Economy

Energy exports continue to fuel the Canadian economy

From the Fraser Institute

Without exports of oil, natural gas and other energy goods, Canada’s cumulative trade deficit with the rest of the world—which stood at $130 billion in the decade ending in 2023—would have ballooned to $1 trillion.

Energy sits at the heart of Canada’s export economy, even though some federal policymakers and provincial governments appear to be discomfited by that fact.

In recent years, energy has supplied 20–25 percent of Canada’s total international exports (goods plus services combined), with crude oil, refined petroleum products, and natural gas making up the lion’s share of our energy-related shipments to other countries. Canada’s energy export basket also includes coal, uranium, and electricity.

In the last two decades, energy has become Canada’s leading export sector, mainly owing to higher oil production volumes, rising hydrocarbon exports, and still-robust global demand for fossil fuels (which provide 80 percent of the world’s primary energy). Measured in millions of barrels of oil equivalent (BOE), Canadian conventional oil and gas production rose from 4.5 million BOE per day in 2015 to 5.4 million/day last year, with most of the additional output destined for the United States. With the completion of pipeline expansion projects and the looming start-up of liquefied natural gas (LNG) production on the West Coast, oil and gas are set to play an even bigger role in Canada’s economy and export portfolio in the coming years.

A May 2024 modelling study by S&P Global Commodity Insights predicts a further jump in conventional oil and gas output of between 0.5 and 1.0 million BOE/day by 2035, assuming the federal government doesn’t impose draconian caps on production in the sector as part of its shambolic climate policy agenda. Based on that scenario, S&P estimates that production, capital and operating spending in Canada’s conventional oil and gas industry will add up to $1.3 trillion to Canada’s gross domestic product by 2035. This forecast is premised on a modest (8 percent) increase in output and further declines in the sector’s greenhouse gas emissions intensity due to efficiency measures, advances in technology, greater use of carbon capture, and other factors.

To illustrate the contribution that energy makes to Canada’s prosperity, the Coalition for A Better Future recently estimated that without exports of oil, natural gas and other energy goods, Canada’s cumulative trade deficit with the rest of the world—which stood at $130 billion in the decade ending in 2023—would have ballooned to $1 trillion.

Thanks to energy production, Canada garners up to $200 billion of additional export receipts each year—and the figure is set to rise significantly in the next decade. This outsized stream of export earnings furnishes the means to pay for imports, supports hundreds of thousands of high-paying jobs, and generates tens of billions of dollars of extra revenues for Canadian governments.

In Canada’s case, it is also worth noting that energy reliably produces the largest trade surplus of any sector, by a wide margin. And, as noted above, that surplus will increase in size over the rest of this decade and possibly beyond, mainly due to oil and gas output and exports climbing from current levels.

Averaged over the period 2022-23, Canada’s two-way trade in energy goods yielded a net annual surplus of almost $150 billion. This dwarfs the surpluses posted in other natural resource-based sectors such as metal ores, non-metallic minerals, agri-food, and forest products. Large trade surpluses in energy—and, to a lesser extent, in other natural resource industries—offset chronic Canadian trade deficits in consumer goods, machinery and equipment, electronic products, and other high-tech goods. Canada also runs a trade deficit of $35-40 billion in motor vehicles and parts.

Trudeau government ministers are fond of talking up (and subsidizing) Canadian non-fossil fuel energy industries, like (carbon-free) electricity, biofuels, hydrogen (production of which currently is almost non-existent in Canada) and the “clean tech” sector. However, except for electricity, these segments of the Canadian energy sector are very small in size and export little. And while the “clean tech” industry does hold considerable promise over the medium term, today it accounts for less than one percent of Canada’s international exports.

When it comes to energy exports, the reality for Canada is that oil, natural gas, and other fossil fuel products dominate the picture—and will continue to do so for the foreseeable future.

Author:

2025 Federal Election

Next federal government should end corporate welfare for forced EV transition

From the Fraser Institute

By Tegan Hill and Jake Fuss

Corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

General Motors recently announced the temporary closure of its electric vehicle (EV) manufacturing plant in Ontario, laying off 500 people because its new EV isn’t selling. The plant will shut down for six months despite hundreds of millions in government subsides financed by taxpayers. This is just one more example of corporate welfare—when governments subsidize favoured industries and companies—and it’s time for the provinces and the next federal government to eliminate it.

Between the federal government and Ontario government, GM received about $500 million to help fund its EV transition. But this is just one example of corporate welfare in the auto sector. Stellantis and Volkswagen will receive about $28 billion in government subsidies while Honda is promised $5 billion.

More broadly, from 2007 to 2019, the last pre-COVID year of data, the federal government spent an estimated $84.6 billion (adjusted for inflation) on corporate welfare while provincial and local governments spent another $302.9 billion. And crucially, these numbers exclude other forms of government support such as loan guarantees, direct investments and regulatory privileges, so the actual cost of corporate welfare during this period was much higher.

Of course, politicians claim that corporate welfare benefits workers. Yet according to a significant body of research, corporate welfare fails to generate widespread economic benefit. Think of it this way—if the businesses that received subsidies were viable to begin with, they wouldn’t need government support. So unprofitable companies are kept in business through governments’ support, which can prevent resources, including investment and workers, from moving to profitable companies, hurting overall economic growth.

Put differently, rather than fuelling economic growth, corporate welfare simply shifts jobs and investment away from other firms and industries—which are more productive, as they don’t require government funding to be economically viable—to the governments’ preferred industries and firms, circumventing the preferences of consumers and investors. And since politicians spend other people’s money, they have little incentive to be careful investors.

Governments also must impose higher tax rates on everyone else to pay for corporate welfare. In turn, higher tax rates discourage entrepreneurship and business investment—again, which fuels economic growth. And the higher the tax rates, the more economic activity they discourage.

GM’s EV plant shut down once again proves that when governments try to engineer the economy with corporate welfare, workers will ultimately lose. It’s time for the provinces and the next federal government—whoever it may be—to finally put an end to this costly and ineffective policy approach.

Bjorn Lomborg

Net zero’s cost-benefit ratio is crazy high

From the Fraser Institute

The best academic estimates show that over the century, policies to achieve net zero would cost every person on Earth the equivalent of more than CAD $4,000 every year. Of course, most people in poor countries cannot afford anywhere near this. If the cost falls solely on the rich world, the price-tag adds up to almost $30,000 (CAD) per person, per year, over the century.

Canada has made a legal commitment to achieve “net zero” carbon emissions by 2050. Back in 2015, then-Prime Minister Trudeau promised that climate action will “create jobs and economic growth” and the federal government insists it will create a “strong economy.” The truth is that the net zero policy generates vast costs and very little benefit—and Canada would be better off changing direction.

Achieving net zero carbon emissions is far more daunting than politicians have ever admitted. Canada is nowhere near on track. Annual Canadian CO₂ emissions have increased 20 per cent since 1990. In the time that Trudeau was prime minister, fossil fuel energy supply actually increased over 11 per cent. Similarly, the share of fossil fuels in Canada’s total energy supply (not just electricity) increased from 75 per cent in 2015 to 77 per cent in 2023.

Over the same period, the switch from coal to gas, and a tiny 0.4 percentage point increase in the energy from solar and wind, has reduced annual CO₂ emissions by less than three per cent. On that trend, getting to zero won’t take 25 years as the Liberal government promised, but more than 160 years. One study shows that the government’s current plan which won’t even reach net-zero will cost Canada a quarter of a million jobs, seven per cent lower GDP and wages on average $8,000 lower.

Globally, achieving net-zero will be even harder. Remember, Canada makes up about 1.5 per cent of global CO₂ emissions, and while Canada is already rich with plenty of energy, the world’s poor want much more energy.

In order to achieve global net-zero by 2050, by 2030 we would already need to achieve the equivalent of removing the combined emissions of China and the United States — every year. This is in the realm of science fiction.

The painful Covid lockdowns of 2020 only reduced global emissions by about six per cent. To achieve net zero, the UN points out that we would need to have doubled those reductions in 2021, tripled them in 2022, quadrupled them in 2023, and so on. This year they would need to be sextupled, and by 2030 increased 11-fold. So far, the world hasn’t even managed to start reducing global carbon emissions, which last year hit a new record.

Data from both the International Energy Agency and the US Energy Information Administration give added cause for skepticism. Both organizations foresee the world getting more energy from renewables: an increase from today’s 16 per cent to between one-quarter to one-third of all primary energy by 2050. But that is far from a transition. On an optimistically linear trend, this means we’re a century or two away from achieving 100 percent renewables.

Politicians like to blithely suggest the shift away from fossil fuels isn’t unprecedented, because in the past we transitioned from wood to coal, from coal to oil, and from oil to gas. The truth is, humanity hasn’t made a real energy transition even once. Coal didn’t replace wood but mostly added to global energy, just like oil and gas have added further additional energy. As in the past, solar and wind are now mostly adding to our global energy output, rather than replacing fossil fuels.

Indeed, it’s worth remembering that even after two centuries, humanity’s transition away from wood is not over. More than two billion mostly poor people still depend on wood for cooking and heating, and it still provides about 5 per cent of global energy.

Like Canada, the world remains fossil fuel-based, as it delivers more than four-fifths of energy. Over the last half century, our dependence has declined only slightly from 87 per cent to 82 per cent, but in absolute terms we have increased our fossil fuel use by more than 150 per cent. On the trajectory since 1971, we will reach zero fossil fuel use some nine centuries from now, and even the fastest period of recent decline from 2014 would see us taking over three centuries.

Global warming will create more problems than benefits, so achieving net-zero would see real benefits. Over the century, the average person would experience benefits worth $700 (CAD) each year.

But net zero policies will be much more expensive. The best academic estimates show that over the century, policies to achieve net zero would cost every person on Earth the equivalent of more than CAD $4,000 every year. Of course, most people in poor countries cannot afford anywhere near this. If the cost falls solely on the rich world, the price-tag adds up to almost $30,000 (CAD) per person, per year, over the century.

Every year over the 21st century, costs would vastly outweigh benefits, and global costs would exceed benefits by over CAD 32 trillion each year.

We would see much higher transport costs, higher electricity costs, higher heating and cooling costs and — as businesses would also have to pay for all this — drastic increases in the price of food and all other necessities. Just one example: net-zero targets would likely increase gas costs some two-to-four times even by 2030, costing consumers up to $US52.6 trillion. All that makes it a policy that just doesn’t make sense—for Canada and for the world.

-

International2 days ago

International2 days agoPope Francis Dies on Day after Easter

-

International2 days ago

International2 days agoJD Vance was one of the last people to meet Pope Francis

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust

-

2025 Federal Election23 hours ago

2025 Federal Election23 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

COVID-191 day ago

COVID-191 day agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPOLL: Canadians want spending cuts

-

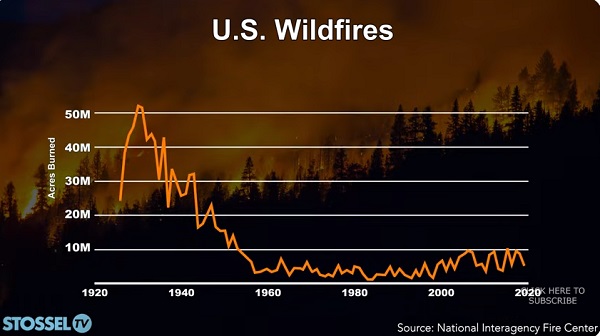

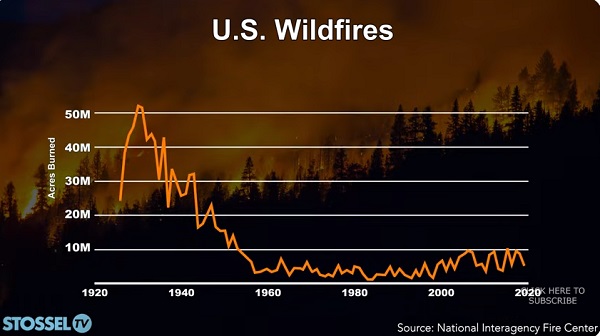

John Stossel1 day ago

John Stossel1 day agoClimate Change Myths Part 2: Wildfires, Drought, Rising Sea Level, and Coral Reefs