Business

From Smug to Subservient, Justin Trudeau Bows to MAGA Realities at Mar-a-Lago

After years of mocking Trump and betting on a woke Washington, Trudeau now finds himself groveling to save Canada’s economy from MAGA’s hardball tactics.

Justin Trudeau has spent years mocking and deriding the MAGA movement, banking on a continuation of woke, progressive leadership in Washington. He bet everything on a Kamala Harris presidency, believing the days of Donald Trump’s America-first agenda were a distant memory. Now, with Trump back in office, Trudeau finds himself groveling at Mar-a-Lago, trying to salvage what’s left of Canada’s crumbling economic future.

This is the same Justin Trudeau who painted MAGA as a dangerous fringe movement, aligning himself with global elites and lecturing Americans on their supposed moral failings. He openly scoffed at Trump’s tariffs, his immigration policies, and his tough-on-China stance. Trudeau’s bet? That a Democrat-controlled America would reward his sycophantic pandering with favorable trade deals and continued subsidies for his progressive fantasies.

But Trudeau’s gamble failed. Trump is back, and Trudeau’s entire house of cards is collapsing. Canada’s economy, propped up by unfair trade advantages and U.S. energy consumption, is suddenly exposed. The 25% tariff threat on Canadian imports has Trudeau scrambling, not with bold leadership, but with empty promises and nervous laughter at Mar-a-Lago.

In a moment of pure irony, Trudeau, who once lectured Trump about values, now finds himself kneeling to kiss the ring. MAGA, what? Gone is the smug defiance, replaced by desperate platitudes about border security and economic cooperation. But let’s be clear: Trudeau isn’t there to protect Canadian interests; he’s there to save face. His government is woefully unprepared for Trump’s hardball tactics, and the Prime Minister’s office knows it.

During a recent dinner at Mar-a-Lago, President-elect Donald Trump reportedly suggested that Canada could become the 51st U.S. state if it couldn’t handle the economic impact of proposed tariffs. This remark came after Prime Minister Justin Trudeau expressed concerns that a 25% tariff on Canadian imports would “kill” Canada’s economy.

Trump’s comment underscores the significant economic interdependence between the two nations. In 2022, trade between the U.S. and Canada exceeded $900 billion, with the U.S. accounting for 63.4% of Canada’s global trade. This deep economic integration means that shifts in U.S. trade policy can have profound effects on Canada’s economy.

Trump’s quip about Canada becoming the “51st state” wasn’t just a joke; it was a power move, a reminder of who holds the cards in this relationship. While Trudeau nervously laughed, the message was clear: Canada needs the U.S. far more than the U.S. needs Canada. Trudeau’s weakness has brought us here. Instead of securing energy independence, he’s strangled Alberta’s oil industry with crippling regulations. Instead of standing up to China, he’s kowtowed to Beijing while relying on U.S. trade to keep his agenda afloat.

And now, Trudeau is at the mercy of a man he spent years mocking. Trump’s tariffs are a direct consequence of Trudeau’s inability to lead. His failure to address illegal immigration and the fentanyl crisis has made Canada not just a bad neighbor, but a liability.

Trudeau’s Liberals have always been more concerned with appearances than action, more focused on virtue signaling than real governance. But now, the bill has come due. And the man holding the ledger is none other than Donald J. Trump.

So here we are: Justin Trudeau, the woke globalist, reduced to pleading for mercy at Mar-a-Lago. His smugness replaced by desperation, his rhetoric exposed as hollow. MAGA what, indeed.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

2025 Federal Election

Next federal government should end corporate welfare for forced EV transition

From the Fraser Institute

By Tegan Hill and Jake Fuss

Corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

General Motors recently announced the temporary closure of its electric vehicle (EV) manufacturing plant in Ontario, laying off 500 people because its new EV isn’t selling. The plant will shut down for six months despite hundreds of millions in government subsides financed by taxpayers. This is just one more example of corporate welfare—when governments subsidize favoured industries and companies—and it’s time for the provinces and the next federal government to eliminate it.

Between the federal government and Ontario government, GM received about $500 million to help fund its EV transition. But this is just one example of corporate welfare in the auto sector. Stellantis and Volkswagen will receive about $28 billion in government subsidies while Honda is promised $5 billion.

More broadly, from 2007 to 2019, the last pre-COVID year of data, the federal government spent an estimated $84.6 billion (adjusted for inflation) on corporate welfare while provincial and local governments spent another $302.9 billion. And crucially, these numbers exclude other forms of government support such as loan guarantees, direct investments and regulatory privileges, so the actual cost of corporate welfare during this period was much higher.

Of course, politicians claim that corporate welfare benefits workers. Yet according to a significant body of research, corporate welfare fails to generate widespread economic benefit. Think of it this way—if the businesses that received subsidies were viable to begin with, they wouldn’t need government support. So unprofitable companies are kept in business through governments’ support, which can prevent resources, including investment and workers, from moving to profitable companies, hurting overall economic growth.

Put differently, rather than fuelling economic growth, corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

Governments also must impose higher tax rates on everyone else to pay for corporate welfare. In turn, higher tax rates discourage entrepreneurship and business investment—again, which fuels economic growth. And the higher the tax rates, the more economic activity they discourage.

GM’s EV plant shut down once again proves that when governments try to engineer the economy with corporate welfare, workers will ultimately lose. It’s time for the provinces and the next federal government—whoever it may be—to finally put an end to this costly and ineffective policy approach.

Business

Hudson’s Bay Bid Raises Red Flags Over Foreign Influence

From the Frontier Centre for Public Policy

A billionaire’s retail ambition might also serve Beijing’s global influence strategy. Canada must look beyond the storefront

When B.C. billionaire Weihong Liu publicly declared interest in acquiring Hudson’s Bay stores, it wasn’t just a retail story—it was a signal flare in an era where foreign investment increasingly doubles as geopolitical strategy.

The Hudson’s Bay Company, founded in 1670, remains an enduring symbol of Canadian heritage. While its commercial relevance has waned in recent years, its brand is deeply etched into the national identity. That’s precisely why any potential acquisition, particularly by an investor with strong ties to the People’s Republic of China (PRC), deserves thoughtful, measured scrutiny.

Liu, a prominent figure in Vancouver’s Chinese-Canadian business community, announced her interest in acquiring several Hudson’s Bay stores on Chinese social media platform Xiaohongshu (RedNote), expressing a desire to “make the Bay great again.” Though revitalizing a Canadian retail icon may seem commendable, the timing and context of this bid suggest a broader strategic positioning—one that aligns with the People’s Republic of China’s increasingly nuanced approach to economic diplomacy, especially in countries like Canada that sit at the crossroads of American and Chinese spheres of influence.

This fits a familiar pattern. In recent years, we’ve seen examples of Chinese corporate involvement in Canadian cultural and commercial institutions, such as Huawei’s past sponsorship of Hockey Night in Canada. Even as national security concerns were raised by allies and intelligence agencies, Huawei’s logo remained a visible presence during one of the country’s most cherished broadcasts. These engagements, though often framed as commercially justified, serve another purpose: to normalize Chinese brand and state-linked presence within the fabric of Canadian identity and daily life.

What we may be witnessing is part of a broader PRC strategy to deepen economic and cultural ties with Canada at a time when U.S.-China relations remain strained. As American tariffs on Canadian goods—particularly in aluminum, lumber and dairy—have tested cross-border loyalties, Beijing has positioned itself as an alternative economic partner. Investments into cultural and heritage-linked assets like Hudson’s Bay could be seen as a symbolic extension of this effort to draw Canada further into its orbit of influence, subtly decoupling the country from the gravitational pull of its traditional allies.

From my perspective, as a professional with experience in threat finance, economic subversion and political leveraging, this does not necessarily imply nefarious intent in each case. However, it does demand a conscious awareness of how soft power is exercised through commercial influence, particularly by state-aligned actors. As I continue my research in international business law, I see how investment vehicles, trade deals and brand acquisitions can function as instruments of foreign policy—tools for shaping narratives, building alliances and shifting influence over time.

Canada must neither overreact nor overlook these developments. Open markets and cultural exchange are vital to our prosperity and pluralism. But so too is the responsibility to preserve our sovereignty—not only in the physical sense, but in the cultural and institutional dimensions that shape our national identity.

Strategic investment review processes, cultural asset protections and greater transparency around foreign corporate ownership can help strike this balance. We should be cautious not to allow historically Canadian institutions to become conduits, however unintentionally, for geopolitical leverage.

In a world where power is increasingly exercised through influence rather than force, safeguarding our heritage means understanding who is buying—and why.

Scott McGregor is the managing partner and CEO of Close Hold Intelligence Consulting.

-

International2 days ago

International2 days agoPope Francis Dies on Day after Easter

-

International2 days ago

International2 days agoJD Vance was one of the last people to meet Pope Francis

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

COVID-191 day ago

COVID-191 day agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust

-

John Stossel1 day ago

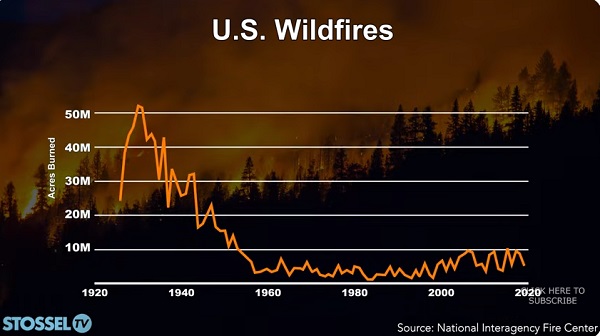

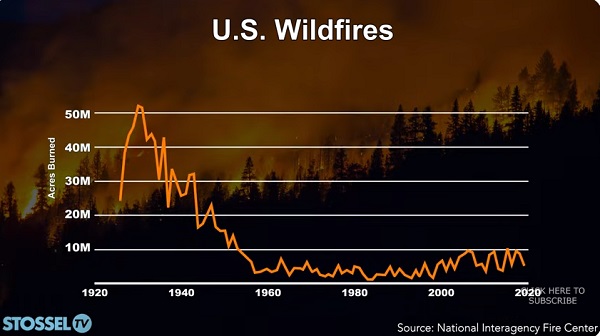

John Stossel1 day agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign