Business

DEA’s Most Wanted in U.S. Custody: Mexico Extradites Dozens Amid Trump Trade Standoff

Sam Cooper

Sam Cooper

In a stunning move just days before the Trump administration is set to impose sweeping tariffs over Mexico’s role in America’s fentanyl crisis, Mexican President Claudia Sheinbaum engineered the largest single-day extradition of cartel leaders in history, delivering 29 top-level traffickers—including one of the most notorious figures in modern drug war history—into U.S. custody.

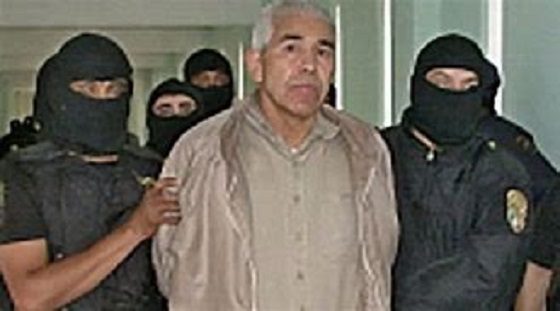

Among those flown north on Mexican military aircraft Thursday was Rafael Caro Quintero, the infamous cartel boss accused of ordering the brutal 1985 torture and murder of DEA agent Enrique ‘Kiki’ Camarena, a crime dramatized in the Netflix series Narcos: Mexico. Other high-profile extraditees include Antonio Oseguera Cervantes, alleged brother of Jalisco New Generation Cartel (CJNG) leader “El Mencho,” as well as key leaders from the Zetas, the Gulf Cartel, and La Nueva Familia Michoacana.

In Washington, U.S. Attorney General Pamela Bondi hailed the mass extradition as a turning point in the war on cartel violence. “As President Trump has made clear, cartels are terrorist groups, and this Department of Justice is devoted to destroying cartels and transnational gangs,” Bondi said in a press release. “We will prosecute these criminals to the fullest extent of the law in honor of the brave law enforcement agents who have dedicated their careers—and in some cases, given their lives—to protect innocent people from the scourge of violent cartels.”

DEA Acting Administrator Derek S. Maltz declared, “Today, 29 fugitive cartel members have arrived in the United States from Mexico, including one name that stands above the rest for the men and women of the DEA—Rafael Caro Quintero. This moment is extremely personal for the men and women of DEA who believe Caro Quintero is responsible for the brutal torture and murder of DEA Special Agent Enrique ‘Kiki’ Camarena.”

The defendants are collectively accused of importing massive amounts of cocaine, methamphetamine, fentanyl, and heroin into the United States, along with a litany of violent crimes including murder, money laundering, and illegal weapons trafficking. The Justice Department noted that many of these cartel leaders had long-standing U.S. extradition requests that were not honored during prior administrations but were accelerated following direct White House pressure.

As the Mexican delegation, including Foreign Secretary Juan Ramón de la Fuente and security chief Omar García Harfuch, met with Secretary of State Marco Rubio in Washington, the mass extradition signaled Sheinbaum’s readiness to make dramatic concessions to avert Trump’s threatened tariffs. The unprecedented handover also coincided with the State Department formally designating six cartels as foreign terrorist organizations.

Award-winning Mexican journalist Ioan Grillo, reporting on Sheinbaum’s transformative move, cited comments from Mike Vigil, former head of the DEA’s international operations, saying, “This is the highest number of extraditions [in one day] in the history of Mexico, without question. This is historic. … These guys unleashed a river of blood… Everybody is elated with the extraditions.”

However, the decision has ignited controversy within Mexico’s legal community, Grillo reported, noting longstanding criminal defense stances were “bulldozed.”

Juan Manuel Delgado, lawyer for Miguel Ángel Treviño, one of the most feared Zetas leaders, called the move an assault on Mexican sovereignty. “My client’s extradition tramples on due process and demonstrates that Mexico is bending entirely to U.S. will,” Delgado reportedly told CrashOut magazine.

Notably, while Mexico typically secures agreements that extradited criminals will not face the death penalty, the U.S. statement made no such assurances, raising the possibility that figures like Caro Quintero could face capital punishment.

While Mexico is in the crosshairs of Trump’s fentanyl crackdown, attention is also turning to Canada’s underreported role in the continent’s cartel problem. Organized crime experts say that over the past 15 years, cartel networks have deeply infiltrated Ontario, British Columbia, and Quebec, using Canada as both a fentanyl production hub and a gateway to launder cartel proceeds. It’s a little-known fact that the cartels started to gain presence in Canadian narco-trafficking cells almost 50 years ago, one expert told The Bureau.

However, it remains unclear whether Canada’s newly appointed Fentanyl Commissioner, Kevin Brosseau, has made any significant progress in responding to Trump’s demands for tougher action. An expert who could not be named due to the sensitivities of investigations and political discussions said cartels have thrived under Canada’s lax enforcement and weak financial crime controls. The question now is whether Brosseau will have any real impact on the concerns or simply be part of “performative” meetings run out of Ottawa, they said.

With Trump’s administration signaling that Canada will be hit next week with economic penalties if fentanyl production and money laundering continue unchecked, the Trudeau government faces growing pressure to show concrete results in combating cartel expansion within its borders.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

Cuba has lost 24% of it’s population to emigration in the last 4 years

MxM News

MxM News

Quick Hit:

A new study finds Cuba has lost nearly a quarter of its population since 2020, driven by economic collapse and a mass emigration wave unseen outside of war zones. The country’s population now stands at just over 8 million, down from nearly 10 million.

Key Details:

- Independent study estimates Cuba’s population at 8.02 million—down 24% in four years.

- Over 545,000 Cubans left the island in 2024 alone—double the official government figure.

- Demographer warns the crisis mirrors depopulation seen only in wartime, calling it a “systemic collapse.”

Diving Deeper:

Cuba is undergoing a staggering demographic collapse, losing nearly one in four residents over the past four years, according to a new study by economist and demographer Juan Carlos Albizu-Campos. The report estimates that by the end of 2024, Cuba’s population will stand at just over 8 million people—down from nearly 10 million—a 24% drop that Albizu-Campos says is comparable only to what is seen in war-torn nations.

The study, accessed by the Spanish news agency EFE, points to mass emigration as the primary driver. In 2024 alone, 545,011 Cubans are believed to have left the island. That number is more than double what the regime officially acknowledges, as Cuba’s government only counts those heading to the United States, ignoring large flows to destinations like Mexico, Spain, Serbia, and Uruguay.

Albizu-Campos describes the trend as “demographic emptying,” driven by what he calls a “quasi-permanent polycrisis” in Cuba—an interwoven web of political repression, economic freefall, and social decay. For years, Cubans have faced food and medicine shortages, blackout-plagued days, fuel scarcity, soaring inflation, and a broken currency system. The result has been not just migration, but a desperate stampede for the exits.

Yet, the regime continues to minimize the damage. Official figures from the National Office of Statistics and Information (ONEI) put Cuba’s population at just over 10 million in 2023. However, even those numbers acknowledge a shrinking population and the lowest birth rate in decades—confirming the crisis, if not its full scale.

Cuba hasn’t held a census since 2012. The last scheduled one in 2022 has been repeatedly delayed, allegedly due to lack of resources. Experts doubt that any new attempt will be transparent or complete.

Albizu-Campos warns that the government’s refusal to confront the reality of the collapse is obstructing any chance at solutions. More than just a demographic issue, the study describes Cuba’s situation as a “systemic crisis.”

“Havana (Cuba, February 2023)” by Bruno Rijsman licensed under CC BY-SA 2.0 DEED.

Business

Tariff-driven increase of U.S. manufacturing investment would face dearth of workers

From the Fraser Institute

Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

Donald Trump has long been convinced that the United States must revitalize its manufacturing sector, having—unwisely, in his view—allowed other countries to sell all manner of foreign-produced manufactured goods in the giant American market. As president, he’s moved quickly to shift the U.S. away from its previous embrace of liberal trade and open markets as cornerstones of its approach to international economic policy —wielding tariffs as his key policy instrument. Since taking office barely two months ago, President Trump has implemented a series of tariff hikes aimed at China and foreign producers of steel and aluminum—important categories of traded manufactured goods—and threatened to impose steep tariffs on most U.S. imports from Canada, Mexico and the European Union. In addition, he’s pledged to levy separate tariffs on imports of automobiles, semi-conductors, lumber, and pharmaceuticals, among other manufactured goods.

In the third week of March, the White House issued a flurry of news releases touting the administration’s commitment to “position the U.S. as a global superpower in manufacturing” and listing substantial new investments planned by multinational enterprises involved in manufacturing. Some of these appear to contemplate relocating manufacturing production in other jurisdictions to the U.S., while others promise new “greenfield” investments in a variety of manufacturing industries.

President Trump’s intense focus on manufacturing is shared by a large slice of America’s political class, spanning both of the main political parties. Yet American manufacturing has hardly withered away in the last few decades. The value of U.S. manufacturing “output” has continued to climb, reaching almost $3 trillion last year (equal to 10 per cent of total GDP). The U.S. still accounts for 15 per cent of global manufacturing production, measured in value-added terms. In fact, among the 10 largest manufacturing countries, it ranks second in manufacturing value-added on a per-capita basis. True, China has become the world’s biggest manufacturing country, representing about 30 per cent of global output. And the heavy reliance of Western economies on China in some segments of manufacturing does give rise to legitimate national security concerns. But the bulk of international trade in manufactured products does not involve goods or technologies that are particularly critical to national security, even if President Trump claims otherwise. Moreover, in the case of the U.S., a majority of two-way trade in manufacturing still takes place with other advanced Western economies (and Mexico).

In the U.S. political arena, much of the debate over manufacturing centres on jobs. And there’s no doubt that employment in the sector has fallen markedly over time, particularly from the early 1990s to the mid-2010s (see table below). Since 2015, the number of American manufacturing jobs has actually risen modestly. However, as a share of total U.S. employment, manufacturing has dropped from 30 per cent in the 1970s to around 8 per cent in 2024.

| U.S. Manufacturing Employment, Select Years (000)* | |

|---|---|

| 1990 | 17,395 |

| 2005 | 14,189 |

| 2010 | 14,444 |

| 2015 | 12,333 |

| 2022 | 12,889 |

| 2024 | 12,760 |

| *December for each year shown. Source: U.S. Bureau of Labor Statistics | |

Economists who have studied the trend conclude that the main factors behind the decline of manufacturing employment include continuous automation, significant gains in productivity across much of the sector, and shifts in aggregate demand and consumption away from goods and toward services. Trade policy has also played a part, notably China’s entry into the World Trade Organization (WTO) in 2001 and the subsequent dramatic expansion of its role in global manufacturing supply chains.

Contrary to what President Trump suggests, manufacturing’s shrinking place in the overall economy is not a uniquely American phenomenon. As Harvard economist Robert Lawrence recently observed “the employment share of manufacturing is declining in mature economies regardless of their overall industrial policy approaches. The trend is apparent both in economies that have adopted free-market policies… and in those with interventionist policies… All of the evidence points to deep and powerful forces that drive the long-term decline in manufacturing’s share of jobs and GDP as countries become richer.”

This brings us back to the president’s seeming determination to rapidly ramp up manufacturing investment and production as a core element of his “America First” program. An important issue overlooked by the administration is where to find the workers to staff a resurgent U.S. manufacturing sector. For while manufacturing has become a notably “capital-intensive” part of the U.S. economy, workers are still needed. And today, it’s hard to see where they will be found. This is especially true given the Trump administration’s well-advertised skepticism about the benefits of immigration.

According to the U.S. Bureau of Labor Statistics, the current unemployment rate across America’s manufacturing industries collectively stands at a record low 2.9 per cent, well below the economy-wide rate of 4.5 per cent. In a recent survey by the National Association of Manufacturers, almost 70 per cent of American manufacturers cited the inability to attract and retain qualified employees as the number one barrier to business growth. A cursory look at the leading industry trade journals confirms that skill and talent shortages remain persistent in many parts of U.S. manufacturing—and that shortages are destined to get worse amid the expected significant jump in manufacturing investment being sought by the Trump administration.

As often seems to be the case with Trump’s stated policy objectives, the math surrounding his manufacturing agenda doesn’t add up. Manufacturing in America is in far better shape than the president acknowledges. And a tariff-driven avalanche of manufacturing investment—should one occur—will soon find the sector reeling from an unprecedented human resource crisis.

Jock Finlayson

Senior Fellow, Fraser Institut

-

Health2 days ago

Health2 days agoRFK Jr. says ‘everything is going to change’ with CDC vaccine policy in Michael Knowles interview

-

Business2 days ago

Business2 days agoLabor Department cancels “America Last” spending spree spanning five continents

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoNext federal government should recognize Alberta’s important role in the federation

-

Addictions2 days ago

Addictions2 days agoThere’s No Such Thing as a “Safer Supply” of Drugs

-

Economy1 day ago

Economy1 day agoClearing the Path: Why Canada Needs Energy Corridors to Compete

-

2025 Federal Election13 hours ago

2025 Federal Election13 hours ago2025 Federal Election Interference from China! Carney Pressed to Remove Liberal MP Over CCP Bounty Remark

-

Uncategorized12 hours ago

Uncategorized12 hours agoPoilievre on 2025 Election Interference – Carney sill hasn’t fired Liberal MP in Chinese election interference scandal

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoCanadian Banks Tied to Chinese Fentanyl Laundering Risk U.S. Treasury Sanctions After Cartel Terror Designation