Energy

House votes to block China from buying oil from US reserves

By Matthew Daly in Washington

WASHINGTON (AP) — The Republican-controlled House on Thursday voted to block oil from the country’s emergency stockpile from going to China.

The bill, one of the first introduced by the new GOP majority, would prohibit the Energy Department from selling oil from the Strategic Petroleum Reserve to companies owned or influenced by the Chinese Communist Party. It passed easily, 331-97, with 113 Democrats joining unanimous Republicans in support.

Rep. Cathy McMorris, R-Wash., the new head of the House Energy and Commerce Committee, said the bill would help end what she called President Joe Biden’s “abuse of our strategic reserves.”

Biden withdrew 180 million barrels from the strategic reserve last year in a bid to halt rising gasoline prices amid production cuts by OPEC and a ban on Russian oil imports following Moscow’s invasion of Ukraine. The monthslong sales brought the stockpile to its lowest level since the 1980s. The administration said last month it will start to replenish the reserve now that oil prices have gone down.

McMorris Rodgers accused Biden of using the reserve to “cover up his failed policies” that she said are driving up energy prices and inflation.

“Draining our strategic reserves for political purposes and selling it to China is a significant threat to our national and energy security. This must be stopped,” McMorris Rodgers said.

The measure is the first in a series of GOP proposals aimed at “unleashing American energy production,” McMorris Rodgers said as Republicans seek to boost U.S. production of oil, natural gas and other fossil fuels.

“There’s more to come. This is just the beginning,” she said.

Democrats, including former Energy and Commerce Chairman Frank Pallone of New Jersey, said Republicans were trying to fix a problem of their own making. China is among numerous potential adversaries that buy U.S. oil after the GOP-led Congress lifted an export ban in 2015.

“If Republicans were serious about addressing this issue, they would have brought forward a bill that banned all oil exports to China,” Pallone said, adding that sales from the strategic reserve amounted to about 2% of U.S. oil sold to China last year.

“If we truly want to address China using American oil to build its reserves, let’s actually take a serious look at that, rather than skirt around the issue because Republicans are scared of Big Oil’s wrath,” Pallone said.

The current process allows for crude oil sales from the strategic reserve to companies that make the highest offer, which includes U.S. subsidiaries of foreign oil companies, and they could then export that crude oil overseas. Last year, millions of barrels of oil from the U.S. reserves wound up being exported to China, including to a subsidiary of China’s state-run oil company, Sinopec.

The Energy Department said in a statement Thursday that Biden “rightly authorized emergency use” of the strategic reserve, also known as the SPR, to address supply disruptions and “provide relief to American families and refineries when needed the most.”

The Treasury Department estimates that release of oil from the emergency stockpile lowered prices at the pump by up to 40 cents per gallon. Gasoline prices, meanwhile, averaged about $3.27 per gallon on Thursday, down from just over $5 per gallon at their peak in June, according to the AAA auto club.

“By law we are required to select the highest value bid to ensure the best return for taxpayers, and since 2017 the vast majority of oil sold from the reserve is sold to American entities,” the Energy Department said. Over the last five years, less than 3% of oil from the strategic reserve has gone to China, officials said.

The House bill now goes to the Democratic-controlled Senate. Sen. John Barrasso, R-Wyo., has introduced a similar measure.

Energy

Liberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

From Energy Now

By Margareta Dovgal

Playing politics with pipelines is a time-honored Canadian tradition. Recent events in the House of Commons offered a delightful twist on the genre.

The Conservatives introduced a motion quoting the Liberals’ own pipeline promises laid out in the Memorandum of Understanding (MOU) with Alberta, nearly verbatim. The Liberals, true to form, killed it 196–139 with enthusiastic help from the NDP, Bloc, and Greens.

We all knew how this would end. Opposition motions like this never pass; no government, especially not one led by Mark Carney, is going to let the opposition dictate the agenda. There’s not much use feigning outrage that the Liberals voted it down. The more entertaining angle has been watching closely as Liberal MPs twist themselves into pretzels explaining why they had to vote “no” on a motion that cheers on a project they claim to support in principle.

Liberal MP Corey Hogan dismissed the motion as “game-playing” designed to “poke at people”.

And he’s absolutely right to call it a “trap” for the Liberals. But traps only work when you walk into them.

Indigenous Services Minister Mandy Gull-Masty deemed the motion an “immature waste of parliamentary time” and “clearly an insult towards Indigenous Peoples” because it didn’t include every clause of the original agreement. Energy Minister Tim Hodgson decried it as a “cynical ploy to divide us” that “cherry-picked” the MOU.

Yet the prize for the most tortured metaphor goes to the prime minister himself. Defending his vote against his own pipeline promise, Carney lectured the House that “you have to eat the entire meal, not just the appetizer.”

It’s a clever line, and it also reveals the problem. The “meal” Carney is serving is stuffed with conditions. Environmental targets or meaningful engagement with Indigenous communities aren’t unrealistic asks. A crippling industrial carbon price as a precondition might be though.

But the prime minister has already said the quiet part out loud.

Speaking in the House a few weeks ago, Carney admitted that the agreement creates “necessary conditions, but not sufficient conditions,” before explicitly stating: “We believe the government of British Columbia has to agree.”

There is the poison pill. Handing a de facto veto to a provincial government that has spent years fighting oil infrastructure is neither constitutionally required nor politically likely. Elevating B.C.’s “agreement” to a condition, which is something the MOU text itself carefully avoids doing, means that Carney has made his own “meal” effectively inedible.

Hodgson’s repeated emphasis that the Liberal caucus supports “the entire MOU, the entire MOU” only reinforces this theory.

This entire episode forces us to ask whether the MOU is a real plan to build a pipeline, or just a national unity play designed to cool down the separatist temperature in Alberta. My sense is that Ottawa knew they had to throw a bone to Premier Danielle Smith because the threat of the sovereignty movement is gaining real traction. But you can’t just create the pretense of negotiation to buy time.

With the MOU getting Smith boo’ed at her own party’s convention by the separatists, it’s debatable whether that bone was even an effective one to throw.

There is a way. The federal government has the jurisdiction. If they really wanted to, they could just do it, provided the duty to consult with and accommodate Indigenous peoples was satisfied. Keep in mind: no reasonable interpretation equates Section 35 of the Charter to a veto.

Instead, the MOU is baked with so many conditions that the Liberals have effectively laid the groundwork for how they’re going to fail.

With overly-hedged, rather cryptic messaging, Liberals have themselves given considerable weight to a cynical theory, that the MOU is a stalling tactic, not a foundation to get more Canadian oil to the markets it’s needed in. Maybe Hodgson is telling the truth, and caucus is unified because the radicals are satisfied that “the entire MOU” ensures that a new oil pipeline will never reach tidewater through BC.

So, hats off to the legislative affairs strategists in the Conservative caucus. The real test of Carney’s political power continues: can he force a caucus that prefers fantasy economics into a mold of economic literacy to deliver on the vision Canadians signed off on? Or will he be hamstrung trying to appease the radicals from within?

Margareta Dovgal is managing director of Resource Works Society.

Daily Caller

Paris Climate Deal Now Decade-Old Disaster

From the Daily Caller News Foundation

By Steve Milloy

The Paris Climate Accord was adopted 10 years ago this week. It’s been a decade of disaster that President Donald Trump is rightly trying again to end.

The stated purpose of the agreement was for countries to voluntarily cut emissions to avoid the average global temperature exceeding the (guessed at) pre-industrial temperature by 3.6°F (2°C) and preferably 2.7°F (1.5°C).

Since December 2015, the world spent an estimated $10 trillion trying to achieve the Paris goals. What has been accomplished? Instead of reducing global emissions, they have increased about 12 percent. While the increase in emissions is actually a good thing for the environment and humanity, spending $10 trillion in a failed effort to cut emissions just underscores the agreement’s waste, fraud and abuse.

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

But wasting $10 trillion is only the tip of the iceberg.

The effort to cut emissions was largely based on forcing industrial countries to replace their tried-and-true fossil fuel-based energy systems with not-ready-for-prime-time wind, solar and battery-based systems. This forced transition has driven up energy costs and made energy systems less reliable. The result of that has been economy-crippling deindustrialization in former powerhouses of Germany and Britain.

And it gets worse.

European nations imagined they could reduce their carbon footprint by outsourcing their coal and natural gas needs to Russia. That outsourcing enriched Russia and made the European economy dependent on Russia for energy. That vulnerability, in turn, and a weak President Joe Biden encouraged Vladimir Putin to invade Ukraine.

The result of that has been more than one million killed and wounded, the mass destruction of Ukraine worth more than $500 billion so far and the inestimable cost of global destabilization. Europe will have to spend hundreds of billions more on defense, and U.S. taxpayers have been forced to spend hundreds of billions on arms for Ukraine. Putin has even raised the specter of using nuclear weapons.

President Barack Obama unconstitutionally tried to impose the Paris agreement on the U.S. as an Executive agreement rather than a treaty ratified by the U.S. Senate. Although Trump terminated the Executive agreement during his first administration, President Joe Biden rejoined the agreement soon after taking office, pledging to double Obama’s emissions cuts pledge to 50 percent below 2005 levels by 2030.

Biden’s emissions pledge was an impetus for the 2022 Inflation Reduction Act that allocated $1.2 trillion in spending for what Trump labeled as the Green New Scam. Although Trump’s One Big Beautiful Bill Act reduced that spending by about $500 billion and he is trying to reduce it further through Executive action, much of that money was used in an effort to buy the 2024 election for Democrats. The rest has been and will be used to wreck our electricity grid with dangerous, national security-compromising wind, solar and battery equipment from Communists China.

Then there’s this. At the Paris climate conference in 2015, U.S. Secretary of State John Kerry stated quite clearly that emissions cuts by the U.S. and other industrial countries were meaningless and would accomplish nothing since the developing world’s emissions would be increasing.

Finally, there is the climate realism aspect to all this. After the Paris agreement was signed and despite the increase in emissions, the average global temperature declined during the years from 2016 to 2022, per NOAA data.

The super El Nino experienced during 2023-2024 caused a temporary temperature spike. La Nina conditions have now returned the average global temperature to below the 2015-2016 level, per NASA satellite data. The overarching point is that any “global warming” that occurred over the past 40 years is actually associated with the natural El Nino-La Nina cycle, not emissions.

The Paris agreement has been all pain and no gain. Moreover, there was never any need for the agreement in the first place. A big thanks to President Trump for pulling us out again.

Steve Milloy is a biostatistician and lawyer. He posts on X at @JunkScience.

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Energy2 days ago

Energy2 days agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Bruce Dowbiggin2 days ago

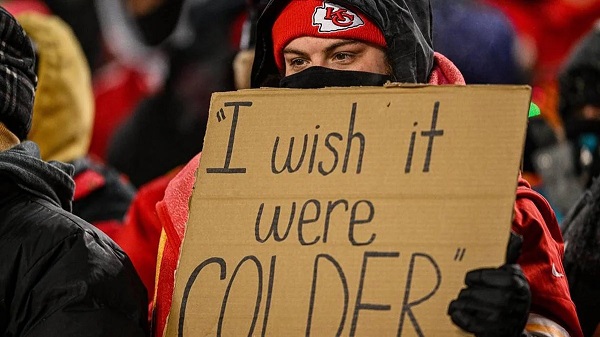

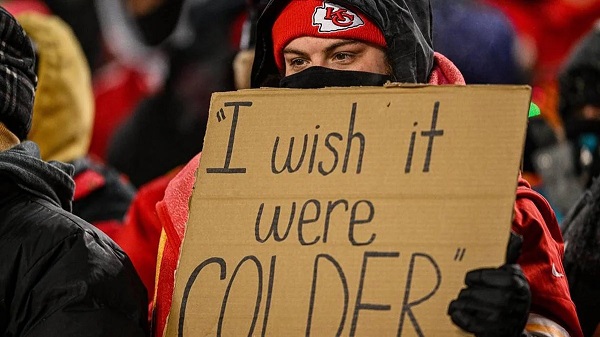

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria

-

Energy2 days ago

Energy2 days agoCan we not be hysterical about AI and energy usage?

-

Energy2 days ago

Energy2 days agoEnergy security matters more than political rhetoric

-

Business6 hours ago

Business6 hours agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

armed forces1 day ago

armed forces1 day agoOttawa’s Newly Released Defence Plan Crosses a Dangerous Line

-

Censorship Industrial Complex4 hours ago

Censorship Industrial Complex4 hours agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info