Fraser Institute

Government meddling contributes to doctor exodus in Quebec

From the Fraser Institute

By Bacchus Barua and Yanick Labrie

They have not left Quebec’s health-care system but rather have opted out of the province’s publicly-financed framework to provide care to their patients privately.

Quebec’s health minister recently came under fire after reports revealed a record number of physicians left the province’s public system to practise privately. Less discussed are the reasons why physicians made this choice.

Indeed, it turns out that ill-conceived attempts to protect publicly-funded health care by the Trudeau government and successive provincial governments may have contributed to the increasing numbers of physicians opting-out.

To be clear, the 780 physicians in question account for about four per cent of physicians in the province. However, this represents a 22 per cent increase in the number of physicians leaving the public system compared to the previous year—and is part of a growing trend. More importantly, they have not left Quebec’s health-care system but rather have opted out of the province’s publicly-financed framework to provide care to their patients privately.

Why?

One reason, is because governments have forced them to do so.

Until recently, physicians in Quebec (including those who practiced in the public sector) were allowed to charge patients so-called “accessory-fees” in certain instances—for example, if the service was either not covered or insufficiently reimbursed by the government’s fee schedule.

However, the federal Canada Health Act (CHA) clearly states that “extra-billing” of this nature, when charged by physicians who also bill the public system, must result in dollar-for-dollar deductions in federal health-care transfer payments to the province. In other words, the CHA encourages provincial efforts to effectively force doctors to choose between the public and private system if any out-of-pocket expenses are involved.

And so, under financial threat by the Trudeau government, Quebec eventually clamped down on such fees charged by physicians who worked in the public system.

Consequently, physicians who relied on these payments to cover a portion of their operating costs faced an unfortunate choice—stay in the public system at the risk of financial ruin or opt-out entirely and practise exclusively in the private sector.

For many, the choice was obvious. One study found that by 2019 “an additional 69 specialist physicians opted out after the 2017 clampdown on double billing [sic] than previous trends would have predicted.” Several clinics offering endoscopy and colonoscopy services simply closed their doors. Quebecers also ended up with a less convenient health-care experience following this clamp down, as evidenced by the reduction in clinic-provided services that followed.

This attitude to extra-billing stands in stark contrast to the situation in other universal health-care countries such as Australia where consultations with specialists are usually only partially (85 per cent) covered by the universal plan. In fact, physicians (family doctors and specialists) can generally set fees above the government’s fee schedule so long as they forgo the convenience of directly billing the government (i.e. patients claim reimbursement after the fact). Notably, Australia’s health-care system costs less than Canada’s in total (including these private payments) yet delivers more rapid access to health-care services with a greater availability of medical professionals, hospital beds, and diagnostic and surgical technologies.

More generally, a recent study found 22 of 28 universal health-care countries require patients to share a portion of the cost of treatment (with generous protections for vulnerable groups). These include deductibles (an amount individuals must pay before insurance coverage kicks in), co-insurance payments (the patient pays a certain percentage of treatment cost) and copayments (the patient pays a fixed amount per treatment). Crucially, many of these countries including Australia, Germany, the Netherlands and Switzerland also have shorter wait times than we endure.

In these countries, physicians are also generally allowed to practise both in publicly-funded universal settings and private settings (a policy known as “dual practice”) rather than having their activities restricted to one setting only. In other words, Canada’s federal restrictions on cost-sharing and extra-billing (such as Quebec’s accessory fees) and provincial barriers to dual-practice place our universal system in the minority of a small cohort of countries that are not particularly known for stellar performance.

The looming threat of further reductions in federal cash transfers, under the CHA, has led to provinces such as Quebec imposing increasingly restrictive conditions on physicians in the public system. And in response, physicians—by opting-out—are indicating that they’ve had enough.

It’s ironic that the very groups intent on supposedly “protecting public health care” by forcing physicians to choose between the public and private systems have enforced policies that may very well lead to the public system’s continued demise.

Authors:

Business

State of the Canadian Economy: Number of publicly listed companies in Canada down 32.7% since 2010

From the Fraser Institute

By Ben Cherniavsky and Jock Finlayson

Initial public offerings down 94% since 2010, reflecting country’s economic stagnation

Canadian equity markets are flashing red lights reflective of the larger stagnation, lack of productivity growth and lacklustre innovation of the

country’s economy, with the number of publicly listed companies down 32.7 per cent and initial public offerings down 92.5 per cent since 2010, finds a new report published Friday by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Even though the value of the companies trading on Canada’s stock exchanges has risen substantially over time, there has been an alarming decrease in the number of companies listed on the exchanges as well as the number of companies choosing to go public,” said Ben Cherniavsky, co-author of Canada’s Shrinking Stock Market: Causes and Implications for Future Economic Growth.

The study finds that over the past 15 years, the number of companies listed on Canada’s two stock markets (the TSX and the TSXV) has fallen from 3,141 in 2010 to 2,114 in 2024—a 32.7 per cent decline.

Similarly, the number of new public stock listings (IPOs) on the two Canadian exchanges has also plummeted from 67 in 2010 to just four in 2024, and only three the year before.

Previous research has shown that well-functioning, diverse public stock markets are significant contributors to economic growth, higher productivity and innovation by supplying financing (i.e. money) to the business sector to enable growth and ongoing investments.

At the same time, the study also finds an explosion of investment in what’s known as private equity in Canada, increasing assets under management from $21.7 billion (US) in 2010 to over $93.1 billion (US) in 2024.

“The shift to private equity has enormous implications for average investors, since it’s difficult if not impossible for average investors to access private equity funds for their savings and investments,” explained Cherniavsky.

Crucially, the study makes several recommendations to revitalize Canada’s stagnant capital markets, including reforming Canada’s complicated regulatory regime for listed companies, scaling back corporate disclosure requirements, and pursuing policy changes geared to improving Canada’s lacklustre performance on business investment, productivity growth, and new business formation.

“Public equity markets play a vital role in raising capital for the business sector to expand, and they also provide an accessible and low-cost way for Canadians to invest in the commercial success of domestic businesses,” said Jock Finlayson, a senior fellow with the Fraser Institute and study co-author.

“Policymakers and all Canadians should be concerned by the alarming decline in the number of publicly traded companies in Canada, which risks economic stagnation and lower living standards ahead.”

Canada’s Shrinking Stock Market: Causes and Implications for Future Economic Growth

- Public equity markets are an important part of the wider financial system.

- Since the early 2000s, the number of public companies has fallen in many countries, including Canada. In 2008, for instance, Canada had 3,520 publicly traded companies on its two exchanges, compared to 2,114 in 2024.

- This trend reflects [1] the impact of mergers and acquisitions, [2] greater access to private capital, [3] increasing regulatory and governance costs facing publicly traded businesses, and [4] the growth of index investing.

- Canada’s poor business climate, including many years of lacklustre business investment and little or no productivity growth, has also contributed to the decline in stock exchange listings.

- The number of new public stock listings (IPOs) on Canadian exchanges has plummeted: between 2008 and 2013, the average was 47 per year, but this dropped to 16 between 2014 and 2024, with only 5 new listings recorded in 2024.

- At the same time, the value of private equity in Canada has skyrocketed from $12.8 billion in 2008 to $93.2 billion in 2024. These trends are concerning, as most Canadians cannot easily access private equity investment vehicles, so their domestic investment options are shrinking.

- The growth of index investing is contributing to the decline in public listings, particularly among smaller companies. In 2008, there were 1,232 listed companies on the TSX Composite and 84 exchange-traded funds; in 2024, there were only 709 listed companies on the TSX and 1,052 exchange-traded funds.

- The trends discussed in this study are also important because Canada has relied more heavily than other jurisdictions on public equity markets to finance domestic businesses.

- Revitalizing Canada’s stagnant stock markets requires policy reforms, particularly regulatory changes to reduce costs to issuers and policies to improve the conditions for private-sector investment and business growth.

Alberta

Alberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

From the Fraser Institute

By Nadeem Esmail, Mackenzie Moir and Lauren Asaad

In October, Alberta’s provincial government announced forthcoming legislative changes that will allow patients to pay out-of-pocket for any diagnostic test they want, and without a physician referral. The policy, according to the Smith government, is designed to help improve the availability of preventative care and increase testing capacity by attracting additional private sector investment in diagnostic technology and facilities.

Unsurprisingly, the policy has attracted Ottawa’s attention, with discussions now taking place around the details of the proposed changes and whether this proposal is deemed to be in line with the Canada Health Act (CHA) and the federal government’s interpretations. A determination that it is not, will have both political consequences by being labeled “non-compliant” and financial consequences for the province through reductions to its Canada Health Transfer (CHT) in coming years.

This raises an interesting question: While the ultimate decision rests with Ottawa, does the Smith government’s new policy comply with the literal text of the CHA and the revised rules released in written federal interpretations?

According to the CHA, when a patient pays out of pocket for a medically necessary and insured physician or hospital (including diagnostic procedures) service, the federal health minister shall reduce the CHT on a dollar-for-dollar basis matching the amount charged to patients. In 2018, Ottawa introduced the Diagnostic Services Policy (DSP), which clarified that the insured status of a diagnostic service does not change when it’s offered inside a private clinic as opposed to a hospital. As a result, any levying of patient charges for medically necessary diagnostic tests are considered a violation of the CHA.

Ottawa has been no slouch in wielding this new policy, deducting some $76.5 million from transfers to seven provinces in 2023 and another $72.4 million in 2024. Deductions for Alberta, based on Health Canada’s estimates of patient charges, totaled some $34 million over those two years.

Alberta has been paid back some of those dollars under the new Reimbursement Program introduced in 2018, which created a pathway for provinces to be paid back some or all of the transfers previously withheld on a dollar-for-dollar basis by Ottawa for CHA infractions. The Reimbursement Program requires provinces to resolve the circumstances which led to patient charges for medically necessary services, including filing a Reimbursement Action Plan for doing so developed in concert with Health Canada. In total, Alberta was reimbursed $20.5 million after Health Canada determined the provincial government had “successfully” implemented elements of its approved plan.

Perhaps in response to the risk of further deductions, or taking a lesson from the Reimbursement Action Plan accepted by Health Canada, the province has gone out of its way to make clear that these new privately funded scans will be self-referred, that any patient paying for tests privately will be reimbursed if that test reveals a serious or life-threatening condition, and that physician referred tests will continue to be provided within the public system and be given priority in both public and private facilities.

Indeed, the provincial government has stated they do not expect to lose additional federal health care transfers under this new policy, based on their success in arguing back previous deductions.

This is where language matters: Health Canada in their latest CHA annual report specifically states the “medical necessity” of any diagnostic test is “determined when a patient receives a referral or requisition from a medical practitioner.” According to the logic of Ottawa’s own stated policy, an unreferred test should, in theory, be no longer considered one that is medically necessary or needs to be insured and thus could be paid for privately.

It would appear then that allowing private purchase of services not referred by physicians does pass the written standard for CHA compliance, including compliance with the latest federal interpretation for diagnostic services.

But of course, there is no actual certainty here. The federal government of the day maintains sole and final authority for interpretation of the CHA and is free to revise and adjust interpretations at any time it sees fit in response to provincial health policy innovations. So while the letter of the CHA appears to have been met, there is still a very real possibility that Alberta will be found to have violated the Act and its interpretations regardless.

In the end, no one really knows with any certainty if a policy change will be deemed by Ottawa to run afoul of the CHA. On the one hand, the provincial government seems to have set the rules around private purchase deliberately and narrowly to avoid a clear violation of federal requirements as they are currently written. On the other hand, Health Canada’s attention has been aroused and they are now “engaging” with officials from Alberta to “better understand” the new policy, leaving open the possibility that the rules of the game may change once again. And even then, a decision that the policy is permissible today is not permanent and can be reversed by the federal government tomorrow if its interpretive whims shift again.

The sad reality of the provincial-federal health-care relationship in Canada is that it has no fixed rules. Indeed, it may be pointless to ask whether a policy will be CHA compliant before Ottawa decides whether or not it is. But it can be said, at least for now, that the Smith government’s new privately paid diagnostic testing policy appears to have met the currently written standard for CHA compliance.

Lauren Asaad

Policy Analyst, Fraser Institute

-

Business2 days ago

Business2 days agoCanada Hits the Brakes on Population

-

Crime1 day ago

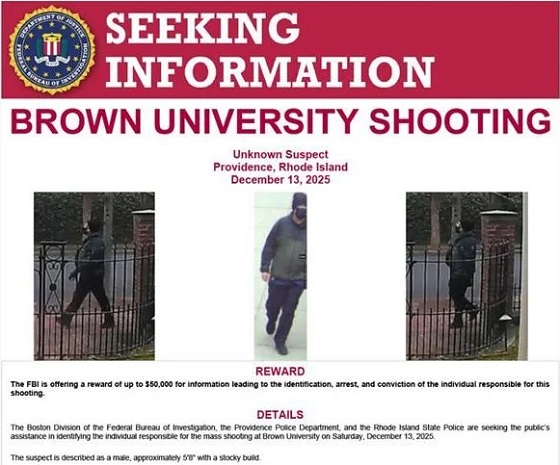

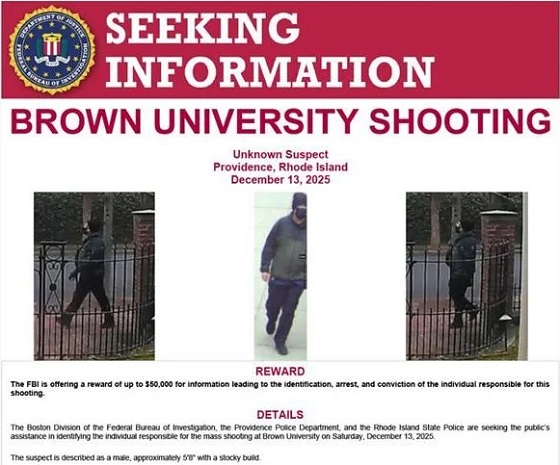

Crime1 day agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada Lets Child-Porn Offenders Off Easy While Targeting Bible Believers

-

Health20 hours ago

Health20 hours agoRFK Jr reversing Biden-era policies on gender transition care for minors

-

Agriculture2 days ago

Agriculture2 days agoWhy is Canada paying for dairy ‘losses’ during a boom?

-

Alberta22 hours ago

Alberta22 hours agoAlberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

-

Business2 days ago

Business2 days agoWhite House declares inflation era OVER after shock report

-

Business1 day ago

Business1 day agoTrump signs order reclassifying marijuana as Schedule III drug