Energy

If Canada won’t build new pipelines now, will it ever?

Canada must not allow ideological dogma and indecision to squander a rare chance to lock in our energy sovereignty for good

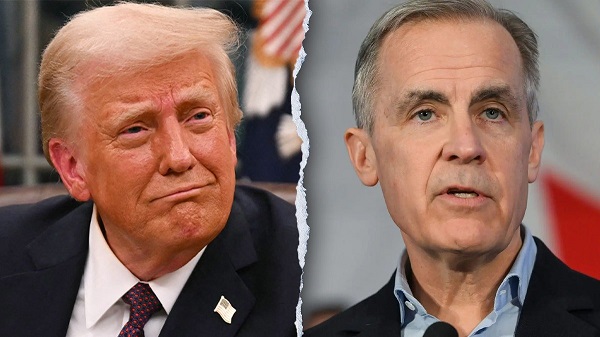

Canada teeters on the edge, battered by a trade war and Trump’s tariff threats from its once-steady southern ally, yet held back by its own indecision. Trump’s 25 percent tariffs have exposed a brutal truth: Canada’s economy, especially its oil exports, is nearly 100 percent dependent on the U.S.

Voices are crying out to lament the regulatory chaos, ideological zeal, and whispers of “peak oil” that stall progress. If Canada won’t build pipelines when its sovereignty and prosperity are at stake, will it ever? The economics are clear, peak oil is a myth, and the only barriers are self-imposed: dogma, tangled rules, and bad thinking.

The infrastructure Canada can command is immense. Four million barrels of crude flow to the U.S. daily, and Trump’s threats have made that number look even bigger.

The Trans Mountain Expansion (TMX) is proof—linking Alberta to Asia’s markets, with royalties already filling public coffers.

But it’s a lone success. Energy East and Northern Gateway are buried, killed by delays and poor decisions. Private capital is gun-shy, scarred by TMX’s $34 billion price tag, ballooned by a broken system. Why risk billions when the path is a minefield?

The stakes are higher than ever. Forget the claim that oil demand peaks this year at 102 million barrels daily. Experts see a different horizon: Goldman Sachs predicts growth to 2034, OPEC to 2050, BP to 2035—some forecasts topping 80 million barrels.

Enbridge’s Greg Ebel sees “well north” of 100 million by mid-century, driven by Asia’s demand and the developing world’s hunger for energy. Peak oil is a ghost story, not a reality. Canada sits on the third-largest reserves in the world and could dominate the global market, not just feed one neighbour. Pipelines to every coast—east, west, and north—would unlock that future and secure riches for decades.

So what’s holding us back? Ideology, for starters.

Environmental lobbying and influence wrap resource projects in suffocating red tape—emissions caps and endless assessments that kill progress. Years of environmental studies and “net zero” hurdles that no pipeline can clear are choking off bold ideas.

Quebec’s stance has softened under Trump’s pressure, but problematic ideals still linger that blind leaders to reality. The regulatory mess makes it worse.

Today’s system demands a $1 billion bet upfront—engineering, consultations—before a shovel hits the dirt. Companies like TC Energy have been burned before, and others won’t play unless there’s reform. TMX worked because it was a government rescue, but its cost is a deterrent to others.

Then there’s the mess of bad ideas. Government officials will talk about pipelines one day and then express doubts about them the next, leaving a void of leadership. Former prime minister Jean Chrétien very strongly backed a West-East pipeline at the Liberal Party leadership convention.

New leader Mark Carney supports energy links but will not name pipelines, even though public support for them has surged. Four out of five Canadians back coast-to-coast pipelines—but leaders continue to waver.

If not now—when we’re in a trade war and facing annexation—when? Canada’s future is about the infrastructure it controls, not the excuses it clings to. The wealth is waiting, the demand is there, and the barriers are ours to break. Ditch the dogma, fix the rules, and build. Or remain a nation forever poised to rise but never brave enough to do it.

Canadian Energy Centre

Why nation-building Canadian resource projects need Indigenous ownership to succeed

Chief Greg Desjarlais of Frog Lake First Nation signs an agreement in September 2022 whereby 23 First Nations and Métis communities in Alberta will acquire an 11.57 per cent ownership interest in seven Enbridge-operated oil sands pipelines for approximately $1 billion. Photo courtesy Enbridge

From the Canadian Energy Centre

U.S. trade dispute converging with rising tide of Indigenous equity

A consensus is forming in Canada that Indigenous ownership will be key to large-scale, nation-building projects like oil and gas pipelines to diversify exports beyond the United States.

“Indigenous ownership benefits projects by making them more likely to happen and succeed,” said John Desjarlais, executive director of the Indigenous Resource Network.

“This is looked at as not just a means of reconciliation, a means of inclusion or a means of managing risk. I think we’re starting to realize this is really good business,” he said.

“It’s a completely different time than it was 10 years ago, even five years ago. Communities are much more informed, they’re much more engaged, they’re more able and ready to consider things like ownership and investment. That’s a very new thing at this scale.”

John Desjarlais, executive director of the Indigenous Resource Network in Bragg Creek, Alta. Photo by Dave Chidley for the Canadian Energy Centre

John Desjarlais, executive director of the Indigenous Resource Network in Bragg Creek, Alta. Photo by Dave Chidley for the Canadian Energy Centre

Canada’s ongoing trade dispute with the United States is converging with a rising tide of Indigenous ownership in resource projects.

“Canada is in a great position to lead, but we need policymakers to remove barriers in developing energy infrastructure. This means creating clear and predictable regulations and processes,” said Colin Gruending, Enbridge’s president of liquids pipelines.

“Indigenous involvement and investment in energy projects should be a major part of this strategy. We see great potential for deeper collaboration and support for government programs – like a more robust federal loan guarantee program – that help Indigenous communities participate in energy development.”

In a statement to the Canadian Energy Centre, the Alberta Indigenous Opportunities Corporation (AIOC) – which has backstopped more than 40 communities in energy project ownership agreements with a total value of over $725 million – highlighted the importance of seizing the moment:

“The time is now. Canada has a chance to rethink how we build and invest in infrastructure,” said AIOC CEO Chana Martineau.

“Indigenous partnerships are key to making true nation-building projects happen by ensuring critical infrastructure is built in a way that is competitive, inclusive and beneficial for all Canadians. Indigenous Nations are essential partners in the country’s economic future.”

Key to this will be provincial and federal programs such as loan guarantees to reduce the risk for Indigenous groups and industry participants.

“There are a number of instruments that would facilitate ownership that we’ve seen grow and develop…such as the loan guarantee programs, which provide affordable access to capital for communities to invest,” Desjarlais said.

Workers lay pipe during construction of the Trans Mountain pipeline expansion on farmland in Abbotsford, B.C. on Wednesday, May 3, 2023. CP Images photo

Workers lay pipe during construction of the Trans Mountain pipeline expansion on farmland in Abbotsford, B.C. on Wednesday, May 3, 2023. CP Images photo

Outside Alberta, there are now Indigenous loan guarantee programs federally and in Saskatchewan. A program in British Columbia is in development.

The Indigenous Resource Network highlights a partnership between Enbridge and the Willow Lake Métis Nation that led to a land purchase of a nearby campground the band plans to turn into a tourist destination.

“Tourism provides an opportunity for Willow Lake to tell its story and the story of the Métis. That is as important to our elders as the economic considerations,” Willow Lake chief financial officer Michael Robert told the Canadian Energy Centre.

The AIOC reiterates the importance of Indigenous project ownership in a call to action for all parties:

“It is essential that Indigenous communities have access to large-scale capital to support this critical development. With the right financial tools, we can build a more resilient, self-sufficient and prosperous economy together. This cannot wait any longer.”

In an open letter to the leaders of all four federal political parties, the CEOs of 14 of Canada’s largest oil and gas producers and pipeline operators highlighted the need for the federal government to step up its participation in a changing public mood surrounding the construction of resource projects:

“The federal government needs to provide Indigenous loan guarantees at scale so industry may create infrastructure ownership opportunities to increase prosperity for communities and to ensure that Indigenous communities benefit from development,” they wrote.

For Desjarlais, it is critical that communities ultimately make their own decisions about resource project ownership.

“We absolutely have to respect that communities want to self-determine and choose how they want to invest, choose how they manage a lot of the risk and how they mitigate it. And, of course, how they pursue the rewards that come from major project investment,” he said.

Daily Caller

AI Needs Natural Gas To Survive

From the Daily Caller News Foundation

By David Blackmon

As recent studies project a big rise in power generation demand from the big datacenters that are proliferating around the United States, the big question continues to focus in on what forms of generation will rise to meet the new demand. Most datacenters have plans to initially interconnect into local power grids, but the sheer magnitude of their energy needs threatens to outstrip the ability of grid managers to expand supply fast enough.

This hunger for more affordable, 24/7 baseload capacity is leading to a variety of proposed solutions, including President Donald Trump’s new executive orders focused on reviving the nation’s coal industry, scheduled to be signed Tuesday afternoon. But efforts to restart the permitting of new coal-fired power plants in the US will require additional policy changes, efforts which will take time and could ultimately fail. In the meantime, datacenter developers find themselves having to delay construction and completion dates until firm power supply can be secured.

Datacenters specific to AI technology require ever-increasing power loads. For instance, a single AI query can consume nearly ten times the power of a traditional internet search, and projections suggest that U.S. data center electricity consumption could double or even triple by 2030, rising from about 4-5% of total U.S. electricity today to as much as 9-12%. Globally, data centers could see usage climb from around 536 terawatt-hours (TWh) in 2025 to over 1,000 TWh by 2030. In January, a report from the American Security Project estimated that datacenters could consume about 12% of all U.S. power supply.

Obviously, the situation calls for innovative solutions. A pair of big players in the natural gas industry, Liberty Energy and Range Resources, announced on April 8 plans to diversify into the power generation business with the development of a major new natural gas power plant to be located in the Pittsburgh area. Partnering with Imperial Land Corporation (ILC), Liberty and Range will locate the major power generation plant in the Fort Cherry Development District, a Class A industrial park being developed by ILC.

“The strategic collaboration between Liberty, ILC, and Range will focus on a dedicated power generation facility tailored to meet the energy demands of data centers, industrial facilities, and other high-energy-use businesses in Pennsylvania,” the companies said in a joint release.

Plans for this new natural gas power project follows closely on the heels of the March 22 announcement for plans to transform the largest coal-fired power plant in Pennsylvania, the Homer City generating station, into a new gas-fired facility. The planned revitalized plant would house 7 natural gas turbines with a combined capacity of 4.5 GW, enough power 3 million homes.

Both the Homer City station and the Fort Cherry plant will use gas produced out of the Appalachia region’s massive Marcellus Shale formation, the most prolific gas basin in North America. But plans like these by gas companies to invest in their own products for power needs aren’t isolated to Pennsylvania.

In late January, big Permian Basin oil and gas producer Diamondback Energy told investors that it is seeking equity partners to develop a major gas-fired plan on its own acreage in the region. The facility would primarily supply electricity to data centers, which are expected to proliferate in Texas due to the AI boom, while also providing power for Diamondback’s own field operations. This dual-purpose approach could lower the company’s power costs and create a new revenue stream by selling excess electricity.

Prospects for expansion of gas generation in the U.S. received a big boost in January when GE Vernova announced plans for a $600 million expansion of its manufacturing capacity for gas turbines and other products in the U.S. GE Vernova is the main supplier of turbines for U.S. power generation needs. The company plans to build 37 gas power turbines in 2025, with a potential increase to over 70 by 2027, to meet rising energy demands.

The bottom line on these and other recent events is this: Natural gas is quickly becoming the power generation fuel of choice to feed the needs of the expanding datacenter industry through 2035, and potentially beyond. Given that reality, the smart thing to do for these and other companies in the natural gas business is to put down big bets on themselves.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNo Matter The Winner – My Canada Is Gone

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoASK YOURSELF! – Can Canada Endure, or Afford the Economic Stagnation of Carney’s Costly Climate Vision?

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCSIS Warned Beijing Would Brand Conservatives as Trumpian. Now Carney’s Campaign Is Doing It.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoInside Buttongate: How the Liberal Swamp Tried to Smear the Conservative Movement — and Got Exposed

-

Alberta2 days ago

Alberta2 days agoProvince to expand services provided by Alberta Sheriffs: New policing option for municipalities

-

Alberta2 days ago

Alberta2 days agoMade in Alberta! Province makes it easier to support local products with Buy Local program

-

International2 days ago

International2 days agoTulsi Gabbard tells Trump she has ‘evidence’ voting machines are ‘vulnerable to hackers’

-

COVID-191 day ago

COVID-191 day agoCOVID virus, vaccines are driving explosion in cancer, billionaire scientist tells Tucker Carlson