines, Carney’s words flow both ways

-

Business1 day ago

Business1 day agoIs Government Inflation Reporting Accurate?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFormer WEF insider accuses Mark Carney of using fear tactics to usher globalism into Canada

-

Environment2 days ago

Environment2 days agoExperiments to dim sunlight will soon be approved by UK government: report