Economy

Fossil fuels aren’t going anywhere, we benefit too much from them

From the MacDonald Laurier Institute

By Chris Sankey

Indigenous people are finally reaping the rewards.

Over the last eight years we have experienced an unprecedented push from environmental activists to phase out fossil fuels. The Government of Canada seems to think it is possible. During question period in the Senate earlier this year, Sen. David Wells noted that, according to the Liberals, the energy transition “will cost $100-$125 billion per year at least to 2050,” and asked “When Canada only emits 1.5 per cent of global emissions, how does this expenditure make sense?”

Let me repeat that. $125 billion each year.

Who is going to pay for this? This is simply not possible, unless people want to see the Canadian economy in ruins.

Without fossil fuels, life as we know it would not be possible. State-of-the-art lifesaving medical equipment comes from fossil fuels and critical minerals from mining. Critical infrastructure, vehicles, planes, trains, container ships, ferries, and the billions of household necessities we buy from Canadian Tire, Walmart, Amazon and Ikea come from fossil fuels and help us function in our everyday lives. Without these needs we simply do not prosper.

Take for instance the environmental marches we see on our streets. The protesters seemingly have zero understanding of what makes their marches possible? Yes, fossil fuels. If you are going to protest for “Just Stop Oil,” then climate activists have to stop blocking traffic, because an idling vehicle is so much harder on the environment. And what about showing up in clothing and holding up signs made of hydrocarbons demonstrates your commitment to saving the planet? Hypocrisy? Absolutely.

From the moment we come out of our mother’s body, fossil fuels make our lives better. From cradle to grave, our lives are intertwined with fossil fuels. Just think of the act of giving birth. Chances are the mother was rushed to hospital in an ambulance, helicopter, plane, your personal vehicle, or taxi. As grandparents, siblings, uncles, aunts and cousins arrive at the hospital in their fossil fuel-powered cars and trucks smiling ear to ear welcoming the new baby to the family. They show up with gifts likely made from fossil fuels and critical minerals. If it is not made from fossil fuels, they were most definitely transported to the store using fossil fuels.

It is time we stop kidding ourselves that we can step away from the oil and gas wealth upon which our country benefits so much.

Only now, it will be Indigenous communities who are going to lead the multi-billion-dollar opportunity and put Canada at the front of global markets as a preferred supplier. For far too long, activist’s voice have been the determining factor in how governments make decisions on this necessary industry in our territories.

We need to make sure we have a framework that lays out a technology transition where we produce cleaner oil and gas by using new technology that will reduce emissions and grow our economies.

Since the Liberals were elected in 2015 everywhere we turn, our resource sector is being badly hurt. Forestry, fishing, oil and gas are screaming for more production, but federal regulations threaten to not only destroy the energy industry, but all industries with the emissions cap. Renewables are costing taxpayers billions in subsidies and it will not end there.

Indigenous people have always took care of the environment and grown our economies. From fishing, logging, farming and hunting, we used fossil fuels to make it happen.

Obviously, humans did not use fossil fuels prior to the industrial revolution and indigenous people made hunting weapons out of wood and stone. Life was challenging for our ancestors back then; life expectancy was short for all people.

Over time, technology in the energy sector changed for the better. I would be remiss if I did not include the fact that industry did not always have modern clean tech; emissions were high and cancer-causing effects were widespread. That introduced chemicals foreign to indigenous people. Like all things, newer and safer technology emerged. Making life much easier and convenient.

However, historically speaking indigenous people lived on fat and protein. Everything we ate was natural. Like all things that come and go, European contact forever changed our way of life. We were greatly impacted in every possible manner, from social, cultural, status and creed. But like we always have, we persevered like our ancestors wanted us too.

This is our turn to take our rightful place on the global stage. We are watching it play out in real time around the world. Energy and food security is the number one priority around the world. Indigenous communities near and far are leading the way in the pursuit of sustainable development, but government and activists are hindering our ability to progress.

It is important that Canadians be realistic when it comes to the use of oil and gas. All of us want to leave our planet better for the next generation. To do so, we must manage expectations. Many countries are just now finally transitioning to oil and gas from more environmentally harmful coal and countries like India will not be carbon neutral until 2070 or later.

Our country has an abundance of resources that the world wants. They are literally knocking on our door to get access to our wealth. We can help countries like China, India and Indonesia move away from burning coal and wood, and thereby help lift millions out of certain poverty, and improve their health.

New climate change technology has emerged in the energy sector, such as carbon capture and storage that will reduce and eliminate emissions and the need for diluent in oil pipelines. Our combination of Indigenous knowledge and history to the land makes for a stronger argument to partner with Indigenous communities. Alignment amongst indigenous communities is key to securing a project. Proper alignment will de-risk a project and attract investment and industry to the table where we will have a seat and even equity.

Engagement with Indigenous communities is the solution. The vast majority of our people are not against development. We are only against development when we are excluded from the opportunities, or if the evaluation process was developed without Indigenous input.

It is not rocket-science. Include the people whose territory you want to build on. This is an opportunity to build relationships through meaningful dialogue and trust. We must have nation to nation dialogue and build leadership to leadership relationships. No hidden agendas, just up-front, honest conversations about oil and gas and the costs and benefits of development.

I am tired of watching our people struggle. Our people do not want to watch the prosperity boat sail by Poverty Island. Markets do not wait for anyone. We cannot keep waiting for the right time. We cannot keep waiting for life to get better. First Nations can make it better by being at the economic table where our people can bring traditional knowledge to industry and make decisions in the best interests of our communities. Whether we agree or not in the first instance, we need to be in the room working towards a brighter future, because at the end of the day we all need rubber boots too.

Chris Sankey is a Senior fellow at the MacDonald Laurier Institute, a former Elected Councilor for the Lax Kw Alaams Band and Businessman.

Alberta

Is Canada’s Federation Fair?

David Clinton

David Clinton

Contrasting the principle of equalization with the execution

Quebec – as an example – happens to be sitting on its own significant untapped oil and gas reserves. Those potential opportunities include the Utica Shale formation, the Anticosti Island basin, and the Gaspé Peninsula (along with some offshore potential in the Gulf of St. Lawrence).

So Quebec is effectively being paid billions of dollars a year to not exploit their natural resources. That places their ostensibly principled stand against energy resource exploitation in a very different light.

You’ll need to search long and hard to find a Canadian unwilling to help those less fortunate. And, so long as we identify as members of one nation¹, that feeling stretches from coast to coast.

So the basic principle of Canada’s equalization payments – where poorer provinces receive billions of dollars in special federal payments – is easy to understand. But as you can imagine, it’s not easy to apply the principle in a way that’s fair, and the current methodology has arguably lead to a very strange set of incentives.

According to Department of Finance Canada, eligibility for payments is determined based on your province’s fiscal capacity. Fiscal capacity is a measure of the taxes (income, business, property, and consumption) that a province could raise (based on national average rates) along with revenues from natural resources. The idea, I suppose, is that you’re creating a realistic proxy for a province’s higher personal earnings and consumption and, with greater natural resources revenues, a reduced need to increase income tax rates.

But the devil is in the details, and I think there are some questions worth asking:

- Whichever way you measure fiscal capacity there’ll be both winners and losers, so who gets to decide?

- Should a province that effectively funds more than its “share” get proportionately greater representation for national policy² – or at least not see its policy preferences consistently overruled by its beneficiary provinces?

The problem, of course, is that the decisions that defined equalization were – because of long-standing political conditions – dominated by the region that ended up receiving the most. Had the formula been the best one possible, there would have been little room to complain. But was it?

For example, attaching so much weight to natural resource revenues is just one of many possible approaches – and far from the most obvious. Consider how the profits from natural resources already mostly show up in higher income and corporate tax revenues (including income tax paid by provincial government workers employed by energy-related ministries)?

And who said that such calculations had to be population-based, which clearly benefits Quebec (nine million residents vs around $5 billion in resource income) over Newfoundland (545,000 people vs $1.6 billion) or Alberta (4.2 million people vs $19 billion). While Alberta’s average market income is 20 percent or so higher than Quebec’s, Quebec’s is quite a bit higher than Newfoundland’s. So why should Newfoundland receive only minimal equalization payments?

To illustrate all that, here’s the most recent payment breakdown when measured per-capita:

|

For clarification, the latest per-capita payments to poorer provinces ranged from $3,936 to PEI, $1,553 to Quebec, and $36 to Ontario. Only Saskatchewan, Alberta, and BC received nothing.

And here’s how the total equalization payments (in millions of dollars) have played out over the past decade:

Is energy wealth the right differentiating factor because it’s there through simple dumb luck, morally compelling the fortunate provinces to share their fortune? That would be a really difficult argument to make. For one thing because Quebec – as an example – happens to be sitting on its own significant untapped oil and gas reserves. Those potential opportunities include the Utica Shale formation, the Anticosti Island basin, and the Gaspé Peninsula (along with some offshore potential in the Gulf of St. Lawrence).

So Quebec is effectively being paid billions of dollars a year to not exploit their natural resources. That places their ostensibly principled stand against energy resource exploitation in a very different light. Perhaps that stand is correct or perhaps it isn’t. But it’s a stand they probably couldn’t have afforded to take had the equalization calculation been different.

Of course, no formula could possibly please everyone, but punishing the losers with ongoing attacks on the very source of their contributions is guaranteed to inspire resentment. And that could lead to very dark places.

Note: I know this post sounds like it came from a grumpy Albertan. But I assure you that I’ve never even visited the province, instead spending most of my life in Ontario.

Which has admittedly been challenging since the former primer minister infamously described us as a post-national state without an identity.

Subscribe to The Audit.

For the full experience, upgrade your subscription.

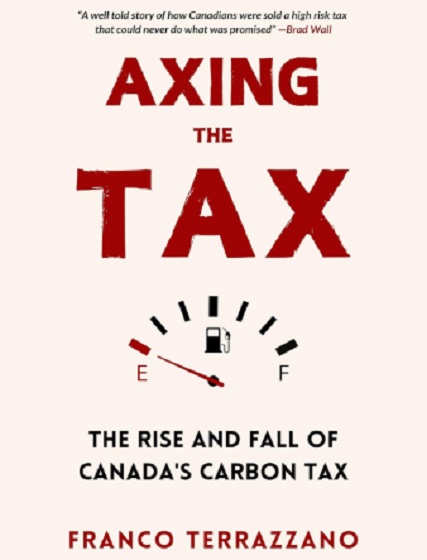

Carbon Tax

The book the carbon taxers don’t want you to read

By Franco Terrazzano

Prime Minister Mark Carney wrote a 500-page book praising carbon taxes.

Well, I just wrote a book smashing through the government’s carbon tax propaganda.

It tells the inside story of the fight against the carbon tax. And it’s THE book the carbon taxers don’t want you to read.

My book is called Axing the Tax: The Rise and Fall of Canada’s Carbon Tax.

Axing the Tax: The Rise and Fall of Canada’s Carbon Tax

Every now and then, the underdog wins one.

And it looks like that’s happening in the fight against the carbon tax.

It’s not over yet, but support for the carbon tax is crumbling. Some politicians vow to scrap it. Others hide behind vague plans to repackage it. But virtually everyone recognizes support for the current carbon tax has collapsed.

It wasn’t always this way.

For about a decade now, powerful politicians, government bureaucrats, academics, media elites and even big business have been pushing carbon taxes on the people.

But most of the time, politicians never asked the people if they supported carbon taxes. In other words, carbon taxes, and the resulting higher gas prices and heating bills, were forced on us.

We were told it was good for us. We were told carbon taxes were inevitable. We were told politicians couldn’t win elections without carbon taxes, even though the politicians that imposed them didn’t openly run on them. We were told that we needed to pay carbon taxes if we wanted to leave a healthy environment for our kids and grandkids. We were told we needed to pay carbon taxes if we wanted to be respected in the international community.

In this decade-long fight, it would have been understandable if the people had given up and given in to these claims. It would have been easier to accept what the elites wanted and just pay the damn bill. But against all odds, ordinary Canadians didn’t give up.

Canadians knew you could care about the environment and oppose carbon taxes. Canadians saw what they were paying at the gas station and on their heating bills, and they knew they were worse off, regardless of how many politicians, bureaucrats, journalists and academics tried to convince them otherwise. Canadians didn’t need advanced degrees in economics, climate science or politics to understand they were being sold a false bill of goods.

Making it more expensive for a mom in Port Hope to get to work, or grandparents in Toronto to pay their heating bill, or a student in Coquitlam to afford food won’t reduce emissions in China, Russia, India or the United States. It just leaves these Canadians, and many like them, with less money to afford everything else.

Ordinary Canadians understood carbon taxes amount to little more than a way for governments to take more money from us and dictate how we should live our lives. Ordinary Canadians also saw through the unfairness of the carbon tax.

Many of the elites pushing the carbon tax—the media, politicians, taxpayer-funded professors, laptop activists and corporate lobbyists—were well off and wouldn’t feel the brunt of carbon taxes. After all, living in a downtown condo and clamouring for higher carbon taxes doesn’t require much gas, diesel or propane.

But running a business, working in a shop, getting kids to soccer and growing food on the farm does. These are the Canadians the political class forgot about when pushing carbon taxes. These are the Canadians who never gave up. These are the Canadians who took time out of their busy lives to sign petitions, organize and attend rallies, share posts on social media, email politicians and hand out bumper stickers.

Because of these Canadians, the carbon tax could soon be swept onto the ash heap of history. I wrote this book for two reasons.

The first is because these ordinary Canadians deserve it. They worked really hard for a really long time against the odds. When all the power brokers in government told them, “Do what we say—or pay,” they didn’t give up. They deserve to know the time and effort they spent fighting the carbon tax mattered. They deserve all the credit.

Thank you for everything you did.

The second reason I wrote this book is so people know the real story of the carbon tax. The carbon tax was bad from the start and we fought it from the start. By reading this book, you will get the real story about the carbon tax, a story you won’t find anywhere else.

This book is important because if the federal Liberals’ carbon tax is killed, the carbon taxers will try to lay blame for their defeat on Prime Minister Justin Trudeau. They will try to say that carbon taxes are a good idea, but Trudeau bungled the policy or wasn’t a good enough salesman. They will try to revive the carbon tax and once again make you pay more for gas, groceries, and home heating.

Just like with any failed five-year plan, there is a lingering whiff among the laptop class and the taxpayer-funded desk rulers that this was all a communication problem, that the ideal carbon tax hasn’t been tried yet. I can smell it outside my office building in Ottawa, where I write these words. We can’t let those embers smoulder and start a fire again.

This book shows why the carbon tax is and always will be bad policy for ordinary Canadians.

Franco’s note: You can pre-order a copy of my new book, Axing the Tax: The Rise and Fall of Canada’s Carbon Tax, here: https://www.amazon.ca/Axing-

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

International2 days ago

International2 days agoFREE MARINE LE PEN!’: Trump defends French populist against ‘lawfare’ charges

-

Automotive2 days ago

Automotive2 days agoDark Web Tesla Doxxers Used Widely-Popular Parking App Data To Find Targets, Analysis Shows

-

COVID-191 day ago

COVID-191 day agoMaxime Bernier slams Freedom Convoy leaders’ guilty verdict, calls Canada’s justice system ‘corrupt’

-

Business2 days ago

Business2 days agoWill Trump’s ‘Liberation Day’ Tariffs End In Disaster Or Prosperity?

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoChina announces “improvements” to social credit system

-

Carbon Tax1 day ago

Carbon Tax1 day agoThe book the carbon taxers don’t want you to read

-

International2 days ago

International2 days agoGermany launches first permanent foreign troop deployment since WW2