Alberta

Finance Minister Nate Horner says Alberta on track to $2.4 billion surplus

Q1 update: Continued fiscal growth

Alberta’s strong fiscal management continues to secure Alberta’s future.

Alberta is on course to record a $2.4-billion surplus at the end of 2023-24, despite an unprecedented wildfire season and ongoing economic volatility. This is $94 million higher than forecast in Budget 2023.

Strong and prudent fiscal management will help Alberta remain the economic engine of Canada. The government’s new fiscal framework requires the government to use at least half of available surplus cash to pay down debt, freeing up money that can support the needs of Alberta families now and for decades to come. Based on the first quarter update, Alberta plans to eliminate $2.6 billion in taxpayer-supported debt this fiscal year.

“Alberta’s finances remain strong, and thanks to our new fiscal framework, Alberta’s fiscal position is poised to become even stronger. Our continued priorities of paying down debt and saving for the future will ensure we have the capacity to meet Albertans’ needs both today and well into the future.”

After the required 50 per cent of projected available surplus cash is used to pay off maturing debt, remaining surplus cash will be allocated to the Alberta Fund, where it can be used for additional debt repayment, contributions to the Alberta Heritage Savings Trust Fund and one-time initiatives that do not lead to a permanent increase in government spending. A projected $2.6 billion will be set aside in the Alberta Fund in 2023-24.

Revenue

Revenue for 2023-24 is forecast at $71.1 billion, a $491-million increase from Budget 2023.

Alberta’s robust business environment is attracting investment and people from around the country, driving a projected $1.5-billion increase in corporate and personal income tax revenue.

The corporate income tax revenue forecast has increased by $889 million, following a record-high year in 2022-23. At eight per cent, Alberta’s general corporate income tax rate is the lowest in the country. Alberta’s low taxes remain one reason investors choose Alberta.

Keeping life affordable is a key priority for Alberta’s government, which is why it paused the provincial fuel tax on gasoline and diesel in January. Extending the pause to the end of 2023 will save Albertans and Alberta businesses 13 cents per litre on gasoline and diesel for the rest of the calendar year. As a result, fuel tax revenue is forecast to be reduced by $532 million – money that is going directly back into the pockets of Albertans every time they fill up their vehicle.

Between April 1 and June 30, the price of West Texas Intermediate (WTI) oil averaged US$74 per barrel. It is now forecast to average $US75 per barrel over the course of the fiscal year, $4 lower than the Budget 2023 forecast. The resulting impact on Alberta’s revenue is being offset by a narrower light-heavy oil price differential, which is now forecast to average US$15 per barrel, $5 narrower than at budget.

Bitumen royalties are projected to increase by $515 million in 2023-24; however, overall resource revenue is projected to decrease by $694 million from the budget forecast. Lower natural gas royalties account for most of the projected decrease due to weaker prices, robust North American production and the impact of wildfires on production in Alberta.

Expense

Expense for 2023-24 is forecast at $68.7 billion, a $397-million increase from Budget 2023. The expense increase before the forecast contingency allocation is $1.6 billion. Of this, $397 million is funded by dedicated revenue and $1.2 billion is set aside as a preliminary allocation from the contingency, leaving $323 million unallocated.

The unprecedented wildfire season in the province prompted Alberta’s government to act swiftly and responsibly to ensure the safety of Albertans in affected areas. To date, the government has allocated $750 million for fighting wildfires in the province this year, along with $175 million for uninsurable losses, $75 million of which is expected to be covered by the federal government, and $55 million, mainly for emergency evacuation payments. Alberta’s government will continue to support Albertans during difficult situations like natural disasters.

The operating expense forecast has increased by $179 million, mainly due to a $214-million increase in Health funding that is being fully offset by federal bilateral agreement revenue. Capital grant increases of $170 million are mainly for re-profiling projects from the 2022-23 fiscal year.

Debt servicing costs are forecast to increase $245 million from budget, mainly due to higher interest rates – reiterating the importance of government’s commitment to paying down debt.

Alberta Heritage Savings Trust Fund

The Alberta Heritage Savings Trust Fund is Alberta’s long-term savings account, and the government remains committed to growing it. The fund performed well during the 2023-24 first quarter, earning a two per cent return with a net investment income of $739 million. Its fair value of net assets on June 30 was $21.6 billion, an increase from the $21.2 billion recorded at the end of the previous fiscal year.

Over five years, the fund returned 6.4 per cent, which is 0.6 per cent above the return of its passive benchmark.

Economic outlook

By continuing to grow and diversify Alberta’s economy, Alberta’s government is continuing to exceed expectations. Alberta’s real gross domestic product is now expected to rise three per cent in 2023, up 0.2 percentage points from Budget 2023. Projections by private forecasters show the province is expected to lead the country in economic growth this year.

Robust population growth is supporting Alberta’s labour market and generating demand and activity in Alberta’s economy, ultimately boosting the province’s economic outlook. Although risks and uncertainty persist due to rising interest rates, high consumer prices and other factors, Alberta’s economy remains well-positioned to withstand any challenges that arise.

Quick facts

- The amount of surplus cash available for debt repayment and the Alberta Fund is calculated after several necessary cash adjustments are made.

- In 2023-24, the total amount available for allocation is forecast at $5.2 billion, which includes $5.1 billion carried over from the 2022-23 final results.

Alberta

Danielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

From LifeSiteNews

The Alberta premier has denounced Skate Canada as ‘disgraceful’ for refusing to host events in the province because of a ban on ‘transgender’ men in women’s sports.

Alberta Premier Danielle Smith has demanded an apology after Skate Canada refused to continue holding events in Alberta.

In a December 16 post on X, Smith denounced Skate Canada’s recent decision to stop holding competitions in Alberta due to a provincial law keeping gender-confused men from competing in women’s sports.

“Women and girls have the right to play competitive sports in a safe and fair environment against other biological females,” Smith declared. “This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.”

Women and girls have the right to play competitive sports in a safe and fair environment against other biological females.

This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.

Skate Canada‘s refusal to hold events in… pic.twitter.com/n4vbkTx6B0

— Danielle Smith (@ABDanielleSmith) December 16, 2025

“Skate Canada‘s refusal to hold events in Alberta because we choose to protect women and girls in sport is disgraceful,” she declared.

“We expect they will apologize and adjust their policies once they realize they are not only compromising the fairness and safety of their athletes, but are also offside with the international community, including the International Olympic Committee, which is moving in the same direction as Alberta,” Smith continued.

Earlier this week, Skate Canada announced their decision in a statement to CBC News, saying, “Following a careful assessment of Alberta’s Fairness and Safety in Sport Act, Skate Canada has determined that we are unable to host events in the province while maintaining our national standards for safe and inclusive sport.”

Under Alberta’s Fairness and Safety in Sport Act, passed last December, biological men who claim to be women are prevented from competing in women’s sports.

Notably, Skate Canada’s statement failed to address safety and fairness concerns for women who are forced to compete against stronger, and sometimes violent, male competitors who claim to be women.

Under their 2023 policy, Skate Canada states “skaters in domestic events sanctioned by Skate Canada who identify as trans are able to participate in the gender category in which they identify.”

While Skate Canada maintains that gender-confused men should compete against women, the International Olympic Committee is reportedly moving to ban gender-confused men from women’s Olympic sports.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely that males have a considerable innate advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

Alberta

Alberta’s huge oil sands reserves dwarf U.S. shale

From the Canadian Energy Centre

By Will Gibson

Oil sands could maintain current production rates for more than 140 years

Investor interest in Canadian oil producers, primarily in the Alberta oil sands, has picked up, and not only because of expanded export capacity from the Trans Mountain pipeline.

Enverus Intelligence Research says the real draw — and a major factor behind oil sands equities outperforming U.S. peers by about 40 per cent since January 2024 — is the resource Trans Mountain helps unlock.

Alberta’s oil sands contain 167 billion barrels of reserves, nearly four times the volume in the United States.

Today’s oil sands operators hold more than twice the available high-quality resources compared to U.S. shale producers, Enverus reports.

“It’s a huge number — 167 billion barrels — when Alberta only produces about three million barrels a day right now,” said Mike Verney, executive vice-president at McDaniel & Associates, which earlier this year updated the province’s oil and gas reserves on behalf of the Alberta Energy Regulator.

Already fourth in the world, the assessment found Alberta’s oil reserves increased by seven billion barrels.

Verney said the rise in reserves despite record production is in part a result of improved processes and technology.

“Oil sands companies can produce for decades at the same economic threshold as they do today. That’s a great place to be,” said Michael Berger, a senior analyst with Enverus.

BMO Capital Markets estimates that Alberta’s oil sands reserves could maintain current production rates for more than 140 years.

The long-term picture looks different south of the border.

The U.S. Energy Information Administration projects that American production will peak before 2030 and enter a long period of decline.

Having a lasting stable source of supply is important as world oil demand is expected to remain strong for decades to come.

This is particularly true in Asia, the target market for oil exports off Canada’s West Coast.

The International Energy Agency (IEA) projects oil demand in the Asia-Pacific region will go from 35 million barrels per day in 2024 to 41 million barrels per day in 2050.

The growing appeal of Alberta oil in Asian markets shows up not only in expanded Trans Mountain shipments, but also in Canadian crude being “re-exported” from U.S. Gulf Coast terminals.

According to RBN Energy, Asian buyers – primarily in China – are now the main non-U.S. buyers from Trans Mountain, while India dominates purchases of re-exports from the U.S. Gulf Coast. .

BMO said the oil sands offers advantages both in steady supply and lower overall environmental impacts.

“Not only is the resulting stability ideally suited to backfill anticipated declines in world oil supply, but the long-term physical footprint may also be meaningfully lower given large-scale concentrated emissions, high water recycling rates and low well declines,” BMO analysts said.

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Energy2 days ago

Energy2 days agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Business7 hours ago

Business7 hours agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

armed forces1 day ago

armed forces1 day agoOttawa’s Newly Released Defence Plan Crosses a Dangerous Line

-

Energy7 hours ago

Energy7 hours agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex4 hours ago

Censorship Industrial Complex4 hours agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Bruce Dowbiggin2 days ago

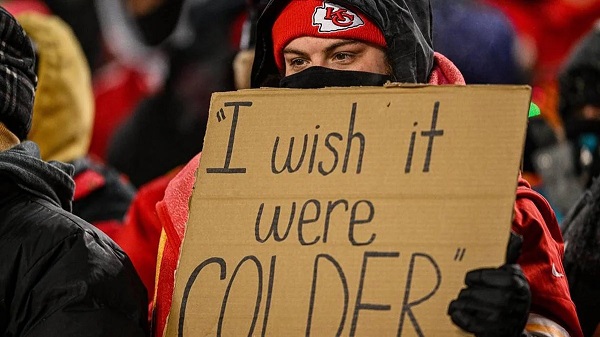

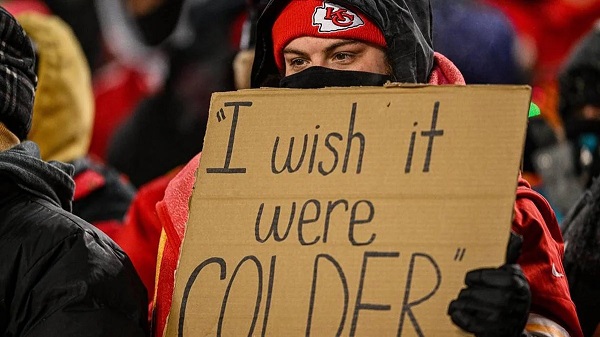

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria

-

Energy2 days ago

Energy2 days agoCan we not be hysterical about AI and energy usage?