National

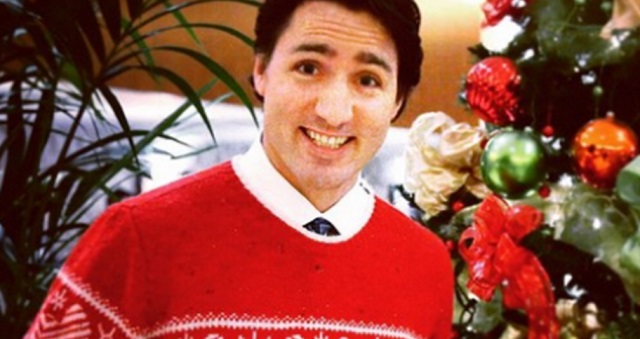

Generous Justin: Trudeau hands out one million raises in four years

From the Canadian Taxpayers Federation

Author: Ryan Thorpe

The Trudeau government rubberstamped more than one million pay raises to federal bureaucrats since 2020, according to access-to-information records obtained by the Canadian Taxpayers Federation.

The federal government gave 319,067 bureaucrats a raise in 2023. The government has consistently declined to disclose how much annual pay raises cost taxpayers.

“Taxpayers deserve to know how much all these raises are costing us,” said Franco Terrazzano, CTF Federal Director. “It’s wrong for the government to hand out a million raises while taxpayers lost their jobs or struggled to afford ground beef and rent.”

The cost of the federal payroll hit $67 billion last year, a record high, representing a 68 per cent increase since 2016.

Meanwhile, the size of the bureaucracy spiked by about 40 per cent since Prime Minister Justin Trudeau took office, with more than 98,000 new employees being added to the federal payroll.

In 2020, the federal government issued 373,134 pay raises to bureaucrats, followed by 266,646 in 2021 and 162,263 in 2022.

All told, the feds rubberstamped 1,121,110 pay raises since the beginning of 2020.

“What extra value have taxpayers received from the million raises Trudeau has given bureaucrats?” Terrazzano said. “You shouldn’t get a raise just because you show up to work twice a week with your shoes tied.”

The raises come on top of lavish bonuses for federal bureaucrats. The government rubberstamped $406 million in bonuses in 2023 alone.

Bureaucrats working in federal departments and agencies took home $210 million in bonuses last year, while bureaucrats working in federal Crown corporations took $195 million in bonuses.

The government dished out more than $1.5 billion in bonuses to employees in federal departments since 2015, despite the fact that “less than 50 per cent of [performance] targets are consistently met within the same year,” according to the Parliamentary Budget Officer.

The average compensation for each full-time federal employee is $125,300 when pay, pension, paid time off, shift premiums and other benefits are considered, according to the PBO.

Meanwhile, the average annual salary among all full-time workers was less than $70,000 in 2023, according to data from Statistics Canada.

Government employees also receive an “8.5 per cent wage premium, on average, over their private-sector counterparts,” according to a report from the Fraser Institute, an independent, non-partisan think tank.

The Public Service Alliance of Canada, the largest union representing federal bureaucrats, is currently fighting against a government order asking employees return to the office three days per week.

Alex Silas, PSAC’s regional executive vice-president for the National Capital Region, said bureaucrats were “infuriated” by the government asking them to show up to their jobs in person three days per week.

“Taxpayers have zero sympathy for overpaid bureaucrats throwing a hissy fit about having to swap out their sweatpants for suits,” Terrazzano said. “Taxpayers are the ones who should be complaining after the feds hired tens of thousands of extra bureaucrats, paid out hundreds of thousands of raises and hundreds of millions in bonuses and still can’t deliver good services.

“Trudeau needs to take some air out of his ballooning bloated bureaucracy.”

Food

Canada Still Serves Up Food Dyes The FDA Has Banned

From the Frontier Centre for Public Policy

By Lee Harding

Canada is falling behind on food safety by continuing to allow seven synthetic food dyes that the United States and several other jurisdictions are banning due to clear health risks.

The United States is banning nine synthetic food dyes linked to health risks, but Canada is keeping them on store shelves. That’s a mistake.

On April 22, 2025, the U.S. Department of Health and Human Services and the Food and Drug Administration (FDA) announced they would ban nine petroleum-based dyes, artificial colourings that give candies, soft drinks and snack foods their bright colours, from U.S. foods before 2028.

The agencies’ directors said the additives presented health risks and offered no nutritional value. In August, the FDA targeted Orange B and Citrus Red No. 2 for even quicker removal.

The good news for Canada is that Orange B was banned here long ago, in 1980, while Citrus Red No. 2 is barely used at all. It is allowed at two parts per million in orange skins. Also, Canada reduced the maximum permitted level for other synthetic dyes following a review in 2016.

The bad news for Canadians is that regulators will keep allowing seven dyes that the U.S. plans to ban, with one possible exception. Health Canada will review Erythrosine (called Red 3 in the U.S.) next year. The FDA banned the substance from cosmetics and drugs applied to the skin in 1990 but waited decades to do the same for food.

All nine dyes targeted by the FDA have shown evidence of tumours in animal studies, often at doses achievable through diet. Over 20 years of meta-analyses also show each dye increases the risk of attention deficit hyperactivity disorder in eight to 10 per cent of children, with a greater risk in mixtures.

At least seven dyes demonstrate broad-spectrum toxicity, especially affecting the liver and kidneys. Several have been found to show estrogenic endocrine effects, triggering female hormones and causing unwanted risks for both males and females. Six dyes have clinical proof of causing DNA damage, while five show microbiome disruption in the gut. One to two per cent of the population is allergic to them, some severely so.

The dyes also carry a risk of dose dependency, or addiction, especially when multiple dyes are combined, a common occurrence in processed foods.

U.S. research suggests the average child consumes 20 to 50 milligrams of synthetic dyes per day, translating to 7.3 to 18.25 kilograms (16.1 to 40.2 pounds) per year. It might be less for Canadian kids now, but eating even a “mere” 20 pounds of synthetic dyes per year doesn’t sound healthy.

It’s debatable how to properly regulate these dyes. Regulators don’t dispute that scientists have found tumours and other problems in rats given large amounts of the dyes. What’s less clear are the implications for humans with typical diets. With so much evidence piling up, some countries have already taken decisive action.

Allura Red (Red 40), slated for removal in the U.S., was previously banned in Denmark, Belgium, France, Switzerland, Sweden and Norway. However, these countries were forced to accept the dye in 2009 when the European Union harmonized its regulations across member countries.

Nevertheless, the E.U. has done what Canada has not and banned Citrus Red No. 2 and Fast Green FCF (Green 3), as have the U.K. and Australia. Unlike Canada, these countries have also restricted the use of Erythrosine (Red 3). And whereas product labels in the E.U. warn that the dyes risk triggering hyperactivity in children, Canadians receive no such warning.

Canadian regulators could defend the status quo, but there’s a strong case for emulating the E.U. in its labelling and bans. Health Canada should expand its review to include the dyes banned by the E.U. and those the U.S. is targeting. Alignment with peers would be good for health and trade, ensuring Canadian manufacturers don’t face export barriers or costly reformulations when selling abroad.

It’s true that natural alternatives present challenges. Dr. Sylvain Charlebois, a food policy expert and professor at Dalhousie University, wrote that while natural alternatives, such as curcumin, carotenes, paprika extract, anthocyanins and beet juice, can replace synthetic dyes, “they come with trade-offs: less vibrancy, greater sensitivity to heat and light, and higher costs.”

Regardless, that option may soon look better. The FDA is fast-tracking a review of calcium phosphate, galdieria blue extract, gardenia blue, butterfly pea flower extract and other natural alternatives to synthetic food dyes. Canada should consider doing the same, not only for safety reasons but to add value to its agri-food sector.

Ultimately, we don’t need colour additives in our food at all. They’re an unnecessary cosmetic that disguises what food really is.

Yes, it’s more fun to have a coloured candy or cupcake than not.What’s less fun is cancer, cognitive disorders, leaky gut and hormonal disruptions. Canada must choose.

Lee Harding is a research fellow for the Frontier Centre for Public Policy.

Addictions

Manitoba Is Doubling Down On A Failed Drug Policy

From the Frontier Centre for Public Policy

Manitoba is choosing to expand the same drug policy model that other provinces are abandoning, policies that normalize addiction while sidelining treatment, recovery, and public safety.

The New Democrat premier of British Columbia, David Eby, stood before reporters last spring and called his government’s decision to permit public drug use in certain spaces a failure.

The policy was part of the broader “harm reduction” strategy meant to address overdose deaths. Instead, it had stirred public anger, increased street disorder and had helped neither users nor the communities that host them. “We do not accept street disorder that makes communities feel unsafe,” Eby said. The province scrapped the plan.

In Alberta, the Conservative government began shutting down safer-supply prescribing due to concerns about drug diversion and misuse. The belief that more opioids can resolve the opioid crisis is losing credibility.

Ontario Progressive Conservatives are moving away from harm reduction by shutting down supervised consumption sites near schools and limiting safer-supply prescribing. Federal funding for programs is decreasing, and the province is shifting its focus to treatment models, even though not all sites are yet closed.

Yet amid these non-partisan reversals, Manitoba’s government has announced its intention to open a supervised drug-use site in Winnipeg. Premier Wab Kinew said, “We have too many Manitobans dying from overdose.” True. But it does not follow that repeating failed approaches will yield different results.

Reversing these failed policies is not a rejection of compassion. It is a recognition that good intentions do not produce good outcomes. Vancouver and Toronto have hosted supervised drug-use sites for years. The death toll keeps rising. Drug deaths in British Columbia topped 2,500 in 2023, even with the most expansive harm reduction infrastructure in the country. A peer-reviewed study published this year found that hospitalizations from opioid poisoning rose after B.C.’s safer-supply policy was implemented. Emergency department visits increased by more than three cases per 100,000 population, with no corresponding drop in fatal overdoses.

And the problem persists day to day. Paramedics in B.C. responded to nearly 4,000 overdose calls in July 2024 alone. The monthly call volume has exceeded 3,000 almost every month this year. These are signs of crisis management without a path to recovery.

There are consequences beyond public health. These policies change the character of neighbourhoods. Businesses suffer. Residents feel unsafe. And most tragically, the person using drugs is offered little more than a cot, a nurse and a quiet signal to continue. Real help, like treatment, housing and purpose, remains out of reach.

Somewhere along the way, bureaucracies stopped asking what recovery looks like. They have settled for managing human decline. They call it compassion. But it is really surrender, wrapped in medical language.

Harm reduction had its time. It made sense when it first emerged, during the AIDS crisis, when dirty needles spread HIV. Back then, the goal was to stop a deadly virus. Today, that purpose has been lost.

When policy drifts into ideology, reality becomes an afterthought. Underneath today’s approach is the belief that drug use is inevitable, that people cannot change, that liberty means letting others fade away quietly. These ideas do not reflect science. They do not reflect hope. They reflect despair. They reflect a politics that prioritizes the appearance of compassion over effectiveness.

What Manitoba needs is treatment access that meets the scale of the problem. That means detox beds, recovery homes and long-term care focused on restoring lives. These may not generate the desired headlines, but they work. They are demanding. They are slow. And they offer respect to the person behind the addiction.

There are no shortcuts. No policy will undo decades of pain overnight. But a policy that keeps people stuck using is not mercy. It is maintenance with no way out.

A government that believes in its people should not copy failure.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

-

Alberta2 days ago

Alberta2 days agoIEA peak-oil reversal gives Alberta long-term leverage

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoHealthcare And Pipelines Are The Front Lines of Canada’s Struggle To Stay United

-

Alberta2 days ago

Alberta2 days agoAlberta can’t fix its deficits with oil money: Lennie Kaplan

-

Business2 days ago

Business2 days agoCanadians love Nordic-style social programs as long as someone else pays for them

-

International2 days ago

International2 days agoTrump vows to pause migration after D.C. shooting

-

Daily Caller2 days ago

Daily Caller2 days ago‘No Critical Thinking’: Parents Sound Alarm As Tech Begins To ‘Replace The Teacher’

-

National1 day ago

National1 day agoAlleged Liberal vote-buying scandal lays bare election vulnerabilities Canada refuses to fix

-

Addictions1 day ago

Addictions1 day agoThe Death We Manage, the Life We Forget