Uncategorized

Floods, destruction from cyclone continue in Mozambique

CHIMANIMANI, Zimbabwe — A week after Cyclone Idai hit coastal Mozambique and swept across the country to Zimbabwe, the death, damage and flooding continues in southern Africa, making it one of the most destructive natural disasters in the region’s recent history.

Floodwaters are rushing across the plains of central Mozambique, submerging homes, villages and entire towns. The flooding has created a muddy inland ocean 50

Torrential rains lifted — at least temporarily — Thursday, and floodwaters began to recede in Beira, the worst-hit city, and in the countryside, according to a Mozambican government report. Aid groups were working non-stop to rescue families clinging to tree branches and rooftops for safety from the surging waters.

“Yesterday, 910 people were rescued by the humanitarian community,” said Caroline Haga of the International Federation of the Red Cross in Beira. She said 210 were rescued by five helicopters and 700 were saved by boats.

“We’re hoping to rescue as many as we can today as it is not raining,” she said. “Rescue activities will continue until everyone is brought to safety.”

Aid organizations are trying to get food, water and clothing. It will be days before Mozambique’s inundated plains drain toward the Indian Ocean and even longer before the full scale of the devastation is known.

Zimbabwe’s eastern mountains have been deluged and the rain is continuing.

Aid has been slow to reach affected villagers due to collapsed infrastructure, although the military has been handing out small packets of cooking oil, maize meal and beans.

Zimbabwean President Emmerson Mnangagwa received a

With the search for survivors finished, Philemon Dada is has begun rebuilding his life in Chimanimani, once a picturesque town.

With a machete and a hoe, he began salvaging poles from the mud to construct a hut to shelter his small family, a first step in what he sees as a long and backbreaking journey to rebuild a life shattered by Cyclone Idai.

He is one of many villagers trying to pick up the pieces in Chimanimani after losing homes, livestock and, in many instances, family members. Some have been taken in by

“I can say I am a bit lucky, my wife and son are still here with me but for everything else, I have to start from scratch,” he said.

Dada has a few food items handed out by the Zimbabwe military, but he knows that like most aid it is unlikely to last long, and he is eager to start growing crops again. Like many people here, he survives on agriculture.

“My bean crop was ready for harvesting before the cyclone, the maize was close. I am back to zero,” he said.

He is particularly pained by his two prized bulls that did the heavy work of drawing the plow for his field. They were killed in the floods.

“It may take a year, maybe even more years just to get back on my feet,” he said.

___

Associated Press writer Andrew Meldrum in Johannesburg contributed to this report.

___

Follow Africa news at https://twitter.com/AP_Africa

Farai Mutsaka, The Associated Press

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Energy2 days ago

Energy2 days agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Bruce Dowbiggin2 days ago

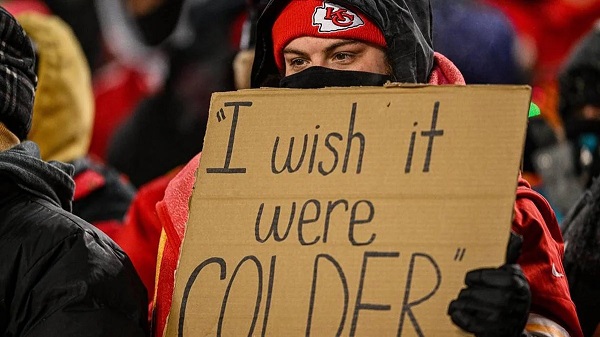

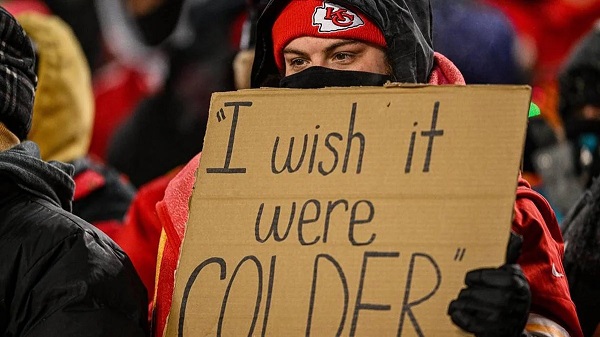

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria

-

Energy2 days ago

Energy2 days agoCan we not be hysterical about AI and energy usage?

-

Alberta20 hours ago

Alberta20 hours agoAlberta’s huge oil sands reserves dwarf U.S. shale

-

Energy2 days ago

Energy2 days agoEnergy security matters more than political rhetoric

-

Daily Caller19 hours ago

Daily Caller19 hours agoParis Climate Deal Now Decade-Old Disaster

-

Business9 hours ago

Business9 hours agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau