National

How Rick Perkins and Larry Brock Revealed a $330 Million Cover-Up While Liberal MPs Run Damage Control

The True Cost of Letting Corruption Slide

Canada’s government is rotting from the inside, and if you needed more proof, look no further than Public Accounts of Canada (PACP) meeting 143. What we witnessed was a showcase of blatant corruption, institutional incompetence, and Trudeau’s Liberal elite running a racket—this time under the guise of environmentalism and “clean tech.” Sustainable Development Technology Canada (SDTC), the so-called green tech fund, has turned into nothing more than a green slush fund used to enrich Trudeau’s cronies while taxpayers foot the bill.

Let’s break it down: Trudeau’s government has turned what should have been a platform to invest in cutting-edge green technology into a cash pipeline for Liberal insiders. The PACP meeting laid bare how $330 million of taxpayer money flowed into conflicted projects approved by board members who had ties to the very companies benefiting from these funds. This isn’t negligence—this is corruption, plain and simple.

The Heroes of Accountability: Larry Brock and Rick Perkins

Two Conservative MPs stood out during this farcical hearing, and thank God they did. Larry Brock and Rick Perkins relentlessly grilled Marta Morgan, the bureaucrat who’s supposed to be in charge of overseeing SDTC. Let’s be real, though—Morgan’s job isn’t about fixing anything. Her role is to protect Trudeau’s insiders, to dodge questions, and to ensure that Canadians never find out the full extent of how deep this rot goes.

Larry Brock didn’t mince words when he compared the SDTC corruption to the Sponsorship Scandal, the Liberal boondoggle from the early 2000s that took down the Martin government. In this case, billions of dollars earmarked for clean technology are being funneled into projects tied to people sitting on SDTC’s board. “This is the sponsorship-style level of corruption within the government, the likes of which we haven’t seen since that scandal,” Brock declared.

Brock’s comparison is spot on. The Sponsorship Scandal was about buying influence with taxpayer money, and SDTC is no different. What’s worse is that this time, it’s all happening under the guise of fighting climate change. Trudeau’s Liberals have mastered the art of using high-minded rhetoric about the environment to hide what’s really happening—a cash grab for Liberal-friendly businesses.

Then there’s Rick Perkins, who absolutely took Marta Morgan to task. He demanded answers about why the SDTC board hadn’t taken steps to recover the $330 million in conflicted transactions. Let’s not forget that Annette Verschuren, former SDTC chair, was found guilty by the Ethics Commissioner for approving $220,000 in funds to her own company. Perkins didn’t hesitate to ask Morgan why the board hadn’t moved to recover this money, despite months having passed since the findings came to light.

“Why have you not taken steps to recover money for the taxpayer? The mandate is there—why aren’t you acting?” Perkins asked pointedly.

Morgan’s response? The same old bureaucratic doublespeak we’ve heard for years. “It has taken a few months for the board to get up and running… We have engaged legal advice,” she said, failing to provide any real answer. That’s not oversight—it’s stonewalling.

Morgan’s Evasion, Liberal Corruption Laid Bare

Morgan’s refusal to answer basic questions about conflicts of interest or the recovery of misallocated funds is exactly what you’d expect from Trudeau’s bureaucrats. When Perkins asked which law firm was advising SDTC on recovering taxpayer funds, Morgan dodged. She refused to name the firm, hiding behind vague references to “ongoing processes.” But let’s be clear here—this is all about protecting the same insiders who enabled this corruption in the first place.

Perkins saw right through it. “Are you getting legal advice as to what process should be followed to recover money? Yes or no? And if you say yes, which law firm is giving you that advice?” he asked, exposing the depth of the cover-up. Morgan couldn’t answer. Why? Because naming the firm would likely reveal the same old swamp creatures, still entangled in this corrupt web of green grift.

This isn’t about oversight or accountability—this is about Trudeau’s Liberals using every trick in the book to protect their insiders.

Redactions, Non-Answers, and Bureaucratic Cover-Ups

But it wasn’t just about recovering money. Larry Brock highlighted the heavily redacted documents that SDTC provided to the committee. He slammed the government for hiding the truth from Canadians, calling the redactions a deliberate attempt to cover up the depth of the corruption. “No small surprise that government departments heavily redacted hundreds of pages… the opposite of transparency and accountability!” Brock exclaimed, expressing the frustration that every taxpayer should feel.

It’s infuriating but not surprising. Trudeau’s Liberals love to talk about transparency and openness, but when push comes to shove, they’ll redact every piece of evidence that exposes their corruption. They know the truth is damning, and they’ll do anything to keep it hidden.

Brock also pressed Morgan on why SDTC continued to take legal advice from Osler, the very firm that helped facilitate the conflicts of interest at the heart of this scandal. Perkins had hammered her on this earlier, and Brock followed up, demanding an explanation for why SDTC hadn’t cut ties with a firm so deeply implicated in the corruption.

Morgan’s response? You guessed it—another non-answer. “Processes are being followed, and we’re looking at legal structures,” she mumbled, refusing to explain why the same law firm that helped create this mess is still providing legal advice. It’s absurd, but it’s par for the course in Trudeau’s Canada.

Liberal MPs Like Iqra Khalid: Protecting the Swamp

Let’s not forget Liberal MP Iqra Khalid, who swooped in during the committee to do what she does best—protect Trudeau’s swamp. Rather than asking tough questions or holding the government accountable, she focused on soft issues like governance improvements and the future of SDTC. Khalid didn’t once mention the $330 million in misallocated funds or the conflicts of interest that allowed board members to enrich themselves.

Instead, she harped on future reforms and administrative improvements, as if that would somehow wipe away the corruption embedded in this system. Khalid is playing a role that every Liberal shill plays—pretend everything is fine, talk about process, and hope that Canadians forget about the billions of dollars being wasted.

The Bigger Picture: SNC-Lavalin Was the Warning

This SDTC scandal is bigger than just the misallocation of funds. It’s a pattern of corruption that’s plagued Trudeau’s government from day one. If you look back, SNC-Lavalin was the canary in the coal mine. That scandal showed us exactly what Trudeau is willing to do—protect his corporate friends at all costs. Trudeau went so far as to pressure his own Attorney General to interfere in a criminal case to help SNC-Lavalin avoid prosecution for bribery.

Back then, Liberal voters shrugged. Trudeau got away with it, and now we’re seeing the consequences. This green slush fund is what happens when corruption goes unchecked. Liberals have become emboldened, knowing that they can use virtue-signaling about the environment to enrich their own, all while claiming they’re saving the planet.

This is what happens when corruption slides.

Agriculture

Why is Canada paying for dairy ‘losses’ during a boom?

This article supplied by Troy Media.

Canadians are told dairy farmers need protection. The newest numbers tell a different story

Every once in a while, someone inside a tightly protected system decides to say the quiet part out loud. That is what Joel Fox, a dairy farmer from the Trenton, Ont., area, did recently in the Ontario Farmer newspaper.

In a candid open letter, Fox questioned why established dairy farmers like himself continue to receive increasingly large government payouts, even though the sector is not shrinking but expanding. For readers less familiar with the system, supply management is the federal framework that controls dairy production through quotas and sets minimum prices to stabilize farmer income.

His piece, titled “We continue to privatize gains, socialize losses,” did not come from an economist or a critic of supply management. It came from someone who benefits from it. Yet his message was unmistakable: the numbers no longer add up.

Fox’s letter marks something we have not seen in years, a rare moment of internal dissent from a system that usually speaks with one voice. It is the first meaningful crack since the viral milk-dumping video by Ontario dairy farmer Jerry Huigen, who filmed himself being forced to dump thousands of litres of perfectly good milk because of quota rules. Huigen’s video exposed contradictions inside supply management, but the system quickly closed ranks until now. Fox has reopened a conversation that has been dormant for far too long.

In his letter, Fox admitted he would cash his latest $14,000 Dairy Direct Payment Program cheque, despite believing the program wastes taxpayer money. The Dairy Direct Payment Program was created to offset supposed losses from trade agreements like the Comprehensive Economic and Trade Agreement (CETA), the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Canada–United States–Mexico Agreement (CUSMA).

During those negotiations, Ottawa promised compensation because the agreements opened a small share of Canada’s dairy market, roughly three to five per cent, to additional foreign imports. The expectation was that this would shrink the domestic market. But those “losses” were only projections based on modelling and assumptions about future erosion in market share. They were predictions, not actual declines in production or demand. In reality, domestic dairy demand has strengthened.

Which raises the obvious question: why are we compensating dairy farmers for producing less when they are, in fact, producing more?

This month, dairy farmers received another one per cent quota increase, on top of several increases totalling four to five per cent in recent years. Quota only goes up when more milk is needed.

If trade deals had actually harmed the sector, quota would be going down, not up. Instead, Canada’s population has grown by nearly six million since 2015, processors have expanded and consumption has held steady. The market is clearly expanding.

Understanding what quota is makes the contradiction clearer. Quota is a government-created financial asset worth $24,000 to $27,000 per kilogram of butterfat. A mid-sized dairy farm may hold about $2.5 million in quota. Over the past few years, cumulative quota increases of five per cent or more have automatically added $120,000 to $135,000 to the value of a typical farm’s quota, entirely free.

Larger farms see even greater windfalls. Across the entire dairy system, these increases represent hundreds of millions of dollars in newly created quota value, likely exceeding $500 million in added wealth, generated not through innovation or productivity but by a regulatory decision.

That wealth is not just theoretical. Farm Credit Canada, a federal Crown corporation, accepts quota as collateral. When quota increases, so does a farmer’s borrowing power. Taxpayers indirectly backstop the loans tied to this government-manufactured asset. The upside flows privately; the risk sits with the public.

Yet despite rising production, rising quota values, rising equity and rising borrowing capacity, Ottawa continues issuing billions in compensation. Between 2019 and 2028, nearly $3 billion will flow to dairy farmers through the Dairy Direct Payment Program. Payments are based on quota holdings, meaning the largest farms receive the largest cheques. New farmers, young farmers and those without quota receive nothing. Established farms collect compensation while their asset values grow.

The rationale for these payments has collapsed. The domestic market did not shrink. Quota did not contract. Production did not fall. The compensation continues only because political promises are easier to maintain than to revisit.

What makes Fox’s letter important is that it comes from someone who gains from the system. When insiders publicly admit the compensation makes no economic sense, policymakers can no longer hide behind familiar scripts. Fox ends his letter with blunt honesty: “These privatized gains and socialized losses may not be good for Canadian taxpayers … but they sure are good for me.”

Canada is not being asked to abandon its dairy sector. It is being asked to face reality. If farmers are producing more, taxpayers should not be compensating them for imaginary declines. If quota values keep rising, Ottawa should not be writing billion-dollar cheques for hypothetical losses.

Fox’s letter is not a complaint; it is an opportunity. If insiders are calling for honesty, policymakers should finally be willing to do the same.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Agriculture

Canadians should thank Trump for targeting supply management

This article supplied by Troy Media.

By Gwyn Morgan

By Gwyn Morgan

Trump is forcing the Canadian government to confront what it has long avoided: an end to supply management

U.S. President Donald Trump’s deeply harmful tariff rampage has put the Canada-U.S.-Mexico Agreement (CUSMA) under renewed strain. At the centre of that uncertainty is Canada’s supply management system, an economically costly and politically protected regime Ottawa has long refused to reform.

Supply management uses quotas and fixed prices for milk, eggs and poultry with the intention of matching supply with demand while restricting imports. Producers need quota in order to produce and sell output legally. Given the thousands of farmers spread across the country, combined with the fact that the quotas are specific to milk, eggs, chickens and turkey, the bureaucracy (and number of bureaucrats) required is huge and extremely costly. Department of Agriculture and Agri-Food 2024-25 transfer payments included $4.8 billion for “Supply Management Initiatives.”

The bureaucrats often get it wrong. Canada’s most recent chicken production cycle saw one of the worst supply shortfalls in more than 50 years. Preset quota limits stopped farmers from responding to meet demand, leaving consumers with higher grocery bills for 11th-hour imports. The reality is that accurately predicting demand is impossible.

The dysfunction doesn’t stop with chicken. Egg imports under the shortage allocation program had already topped 14 million dozen by mid-year. Our trading partners are taking full advantage. Chile, for example, is on track to double chicken exports.

The cost to consumers is considerable. Pre-pandemic research estimates the average Canadian family pays $300 to $444 extra for food as a result of supply management. And since, as a share of their income, lower-income Canadians spend three times as much as middle-income Canadians and almost five times as much as upper-income Canadians, the impact on them is proportionally much greater.

It’s no surprise that farmers are anxious to protect their monopoly. In most cases, they have paid hefty sums for their quota. If the price of their product were allowed to fall to free-market levels, the value of their quota would go to zero. In addition, the Dairy Farmers of Canada argue that supply management means “the right amount of food is produced,” producers get a “fair return,” and import restrictions guarantee access to “homegrown food,” all of which is debatable.

All price-fixing systems create problems. Dairy cattle are not machines. A cow’s milk production varies. If a farmer gets more milk than his quota, the excess must be dumped. When governments limit the supply of any item, its value always rises. Dairy quotas, by their very nature, have become a valuable commodity, selling for more than $25,000 per “cow equivalent.” That means a 100-head dairy farm is worth at least $2,500,000 in quota alone, a value that exists only because of the legislated ability to charge higher-than-market prices.

Dairy isn’t the only sector where government-regulated quotas have become very valuable. The West Coast fishery is another. Commercial fishery quotas for salmon and halibut have become valuable commodities worth millions of dollars, completely out of reach for independent fishers, turning them into de facto employees of quota holders.

While of relatively limited national importance, supply management is of major political significance in Quebec. As George Mason University and Montreal Economic Institute economist Vincent Geloso notes, “In 17 ridings provincially, people under supply management are strong enough to change the outcome of the election.”

That brings us back to the upcoming CUSMA negotiations. Under CUSMA, the U.S. gets less than five per cent of Canada’s agricultural products market. Given that President Trump has been a long-standing critic of supply management, especially in dairy, it’s certain to be targeted.

Looking to pre-empt concessions, supply-managed farmer associations lobbied the federal government to pass legislation keeping supply management off the table in any future trade negotiations. This makes voters in those 17 Quebec ridings happy, but it’s certain to enrage Trump, starting the CUSMA negotiations off on a decidedly adversarial note. As Concordia University economist Moshe Lander says: “The government seems willing even to accept tariffs and damage to the Canadian economy rather than put dairy supply management on the table.”

Parliament can pass whatever laws it likes, but Trump has made it clear that ending supply management, especially in dairy, is one of his main goals in the CUSMA review. It’s hard to see how a deal can be made without substantial reform. That will make life difficult for the federal Liberals. But the president will be doing Canadian consumers a big favour.

Gwyn Morgan is a retired business leader who has been a director of five global corporations.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Crime3 hours ago

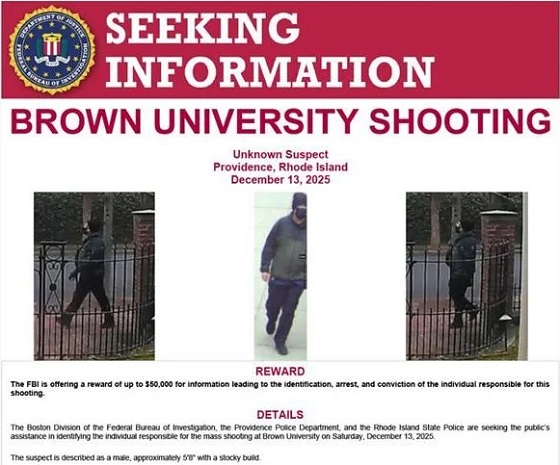

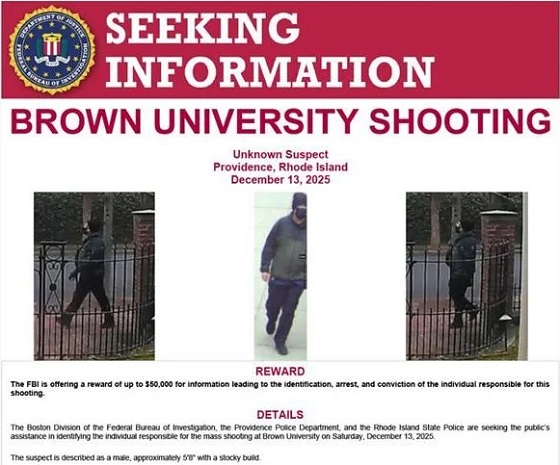

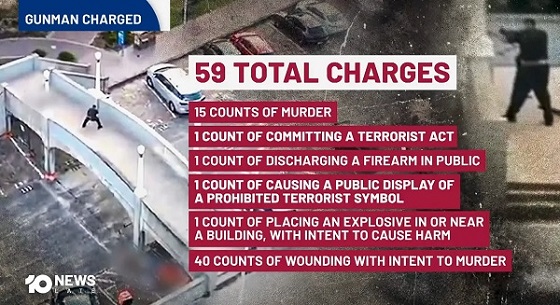

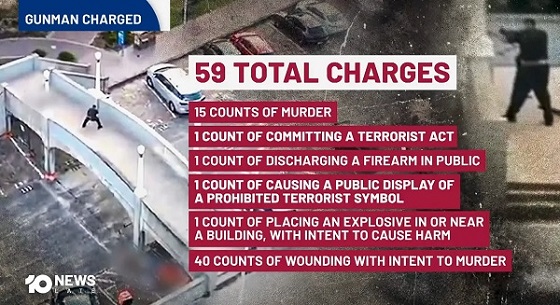

Crime3 hours agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Business2 days ago

Business2 days agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

Business15 hours ago

Business15 hours agoCanada Hits the Brakes on Population

-

Energy2 days ago

Energy2 days agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Frontier Centre for Public Policy17 hours ago

Frontier Centre for Public Policy17 hours agoCanada Lets Child-Porn Offenders Off Easy While Targeting Bible Believers

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

International2 days ago

International2 days agoBondi Beach Shows Why Self-Defense Is a Vital Right

-

Crime2 days ago

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat