Automotive

‘Fundamentally Wrong’: Virginia Heads For Exit Ramp After Adopting California’s ‘Out-Of-Touch’ EV Rules

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By NICK POPE

Virginia is ditching rules that would have mandated 100% of new car sales to be electric vehicles (EVs) by 2035.

Under former Democratic Virginia Gov. Ralph Northam, the state enacted a law in 2021 that hitched it to California’s stringent vehicle emissions standards, the latest version of which will require the phase-out of internal combustion engine models by 2035. Current Republican Gov. Glenn Youngkin and his administration announced Wednesday that Virginia will not be following California’s new regulations once the current set expires at the end of the year.

“Once again, Virginia is declaring independence – this time from a misguided electric vehicle mandate imposed by unelected leaders nearly 3,000 miles away from the Commonwealth,” Youngkin said in a statement. “The idea that government should tell people what kind of car they can or can’t purchase is fundamentally wrong. Virginians deserve the freedom to choose which vehicles best fit the needs of their families and businesses. The law is clear, and I am proud to announce Virginians will no longer be forced to live under this out-of-touch policy.”

Once again, Virginia is declaring independence – this time from a misguided electric vehicle mandate imposed by unelected leaders nearly 3,000 miles away from the Commonwealth.

— Governor Glenn Youngkin (@GovernorVA) June 5, 2024

Youngkin has opposed the policy because “California’s requirements for their citizens should not be a one size fits all solution for Virginia,” the governor’s staff previously told to the Daily Caller News Foundation. Previous efforts by state Republicans to repeal the law linking Virginia to California’s standards failed, and legislative avenues to get rid of the rules closed when Democrats cemented control of the state legislature in last fall’s elections.

The governor’s office cited a legal opinion by Republican Virginia Attorney General Jason Miyares to substantiate its decision. Miyares’ opinion asserted that the state is not obligated to abide by the California Air Resource Board’s (CARB) Advanced Clean Cars II rules, which would have taken effect at the beginning of 2025 and required EVs to make up 35% of all new car sales starting in model year 2026 on the way to 100% by 2035.

“Given that EVs only amounted to 9% of vehicles sold in Virginia in 2023, application of the misguided mandates could have resulted in hundreds of millions of dollars in penalties,” Youngkin’s office said in the official announcement. “Virginia auto consumers and dealers could be forced to bear these costs. Not only would this leave auto dealers with less money to pay staff, offer raises, and grow their businesses, it could force many small auto dealers to permanently close their doors.”

Numerous Democrat-leaning or blue states have adopted CARB’s auto emissions standards, which are more stringent than federal standards, according to The Wall Street Journal.

Neither CARB nor the office of Democratic California Gov. Gavin Newsom responded immediately to requests for comment.

Automotive

Carney’s Budget Risks Another Costly EV Bet

From the Frontier Centre for Public Policy

GM’s Ontario EV plant was sold as a green success story. Instead it collapsed under subsidies, layoffs and unsold vans

Every age invents new names for old mistakes. In ours, they’re sold as investments. Before the Carney government unveils its November budget promising another future paid for in advance, Canadians should remember Ingersoll, Ont., one of the last places a prime minister tried to buy tomorrow.

Eager to transform the economy, in December 2022, former prime minister Justin Trudeau promised that government backing would help General Motors turn its Ingersoll plant into a beacon of green industry. “By 2025 it will be producing 50,000 electric vehicles per year,” he declared: 137 vehicles daily, six every hour. What sounded like renewal became an expensive demonstration of how progressive governments peddle rampant spending as sound strategy.

The plan began with $259 million from Ottawa and another $259 million from Ontario: over half a billion to switch from Equinox production to BrightDrop electric delivery vans. The promise was thousands of “good, middle-class jobs.”

The assembly plant employed 2,000 workers before retooling. Today, fewer than 700 remain; a two-thirds collapse. With $518 million in public funds and only 3,500 vans built in 2024, taxpayers paid $148,000 per vehicle. The subsidy works out to over half a million dollars per remaining worker. Two out of every three employees from Trudeau’s photo-op are now unemployed.

The failure was entirely predictable. Demand for EVs never met the government’s plan. Parking lots filled with unsold inventory. GM did the rational thing: slowed production, cut staff and left. The Canadian taxpayer was left to pay the bill.

This reveals the weakness of Ottawa’s industrial policy. Instead of creating conditions for enterprise, such as reliable energy, stable regulation, and moderate taxes, progressive governments spend to gain applause. They judge success by the number of jobs announced, yet those jobs vanish once the cameras leave.

Politicians keep writing cheques to industry. Each administration claims to be more strategic, yet the pattern persists. No country ever bought its way into competitiveness.

Trudeau “bet big on electric vehicles,” but betting with other people’s money isn’t vision; it’s gambling. The wager wasn’t on technology but narrative, the naive idea that moral intention could replace market reality. The result? Fewer jobs, unwanted products and claims of success that convinced no one.

Prime Minister Mark Carney has mastered the same rhetorical sleight of hand. Spending becomes “investment,” programs become “platforms.” He promises to “catalyze unprecedented investments” while announcing fiscal restraint: investing more while spending less. His $13-billion federal housing agency is billed as a future investment, though it’s immediate public spending under a moral banner.

“We can build big. Build bold. Build now,” Carney declared, promising infrastructure to “reduce our vulnerabilities.” The cadence of certainty masks the absence of limits. Announcing “investment” becomes synonymous with action itself; ambition replaces accountability.

The structure mirrors the Ingersoll case: promise vast returns from state-directed spending, redefine subsidy as vision, rely on tomorrow to conceal today’s bill. “Investment” has become the language of evasion, entitlement and false pride.

As Carney prepares his first budget, Canadians should remember what happened when their last leader tried to buy a future with lavish “investment.”

A free economy doesn’t need bribery to breathe. It requires the discipline of risk and liberty to fail without dragging a country down. Ingersoll wasn’t undone by technology but by ideological conceit. Prosperity cannot be decreed and markets cannot be commanded into obedience.

Every age invents new names for old mistakes. Ours keeps making the same ones. Entitled hubris knows no bounds.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Automotive

Parliament Forces Liberals to Release Stellantis Contracts After $15-Billion Gamble Blows Up In Taxpayer Faces

After betting taxpayer billions on a green-industry deal that collapsed under U.S. tariffs, MPs move to expose what Ottawa promised Stellantis and what Canadians actually got for the money.

Parliament just blew the lid off one of the biggest corporate giveaways in Canadian history.

For years, Ottawa and Queen’s Park have bragged about “historic investments” in green manufacturing. What they didn’t say is that $15 billion of your money went to Stellantis, the Dutch auto conglomerate behind Chrysler, Jeep, and Ram, only for the company to announce it’s cutting 3,000 jobs in Brampton and shipping them south to the United States.

That betrayal is what triggered a heated meeting of the House of Commons Government Operations Committee on October 21. What started as routine procedure turned into a full-scale reckoning over how billions were handed to a foreign corporation with almost no strings attached.

Conservative MP Garnett Genuis opened with a blunt motion: produce every contract, memorandum of understanding, or side deal the government signed with Stellantis and its affiliates since 2015. Every page, every clause, in both official languages, “without redaction.” The demand wasn’t symbolic, it was about finding out if Trudeau’s government ever required the company to keep those Canadian jobs it was paid to “protect.”

Liberals scrambled to block it. MP Jenna Sudds proposed an amendment that would let bureaucrats black out whatever they deemed “sensitive.” In practice, that meant hiding anything embarrassing — from cabinet discussions to corporate fine print. Opposition MPs called it exactly what it was: a cover-up clause. It failed.

The committee floor turned into open warfare. The Bloc Québécois tried a softer sub-amendment giving the House Law Clerk power to vet redactions. Conservatives countered with their own version forcing departments to hand over unredacted contracts and justify any blackouts in writing. After a suspension and some backroom wrangling, a rare thing happened: compromise.

The motion passed unanimously. Even the Liberals couldn’t vote against it once the light was on.

The debate itself revealed how badly Ottawa has lost control of its own economic agenda. Conservatives pressed officials on why Canadians were paying billions for “job creation” only to see Stellantis pack up for Illinois once U.S. tariffs came down. Liberals blamed Trump, tariffs, and “global conditions,” the excuses were almost comical. Liberal members blamed Donald Trump —yes, really— for Stellantis abandoning Canada. According to them, Trump’s tariffs and “America First” trade policy scared the company into moving production south.

But here’s what they didn’t say: Trump announced his 2024 presidential campaign on November 15, 2022, promising to rip up Joe Biden’s green industrial agenda and bring manufacturing back to U.S. soil. Everyone heard it. Everyone knew it. And yet, on July 6, 2023, more than half a year later, Ottawa proudly unveiled its $15-billion subsidy for Stellantis and LG Energy Solution — a deal built entirely on the assumption that Trump wouldn’t win.

So let’s be clear about what happened here. They didn’t just hand billions to a foreign automaker. They gambled that the next U.S. president wouldn’t change course. They bet the house —your tax dollars— on a political outcome in another country.

Think about that. Fifteen billion dollars of public money wagered on a campaign prediction. They bet on black, and it landed on red.

Even if the gamble had gone their way — even if Trump had lost and Biden’s green subsidy regime had survived untouched — the deal would still have been a terrible bargain.

During the committee meeting, the Bloc Québécois pointed to the 2023 Parliamentary Budget Officer’s report, which projected that the combined federal and Ontario subsidies to Stellantis and Volkswagen, roughly $28 billion total, including Stellantis’s $15 billion share, wouldn’t even break even for twenty years. That means taxpayers would have to wait until the mid-2040s just to recover what Ottawa spent.

So imagine the “best-case scenario”: the U.S. keeps its green-industry incentives, the plant stays in Canada, and production runs at full capacity. Even then, ordinary Canadians don’t see a financial return for two decades. There are no guaranteed profits, no guaranteed jobs, and no repayment. It was a long-odds bet on a global policy trend, financed entirely with public money.

In other words, whether the roulette wheel landed on black or red, the house still lost because the government put your chips on the table in a game it never controlled.

Behind the numbers, the story is brutally simple: Ottawa slid its chips across the table, wrote the cheques, and Stellantis walked away with the winnings. When MPs tried to see the receipts, the government grabbed for the cover of secrecy — no sunlight, no scrutiny, just “trust us.”

Now, for the first time, Parliament is about to peek under the table. The committee will finally see the real contracts — not the press releases, not the slogans, but the fine print that tells Canadians what they actually paid for. The review will happen behind closed doors at first, but the pressure to show the public what’s inside will be enormous.

Because if those documents confirm what MPs already suspect —that there were no job guarantees, no clawbacks, and no consequences —then this isn’t just a bad hand. It’s a rigged table.

Ottawa didn’t just gamble with taxpayer money; it gambled against the odds, and the dealer —in this case, Stellantis— already knew the outcome. Even if the wheel had landed on black, taxpayers were still stuck covering a twenty-year “break-even” fantasy, as the Bloc reminded everyone.

The next two weeks will show Canadians whether their government actually bought jobs or just bought headlines. One thing is certain: the high-rollers in Ottawa have been playing roulette with your money, and the wheel’s finally slowing down.

-

International2 days ago

International2 days agoSagrada Familia Basilica in Barcelona is now tallest church in the world

-

Alberta2 days ago

Alberta2 days agoGondek’s exit as mayor marks a turning point for Calgary

-

Agriculture2 days ago

Agriculture2 days agoCloned foods are coming to a grocer near you

-

Fraser Institute2 days ago

Fraser Institute2 days agoOttawa continues to infringe in areas of provincial jurisdiction

-

Business21 hours ago

Business21 hours agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Censorship Industrial Complex21 hours ago

Censorship Industrial Complex21 hours agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

Crime8 hours ago

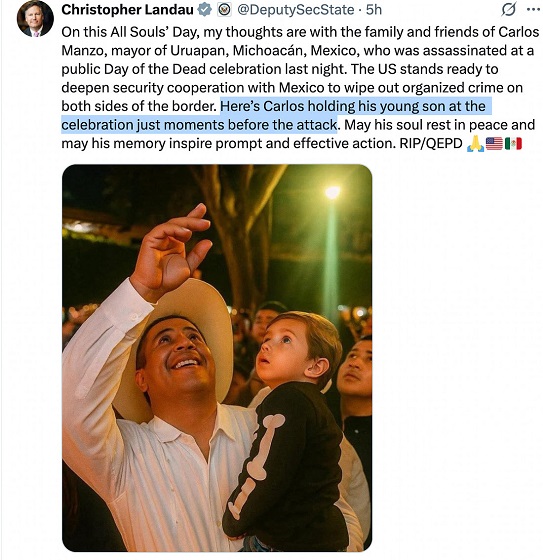

Crime8 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Business19 hours ago

Business19 hours agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy