Uncategorized

Holding out slim hope as crews search for more fire dead

PARADISE, Calif. — More than a dozen coroner search and recovery teams looked for human remains from a Northern California wildfire that killed at least 42 — making it the deadliest in state history — as anxious relatives visited shelters and called police hoping to find loved ones alive.

Lisa Jordan drove 600 miles (1,000

“I’m staying hopeful,” she said. “Until the final word comes, you keep fighting against it.”

Butte County Sheriff Kory Honea updated the confirmed fatality number Monday night — a figure that is almost certain to spike following the blaze that last week destroyed Paradise, a town of 27,000 about 180 miles (290

Authorities were bringing in two mobile morgue units and requesting 150 search and rescue personnel. Officials were unsure of the exact number of missing.

“I want to recover as many remains as we possibly can, as soon as we can. Because I know the toll it takes on loved ones,” Honea said.

Chaplains accompanied some coroner search teams that visited dozens of addresses belonging to people reported missing. For those on the grim search, no cars in the driveway is good, one car a little more ominous and multiple burned-out vehicles equals a call for extra vigilance.

State officials said the cause of the inferno was under investigation.

Meanwhile, a landowner near where the blaze began, Betsy Ann Cowley, said she got an email from Pacific Gas & Electric Co. the day before the fire last week telling her that crews needed to come onto her property because the utility’s power lines were causing sparks. PG&E had no comment on the email.

Stan Craig’s sister, Beverly Craig Powers, has not returned numerous texts and calls, and the adult children of her partner, Robert Duvall, have not heard from their father, he said. The couple was last seen evacuating their Paradise home on Thursday with two pickup trucks and a travel trailer, so they could be camping.

He knows friends and family are still being reunited with missing loved ones, but he said his unease grows every day. Still, the Fresno, California, resident wasn’t planning on heading to the fire area. As a former firefighter himself, he said he understands the chaos wildfires cause.

“I’m going to stay here until I have something more to go on,” he said.

The blaze was part of an outbreak of wildfires on both ends of the state. Together, they were blamed for 44 deaths, including two in celebrity-studded Malibu in Southern California , where firefighters appeared to be gaining ground against a roughly 143-square-mile (

All told, more than 8,000 firefighters statewide were battling wildfires that destroyed more than 7,000 structures and scorched more than 325 square miles (840 square

There were tiny signs of some sense of order returning to Paradise and anonymous gestures meant to rally the spirits of firefighters who have worked in a burned-over wasteland for days.

Large American flags stuck into the ground lined both sides of the road at the town limits, and temporary stop signs appeared overnight at major intersections. Downed power lines that had blocked roads were cut away, and crews took down burned trees with chain saws.

The 42 dead in Northern California surpassed the deadliest single fire on record, a 1933 blaze in Griffith Park in Los Angeles. A series of wildfires in Northern California’s wine country last fall killed 44 people and destroyed more than 5,000 homes.

___

Contributing to this report were Associated Press writers Sudhin Thanawala, Janie Har, Jocelyn Gecker and Daisy Nguyen in San Francisco and Andrew Selsky in Salem, Oregon.

Martha Mendoza And Gillian Flaccus, The Associated Press

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

-

Business23 hours ago

Business23 hours agoCanada Hits the Brakes on Population

-

Crime12 hours ago

Crime12 hours agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

International2 days ago

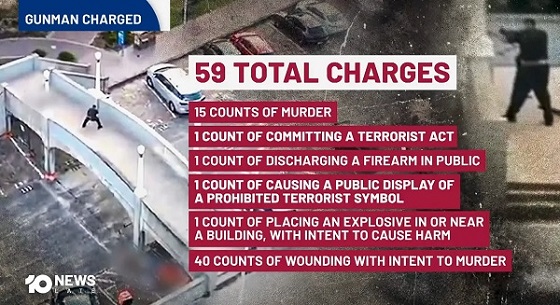

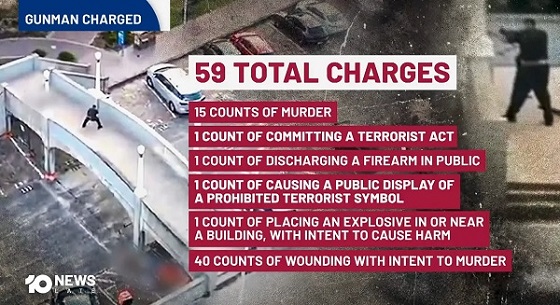

International2 days agoBondi Beach Shows Why Self-Defense Is a Vital Right

-

Crime2 days ago

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat

-

Agriculture23 hours ago

Agriculture23 hours agoWhy is Canada paying for dairy ‘losses’ during a boom?

-

Crime2 days ago

Crime2 days agoBondi Beach Survivor Says Cops Prevented Her From Fighting Back Against Terrorists

-

International1 day ago

International1 day agoHouse Rejects Bipartisan Attempt To Block Trump From Using Military Force Against Venezuela