Economy

Federal carbon tax hike will hurt future generations

From the Fraser Institute

” since 2005, emissions from China increased by a staggering 71.7 per cent. It’s absurd to think that, even if Canada could drive it’s GHG emissions to zero, there would be any measurable impact on the global climate. “

Despite calls from seven of Canada’s premiers (including one premier from his own party) to scrap the upcoming carbon tax hike, and the threat of a non-confidence vote by the Opposition in Parliament, Prime Minister Trudeau has doubled down as he tries to convince Canadians that somehow this tax, which is set to rise from $65 per tonne of greenhouse gas emissions (GHG) to $80/tonne on April 1, will really be good for them.

Speaking with reporters in Calgary (not coincidentally Premier Danielle Smith’s backyard), the prime minister said, “My job is not to be popular,” adding “My job is to do the right things for Canada now and do the right things for Canadians a generation from now” to “deliver that better future one generation from now, two generations from now.”

But Trudeau’s argument that somehow GHG reductions, which might stem from Canada’s carbon tax, will yield appreciable benefits of any kind—economic or environmental—now or in future is nonsense.

Why?

Because Canada’s share of global GHG emissions is slowly declining and small relative to the world’s larger emitters particularly China. Indeed, in 2021 Canada’s emissions comprised 1.5 per cent of global GHG emissions compared to 26 per cent for China (in 2018). And since 2005, emissions from China increased by a staggering 71.7 per cent. It’s absurd to think that, even if Canada could drive it’s GHG emissions to zero, there would be any measurable impact on the global climate. And no impact on climate means no improved environmental benefits for future generations.

Economically, the prime minister’s argument is even less compelling than the proclaimed environmental benefit. According to a study published by the Fraser Institute, implementing a $170 carbon tax would shrink Canada’s economy by 1.8 per cent and produce significant job losses and reduced real income in every province.

The cadre of Trudeau government policies, including the carbon tax and imposition of federal bills C-48 (which bans large oil tankers carrying crude oil off British Columbia’s north coast, limiting access to Asian markets) and C-69 (which introduces subjective criteria including the “social impact” of energy investment into the evaluation process of major energy projects), combined with impending regulations such as GHG emission caps, are contributing to a collapse in business investment and ultimately economic stagnation in Canada. Per-person gross domestic product (GDP)—a broad measure of living standards—has barely budged in the last nine years and in fact stood in 2014 at $58,162, which is $51 higher than at the end of 2023 (inflation-adjusted). In other words, living standards for Canadians have declined.

Capital investment, which contributes to economic growth and higher living standards, is also declining. A 2021 Fraser Institute study showed that the growth rate of overall capital expenditures in Canada slowed substantially from 2005 to 2019, and the growth rate from 2015 to 2019 was lower than in virtually any other period since 1970. Moreover, as recently as 2000 to 2010, overall capital investment in Canada enjoyed a substantially higher growth rate than in other developed countries, but from 2010 to 2019, Canada’s investment growth rate dropped substantially below that of the United States and many other developed countries. Corporate investment in Canada as a share of total investment was also the lowest among a set of developed countries from 2005 to 2019.

Far from delivering environmental or economic benefits for Canadians “one generation from now” or “two generations from now,” Prime Minister Trudeau’s policies have thrown serious shadows over the future economic prospects of Canadians who will find themselves less well-off and less economically capable of adapting to predicted climate risks whether manmade or natural.

Author:

Business

Saskatchewan becomes first Canadian province to fully eliminate carbon tax

From LifeSiteNews

Saskatchewan has become the first Canadian province to free itself entirely of the carbon tax.

On March 27, Saskatchewan Premier Scott Moe announced the removal of the provincial industrial carbon tax beginning April 1, boosting the province’s industry and making Saskatchewan the first carbon tax free province.

Under Moe’s direction, Saskatchewan has dropped the industrial carbon tax which he says will allow Saskatchewan to thrive under a “tariff environment.”

“I would hope that all of the parties running in the federal election would agree with those objectives and allow the provinces to regulate in this area without imposing the federal backstop,” he continued.

The removal of the tax is estimated to save Saskatchewan residents up to 18 cents a liter in gas prices.

The removal of the tax will take place on April 1, the same day the consumer carbon tax will reduce to 0 percent under Prime Minister Mark Carney’s direction. Notably, Carney did not scrap the carbon tax legislation: he just reduced its current rate to zero. This means it could come back at any time.

Furthermore, while Carney has dropped the consumer carbon tax, he has previously revealed that he wishes to implement a corporation carbon tax, the effects of which many argued would trickle down to all Canadians.

The Saskatchewan Association of Rural Municipalities (SARM) celebrated Moe’s move, noting that the carbon tax was especially difficult on farmers.

“I think the carbon tax has been in place for approximately six years now coming up in April and the cost keeps going up every year,” SARM president Bill Huber said.

“It puts our farming community and our business people in rural municipalities at a competitive disadvantage, having to pay this and compete on the world stage,” he continued.

“We’ve got a carbon tax on power — and that’s going to be gone now — and propane and natural gas and we use them more and more every year, with grain drying and different things in our farming operations,” he explained.

“I know most producers that have grain drying systems have three-phase power. If they haven’t got natural gas, they have propane to fire those dryers. And that cost goes on and on at a high level, and it’s made us more noncompetitive on a world stage,” Huber decalred.

The carbon tax is wildly unpopular and blamed for the rising cost of living throughout Canada. Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne.

2025 Federal Election

Fight against carbon taxes not over yet

As the federal government removes the consumer carbon tax, the Canadian Taxpayers Federation is calling on all party leaders to oppose all carbon taxes, including the hidden tax on business.

“Canadians fought hard to force Ottawa to back down on its consumer carbon tax and now the fight moves to stopping the hidden carbon tax on business,” said Franco Terrazzano, CTF Federal Director. “Canadians can’t afford a carbon tax on business that pushes up prices at the gas station and makes it harder for our businesses to compete while they’re already struggling with a trade war.”

Today, the federal government cut the consumer carbon tax rate to $0. This will reduce taxes by about 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

The federal government still imposes an industrial carbon tax on oil and gas, steel and fertilizer businesses, among others.

During the Liberal Party leadership race, Prime Minister Mark Carney said he would “improve and tighten” the industrial carbon tax and “extend the framework to 2035.”

Just 12 per cent of Canadians believe businesses pay most of the cost of the industrial carbon tax, according to a Leger poll commissioned by the CTF. Meanwhile, 70 per cent said businesses would pass most or some carbon tax costs on to consumers.

Conservative Party Leader Pierre Poilievre said he will “repeal the entire carbon tax law, including the tax on Canadian businesses and industries.”

“Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive,” Terrazzano said. “Canadians know Poilievre will end all carbon taxes and Canadians know Carney’s carbon tax costs won’t be zero.

“Carney owes Canadians a clear answer: How much will your carbon tax cost?”

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election1 day ago

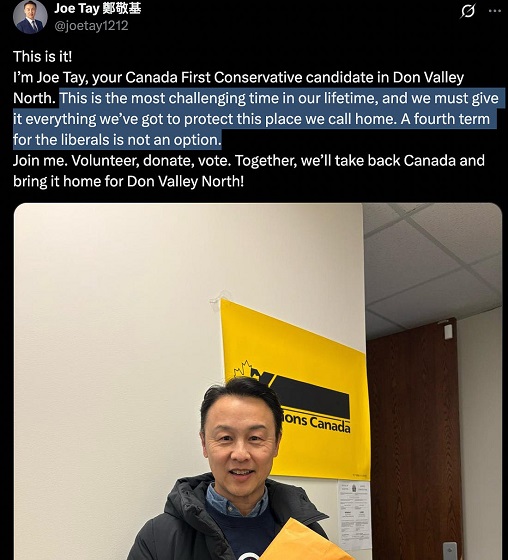

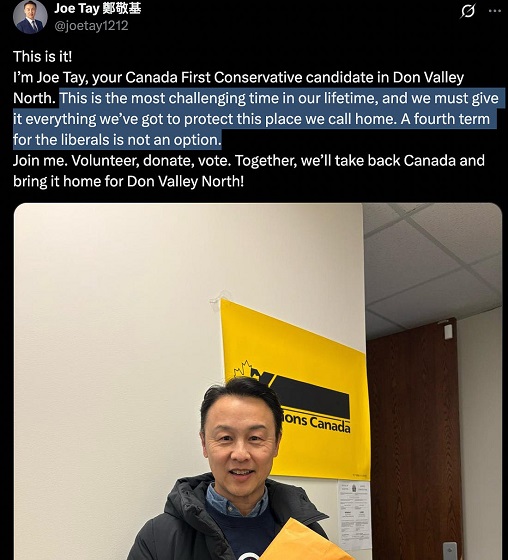

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election2 days ago

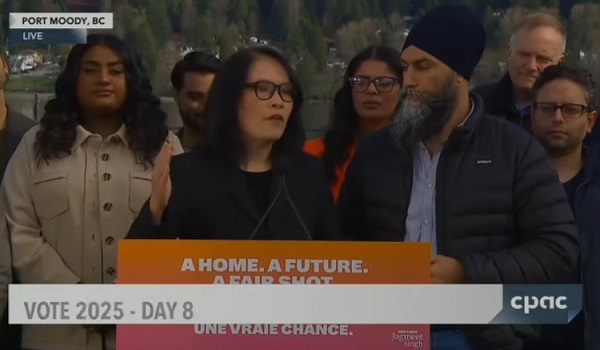

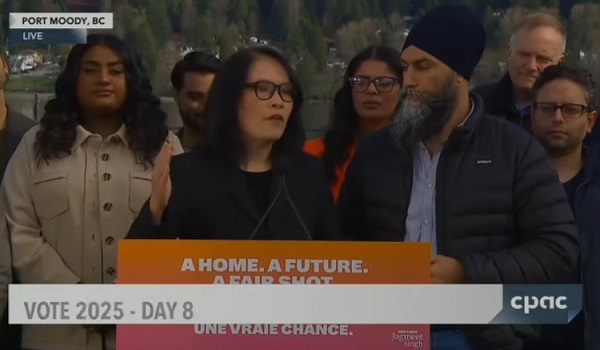

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

Daily Caller19 hours ago

Daily Caller19 hours agoBiden Administration Was Secretly More Involved In Ukraine Than It Let On, Investigation Reveals

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election22 hours ago

2025 Federal Election22 hours agoRCMP Confirms It Is ‘Looking Into’ Alleged Foreign Threat Following Liberal Candidate Paul Chiang Comments

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoAlcohol tax and MP pay hike tomorrow (April 1)