Business

Federal carbon tax a hot issue today

From Resource Works

When it comes to Canada and carbon taxes, times have certainly changed in very little time.

We had wondered how long Ottawa’s national carbon-tax system would last when, after implementing it as a mandatory national scheme, the feds suddenly announced an exemption for home heating oil in Newfoundland and Labrador.

Pressed by NL Premier Andrew Furey, a Liberal, and Liberal MP Ken McDonald, Prime Minister Justin Trudeau announced the exemption last October, saying it would help Atlantic Canadians with the cost of living.

The exemption would last until March 31, 2027. And for NL households that burn oil, the feds said it would mean an average $250 annual savings.

Alberta and Saskatchewan saw the exemption as unmitigated vote-buying politics, and they weren’t alone.

On Jan. 1, 2024, Saskatchewan stopped collecting the federal carbon tax on natural gas used for home heating in that province. Premier Scott Moe declared that this was in response to Ottawa’s “unfair” exemption for Newfoundland and Labrador.

“Trudeau has provided a carbon tax exemption on home heating for families in one part of the country, but not here. It’s unfair, it’s unacceptable.”

Saskatchewan went on to challenge the exemption, in federal court, on constitutional grounds, and won a temporary injunction. Later, pending a final court decision, Saskatchewan and Ottawa agreed that the province would be responsible for “50 percent of the outstanding tax amounts.”

But Ottawa’s carbon tax (oops, sorry, Ottawa likes to call it “carbon pricing” and “carbon pollution pricing”) has now run into new political trouble.

First, national NDP leader Jagmeet Singh, who had voted for the carbon tax, pulled out of a deal supporting Trudeau’s Liberal Party in government.

Singh then went on to slam Trudeau’s approach of exempting fuels in favored geography. And he said the NDP would come up with a system that doesn’t “put the burden on the backs of working people.”

Then, British Columbia Premier David Eby, long a strong supporter of the carbon tax — but facing an election on Oct. 19 — suddenly declared: “I think it’s critical to also recognize that the context and the challenge for British Columbians have changed. A lot of British Columbians are struggling with affordability.

“If the federal government decides to remove the legal backstop requiring us to have a consumer carbon tax in British Columbia, we will end the consumer carbon tax in British Columbia.”

Would Prime Minister Trudeau remove the backstop requirement?

Apparently not. Instead, Environment and Climate Change Canada is looking to run a $7-million “climate literacy and action” advertising campaign to promote the carbon tax and the quarterly rebates that many Canadians receive under it.

And the prime minister, earlier this year, declined to meet the premiers of Alberta, Ontario, Saskatchewan, New Brunswick, and Newfoundland and Labrador on the issue.

“The carbon tax has contributed to increasing stress and financial pain for millions of Canadians,” Alberta Premier Danielle Smith wrote to the prime minister.

Ontario Premier Doug Ford wrote: “While we all have a role in protecting the environment, it cannot be done on the backs of hardworking people.”

But Trudeau turned down the call for a meeting: “We had a meeting on carbon pricing and every single premier came together to work on establishing a pan-Canadian framework on climate change years ago.

“And part of it was that there would be a federal backstop to make sure that pollution wasn’t free anywhere across the country.”

Whether the carbon tax has “worked” or not to reduce pollution is an open question. Supporters say yes. Opponents say no.

A poll late last year found that Canadians were feeling slightly more confident in the carbon tax’s effectiveness at combating climate change — but uncertainty was still high.

But the Liberal government is already getting a message from voters — having lost in two recent by-elections in Manitoba and Quebec, and in an earlier one in a “safe seat” in Ontario (Toronto-St. Paul’s).

In the Quebec one on Monday, the Liberals lost their longtime safe seat of LaSalle—Émard—Verdun to the NDP, by just over 200 votes. It had been a Liberal stronghold for years, won by more than 20 percent of the vote in previous campaigns.

The next federal election will take place on or before October 2025, and Trudeau’s opponents have already been loudly cranking up “Axe the Tax” campaigns.

And that means the carbon tax.

Business

Chinese firm unveils palm-based biometric ID payments, sparking fresh privacy concerns

By Ken Macon

Alipay’s biometric PL1 scanner uses vein and palm-print data for processing payments, raising security concerns over the storage and use of permanent biometric data.

Alipay, the financial arm of Alibaba, has introduced a new palm-based biometric terminal, dubbed the PL1, which enables individuals to make purchases simply by presenting their hand – no phone, card, or PIN required. Positioned as a faster, touch-free alternative for payment, this system reflects a growing industry shift toward frictionless biometric transactions.

At the core of the PL1 is a dual-mode recognition system that combines surface palm print detection with internal vein mapping. This multi-layered authentication relies on deeply unique biological signatures that are significantly harder to replicate than more common methods like fingerprints or facial scans. Alipay reports that the device maintains a false acceptance rate of less than one in a million, suggesting a substantial improvement in resisting identity spoofing.

Enrollment is designed to be quick: users hover their palm over the sensor and link their account through a QR code. Once registered, purchases are completed in around two seconds without physical interaction. During early trials in Hangzhou, this system reportedly accelerated checkout lines and contributed to more hygienic point-of-sale environments.

The PL1 arrives at a time of rapid expansion in the biometric payments sector. Forecasts estimate that more than 3 billion people will use biometrics for transactions by 2026, with total payments surpassing $5 trillion. Major players are already onboard: Amazon has integrated palm authentication across U.S. retail and healthcare facilities, while JP Morgan is gearing up for a national deployment in the same year.

Alipay envisions the PL1’s use extending well beyond checkout counters. It is exploring applications in public transit, controlled access facilities, and healthcare check-ins, reflecting a broader trend toward embedding biometric systems in daily infrastructure. However, while domestic deployment benefits from favorable policy conditions, international expansion may be constrained by differing legal standards, particularly in jurisdictions that enforce stringent rules on biometric data usage and consent.

Despite the technological advancements and convenience the PL1 offers, privacy remains a major point of contention. Unlike passwords or cards that can be reset or replaced, biometric data is immutable. If compromised, individuals cannot simply “change” their palm patterns or vein structures. This permanence heightens the stakes of any potential data breach and raises long-term concerns about identity theft and surveillance.

Alipay’s approach, storing encrypted biometric templates locally on devices and restricting data flow within national border, does address certain regulatory demands, especially within China, but the broader implications of biometrics are likely to be a growing privacy and surveillance concern in the coming years.

Business

Trump considers $5K bonus for moms to increase birthrate

MxM News

MxM News

Quick Hit:

President Trump voiced support Tuesday for a $5,000 cash bonus for new mothers, as his administration weighs policies to counter the country’s declining birthrate. The idea is part of a broader push to promote family growth and revive the American family structure.

Key Details:

- Trump said a reported “baby bonus” plan “sounds like a good idea to me” during an Oval Office interview.

- Proposals under consideration include a $5,000 birth bonus, prioritizing Fulbright scholarships for parents, and fertility education programs.

- U.S. birthrates hit a 44-year low in 2023, with fewer than 3.6 million babies born.

Diving Deeper:

President Donald Trump signaled his support Tuesday for offering financial incentives to new mothers, including a potential $5,000 cash bonus for each child born, as part of an effort to reverse America’s falling birthrate. “Sounds like a good idea to me,” Trump told The New York Post in response to reports his administration is exploring such measures.

The discussions highlight growing concern among Trump administration officials and allies about the long-term implications of declining fertility and family formation in the United States. According to the report, administration aides have been consulting with pro-family advocates and policy experts to brainstorm solutions aimed at encouraging larger families.

Among the proposals: a $5,000 direct payment to new mothers, allocating 30% of all Fulbright scholarships to married applicants or those with children, and launching federally supported fertility education programs for women. One such program would educate women on their ovulation cycles to help them better understand their reproductive health and increase their chances of conceiving.

The concern stems from sharp demographic shifts. The number of babies born in the U.S. fell to just under 3.6 million in 2023—down 76,000 from 2022 and the lowest figure since 1979. The average American family now has fewer than two children, a dramatic drop from the once-common “2.5 children” norm.

Though the birthrate briefly rose from 2021 to 2022, that bump appears to have been temporary. Additionally, the age of motherhood is trending older, with fewer teens and young women having children, while more women in their 30s and 40s are giving birth.

White House Press Secretary Karoline Leavitt underscored the administration’s commitment to families, saying, “The President wants America to be a country where all children can safely grow up and achieve the American dream.” Leavitt, herself a mother, added, “I am proud to work for a president who is taking significant action to leave a better country for the next generation.”

-

2025 Federal Election2 days ago

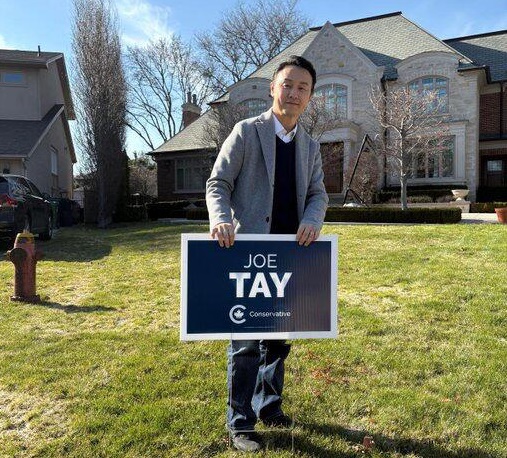

2025 Federal Election2 days agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoHow Canada’s Mainstream Media Lost the Public Trust

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

COVID-192 days ago

COVID-192 days agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPOLL: Canadians want spending cuts

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoMark Carney Wants You to Forget He Clearly Opposes the Development and Export of Canada’s Natural Resources

-

John Stossel2 days ago

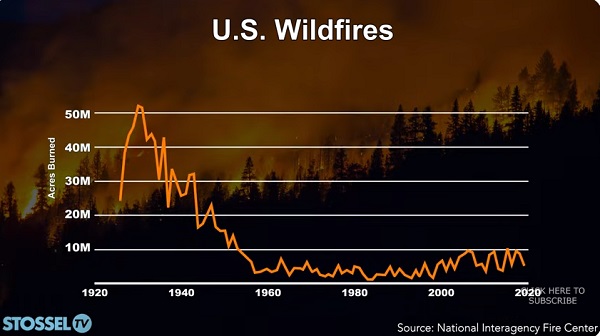

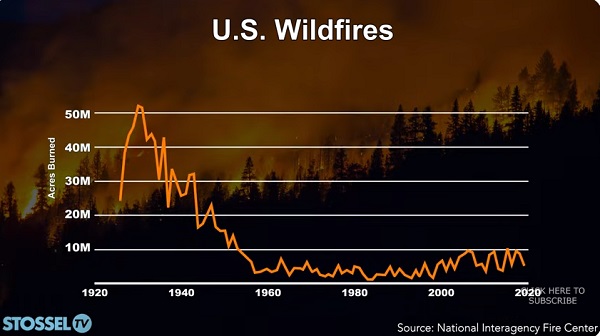

John Stossel2 days agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCHINESE ELECTION THREAT WARNING: Conservative Candidate Joe Tay Paused Public Campaign