Alberta

Canadian energy company produces more energy and less green house gas emissions

It would be interesting to know how many Albertans realize that Canadian energy companies are already producing less green house gas emissions. Furthermore how many people know companies like Cenovus Energy have pledged and are already working toward incredibly aggressive emissions targets? It’s true. It’s already happening. You can learn more about the Cenovus green house gas (ghg) emmissions strategy right here.

From Cenovus Energy

Climate & greenhouse gas (GHG) emissions

- Reduce emissions intensity by 30%(1)

- Hold absolute emissions flat(1)

Cenovus’s long-term ambition is to reach net zero emissions by 2050.

(1) Includes scope 1 and 2 emissions from operated facilities. Uses a 2019 baseline. For more details, see the Definitions section of our ESG targets news release.

At Cenovus, we recognize the growing concerns of people around the world about climate change and we share the goal of reducing GHG emissions.

Governments are supporting the transition to a lower-carbon future by introducing increasingly stringent climate-related policies and creating incentives for emissions-reduction solutions. We believe companies that fail to adapt to this transition will face growing carbon-related risks, while those that act now will position themselves for long-term business resilience. That’s why Cenovus is focused on demonstrating equally strong financial, operational, and environmental, social & governance (ESG) performance.

Cenovus is already one of the lowest emissions producers of oil in Canada with production emissions well below the global average. Building on this, our new GHG emissions targets are among the most ambitious in the world for an upstream exploration and production company.

30% GHG intensity reduction

We plan to reduce our per-barrel GHG emissions by 30% by the end of 2030, using a 2019 baseline, and hold our absolute emissions flat by the end of 2030. In setting our GHG targets, we worked comprehensively with global experts to stress test both the targets and our strategic options for achieving them. And we analyzed scenarios from third parties to assess the resiliency of our business as we further reduce our emissions intensity.

Our GHG emissions strategy includes a number of options to reach our targets. These opportunities are at various stages of development, and include: additional operational optimization, incorporating cogeneration capacity into future oil sands phases, more extensive deployment of solvent technology, further advancement of the methane emissions reduction initiatives already underway at our Deep Basin operations and additional operational efficiencies, including the use of data analytics. Cenovus is also considering other direct and indirect initiatives that generate credible, additional and permanent carbon offsets.

Net zero emissions by 2050

Cenovus’s long-term ambition is to reach net zero emissions by 2050. This is intended to address upstream (scope 1 and scope 2) emissions and will require ongoing focus on technology solutions beyond those that are commercial and economic today. We continue to identify opportunities to participate in longer-term solutions to address emissions from our operations and beyond. This includes extensive collaboration efforts with our peers, academics, other industries and entrepreneurs from around the world.

Air quality

We monitor ambient air quality at our operations to ensure that sulphur dioxide (SO2), hydrogen sulphide (H2S) and nitrogen oxides (NOx) concentrations remain within acceptable levels. To reduce air pollutants such as SO2 and NOx, as well as GHG emissions such as methane, we invest in technologies that help lower energy consumption in our day-to-day operations and processes.

We’ve already made significant progress in reducing methane emissions at Cenovus and we’re continuing to work on projects at our operations to further reduce emissions. Studies have shown that methane is a much more potent GHG than CO2, which means that reducing methane emissions is a critical part of any plan to address climate change.

Quick facts

- Between 2004 and 2019, Cenovus reduced the CO2 emissions intensity of its oil sands operations by about 30%

- NOx emissions at our Christina Lake oil sands facility are about 50% below the regulatory threshold of 400 tonnes per year

Alberta

Low oil prices could have big consequences for Alberta’s finances

From the Fraser Institute

By Tegan Hill

Amid the tariff war, the price of West Texas Intermediate oil—a common benchmark—recently dropped below US$60 per barrel. Given every $1 drop in oil prices is an estimated $750 million hit to provincial revenues, if oil prices remain low for long, there could be big implications for Alberta’s budget.

The Smith government already projects a $5.2 billion budget deficit in 2025/26 with continued deficits over the following two years. This year’s deficit is based on oil prices averaging US$68.00 per barrel. While the budget does include a $4 billion “contingency” for unforeseen events, given the economic and fiscal impact of Trump’s tariffs, it could quickly be eaten up.

Budget deficits come with costs for Albertans, who will already pay a projected $600 each in provincial government debt interest in 2025/26. That’s money that could have gone towards health care and education, or even tax relief.

Unfortunately, this is all part of the resource revenue rollercoaster that’s are all too familiar to Albertans.

Resource revenue (including oil and gas royalties) is inherently volatile. In the last 10 years alone, it has been as high as $25.2 billion in 2022/23 and as low as $2.8 billion in 2015/16. The provincial government typically enjoys budget surpluses—and increases government spending—when oil prices and resource revenue is relatively high, but is thrown into deficits when resource revenues inevitably fall.

Fortunately, the Smith government can mitigate this volatility.

The key is limiting the level of resource revenue included in the budget to a set stable amount. Any resource revenue above that stable amount is automatically saved in a rainy-day fund to be withdrawn to maintain that stable amount in the budget during years of relatively low resource revenue. The logic is simple: save during the good times so you can weather the storm during bad times.

Indeed, if the Smith government had created a rainy-day account in 2023, for example, it could have already built up a sizeable fund to help stabilize the budget when resource revenue declines. While the Smith government has deposited some money in the Heritage Fund in recent years, it has not created a dedicated rainy-day account or introduced a similar mechanism to help stabilize provincial finances.

Limiting the amount of resource revenue in the budget, particularly during times of relatively high resource revenue, also tempers demand for higher spending, which is only fiscally sustainable with permanently high resource revenues. In other words, if the government creates a rainy-day account, spending would become more closely align with stable ongoing levels of revenue.

And it’s not too late. To end the boom-bust cycle and finally help stabilize provincial finances, the Smith government should create a rainy-day account.

Alberta

Governments in Alberta should spur homebuilding amid population explosion

From the Fraser Institute

By Tegan Hill and Austin Thompson

In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Alberta has long been viewed as an oasis in Canada’s overheated housing market—a refuge for Canadians priced out of high-cost centres such as Vancouver and Toronto. But the oasis is starting to dry up. House prices and rents in the province have spiked by about one-third since the start of the pandemic. According to a recent Maru poll, more than 70 per cent of Calgarians and Edmontonians doubt they will ever be able to afford a home in their city. Which raises the question: how much longer can this go on?

Alberta’s housing affordability problem reflects a simple reality—not enough homes have been built to accommodate the province’s growing population. The result? More Albertans competing for the same homes and rental units, pushing prices higher.

Population growth has always been volatile in Alberta, but the recent surge, fuelled by record levels of immigration, is unprecedented. Alberta has set new population growth records every year since 2022, culminating in the largest-ever increase of 186,704 new residents in 2024—nearly 70 per cent more than the largest pre-pandemic increase in 2013.

Homebuilding has increased, but not enough to keep pace with the rise in population. In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Moreover, from 1972 to 2019, Alberta added 2.1 new residents (on average) for every housing unit started compared to 3.9 new residents for every housing unit started in 2024. Put differently, today nearly twice as many new residents are potentially competing for each new home compared to historical norms.

While Alberta attracts more Canadians from other provinces than any other province, federal immigration and residency policies drive Alberta’s population growth. So while the provincial government has little control over its population growth, provincial and municipal governments can affect the pace of homebuilding.

For example, recent provincial amendments to the city charters in Calgary and Edmonton have helped standardize building codes, which should minimize cost and complexity for builders who operate across different jurisdictions. Municipal zoning reforms in Calgary, Edmonton and Red Deer have made it easier to build higher-density housing, and Lethbridge and Medicine Hat may soon follow suit. These changes should make it easier and faster to build homes, helping Alberta maintain some of the least restrictive building rules and quickest approval timelines in Canada.

There is, however, room for improvement. Policymakers at both the provincial and municipal level should streamline rules for building, reduce regulatory uncertainty and development costs, and shorten timelines for permit approvals. Calgary, for instance, imposes fees on developers to fund a wide array of public infrastructure—including roads, sewers, libraries, even buses—while Edmonton currently only imposes fees to fund the construction of new firehalls.

It’s difficult to say how long Alberta’s housing affordability woes will endure, but the situation is unlikely to improve unless homebuilding increases, spurred by government policies that facilitate more development.

-

Alberta2 days ago

Alberta2 days agoGovernments in Alberta should spur homebuilding amid population explosion

-

International2 days ago

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

Alberta2 days ago

Alberta2 days agoLow oil prices could have big consequences for Alberta’s finances

-

2025 Federal Election2 days ago

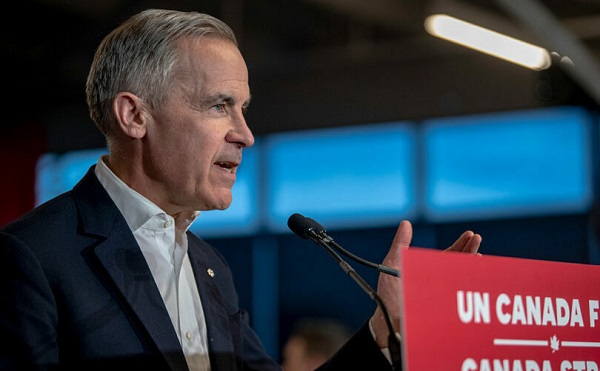

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s

-

Business2 days ago

Business2 days agoIt Took Trump To Get Canada Serious About Free Trade With Itself

-

C2C Journal2 days ago

C2C Journal2 days ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

Opinion1 day ago

Opinion1 day agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

2025 Federal Election19 hours ago

2025 Federal Election19 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences