Uncategorized

Davos 2024: Queen Maxima advocates global digital ID for financial services, vaccine verification

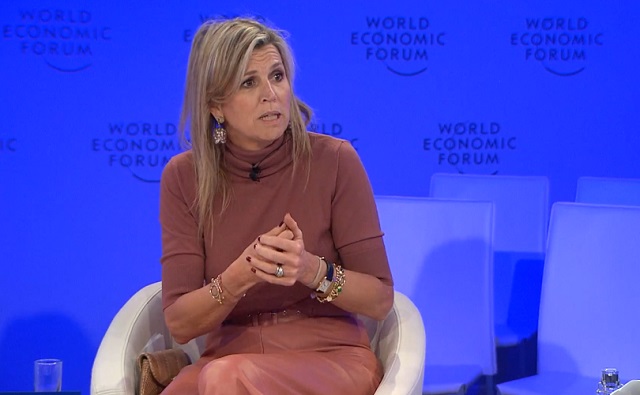

Queen Maxima of the Netherlands

From LifeSiteNews

Digital IDs are ‘good for school enrollment; it is also good for health – who actually got a vaccination or not; it’s very good actually to get your subsidies from the government,’ Queen Maxima of the Netherlands stated at the 2024 Davos summit.

Queen Maxima of the Netherlands tells the World Economic Forum (WEF) in Davos that digital ID is good for knowing “who actually got a vaccination or not” and for financial inclusion.

On Thursday the Dutch queen continued her crusade to see universal adoption of digital ID because she believes it is good for everything from opening a bank account to enrolling in school and for providing proof of vaccination, aka “vaccine passports.”

It [digital ID] is also good for school enrollment; it is also good for health – who actually got a vaccination or not; it’s very good actually to get your subsidies from the government.

Speaking at the WEF annual meeting panel entitled “Comparing Notes on Financial Inclusion,” Her Majesty said:

In order to open up an account, you need to have an ID. I have to say that when I started this job, there were actually very little countries in Africa or Latin America that had one ubiquitous type of ID, and certainly that was digital and certainly that was biometric.

We’ve really worked with all our partners to actually help grow this, and the interesting part of it is that yes, it is very necessary for financial services, but not only.

Queen Maxima of the Netherlands at WEF in Davos: [Digital ID] is very necessary for financial services, but not only – it is also good for school enrollment; it is also good for health — who actually got a vaccination or not" #DigitalID #WEF24 https://t.co/DJiO8nISih pic.twitter.com/RgYA2ahXS0

— Tim Hinchliffe (@TimHinchliffe) January 18, 2024

Beyond financial services, Queen Maxima said that digital ID was good for proving an individual’s vaccination status:

It is also good for school enrollment; it is also good for health – who actually got a vaccination or not; it’s very good actually to get your subsidies from the government.

The Dutch queen also highlighted that for the past 10 years, she had been working on developing Digital Public Infrastructure (DPI), which is a digital stack consisting of digital ID, digital payments systems like Central Bank Digital Currencies (CBDCs), and massive data sharing.

“We’ve been working in the last 10 years on a notion that we call Digital Public Infrastructure. In our experiences in different countries, to actually have these sort of things that are actually very important,” the queen told the WEF panel.

“One of these is IDs, e-signature, digital ID, so that’s extremely important, even having a QR code legislation is very important,” she added.

Last November, the United Nations and the Bill and Melinda Gates Foundation launched their 50-in-5 campaign to get 50 countries to rollout at least one DPI component within the next five years:

Digital public infrastructure (DPI) – which refers to a secure and interoperable network of components that include digital payments, ID, and data exchange systems – is essential for participation in markets and society in a digital era.

Digital Public Infrastructure (DPI) is essential for countries to improve their economies & the well-being of people.

Join us for the launch of the #50in5 initiative to discuss how building inclusive DPI can foster strong economies & equitable societies: https://t.co/SB2QDNJp2I pic.twitter.com/S01Rpxq1VP

— UNDP Digital (@UNDPDigital) October 25, 2023

As the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development, Queen Maxima has been pushing the digital ID agenda for a number of years.

Wonderful to have @UNSGSA HM Queen Máxima of the Netherlands with us at #ID4D event today highlighting the critical role of #DigitalID in inclusive development: https://t.co/bNRaIulRc7 #GoodID #WBGMeetings pic.twitter.com/nNCO8qP50q

— World Bank Digital Development (@WBG_DigitalDev) April 12, 2019

#UNSGSA Queen Máxima delivered the keynote speech at today’s @WorldBank #ID4D event on inclusive digital ID for a resilient recovery from #COVID-19. Read it here → https://t.co/vD9uYPtA7P #financialinclusion pic.twitter.com/8W2tk2ImIY

— UN SG's Special Advocate Queen Máxima (@UNSGSA) October 21, 2020

Vaccine passports, by their very nature, serve as a form of digital identity, according to the WEF.

And the WEF envisions digital identity being linked to everything from financial services and healthcare records to travel, mobility, and digital governance.

A WEF report on “Reimagining Digital ID” published in June 2023, says:

- “Digital ID may weaken democracy and civil society.”

- “The greatest risks arising from digital ID are exclusion, marginalization and oppression.”

- Requiring any form of ID risks exacerbating fundamental social, political and economic challenges as conditional access of any kind always creates the possibility of discrimination and exclusion.”

This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us

Queen Maxima is also a staunch advocate for Central Bank Digital Currencies (CBDCs), which cannot operate without a digital ID.

According to the Bank for International Settlements (BIS) Annual Economic Report 2021:

The most promising way of providing central bank money in the digital age is an account-based CBDC built on digital ID with official sector involvement…

Identification at some level is hence central in the design of CBDCs. This calls for a CBDC that is account-based and ultimately tied to a digital identity.

#CBDCs can help overcome some barriers facing the unbanked, write Agustín Carstens and H.M. Queen Máxima of the Netherlands, the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development @UNSGSA @koninklijhuis @ProSyn https://t.co/C8VXHvDSZ2 pic.twitter.com/aTqJdeTCa2

— Bank for International Settlements (@BIS_org) April 18, 2022

At this very moment, governments and central banks all over the world are exploring how to implement Central Bank Digital Currencies that are inextricably linked with pegging every citizen to a digital identity.

A CBDC adds another layer to digital ID, in that it can program permissions on purchases.

Speaking at the WEF’s 14th Annual Meeting of the New Champions, aka “Summer Davos,” in Tianjing, China, last year, Cornell University professor Eswar Prasad explained that governments could program CBDCs to restrict undesirable purchases and set expiry dates.

You could have a potentially […] darker world where the government decides that units of central bank money can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort.

"You could have a potentially […] darker world where the government decides that [CBDC] can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort": Eswar Prasad, WEF #AMNC23 pic.twitter.com/KkWgaEWAR5

— Tim Hinchliffe (@TimHinchliffe) June 28, 2023

The theme of this year’s WEF Annual Meeting is “Rebuilding Trust.”

Kicking off the meeting this week in his welcome address, WEF founder Klaus Schwab appointed himself and the Davos crowd “trustees” over humanity’s future.

Reprinted with permission from The Sociable.

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

-

Crime1 hour ago

Crime1 hour agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Business2 days ago

Business2 days agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

Business12 hours ago

Business12 hours agoCanada Hits the Brakes on Population

-

Crime1 day ago

Crime1 day agoBondi Beach Survivor Says Cops Prevented Her From Fighting Back Against Terrorists

-

International1 day ago

International1 day agoHouse Rejects Bipartisan Attempt To Block Trump From Using Military Force Against Venezuela

-

Energy2 days ago

Energy2 days agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Frontier Centre for Public Policy15 hours ago

Frontier Centre for Public Policy15 hours agoCanada Lets Child-Porn Offenders Off Easy While Targeting Bible Believers

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info