Alberta

Hinshaw challenged over violating Charter freedoms of Albertans

Originally published on October 29, 2020 by The Justice Centre for Constitutional Freedoms

CALGARY: The Justice Centre today responded to new violations of the Charter-protected freedoms of association and peaceful assembly, announced earlier this week by Dr. Deena Hinshaw, Alberta’s Chief Medical Officer.

On October 26, Dr. Hinshaw declared that Albertans in Calgary and Edmonton cannot gather in groups larger than 15 for dinner parties, birthday parties, wedding and funeral receptions, retirement parties, baby showers and other social events.

“This Order violates freedom of association and freedom of peaceful assembly, as protected by the Canadian Charter of Rights and Freedoms,” stated lawyer John Carpay, president of the Justice Centre.

“This Order is based on ‘cases’ of COVID-19 in Alberta, including thousands of ‘cases’ among people who are not experiencing any symptoms or illness. This Order is not properly grounded in relevant considerations such as deaths, hospitalizations, and ICU capacity, and is therefore not a justifiable violation of fundamental Charter freedoms,” continued Carpay.

Prior to lockdowns being imposed this past March, the word “cases” typically referred to people who are actually sick and clearly displaying symptoms. But today’s “cases” include completely healthy people who simply had a positive PCR test. The reliability of the PCR tests is increasingly in dispute, with the number of false positives as high as 90% according to some reports.

Unsurprisingly, the number of “cases” rises with the number of tests that governments conduct. For example, September saw 28,763 “cases” in Canada, as a result of testing almost two million Canadians.

“What really matters is not the ‘cases’ of perfectly healthy people, but rather the fact that 25,000 Canadians die each month,” explained Carpay. “In September, 171 of those 25,000 Canadian deaths were attributed to COVID-19.”

The media continues to hype “cases” and warn of a “second wave.” Yet government data

shows that since May, monthly COVID-19 deaths in Alberta have remained under 50, with more than 2,000 Albertans dying each and every month of other causes, based on 27,000 Albertans dying each year. Deaths peaked in April and May, when 134 Albertans died along with about 4,000 Albertans who died in those same two months from other causes.

In Alberta and elsewhere, COVID-19 significantly threatens elderly people with one, two, three or more serious pre-existing health conditions, as well as a very small number of adults under 60. However, COVID-19 does not have a significant impact on overall life expectancy. The average age of those reported as COVID deaths in Alberta is 83. Life expectancy in Alberta is 82. To date, 309 Albertans, predominantly elderly near the final stages of their life, have died of COVID-19, almost all of them with one or more serious comorbidities.

“Government data shows that COVID-19 is not the unusually deadly killer that Premier Kenney and Dr. Hinshaw made it out to be when they claimed in April that—even with lockdown measures in place—as many as 32,000 Albertans would die of the virus,” stated Carpay.

“Politicians claim that the lockdowns saved many lives, but they have yet to put forward actual evidence that might support their speculation and conjecture,” stated Carpay.

“Each of Alberta’s 309 COVID-19 deaths is sad and tragic, and so are the other 26,917 deaths that occur in Alberta each year,” continued Carpay.

Each and every month, Albertans mourn the passing of over 2,000 friends and family members, who die of cancer, car accidents, alcoholism, drug overdoses, suicide, heart disease, delayed surgeries, and many other causes. In the past seven months more than 14,000 Albertans have died, 309 of the virus and the remainder of other causes.

Since March, lockdown harms such as increase in drug overdoses, which kill more Albertans than COVID-19 does, have been either ignored or accepted, as if dying of COVID-19 is somehow worse than dying of another cause.

“In light of the Alberta government’s own data on COVID-19 deaths, there is no rational basis for forcing all Albertans to continue living in fear,” stated Carpay.

“Alberta’s politicians and health officials should focus their attention on protecting those who are at serious risk from COVID-19, rather than violating the Charter freedoms of the entire population,” stated Carpay.

“Albertans, and all Canadians, should exercise their freedom of association and freedom of peaceful assembly without fear of prosecution or penalty. This is especially true for the young, who are at more risk of being struck by lightning than dying of COVID,” concluded Carpay.

Source: https://www.jccf.ca

Alberta

Low oil prices could have big consequences for Alberta’s finances

From the Fraser Institute

By Tegan Hill

Amid the tariff war, the price of West Texas Intermediate oil—a common benchmark—recently dropped below US$60 per barrel. Given every $1 drop in oil prices is an estimated $750 million hit to provincial revenues, if oil prices remain low for long, there could be big implications for Alberta’s budget.

The Smith government already projects a $5.2 billion budget deficit in 2025/26 with continued deficits over the following two years. This year’s deficit is based on oil prices averaging US$68.00 per barrel. While the budget does include a $4 billion “contingency” for unforeseen events, given the economic and fiscal impact of Trump’s tariffs, it could quickly be eaten up.

Budget deficits come with costs for Albertans, who will already pay a projected $600 each in provincial government debt interest in 2025/26. That’s money that could have gone towards health care and education, or even tax relief.

Unfortunately, this is all part of the resource revenue rollercoaster that’s are all too familiar to Albertans.

Resource revenue (including oil and gas royalties) is inherently volatile. In the last 10 years alone, it has been as high as $25.2 billion in 2022/23 and as low as $2.8 billion in 2015/16. The provincial government typically enjoys budget surpluses—and increases government spending—when oil prices and resource revenue is relatively high, but is thrown into deficits when resource revenues inevitably fall.

Fortunately, the Smith government can mitigate this volatility.

The key is limiting the level of resource revenue included in the budget to a set stable amount. Any resource revenue above that stable amount is automatically saved in a rainy-day fund to be withdrawn to maintain that stable amount in the budget during years of relatively low resource revenue. The logic is simple: save during the good times so you can weather the storm during bad times.

Indeed, if the Smith government had created a rainy-day account in 2023, for example, it could have already built up a sizeable fund to help stabilize the budget when resource revenue declines. While the Smith government has deposited some money in the Heritage Fund in recent years, it has not created a dedicated rainy-day account or introduced a similar mechanism to help stabilize provincial finances.

Limiting the amount of resource revenue in the budget, particularly during times of relatively high resource revenue, also tempers demand for higher spending, which is only fiscally sustainable with permanently high resource revenues. In other words, if the government creates a rainy-day account, spending would become more closely align with stable ongoing levels of revenue.

And it’s not too late. To end the boom-bust cycle and finally help stabilize provincial finances, the Smith government should create a rainy-day account.

Alberta

Governments in Alberta should spur homebuilding amid population explosion

From the Fraser Institute

By Tegan Hill and Austin Thompson

In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Alberta has long been viewed as an oasis in Canada’s overheated housing market—a refuge for Canadians priced out of high-cost centres such as Vancouver and Toronto. But the oasis is starting to dry up. House prices and rents in the province have spiked by about one-third since the start of the pandemic. According to a recent Maru poll, more than 70 per cent of Calgarians and Edmontonians doubt they will ever be able to afford a home in their city. Which raises the question: how much longer can this go on?

Alberta’s housing affordability problem reflects a simple reality—not enough homes have been built to accommodate the province’s growing population. The result? More Albertans competing for the same homes and rental units, pushing prices higher.

Population growth has always been volatile in Alberta, but the recent surge, fuelled by record levels of immigration, is unprecedented. Alberta has set new population growth records every year since 2022, culminating in the largest-ever increase of 186,704 new residents in 2024—nearly 70 per cent more than the largest pre-pandemic increase in 2013.

Homebuilding has increased, but not enough to keep pace with the rise in population. In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Moreover, from 1972 to 2019, Alberta added 2.1 new residents (on average) for every housing unit started compared to 3.9 new residents for every housing unit started in 2024. Put differently, today nearly twice as many new residents are potentially competing for each new home compared to historical norms.

While Alberta attracts more Canadians from other provinces than any other province, federal immigration and residency policies drive Alberta’s population growth. So while the provincial government has little control over its population growth, provincial and municipal governments can affect the pace of homebuilding.

For example, recent provincial amendments to the city charters in Calgary and Edmonton have helped standardize building codes, which should minimize cost and complexity for builders who operate across different jurisdictions. Municipal zoning reforms in Calgary, Edmonton and Red Deer have made it easier to build higher-density housing, and Lethbridge and Medicine Hat may soon follow suit. These changes should make it easier and faster to build homes, helping Alberta maintain some of the least restrictive building rules and quickest approval timelines in Canada.

There is, however, room for improvement. Policymakers at both the provincial and municipal level should streamline rules for building, reduce regulatory uncertainty and development costs, and shorten timelines for permit approvals. Calgary, for instance, imposes fees on developers to fund a wide array of public infrastructure—including roads, sewers, libraries, even buses—while Edmonton currently only imposes fees to fund the construction of new firehalls.

It’s difficult to say how long Alberta’s housing affordability woes will endure, but the situation is unlikely to improve unless homebuilding increases, spurred by government policies that facilitate more development.

-

Alberta2 days ago

Alberta2 days agoGovernments in Alberta should spur homebuilding amid population explosion

-

International2 days ago

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

Alberta2 days ago

Alberta2 days agoLow oil prices could have big consequences for Alberta’s finances

-

2025 Federal Election2 days ago

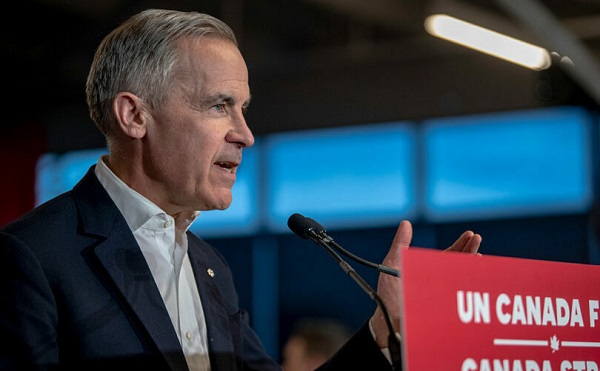

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s

-

Business2 days ago

Business2 days agoIt Took Trump To Get Canada Serious About Free Trade With Itself

-

C2C Journal1 day ago

C2C Journal1 day ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

Opinion1 day ago

Opinion1 day agoCanadians Must Turn Out in Historic Numbers—Following Taiwan’s Example to Defeat PRC Election Interference

-

2025 Federal Election18 hours ago

2025 Federal Election18 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences