Uncategorized

Five new access points to river now open

New boat docks and launches ready for use

August 14, 2019

The City of Edmonton, in partnership with the River Valley Alliance, Province of Alberta and Government of Canada, have officially launched five new access points to Edmonton’s river.

New public docks and launches were installed in locations along the North Saskatchewan River: Whitemud Park (dock and hand launch), Laurier/Buena Vista Park (dock and hand launch), Dawson Park (dock), William Hawrelak Park (dock) and Capilano Park/50th Street (dock, hand launch and upgrades to existing vehicle launch). Construction and installation of the Emily Murphy Park site (dock and hand launch) will be coordinated with the completion of the Groat Road Bridge project.

“This $2.6 million project provides more opportunities for people to safely access the water in more locations along the river,” said Andrew Kwan, Acting Director of Open Spaces Infrastructure Delivery with the City of Edmonton. “With the addition of these five locations, the city will have nine hand launches, seven docks and two motorized boat launches ready for use.”

Environmental studies and public engagement were completed for each location to determine the selected sites. The City and the River Valley Alliance (RVA) worked together to confirm appropriate locations along the river for each new or refurbished boat dock and launch site.

This project creates greater public access to the river and is intended to reinforce the river as a connection to other parts of the region. The City is working in alignment with the RVA mandate to connect Devon to Fort Saskatchewan.

“River Valley Alliance projects are intended to not only connect the river valley through trail systems and footbridges, but to connect people with the river valley, and that includes creating access to it,” said Brent Collingwood, RVA Executive Director. “We’re excited that in working together with our federal, provincial and municipal partners, Edmonton boaters now have more ways to get on the beautiful North Saskatchewan River and enjoy the city from the unique vantage point of being on the water.”

The total budget for the Boat Docks and Launches Project is $2.6 million and was funded by the RVA, the provincial and federal government and the City of Edmonton.

“Alberta is home to some of the most beautiful scenery in the world, and adding these new boat docks will give Albertans more opportunities to explore our great province,” said Jason Nixon, Minister of Environment and Parks. “I’m glad that the River Valley Alliance has done a fantastic job of increasing recreational opportunities in the North Saskatchewan River, and has been able to do this in a way that is environmentally sound and will allow Albertans to enjoy the river valley for generations to come.”

“Investing in recreational infrastructure is vital to developing dynamic and connected communities,” said Randy Boissonnault, Member of Parliament for Edmonton Centre, on behalf of the Honourable François-Philippe Champagne, Minister of Infrastructure and Communities. “These new docks are another exciting milestone in the River Valley Alliance Capital Program that will allow more people to enjoy the North Saskatchewan River from the water as well as its shores. This project is a great example of how we can work in partnership to build sustainable infrastructure for today and the future.”

Construction on the new boat docks and launches was completed in the fall of 2018, at which point they were installed and tested. This spring, the docks were ready for installation, but river levels were too high to put them in the water for public use. The new docks were installed in early August 2019 and are now ready for use.

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Energy2 days ago

Energy2 days agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Business7 hours ago

Business7 hours agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

armed forces1 day ago

armed forces1 day agoOttawa’s Newly Released Defence Plan Crosses a Dangerous Line

-

Energy7 hours ago

Energy7 hours agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex4 hours ago

Censorship Industrial Complex4 hours agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Bruce Dowbiggin2 days ago

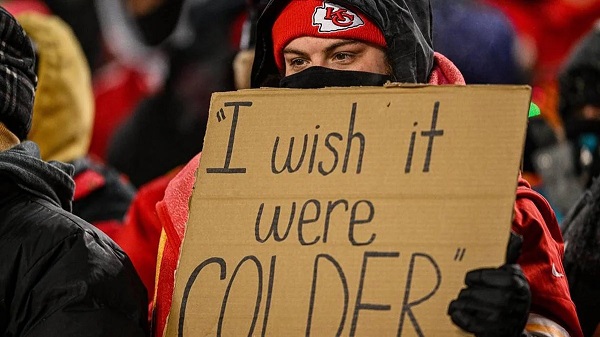

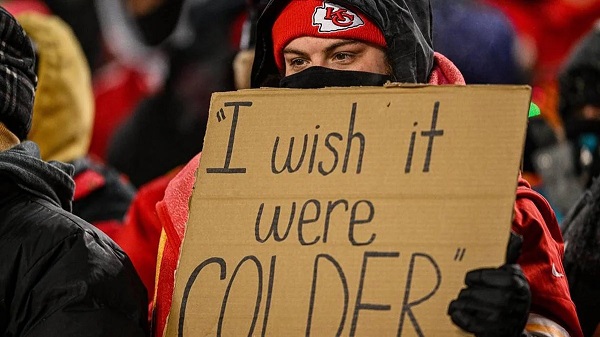

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria

-

Energy2 days ago

Energy2 days agoCan we not be hysterical about AI and energy usage?