Business

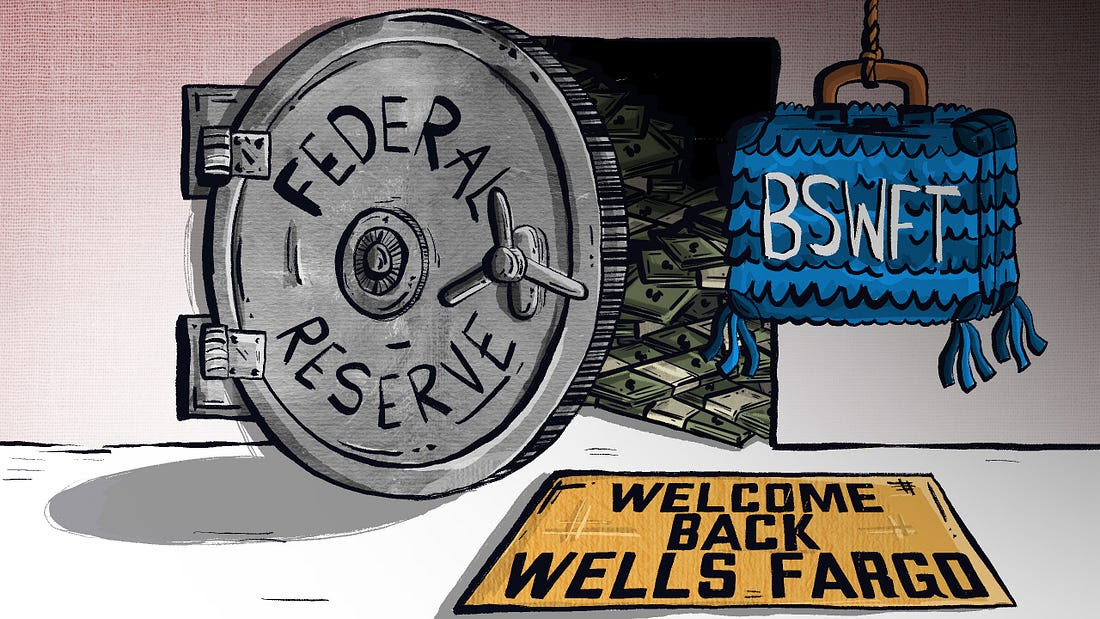

How the federal government weaponized the bank secrecy act to spy on Americans

A Congressional investigation committee released an extremely concerning report this week entitled: “FINANCIAL SURVEILLANCE IN THE UNITED STATES: HOW THE FEDERAL GOVERNMENT WEAPONIZED THE BANK SECRECY ACT TO SPY ON AMERICANS” that details how the US government has been monitoring American citizens through bank transactions, with an emphasis on citizens who have expressed conservative viewpoints.

“Financial data can tell a person’s story, including one’s “religion, ideology, opinions, and interests” as well as one’s “political leanings, locations, and more,”’ the report begins. This investigation began after a whistleblower who happens to be a retired FBI agent alerted Congress that the Bank of America (BoA) voluntarily provided the Biden Administration information on customers who used a credit or debit card in Washington, D.C., around the January 6 protests. The new report has revealed that federal agencies have been working “hand-in-glove with financial institutions, obtaining virtually unchecked access to private financial data and testing out new methods and new technology to continue the financial surveillance of American citizens.”

As I’ve said countless times, “money laundering” is ALWAYS the excuse for why the government must track and monitor our financial transactions. The Bank Secrecy Act (BSA) E-Filing System is a system for financial institutions to file reports required by the BSA electronically. By law, the BSA requires businesses to keep records and file reports to help prevent and detect money laundering. This is how the Biden Administration is attempting to disregard privacy and weaponize financial institutions.

US intelligence agencies searched through records for terms like “Trump” and “MAGA” to target Americans who they believed may hold “extremist” views. The agencies searched for Americans who purchased religious texts, such as the Bible, and also labeled them extremists. Anyone expressing disdain for the COVID lockdowns, vaccines, open borders, or the deep state were placed on a watchlist. Again, the BSA was used as a premise to pull transactions placed by the individuals on this list.

As explained by the investigative committee:

“With narrow exception, federal law does not permit law enforcement to inquire into financial institutions’ customer information without some form of legal process.9 The FBI circumvents this process by tipping off financial institutions to “suspicious” individuals and encouraging these institutions to file a SAR—which does not require any legal process—and thereby provide federal law enforcement with access to confidential and highly sensitive information.10 In doing so, the FBI gets around the requirements of the Bank Secrecy Act (BSA), which, per the Treasury Department, specifies that “it is . . . a bank’s responsibility” to “file a SAR whenever it identifies ‘a suspicious transaction relevant to a possible violation of law or regulation’”11 While at least one financial institution requested legal process from the FBI for information it was seeking,12 all too often the FBI appeared to receive no pushback. In sum, by providing financial institutions with lists of people that it views as generally “suspicious” on the front end, the FBI has turned this framework on its head and contravened the Fourth Amendment’s requirements of particularity and probable cause.”

Under this premise, anyone who held a viewpoint that opposed the Biden Administration was considered a “suspicious” individual who required monitoring. The Treasury Department’s Financial Crimes Enforcement Network created a database to carefully watch potential dissenters. Over 14,000 government employees accessed the FinCEN database last year and conducted over 3 million searches without a warrant. In fact, over 15% of FBI investigations during 2023 has some link to this database. It is estimated that 4.6 million SARs and 20.8 million Currency Transaction Reports (CTRs) were filed in the last year.

The committee noted that the government is incorporating AI to quickly search the web for “suspicious” Americans:

“As the Committee and Select Subcommittee have discussed in other reports, the growth and expansion of AI present major risks to Americans’ civil liberties.211 For example, the Committee and Select Subcommittee uncovered AI being used to censor “alleged misinformation regarding COVID-19 and the 2020 election . . . .”212 Those concerns are not hypothetical. Some AI systems developed by Big Tech companies have been programmed with biases; for example, Google’s Gemini AI program praised liberal views while refusing to do the same for conservative views, despite claiming to be “objective” and “neutral.” With financial institutions seemingly adopting AI solutions to monitor Americans’ transactions, a similarly biased AI program could result in the systematic flagging or censoring of transactions that the AI is trained to view as “suspicious.”

This is extremely troubling and goes beyond government overreach and violated numerous Constitutional protections. The government effectively transformed banking institutions into spy agencies, and anyone who could potentially hold a view that did not fit the Biden-Harris agenda has been treated as potential terrorist. It is completely insane that someone could be seen as an extremist for purchasing a religious text or purchasing a firearm. This is discriminatory, predatory behavior that puts millions of lives at risk. Think of governments in the past who have rounded up names of dissenters based on religion or ideology. They claim they are merely observing us, but the goal is to silence us.

The committee said their investigation has just begun as they will not allow the government’s abuse of financial data to go unchecked. Furthermore, they are concerned that these warrantless searches can lead to widespread debanking practices where the government can easily block any dissenter from participating in society by crippling them financially. This is yet another reason why governments want to push banks to create CBDC so that they can punish citizens with a simple click of a button.

Business

WEF-linked Linda Yaccarino to step down as CEO of X

From LifeSiteNews

Yaccarino had raised concerns among conservatives and free speech advocates for previously serving as chairwoman of a World Economic Forum taskforce and promoting DEI and the COVID shots.

X CEO, Linda Yaccarino, announced today that she is departing from her position at the social media giant.

“After two incredible years, I’ve decided to step down as CEO of 𝕏,” wrote Yaccarino on X.

“When Elon Musk and I first spoke of his vision for X, I knew it would be the opportunity of a lifetime to carry out the extraordinary mission of this company,” she continued. “I’m immensely grateful to him for entrusting me with the responsibility of protecting free speech, turning the company around, and transforming X into the Everything App.”

“I’m incredibly proud of the X team – the historic business turn around we have accomplished together has been nothing short of remarkable,” she said.

After two incredible years, I’ve decided to step down as CEO of 𝕏.

When @elonmusk and I first spoke of his vision for X, I knew it would be the opportunity of a lifetime to carry out the extraordinary mission of this company. I’m immensely grateful to him for entrusting me…

— Linda Yaccarino (@lindayaX) July 9, 2025

Musk hired Yaccarino in May 2023, seven months after his $44 billion purchase of the tech company, then known as “Twitter.”

At the time, Musk’s choice to take the helm at his newly acquired company raised eyebrows among conservative observers who had earlier rejoiced at the tech mogul’s intent to rescue free speech on the internet but now were troubled about the credentials of the digital platform’s new head.

Their concerns were not without good reason.

Yaccarino had previously served as chairwoman of the World Economic Forum’s “future of work” taskforce and sat on the globalist group’s “steering committee” for “media, entertainment, and culture industry.”

She had also boasted about her role as an early cheerleader for the untested COVID-19 jab.

As 2021–2022 Ad Council Chair, she “partnered with the business community, the White House, and government agencies to create a COVID-19 vaccination campaign, featuring Pope Francis and reaching over 200 million Americans,” according to her biography page at NBCUniversal, where she had been president before being lured to Twitter by Musk.

While at NBCUniversal, she also pushed discriminatory, equity-based hiring practices, based on “diversity” characteristics such as gender and race.

“At NBCU, she uses the power of media to advance equity and helps to launch DEI [Diversity, Equity, Inclusion]-focused initiatives,” recounted her online biography.

For the most part, over the last two years, Yaccarino’s performance at X allayed suspicions free speech activists at first harbored.

“Honestly, I was worried when she was hired but she didn’t burn down the house,” quipped popular conservative X account, @amuse.

Mike Benz, who serves as executive director of the Foundation For Freedom Online, a free speech watchdog organization dedicated to restoring the promise of a free and open internet, was far more effusive in his praise of Yaccarino.

“Linda stood up and fought for free speech during arguably its most acute crisis moment in world history when we were almost on the brink of losing it,” said Benz in an X post. “She stepped up for all of us in the face of what seemed like insurmountable pressure from governments, advertisers, boycotters, banking institutions, and astroturfed lynch mobs.”

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller2 days ago

Daily Caller2 days agoBlackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

Business1 day ago

Business1 day agoPrime minister can make good on campaign promise by reforming Canada Health Act

-

Automotive13 hours ago

Automotive13 hours agoFederal government should swiftly axe foolish EV mandate

-

Alberta12 hours ago

Alberta12 hours ago‘Far too serious for such uninformed, careless journalism’: Complaint filed against Globe and Mail article challenging Alberta’s gender surgery law

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoNew Book Warns The Decline In Marriage Comes At A High Cost

-

Economy1 day ago

Economy1 day agoThe stars are aligning for a new pipeline to the West Coast