Automotive

Europe’s EV Market Collapse Provides A Lesson For UAW Leadership

From the Daily Caller News Foundation

From the Daily Caller News Foundation

It is an ill-kept secret of American politics that most of the big labor unions in the country have long been client organizations of the Democratic Party. In presidential election years, endorsements from these unions for the party’s nominee have generally been foregone conclusions regardless of voting attitudes of rank-and-file union members.

Some are quicker to endorse than others. Vice President Kamala Harris barely had time to buy campaign letterhead before the United Auto Workers (UAW) weighed in on July 31 with its endorsement. The union’s bosses made the move despite the reality of the Biden-Harris electric vehicle mandates placing many of that union’s jobs at risk as the companies they work for lose billions each year on quixotic efforts to force the public to enjoy paying premiums for cars they cannot rely upon when the going gets tough.

Even with that early move, the UAW fell 9 days behind the AFL-CIO, which jumped on the Harris bandwagon so quickly it probably made union members’ heads spin. Hey, speed matters when your business model relies on constantly asking for favors and protections from the federal government, for which the Democratic Party has traditionally been the most fertile ground to plow.

Given that reality, the Teamsters Union made big news this week by endorsing — well, no one — despite overwhelming support among the rank-and-file for the Republican candidate, former President Donald Trump. It was the first time the Teamsters had failed to endorse the Democrat in a race since 1996, and only the second time in the union’s existence. Teamsters General President Sean O’Brien spoke at the Republican convention in July — and was snubbed by the Democrats at their convention in return. So, the refusal to endorse Harris was not a huge surprise. But O’Brien, fully aware of the vindictive nature of the Democrats towards their political enemies, apparently decided it would not be politically prudent to give a full-throated endorsement to the candidate his members so obviously prefer.

With the race shaping up to be another nail-biter, it remains to be seen whether any of these major unions’ decisions will prove to be wise. But for the UAW, the move to endorse Harris comes with increasing risk amid a softening market for the EVs being forced on U.S. consumers and the rising challenge by Chinese EV makers to the hegemony of domestic car companies in the U.S. market.

With legacy automakers like Ford and General Motors already bleeding billions of dollars in losses in their EV divisions despite heavy government subsidies in place, they can ill-afford an incursion into the U.S. market from Chinese carmakers who are able to make and sell quality EVs for far less than American car companies can. Right now, Europe is providing an object lesson about what happens in the EV space when governments allow that to happen.

EU countries were slow to move to protect their domestic car manufacturers when Chinese companies like BYD began to flood the European market with EVs. EV buyers in countries like Germany and France eagerly bought up the Chinese cars, saving thousands of Euros per unit in the process. When the EU belatedly moved to impose import tariffs on Chinese cars, the domestic car companies responded by raising prices for their own EVs in an effort to recover losses.

The result has been entirely predictable: EV sales in Germany collapsed by nearly 70% during the month of August. In France, they plunged by 33%. Clearly the appetite among EU car buyers for EVs is extremely price sensitive (no one could have possibly seen that coming), and consumers are more than happy to go back to buying gas-powered cars as cheaper alternatives.

Now, the climate alarmist central planners at the EU are proposing to respond to those uncooperative buyers by imposing massive fines on car makers for continuing to sell them the gas-powered cars they actually want to buy. Because, of course, that would be the response from power-mad apparatchiks.

Given that the Biden-Harris regime has basically followed the EU’s model on EV regulation, the EU’s struggles provide a preview of coming attractions for the U.S. auto market under a Harris presidency. It is hard to believe this is the future the UAW leadership really desires for its members.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Automotive

Elon Musk Poised To Become World’s First Trillionaire After Shareholder Vote

From the Daily Caller News Foundation

At Tesla’s Austin headquarters, investors backed Musk’s 12-step plan that ties his potential trillion-dollar payout to a series of aggressive financial and operational milestones, including raising the company’s valuation from roughly $1.4 trillion to $8.5 trillion and selling one million humanoid robots within a decade. Musk hailed the outcome as a turning point for Tesla’s future.

“What we’re about to embark upon is not merely a new chapter of the future of Tesla but a whole new book,” Musk said, as The New York Times reported.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

The decision cements investor confidence in Musk’s “moonshot” management style and reinforces the belief that Tesla’s success depends heavily on its founder and his leadership.

Tesla Annual meeting starting now

https://t.co/j1KHf3k6ch— Elon Musk (@elonmusk) November 6, 2025

“Those who claim the plan is ‘too large’ ignore the scale of ambition that has historically defined Tesla’s trajectory,” the Florida State Board of Administration said in a securities filing describing why it voted for Mr. Musk’s pay plan. “A company that went from near bankruptcy to global leadership in E.V.s and clean energy under similar frameworks has earned the right to use incentive models that reward moonshot performance.”

Investors like Ark Invest CEO Cathie Wood defended Tesla’s decision, saying the plan aligns shareholder rewards with company performance.

“I do not understand why investors are voting against Elon’s pay package when they and their clients would benefit enormously if he and his incredible team meet such high goals,” Wood wrote on X.

Norway’s sovereign wealth fund, Norges Bank Investment Management — one of Tesla’s largest shareholders — broke ranks, however, and voted against the pay plan, saying that the package was excessive.

“While we appreciate the significant value created under Mr. Musk’s visionary role, we are concerned about the total size of the award, dilution, and lack of mitigation of key person risk,” the firm said.

The vote comes months after Musk wrapped up his short-lived government role under President Donald Trump. In February, Musk and his Department of Government Efficiency (DOGE) team sparked a firestorm when they announced plans to eliminate the U.S. Agency for International Development, drawing backlash from Democrats and prompting protests targeting Musk and his companies, including Tesla.

Back in May, Musk announced that his “scheduled time” leading DOGE had ended.

Automotive

Canada’s EV experiment has FAILED

By Dan McTeague

The government’s attempt to force Canadians to buy EVs by gambling away billions of tax dollars and imposing an EV mandate has been an abject failure.

GM and Stellantis are the latest companies to back track on their EV plans in Canada despite receiving billions in handouts from Canadian taxpayers.

Dan McTeague explains in his latest video.

-

Business2 days ago

Business2 days agoCarney budget continues misguided ‘Build Canada Homes’ approach

-

espionage2 days ago

espionage2 days agoU.S. Charges Three More Chinese Scholars in Wuhan Bio-Smuggling Case, Citing Pattern of Foreign Exploitation in American Research Labs

-

Business2 days ago

Business2 days agoCarney budget doubles down on Trudeau-era policies

-

COVID-192 days ago

COVID-192 days agoCrown still working to put Lich and Barber in jail

-

Business20 hours ago

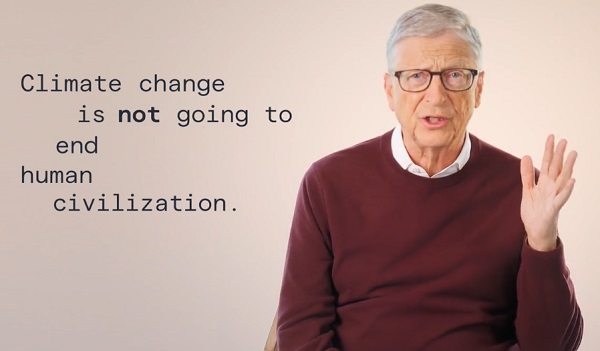

Business20 hours agoBill Gates Gets Mugged By Reality

-

Alberta18 hours ago

Alberta18 hours agoAlberta’s number of inactive wells trending downward

-

Censorship Industrial Complex17 hours ago

Censorship Industrial Complex17 hours agoSchool Cannot Force Students To Use Preferred Pronouns, US Federal Court Rules

-

Alberta17 hours ago

Alberta17 hours agoAlberta Announces Members of Class Size and Complexity Committee