Alberta

Focus on tangible policies—not political finger-pointing— to reduce fire risks

From the Fraser Institute

Was the very specific area around Jasper—not the entire forested lands of Alberta—managed aggressively enough?

With the picturesque town of Jasper badly damaged by fire, Albertans and Canadians across the country are wondering how such destruction was allowed to happen.

Much of the public debate assumes that the disaster, in some way, was human-caused or aggravated by governmental negligence or incompetence. Some argue that government policies to suppress natural wildfires, which were widely implemented across North America after the Second World War, allowed the build-up of massive amounts of fuel for potential mega-blazes. Others argue that governments have been negligent by failing to allow aggressive logging of dead trees and by using insufficient controlled burns to manage fuel loads of underbrush. Some, of course, blame climate change—specifically human-caused climate change. And yes, the climate has changed, warming about 1.2 degrees Celsius since 1850, which may contribute to a heightened risk of forest fires (although there’s no ability to attribute any single climatic event to climate change).

But focusing on these issues misses the forest for the trees and raises philosophical questions about humanity’s relationship with nature, specifically, whether or not it’s desirable—much less feasible—for humanity to think we can control nature at large scales and turn the world into a giant tame botanical garden. Further, focusing on these questions of “too much” or “too little” intervention mostly serves political interests trying to beat each other over the head about climate policies, which are at best capable of only slightly—very slightly—affecting the risk of future forest fires.

Rather, having studied environmental, health and safety policy for several decades, I believe we should focus on very different specific questions about how the fire was allowed to ravage Jasper. These questions cut through the foggier questions of how we manage nature and instead focus on how we manage human risks.

So, was the very specific area around Jasper—not the entire forested lands of Alberta—managed aggressively enough? In 2018, 350 hectares of trees around Jasper were removed. Apparently, that was not enough to protect the human-built environment. Parks Canada will have to answer that question in time.

Did the provincial and federal governments fall short in maintaining sufficient fire-fighting capabilities to protect Jasper? According to some reports, this was a significant source of failure, where the federal government, which maintains no ability to fight fires at night, failed to coordinate with Alberta’s provincial government, which does have night-fighting capabilities.

Did the town of Jasper take enough precautions to protect itself from the risk of conflagration? Are building codes in Jasper sufficiently stringent at fire-proofing human structures? Is the fuel burden within the township itself sufficiently controlled? More broadly, how much are we willing to spend to reduce risks? And how far should we aim to reduce those risks?

The answers to these questions could help produce tangible policies that may help reduce the risk of fire damage in the future.

There’s a lot of finger-pointing right now. Political point-scoring is the order of the day, particularly in the realm of climate policies. But using the Jasper fire for political ends distracts from the important questions about whether or not anybody or any level of government should try to tame nature outside of human-built environments. And about what policies will work best to protect towns like Jasper.

Author:

Alberta

Low oil prices could have big consequences for Alberta’s finances

From the Fraser Institute

By Tegan Hill

Amid the tariff war, the price of West Texas Intermediate oil—a common benchmark—recently dropped below US$60 per barrel. Given every $1 drop in oil prices is an estimated $750 million hit to provincial revenues, if oil prices remain low for long, there could be big implications for Alberta’s budget.

The Smith government already projects a $5.2 billion budget deficit in 2025/26 with continued deficits over the following two years. This year’s deficit is based on oil prices averaging US$68.00 per barrel. While the budget does include a $4 billion “contingency” for unforeseen events, given the economic and fiscal impact of Trump’s tariffs, it could quickly be eaten up.

Budget deficits come with costs for Albertans, who will already pay a projected $600 each in provincial government debt interest in 2025/26. That’s money that could have gone towards health care and education, or even tax relief.

Unfortunately, this is all part of the resource revenue rollercoaster that’s are all too familiar to Albertans.

Resource revenue (including oil and gas royalties) is inherently volatile. In the last 10 years alone, it has been as high as $25.2 billion in 2022/23 and as low as $2.8 billion in 2015/16. The provincial government typically enjoys budget surpluses—and increases government spending—when oil prices and resource revenue is relatively high, but is thrown into deficits when resource revenues inevitably fall.

Fortunately, the Smith government can mitigate this volatility.

The key is limiting the level of resource revenue included in the budget to a set stable amount. Any resource revenue above that stable amount is automatically saved in a rainy-day fund to be withdrawn to maintain that stable amount in the budget during years of relatively low resource revenue. The logic is simple: save during the good times so you can weather the storm during bad times.

Indeed, if the Smith government had created a rainy-day account in 2023, for example, it could have already built up a sizeable fund to help stabilize the budget when resource revenue declines. While the Smith government has deposited some money in the Heritage Fund in recent years, it has not created a dedicated rainy-day account or introduced a similar mechanism to help stabilize provincial finances.

Limiting the amount of resource revenue in the budget, particularly during times of relatively high resource revenue, also tempers demand for higher spending, which is only fiscally sustainable with permanently high resource revenues. In other words, if the government creates a rainy-day account, spending would become more closely align with stable ongoing levels of revenue.

And it’s not too late. To end the boom-bust cycle and finally help stabilize provincial finances, the Smith government should create a rainy-day account.

Alberta

Governments in Alberta should spur homebuilding amid population explosion

From the Fraser Institute

By Tegan Hill and Austin Thompson

In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Alberta has long been viewed as an oasis in Canada’s overheated housing market—a refuge for Canadians priced out of high-cost centres such as Vancouver and Toronto. But the oasis is starting to dry up. House prices and rents in the province have spiked by about one-third since the start of the pandemic. According to a recent Maru poll, more than 70 per cent of Calgarians and Edmontonians doubt they will ever be able to afford a home in their city. Which raises the question: how much longer can this go on?

Alberta’s housing affordability problem reflects a simple reality—not enough homes have been built to accommodate the province’s growing population. The result? More Albertans competing for the same homes and rental units, pushing prices higher.

Population growth has always been volatile in Alberta, but the recent surge, fuelled by record levels of immigration, is unprecedented. Alberta has set new population growth records every year since 2022, culminating in the largest-ever increase of 186,704 new residents in 2024—nearly 70 per cent more than the largest pre-pandemic increase in 2013.

Homebuilding has increased, but not enough to keep pace with the rise in population. In 2024, construction started on 47,827 housing units—the most since 48,336 units in 2007 when population growth was less than half of what it was in 2024.

Moreover, from 1972 to 2019, Alberta added 2.1 new residents (on average) for every housing unit started compared to 3.9 new residents for every housing unit started in 2024. Put differently, today nearly twice as many new residents are potentially competing for each new home compared to historical norms.

While Alberta attracts more Canadians from other provinces than any other province, federal immigration and residency policies drive Alberta’s population growth. So while the provincial government has little control over its population growth, provincial and municipal governments can affect the pace of homebuilding.

For example, recent provincial amendments to the city charters in Calgary and Edmonton have helped standardize building codes, which should minimize cost and complexity for builders who operate across different jurisdictions. Municipal zoning reforms in Calgary, Edmonton and Red Deer have made it easier to build higher-density housing, and Lethbridge and Medicine Hat may soon follow suit. These changes should make it easier and faster to build homes, helping Alberta maintain some of the least restrictive building rules and quickest approval timelines in Canada.

There is, however, room for improvement. Policymakers at both the provincial and municipal level should streamline rules for building, reduce regulatory uncertainty and development costs, and shorten timelines for permit approvals. Calgary, for instance, imposes fees on developers to fund a wide array of public infrastructure—including roads, sewers, libraries, even buses—while Edmonton currently only imposes fees to fund the construction of new firehalls.

It’s difficult to say how long Alberta’s housing affordability woes will endure, but the situation is unlikely to improve unless homebuilding increases, spurred by government policies that facilitate more development.

-

Alberta2 days ago

Alberta2 days agoGovernments in Alberta should spur homebuilding amid population explosion

-

International2 days ago

International2 days agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral

-

Alberta2 days ago

Alberta2 days agoLow oil prices could have big consequences for Alberta’s finances

-

Business2 days ago

Business2 days agoIt Took Trump To Get Canada Serious About Free Trade With Itself

-

2025 Federal Election2 days ago

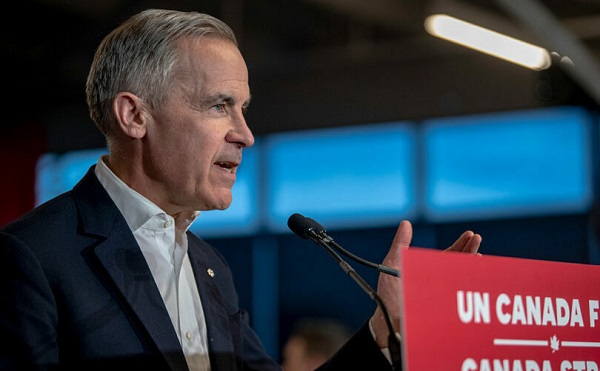

2025 Federal Election2 days agoCarney’s budget is worse than Trudeau’s

-

C2C Journal1 day ago

C2C Journal1 day ago“Freedom of Expression Should Win Every Time”: In Conversation with Freedom Convoy Trial Lawyer Lawrence Greenspon

-

2025 Federal Election17 hours ago

2025 Federal Election17 hours agoColumnist warns Carney Liberals will consider a home equity tax on primary residences

-

2025 Federal Election16 hours ago

2025 Federal Election16 hours agoNine Dead After SUV Plows Into Vancouver Festival Crowd, Raising Election-Eve Concerns Over Public Safety