Uncategorized

Fast-strengthening hurricane closes in on Florida Panhandle

TALLAHASSEE, Fla. — At least 120,000 people along the Florida Panhandle were ordered to clear out on Tuesday as Hurricane Michael rapidly picked up steam in the Gulf of Mexico and closed in with winds of 110 mph and a potential storm surge of 12 feet.

Coastal residents rushed to board up their homes and sandbag their properties against the fast-moving hurricane, which was expected to blow ashore around midday Wednesday along a relatively lightly populated stretch of shoreline known for its fishing villages and white-sand spring-break beaches.

The speed of the storm — Michael was moving north 12 mph (19 kph) — gave people a dwindling number of hours to prepare or flee before being caught in damaging wind and rain.

“Guess what? That’s today,” National Hurricane Center Director Ken Graham said. “If they tell you to leave, you have to leave.”

As of 2 p.m. EDT, Michael had winds of 110 mph (175 kph), just below a Category 3 hurricane, and was getting stronger, drawing energy from Gulf waters in the mid-80s.

The hurricane’s effects will be felt far from its eye.

Forecasters said Michael’s tropical storm-force winds stretched 370 miles (595

Aja Kemp, 36, planned to ride out the storm in her mobile home in Crawfordville. She worked all night stocking shelves at a big-box store that was closing later Tuesday, then got to work securing her yard.

Kemp said the bill

“I just can’t bring myself to spend that much money,” she said. “We’ve got supplies to last us a week. Plenty of water. I made sure we’ve got clean clothes. We got everything tied down.”

Florida Gov. Rick Scott warned that the “monstrous hurricane” was just hours away, and his Democratic opponent for the Senate, Sen. Bill Nelson, said a “wall of water” could cause major destruction along the Panhandle.

“Don’t think that you can ride this out if you’re in a low-lying area,” Nelson said on CNN.

Mandatory evacuation orders went into effect in Bay County for some 120,000 people in Panama City Beach and other low-lying coastal areas in the bull’s-eye.

In Escambia County, on the western edge of the Panhandle, evacuations began in Pensacola Beach and other vulnerable areas, but not in Pensacola itself, a city of about 54,000.

“We don’t know if it’s going to wipe out our house or not,” Jason McDonald, of Panama City, said as he and his wife drove north into Alabama with their two children, ages 5 and 7. “We want to get them out of the way.”

Forecasters said parts of Florida’s marshy, lightly populated Big Bend area — the crook of Florida’s elbow — could see up to 12 feet (3.7

In Apalachicola, population 2,500, some resolved to stay put.

“We’ve been through this before,” Sally Crown said she closed the cafe where she works because the city was shutting off the sewer system in anticipation of the storm.

Crown planned to go home and hunker down with her two dogs: “This might be really bad and serious. But in my experience, it’s always blown way out of proportion.”

Farther inland, in Tallahassee, the state’s capital, people rushed to fill their gas tanks and grab supplies. Many gas stations in Tallahassee had run out of fuel, including the Quick ‘N’ Save, which was also stripped clean of bottled water and down to about two dozen bags of ice.

Tallahassee Mayor Andrew Gillum, Florida’s Democratic nominee for governor, helped people fill sandbags.

Michael could dump up to a foot (30

Forecasters said it could bring 3 to 6 inches of rain to Georgia, the Carolinas and Virginia, triggering flash flooding in a corner of the country still recovering from Hurricane Florence.

“I know people are fatigued from Florence, but don’t let this storm catch you with your guard down,” North Carolina Gov. Roy Cooper said, adding, “A number of homes have rooftop tarps that could be damaged or blown away with this wind.”

While Florence took five days between the time it turned into a hurricane and the moment it blew ashore in the Carolinas, Michael gave Florida what could amount to just two days’ notice. It developed into a hurricane on Monday.

While Florence wrung itself out for days and brought ruinous rains, fast-moving Michael is likely to be more about wind and storm surge.

Michael wasn’t quite done wreaking havoc in the Caribbean.

In Cuba, it dumped more than 10 inches (27

Disaster agencies in El Salvador, Honduras and Nicaragua reported 13 deaths as roofs collapsed and residents were carried away by swollen rivers.

The governors of Florida, Alabama and Georgia declared states of emergency as Michael closed in, and hundreds of Florida National Guard members were activated.

With a month to go before Election Day, Florida voters in evacuation zones were given an extra day to register to vote, once offices reopen after the storm.

The governor also told Florida hospitals and nursing homes to do all they can to assure the safety of the frail and elderly. After Hurricane Irma last year, 14 people died when a South Florida nursing home lost power and air conditioning.

“If you’re responsible for a patient, you’re responsible for the patient. Take care of them,” Scott said.

___

Associated Press writers Jonathan Drew in Raleigh, N.C.; Andrea Rodriguez in Cuba; Brendan Farrington in Tallahassee, Fla.; and Tamara Lush in St. Petersburg, Fla., contributed to this report.

Gary Fineout, The Associated Press

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoUS Condemns EU Censorship Pressure, Defends X

-

Dan McTeague2 days ago

Dan McTeague2 days agoWill this deal actually build a pipeline in Canada?

-

Bruce Dowbiggin24 hours ago

Bruce Dowbiggin24 hours agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

Business2 days ago

Business2 days agoLoblaws Owes Canadians Up to $500 Million in “Secret” Bread Cash

-

Opinion1 day ago

Opinion1 day agoThe day the ‘King of rock ‘n’ roll saved the Arizona memorial

-

Focal Points1 day ago

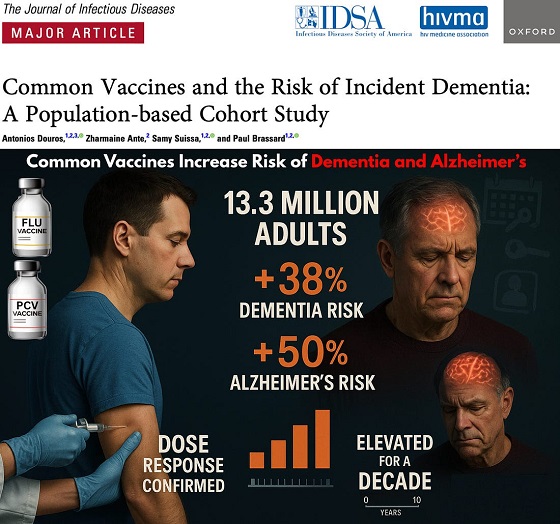

Focal Points1 day agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

espionage1 day ago

espionage1 day agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Banks2 days ago

Banks2 days agoTo increase competition in Canadian banking, mandate and mindset of bank regulators must change