Business

Feds spend $4.3 million printing out budget

From the Canadian Taxpayers Federation

Author: Ryan Thorpe

The average cost for each copy of the budget is $110.

Federal documents, including the budget, are routinely made available for free on government websites.

Here’s how the federal government could have saved money printing the budget:

It could have bought 1,000 top of the line, all-in-one printers at retail price.

Then it could have bought 10,000 multi-packs of colour ink.

Along with 106,000 reams of paper.

And then it could have assigned one of the 108,000 new bureaucrats hired under Prime Minister Justin Trudeau to print out copies of the budget.

Or it could have bought more than 333,000 USB flash drives and handed out digital copies to anyone who wanted to read it.

And even after this epic office supply shopping spree, Ottawa would have saved a million dollars.

Instead, Ottawa blew $4.3 million on printing the federal budget since 2015.

In fact, the government continues to spend half-a-million dollars a year printing paper copies of the budget, more than a decade after authorizing the transition to digital-only publications, according to documents obtained by the Canadian Taxpayers Federation.

“It’s 2024, presumably the government isn’t still using carrier pigeons, so it probably doesn’t need to spend half-a-million dollars printing paper copies of its budget every year,” said Franco Terrazzano, CTF Federal Director. “Not only are taxpayers getting soaked by what’s in the budget, we’re also getting a six-figure tab just to print it out.”

On average, the federal government spends $482,000 annually printing out thousands of copies of its budget, despite the fact the government has been trumpeting its embrace of the digital economy for years.

The costliest year on record was 2023, when the Trudeau government spent $753,160 printing 4,200 copies of the federal budget, according to the records.

That was $443,370 more than the Conservatives spent in 2015, the last year in which the government of former prime minister Stephen Harper tabled a budget.

The least expensive year on record was 2021, when the government spent $215,434 printing copies of its budget.

Cost of printing the federal budget, 2015 to 2024, access-to-information records

|

Year |

Number of copies |

Cost |

|

2015 |

5,911 |

$309,790 |

|

2016 |

5,876 |

$490,334 |

|

2017 |

5,937 |

$553,804 |

|

2018 |

5,561 |

$655,645 |

|

2019 |

4,874 |

$457,793 |

|

2020 |

N/A |

N/A |

|

2021 |

1,599 |

$215,434 |

|

2022 |

3,035 |

$632,273 |

|

2023 |

4,200 |

$753,160 |

|

2024 |

2,225 |

$270,418 |

|

Total |

39,218 |

$4,338,651 |

Given the number of copies the government prints each year, the federal budget would constitute a best seller in the Canadian publishing industry, according to BookNet Canada.

The average cost for each copy of the budget is $110.

In 2012, the Harper government authorized federal departments to transition to online-only publications, estimating the move would save taxpayers $178 million annually.

Federal documents, including the budget, are routinely made available for free on government websites.

“The government proved in 2021 that it could bring printing costs down, so taxpayers expect that to happen every year moving forward,” Terrazzano said. “Printing some physical copies is understandable, but an average tab of half-a-million-dollars is silly.”

Since 2015, the federal government printed 39,218 physical copies of the budget.

According to online calculations, roughly 1,460 standard pine trees would have been cut down to produce that volume of paper.

The Trudeau government is more than 1.8 billion trees short of its promise to plant two billion trees by 2030.

2025 Federal Election

The “Hardhat Vote” Has Embraced Pierre Poilievre

David Krayden

David Krayden

Blue collar and unionized workers are supporting Pierre Poilievre and the CPC

When President Richard Nixon won a landslide in his 1972 reelection, he did so by broadening his own personal popularity and the appeal of the Republican Party to blue collar and unionized workers. It was called the hardhat vote and many working people embraced Nixon because he seemed to be talking the same language as they were. Nixon talked about law and order and getting tough on crime; safer streets and harsher penalties for serious crime. Although unionized workers had traditionally voted for the Democratic Party and seen the Republicans as the party of the wealthy, by 1972 the Democrats had moved far to the left on social issues and were completely out of touch with average Americans who saw Democratic presidential nominee Sen. George McGovern as being soft on crime and approving of the anarchy on the streets.

It’s precisely the language that Conservative Party of Canada leader Pierre Poilievere is speaking in the 2025 federal election. As support for the New Democratic Party has collapsed throughout the election campaign, don’t think most of it is going to the Liberal Party. Poilievre has been targeting blue collar workers for years with his emphasis on the trades and talking about middle class tax cuts and safe streets. A factory or construction worker is middle class and just want an affordable lifestyle for their families. They don’t have a lot of time for the woke underbelly of the Liberals or the NDP and are increasingly reluctant to support either party because both have appealed to elites.

Listen to Karl Lovett, the president of the Local 773 of the International Brotherhood of Electrical Workers, talk about Carney corruption and why he is supporting Poilievre and the CPC in 2025.

“Mark Carney also failed to pay $5 billion in Canadian taxes by hiding his company’s assets in Bermuda above a bike shop. Hard to believe that information comes from Canada’s NDP, or at least who is left of them, because the irony is, Mark Carney has eaten all those people alive. Even the mayor of Lima has warned Canadians not to vote for Mark Carney, and why for ripping him off the poorest of the poor people in Peru. That’s who he ripped off,” Lovett said.

“Listen, there are countless other outrageous examples proving that Mark Carney doesn’t give a damn about the Canadian working man. And now, as prime minister, which he’s not, Carney is promising to put carbon tax and tariff on the auto industry. It’s another rip-off screen that’s right. We’re getting punched by Trump on one side of the border, and Carney plans to punch us on this side of the border, also pretending it’s all about climate change, and now he’s made millions off the workers’ backs. He wants more than money. He wants more power. He wants all of the power to do whatever he wants to do. Mark Carney cannot be trusted with this power. Mark Carney cannot be trusted to protect workers,” Lovett continued.

The union leader told a cheering crowd that “Mark Carney is in it for himself, and when he loses this election, you can bet Mark Carney is going to leave Canada in a New York minute. But there’s hope, there’s hope, there’s our last hope. His name is Pierre Poilievere – the .only hope for Canadian workers. You see Mark Carney fooled Justin Trudeau. We can’t let him keep fooling us.”

“Local 773, which I represent, knows Pierre Poilievre very well. We can proudly tell you that Pierre has our back. Pierre has been putting Canadian people to work and Canadian workers. First, local 773 began working with Pierre Poilievre, the Conservative Member of Parliament Chris Lewis, some years ago, when it became all too clear that the Liberal Party had zero interest in helping out workers. Upon winning the leadership of the party, Pierre made Local 773 his very first priority, he came to my union hall. Pier made the Local 773 Visitor Training Center, and he met all our workers, and he made a pledge to me; he’s not going to turn his back on us, and I believe him,” Lovett said.

Toronto Sun columnist Joe Warmington agreed with me and you can hear that entire interview, below. “Labor wants to work, and they want to, you know, build things, and they want those good, paying jobs, and that’s what Poilievre has always been about, you know.”

“He wants more power. He wants all of the power to do whatever he wants to do. Mark Carney cannot be trusted with this power. Mark Carney cannot be trusted to protect workers,”

“Again, it’s hard to know, but I always felt … and I still think that Poilievre is going to pull this off because of these reasons that you’ve raised today, I never really bought into and again, I’m just one person’s opinion, and I go on the ground. In the air, the polls are saying, I know there’s this main street poll today, maybe it’ll swing differently. But in the air, it says one thing, and on the ground, it says another thing. And that clip you just showed, that’s the ground, that’s where the workers are, that’s where the families are.”

2025 Federal Election

Poilievre will cancel Mark Carney’s new Liberal packaging law and scrap the Liberal plastic ban!

From Conservative Party Communications

Conservative Leader Pierre Poilievre promised today that a new Conservative government will stop Mark Carney’s proposed Liberal food tax and scrap the existing Liberal plastic ban. Poilievre will:

- Stop proposed new labelling and packaging requirements that will raise the cost of fresh produce by as much as 34% and cost the average Canadian household an additional $400 each year.

- Scrap the Liberal plastics ban, including the ban on straws, grocery bags, food containers and cutlery, and other single-use plastics, letting consumers and businesses choose what works for them.

- Protect restaurants, grocers, and low-income Canadians from one-size-fits-all packaging rules that disproportionately affect those who can least afford it.

“After the Lost Liberal Decade, many Canadians can barely afford to put food on the table. And now Mark Carney and the Liberals want to make it even harder with a new food packaging law that will raise the price of food–again,” said Poilievre. “A new Conservative government will keep food prices down by scrapping the Liberal plastic ban and stopping Carney’s new Liberal food tax.”

After a decade of out-of-control spending and massive tax increases, families are spending $800 more on food this year than they did in 2024, and food banks had to handle a record two million visits in a single month. In Montreal, 44 percent of CEGEP students are experiencing some form of food insecurity, while places like Hawkesbury, Kingston, Toronto and Mississauga have all declared food insecurity emergencies.

And food prices are still rocketing upwards, surging by 3.2% over the last year, with no end in sight. In the last month alone, food inflation increased by 1.9 percentage points—the largest monthly jump in food prices in decades.

As if this wasn’t bad enough, Liberals have made life even more expensive and inconvenient for Canadians by banning plastics – including everything from straws to bags to food packaging. The current Liberal ban on single-use plastics will cost Canadians $1.3 billion dollars over the next decade.

Now Mark Carney wants to make it worse by adding complicated and costly new food packaging rules that will drive up the price of food even more–in effect, a new Liberal food tax. Plastic food packaging makes up 1/3 of all plastic packaging in Canada. The proposed Liberal food tax will cost the average Canadian household an additional $400 each year, waste half a million tonnes of food, decrease access to imported fruit and produce, and increase food inflation. The Chemistry Industry Association of Canada has also warned that this tax will put up to 60,000 Canadians out of work.

“The Liberals’ ideological crusade against convenience has already driven up food prices and the last thing Canadians need is Mark Carney’s new food tax added directly to your grocery bill,” said Poilievre. “The choice for Canadians is clear, a fourth Liberal term that will make food even more expensive or a new Conservative government that will axe the food tax and bring back straws, grocery bags and other items, to make life more affordable and convenient for Canadians – For a Change.”

-

espionage2 days ago

espionage2 days agoEx-NYPD Cop Jailed in Beijing’s Transnational Repatriation Plot, Canada Remains Soft Target

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING from THE BUREAU: Pro-Beijing Group That Pushed Erin O’Toole’s Exit Warns Chinese Canadians to “Vote Carefully”

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Executive Orders ensure ‘Beautiful Clean’ Affordable Coal will continue to bolster US energy grid

-

Daily Caller2 days ago

Daily Caller2 days agoDOJ Releases Dossier Of Deported Maryland Man’s Alleged MS-13 Gang Ties

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoAllegations of ethical misconduct by the Prime Minister and Government of Canada during the current federal election campaign

-

John Stossel2 days ago

John Stossel2 days agoClimate Change Myths Part 1: Polar Bears, Arctic Ice, and Food Shortages

-

Business2 days ago

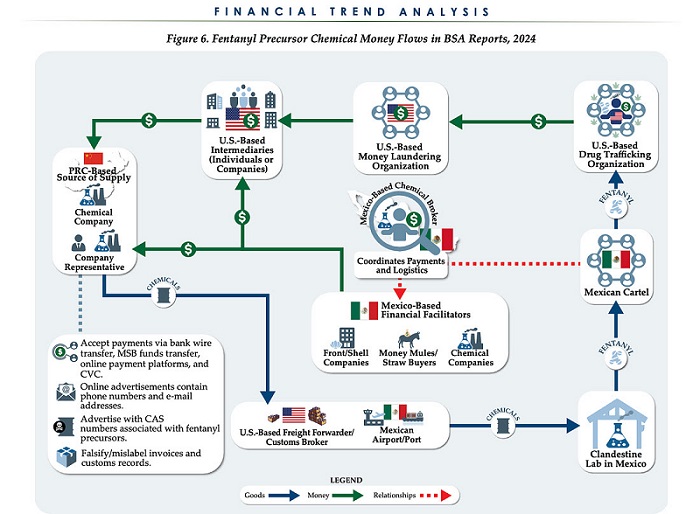

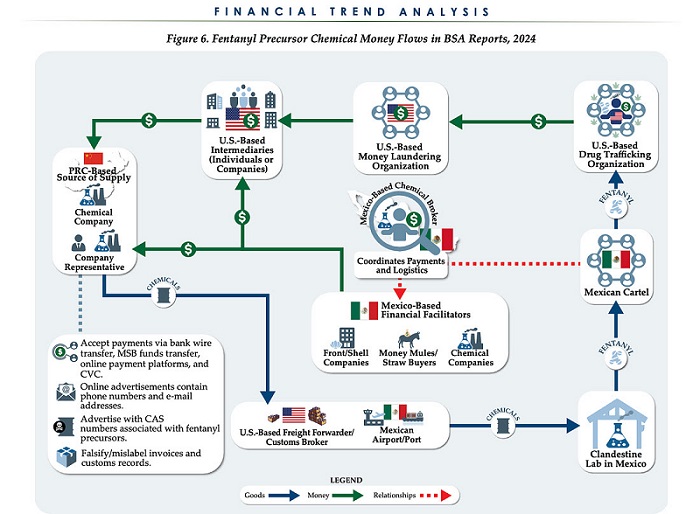

Business2 days agoChina, Mexico, Canada Flagged in $1.4 Billion Fentanyl Trade by U.S. Financial Watchdog

-

Opinion2 days ago

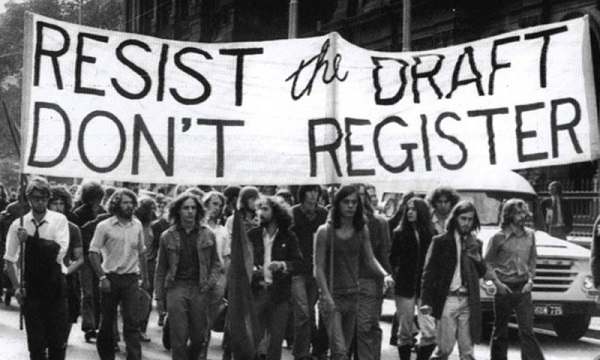

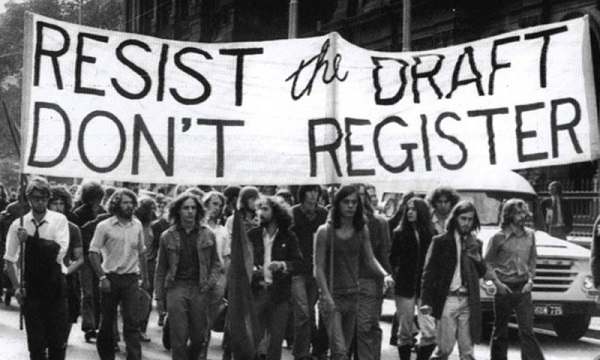

Opinion2 days agoLeft Turn: How Viet Nam War Resisters Changed Canada’s Political Compass