Business

Head of Canada’s drug price regulator resigns same week as colleague steps down

The executive director of Canada’s drug pricing regulator is stepping down — just days after another member resigned because of concerns that the federal government was undermining the regulator’s work.

Douglas Clark, executive director of the Patented Medicine Prices Review Board, announced today he will be leaving his post after almost a decade with the regulator.

On Thursday, Matthew Herder, a professor of health law at Dalhousie University, announced he had resigned from the board, accusing the federal government of failing to implement critically important reforms that would lower the cost of medication.

Herder said in his resignation letter addressed to federal Health Minister Jean-Yves Duclos that he is stepping down because he no longer believes it is possible to serve the public good in this role, which he had held since 2018.

Herder responded today on social media to news of Clark’s resignation, calling it an immense and irreplaceable loss.

Clark has agreed to remain with the board as a special adviser for an unspecified amount of time, and the board says work to appoint Clark’s successor will be launched soon.

The Patented Medicine Prices Review Board regulates the prices of patented medicines sold in Canada.

This report by The Canadian Press was first published Feb. 24, 2023.

Business

Musk Slashes DOGE Savings Forecast By 85%

From the Daily Caller News Foundation

By Thomas English

Elon Musk announced Thursday that the Department of Government Efficiency (DOGE) is now targeting $150 billion in federal savings for fiscal year 2026 — dramatically scaling back earlier claims of slashing as much as $2 trillion.

Musk initially projected DOGE would deliver $2 trillion in savings by targeting government waste, fraud and abuse. That figure was halved to $1 trillion earlier this year, but Musk walked it back again at Thursday’s Cabinet meeting, saying the revised $150 billion projection will “result in better services for the American people” and ensure federal spending “in a way that is sensible and fair and good.”

“I’m excited to announce we anticipate saving in FY ’26 from a reduction of waste and fraud a reduction of $150 billion dollars,” Musk said. “And some of it is just absurd, like, people getting unemployment insurance who haven’t been born yet. I mean, I think anyone can appreciate — I mean, come on, that’s just crazy.”

The announcement marks the latest in a string of revised projections from Musk, who has become the face of President Donald Trump’s aggressive federal efficiency agenda.

“Your people are fantastic,” the president responded. “In fact, hopefully they’ll stay around for the long haul. We’d like to keep as many as we can. They’re great — smart, sharp, finding things that nobody would have thought of.”

Musk originally floated the $2 trillion figure during campaign appearances last fall.

“I think we could do at least $2 trillion,” Musk said at the Madison Square Garden campaign rally in November. “At the end of the day, you’re being taxed — all government spending is taxation … Your money is being wasted, and the Department of Government Efficiency is going to fix that.”

By January, he softened expectations to a “really quite achievable” $1 trillion target before downsizing that figure again this week.

“Our goal is to reduce the deficit by a trillion dollars,” Musk told Fox News’ Bret Baier “Looked at in total federal spending, to drop the federal spending from $7 trillion to $6 trillion by eliminating waste, fraud and abuse … Which seems really quite achievable.”

DOGE’s website, which tracks cost-saving initiatives and contract cancellations, currently calculates total federal savings at $150 billion.

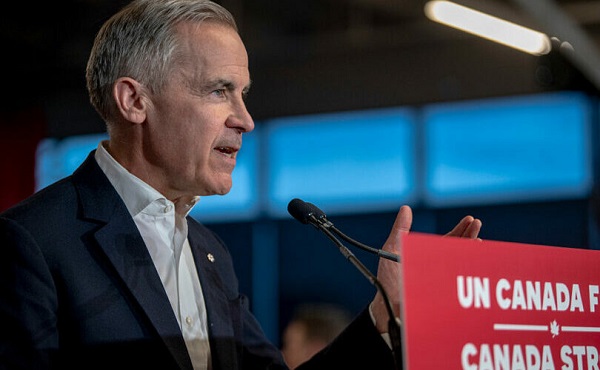

2025 Federal Election

Taxpayers urge federal party leaders to drop home sale reporting to CRA

Party leaders must clarify position on home equity tax

The Canadian Taxpayers Federation is calling on all party leaders to prove they’re against home equity taxes by pledging to immediately remove the Canada Revenue Agency reporting requirement on the sale of primary residences.

“Canadians rely on the sale of their homes to pay for their golden years,” said Carson Binda, CTF B.C. Director. “After the government spent hundreds of thousands of dollars flirting with home taxes, taxpayers need party leaders to prove they won’t tax our homes by removing the CRA reporting requirement.”

Right now, the profit you make from selling your home is exempt from the capital gains tax. However, in 2016, the federal government mandated that Canadians report the sale of their homes to the CRA, even though it’s tax exempt.

The Canada Mortgage and Housing Corporation also spent at least $450,000 to study and influence public opinion in favour of home equity taxes. The report recommended a home equity tax targeting the “housing wealth windfalls gained by many homeowners while they sleep and watch TV.”

“A home equity tax would hurt seniors saving for their golden years and make homes more expensive for younger generations,” Binda said. “If the federal government isn’t planning on imposing a home equity tax, then Canadians shouldn’t be forced to report the sale of their home to the CRA.”

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoRCMP memo warns of Chinese interference on Canadian university campuses to affect election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoResearchers Link China’s Intelligence and Elite Influence Arms to B.C. Government, Liberal Party, and Trudeau-Appointed Senator

-

COVID-191 day ago

COVID-191 day agoFauci, top COVID officials have criminal referral requests filed against them in 7 states

-

Business2 days ago

Business2 days agoStocks soar after Trump suspends tariffs

-

Business2 days ago

Business2 days agoScott Bessent Says Trump’s Goal Was Always To Get Trading Partners To Table After Major Pause Announcement

-

COVID-192 days ago

COVID-192 days agoBiden Admin concealed report on earliest COVID cases from 2019

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoMark Carney vows to provide sterilizing puberty blockers to children ‘without exception’

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoThe status quo in Canadian politics isn’t sustainable for national unity