Energy

Energy Companies May Be On Cusp Of Uncorking Next Massive Oil, Gas Boon

From the Daily Caller News Foundation

From the Daily Caller News Foundation

These companies, all run by smart business people, continue to invest many billions of capital dollars in these risky, long-term projects even as “experts” like the bureaucrats at the International Energy Agency (IEA) continue to predict demand for crude oil is about to peak in the next few years.

Constantly advancing technology has always been the driver behind the advance of the oil-and-gas industry since the first successful U.S. well was drilled by Edwin Drake near Titusville, Pennsylvania, in 1859. The Drake well was drilled to a then unheard-of depth of 69 feet using the most primitive equipment imaginable.

This week, 165 years later, U.S. oil giant Chevron announced it had achieved first production in its Anchor field in the Gulf of Mexico. At its shallow depth, underground pressure in the Drake well would have been negligible, just enough to force the oil up out of the ground. The Anchor semi-submersible floating production unit (FPU) that was started up by Chevron this week enables the capture of massive volumes of oil and natural gas from underground formations up to 34,000 feet below sea level at pressures up to 20,000 pounds per square inch.

“The Anchor project represents a breakthrough for the energy industry,” said Nigel Hearne, executive vice president, Chevron Oil, Products & Gas. “Application of this industry-first deepwater technology allows us to unlock previously difficult-to-access resources and will enable similar deepwater high-pressure developments for the industry.”

Chevron says seven deepwater wells will be tied into the Anchor FPU, which has the capacity to capture, process and transport as much as 75,000 barrels of oil and 28 million cubic feet of natural gas every day. The company estimates reserves in the field of 440 million barrels of oil equivalent with current technology. But, again, the technology deployed by the industry advances every day, meaning a far bigger amount of oil and gas will ultimately be recovered over the coming years.

Other major oil companies, like BP, are also beginning to deploy similar high-pressure technology that they and analysts believe will help them tap into billions of new barrels known to exist in deep, high-pressure formations in various parts of the world. Globally, BP says it believes deployment of advanced technology could help it access up to 10 billion barrels of known high pressure reserves.

Reuters quotes Wood Mackenzie principal analyst Mfon Usoro as saying the new high pressure technologies could enable companies like BP and Chevron to unlock as much as 2 billion barrels of known reserves in the Gulf of Mexico alone. “The industry has done their bit to safely deliver the barrels, with the new technology,” she said, adding: “These ultra-high-pressure fields are going to be a big driver for production growth in the Gulf of Mexico.”

On the same day Chevron made its announcement, Chinese national oil company CNOOC announced the completion of what it believes is the largest offshore platform on Earth, the Marjan facility. The giant platform, which serves similar functionality as the Anchor FPO, will now be shipped 6,400 nautical miles to the Persian Gulf, where it will facilitate the full development of Saudi Arabia’s deepwater Marjan Field.

It is important to keep in mind that the mounting of these massive offshore facilities and drilling of the deepwater wells are all long-term, multi-billion-dollar projects. These are facilities designed to handle the production from these deepwater fields for decades, not just a few years until the vaunted energy transition takes away all the demand for the commodities being produced.

In addition to the projects in the Gulf of Mexico and Persian Gulf, all the companies mentioned here are involved in aggressive efforts to discover and produce oil and gas in deepwater regions around the world. CNOOC, for example, is a 20% owner in the prolific Stabroek block development offshore of Guyana operated by ExxonMobil. Chevron stands to become a 30% owner in that same development via its proposed buyout of Houston-based Hess Corp.

These companies, all run by smart business people, continue to invest many billions of capital dollars in these risky, long-term projects even as “experts” like the bureaucrats at the International Energy Agency (IEA) continue to predict demand for crude oil is about to peak in the next few years. Meanwhile, OPEC says it believes demand for crude will keep rising through at least 2045, perhaps longer.

Someone will be right, and someone will be wrong. Regardless, we can rest assured that advancing technology in the industry itself will ensure there will be no shortage of supply.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Featured image credit: (Screen Capture/PBS NewsHour)

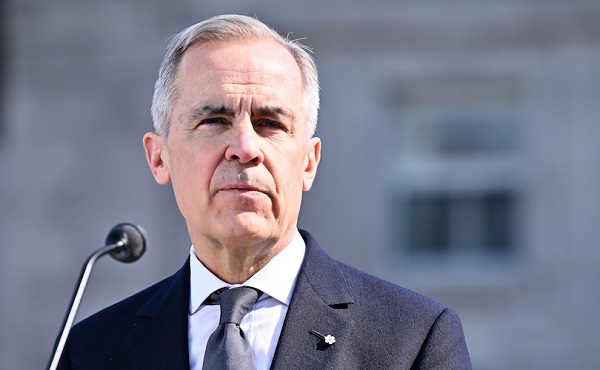

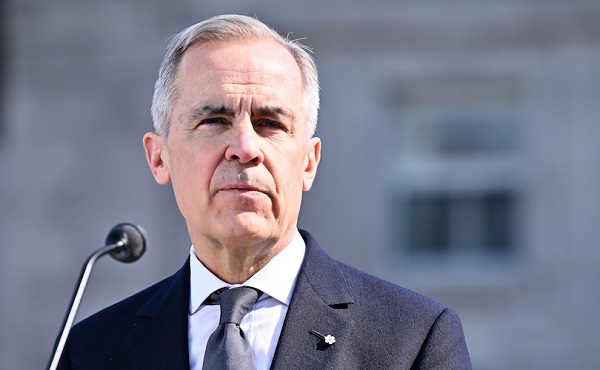

2025 Federal Election

MORE OF THE SAME: Mark Carney Admits He Will Not Repeal the Liberal’s Bill C-69 – The ‘No Pipelines’ Bill

From EnergyNow.Ca

Mark Carney on Tuesday explicitly stated the Liberals will not repeal their controversial Bill C-69, legislation that prevents new pipelines being built.

Carney has been campaigning on boosting the economy and the “need to act forcefully” against President Donald Trump and his tariffs by harvesting Canada’s wealth of natural resources — until it all fell flat around him when he admitted he actually had no intention to build pipelines at all.

When a reporter asked Carney how he plans to maintain Bill C-69 while simultaneously building infrastructure in Canada, Carney replied, “we do not plan to repeal Bill C-69.”

“What we have said, formally at a First Ministers meeting, is that we will move for projects of national interest, to remove duplication in terms of environmental assessments and other approvals, and we will follow the principle of ‘one project, one approval,’ to move forward from that.”

“What’s essential is to work at this time of crisis, to come together as a nation, all levels of government, to focus on those projects that are going to make material differences to our country, to Canadian workers, to our future.”

“The federal government is looking to lead with that, by saying we will accept provincial environmental assessments, for example clean energy projects or conventional energy projects, there’s many others that could be there.”

“We will always ensure these projects move forward in partnership with First Nations.”

Tory leader Pierre Poilievre was quick to respond to Carney’s admission that he has no intention to build new pipelines. “This Liberal law blocked BILLIONS of dollars of investment in oil & gas projects, pipelines, LNG plants, mines, and so much more — all of which would create powerful paychecks for our people,” wrote Poilievre on X.

“A fourth Liberal term will block even more and keep us reliant on the US,” he wrote, urging people to vote Conservative.

Alberta

Energy sector will fuel Alberta economy and Canada’s exports for many years to come

From the Fraser Institute

By any measure, Alberta is an energy powerhouse—within Canada, but also on a global scale. In 2023, it produced 85 per cent of Canada’s oil and three-fifths of the country’s natural gas. Most of Canada’s oil reserves are in Alberta, along with a majority of natural gas reserves. Alberta is the beating heart of the Canadian energy economy. And energy, in turn, accounts for one-quarter of Canada’s international exports.

Consider some key facts about the province’s energy landscape, as noted in the Alberta Energy Regulator’s (AER) 2023 annual report. Oil and natural gas production continued to rise (on a volume basis) in 2023, on the heels of steady increases over the preceding half decade. However, the dollar value of Alberta’s oil and gas production fell in 2023, as the surging prices recorded in 2022 following Russia’s invasion of Ukraine retreated. Capital spending in the province’s energy sector reached $30 billion in 2023, making it the leading driver of private-sector investment. And completion of the Trans Mountain pipeline expansion project has opened new offshore export avenues for Canada’s oil industry and should boost Alberta’s energy production and exports going forward.

In a world striving to address climate change, Alberta’s hydrocarbon-heavy energy sector faces challenges. At some point, the world may start to consume less oil and, later, less natural gas (in absolute terms). But such “peak” consumption hasn’t arrived yet, nor does it appear imminent. While the demand for certain refined petroleum products is trending down in some advanced economies, particularly in Europe, we should take a broader global perspective when assessing energy demand and supply trends.

Looking at the worldwide picture, Goldman Sachs’ 2024 global energy forecast predicts that “oil usage will increase through 2034” thanks to strong demand in emerging markets and growing production of petrochemicals that depend on oil as the principal feedstock. Global demand for natural gas (including LNG) will also continue to increase, particularly since natural gas is the least carbon-intensive fossil fuel and more of it is being traded in the form of liquefied natural gas (LNG).

Against this backdrop, there are reasons to be optimistic about the prospects for Alberta’s energy sector, particularly if the federal government dials back some of the economically destructive energy and climate policies adopted by the last government. According to the AER’s “base case” forecast, overall energy output will expand over the next 10 years. Oilsands output is projected to grow modestly; natural gas production will also rise, in part due to greater demand for Alberta’s upstream gas from LNG operators in British Columbia.

The AER’s forecast also points to a positive trajectory for capital spending across the province’s energy sector. The agency sees annual investment rising from almost $30 billion to $40 billion by 2033. Most of this takes place in the oil and gas industry, but “emerging” energy resources and projects aimed at climate mitigation are expected to represent a bigger slice of energy-related capital spending going forward.

Like many other oil and gas producing jurisdictions, Alberta must navigate the bumpy journey to a lower-carbon future. But the world is set to remain dependent on fossil fuels for decades to come. This suggests the energy sector will continue to underpin not only the Alberta economy but also Canada’s export portfolio for the foreseeable future.

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPM Carney’s Candidate Paul Chiang Steps Down After RCMP Confirms Probe Into “Bounty” Comments

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoLiberal MP Paul Chiang Resigns Without Naming the Real Threat—The CCP

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoFight against carbon taxes not over yet

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoMark Carney refuses to clarify 2022 remarks accusing the Freedom Convoy of ‘sedition’

-

Energy1 day ago

Energy1 day agoWhy are Western Canadian oil prices so strong?

-

2025 Federal Election9 hours ago

2025 Federal Election9 hours agoWEF video shows Mark Carney pushing financial ‘revolution’ based on ‘net zero’ goals

-

Automotive1 day ago

Automotive1 day agoElectric cars just another poor climate policy

-

2025 Federal Election12 hours ago

2025 Federal Election12 hours ago‘Coordinated and Alarming’: Allegations of Chinese Voter Suppression in 2021 Race That Flipped Toronto Riding to Liberals and Paul Chiang