Canadian Energy Centre

Critical energy project approved in positive sign for Ontario, Quebec and Michigan

Inside the Enbridge Straits Maritime Operations Center at Michigan’s Straits of Mackinac. Photo courtesy Enbridge

From the Canadian Energy Centre

By Will Gibson

Michigan regulators give green light to Enbridge Line 5 tunnel

A key artery in the network supplying Michigan, Ontario and Quebec with essential petroleum products has cleared a critical hurdle to continue operations.

In December, Michigan’s Public Service Commission approved a US$500 million project to replace about seven kilometres of the existing Line 5 pipeline underwater in the Straits of Mackinac with a new pipeline housed in a concrete tunnel far beneath the lakebed.

“The commission recognized the reality, which is the public needs the Line 5 tunnel and the products it transports,” says Jason Hayes, director of environmental policy at the Mackinac Centre for Public Policy.

“This is how it is supposed to work, although it took more than three years to get there.”

An energy lifeline

The existing Enbridge Line 5 pipeline has operated since 1953. It moves up to 87 million litres of crude oil and natural gas products for use daily between Superior, Wisconsin and Michigan, Ohio, Ontario and Quebec.

“The average person doesn’t always understand how crucial it is. We do in Sarnia,” says Scott Archer, business agent for UA 663, a local union that representing pipe fitters and welders who work in refineries and petrochemical facilities in Sarnia, Ontario.

“Line 5 is the lifeline for Ontario and also provides feedstock for refineries in Quebec. All of our refineries receive their feedstock from it. It’s what provides vehicle fuel for private and public transportation. Trucking and the railroads rely on it. Our agriculture industry uses it to dry crops.”

Artist’s rendering of the Line 5 tunnel project proposed by Enbridge to protect the pipeline under the Great Lakes. Photo courtesy Enbridge

Artist’s rendering of the Line 5 tunnel project proposed by Enbridge to protect the pipeline under the Great Lakes. Photo courtesy Enbridge

The 1,600 members of UA 663 understand that continued operation of Line 5 doesn’t just affect them or their families, Archer says.

“It’s really the entire region,” he says.

“We have 70,000 people who live in this town and almost all of them depend on Line 5 to feed their families and keep a roof over their head.”

The project approval means just as much in Michigan and Ohio, where the Enbridge network supplies refineries in Detroit and Toledo, as well as propane throughout the region.

“Michigan uses more propane than any other state in the lower 48,” Hayes says.

“About 55 per cent of the propane that heats homes and cooks food in our state goes through Line 5 and comes from Sarnia. Half of the jet fuel used at the Detroit International Airport comes from Line 5 feedstock. It’s essential to keep our state going.”

Aerial images of Michigan’s Straits of Mackinac, the communities of St. Ignace and Mackinaw City, and the Mighty Mac bridge spanning the Straits. Photo courtesy Enbridge

Aerial images of Michigan’s Straits of Mackinac, the communities of St. Ignace and Mackinaw City, and the Mighty Mac bridge spanning the Straits. Photo courtesy Enbridge

Additional approvals required

The tunnel project will need the approval of the Army Corps of Engineers at the federal level before Enbridge can start construction. The Army Corps is completing its environmental impact assessment, expected for completion in 2026.

Michigan’s attorney general Dana Nessel also continues to pursue court action in an effort to shut Line 5 down.

“The commission’s decision is still a big win,” Hayes says.

“[It] acknowledges the reality for regular people in Michigan and Ontario, who need fossil fuels, and the products made from them, in their day-to-day lives right now. It makes no sense to oppose a project that seeks to make it safer to transport them.”

Alberta

The beauty of economic corridors: Inside Alberta’s work to link products with new markets

From the Canadian Energy Centre

Q&A with Devin Dreeshen, Minister of Transport and Economic Corridors

CEC: How have recent developments impacted Alberta’s ability to expand trade routes and access new markets for energy and natural resources?

Dreeshen: With the U.S. trade dispute going on right now, it’s great to see that other provinces and the federal government are taking an interest in our east, west and northern trade routes, something that we in Alberta have been advocating for a long time.

We signed agreements with Saskatchewan and Manitoba to have an economic corridor to stretch across the prairies, as well as a recent agreement with the Northwest Territories to go north. With the leadership of Premier Danielle Smith, she’s been working on a BC, prairie and three northern territories economic corridor agreement with pretty much the entire western and northern block of Canada.

There has been a tremendous amount of work trying to get Alberta products to market and to make sure we can build big projects in Canada again.

CEC: Which infrastructure projects, whether pipeline, rail or port expansions, do you see as the most viable for improving Alberta’s global market access?

Dreeshen: We look at everything. Obviously, pipelines are the safest way to transport oil and gas, but also rail is part of the mix of getting over four million barrels per day to markets around the world.

The beauty of economic corridors is that it’s a swath of land that can have any type of utility in it, whether it be a roadway, railway, pipeline or a utility line. When you have all the environmental permits that are approved in a timely manner, and you have that designated swath of land, it politically de-risks any type of project.

CEC: A key focus of your ministry has been expanding trade corridors, including an agreement with Saskatchewan and Manitoba to explore access to Hudson’s Bay. Is there any interest from industry in developing this corridor further?

Dreeshen: There’s been lots of talk [about] Hudson Bay, a trade corridor with rail and port access. We’ve seen some improvements to go to Churchill, but also an interest in the Nelson River.

We’re starting to see more confidence in the private sector and industry wanting to build these projects. It’s great that governments can get together and work on a common goal to build things here in Canada.

CEC: What is your vision for Alberta’s future as a leader in global trade, and how do economic corridors fit into that strategy?

Dreeshen: Premier Smith has talked about C-69 being repealed by the federal government [and] the reversal of the West Coast tanker ban, which targets Alberta energy going west out of the Pacific.

There’s a lot of work that needs to be done on the federal side. Alberta has been doing a lot of the heavy lifting when it comes to economic corridors.

We’ve asked the federal government if they could develop an economic corridor agency. We want to make sure that the federal government can come to the table, work with provinces [and] work with First Nations across this country to make sure that we can see these projects being built again here in Canada.

Alberta

Alberta’s massive oil and gas reserves keep growing – here’s why

From the Canadian Energy Centre

Q&A with Mike Verney, executive vice-president, McDaniel & Associates

New analysis commissioned by the Alberta Energy Regulator has increased the province’s natural gas reserves by 440 per cent, bumping Canada into the global top 10.

Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

The report was conducted by Calgary-based consultancy McDaniel & Associates. Executive vice-president Mike Verney explains what it means.

CEC: What are “reserves” and why do they matter?

Verney: Reserves are commercial quantities of oil and gas to be recovered in the future. They are key indicators of future production potential.

For companies, that’s a way of representing the future value of their operations. And for countries, it’s important to showcase the runway they have in terms of the future of their oil and gas.

Some countries that have exploited a lot of their resource in the past have low reserves remaining. Canada is in a position where we still have a lot of meat on the bone in terms of those remaining quantities.

CEC: How long has it been since Alberta’s oil and gas reserves were comprehensively assessed?

Verney: Our understanding is the last fully comprehensive review was over a decade ago.

CEC: Does improvement in technology and innovation increase reserves?

Verney: Technological advancements and innovation play a crucial role in increasing reserves. New technologies such as advanced drilling techniques (e.g., hydraulic fracturing, horizontal drilling), enhanced seismic imaging and improved extraction methods enable companies to discover and access previously inaccessible reserves.

As these reserves get developed, the evolution of technology helps companies develop them better and better every year.

CEC: Why have Alberta’s natural gas reserves increased?

Verney: Most importantly, hydraulic fracturing has unlocked material volume, and that’s one of the principal reasons why the new gas estimate is so much higher than what it was in the past.

The performance of the wells that are being drilled has also gotten better since the last comprehensive study.

The Montney competes with every American tight oil and gas play, so we’re recognizing the future potential of that with the gas reserves that are being assigned.

In addition, operators continue to expand the footprint of the Alberta Deep Basin.

CEC: Why have Alberta’s oil reserves increased?

Verney: We discovered over two billion barrels of oil reserves associated with multilateral wells, which is a new technology. In a multilateral well, you drill one vertical well to get to the zone and then once you hit the zone you drill multiple legs off of that one vertical spot. It has been a very positive game-changer.

Performance in the oil sands since the last comprehensive update has also gone better than expected. We’ve got 22 thermal oil sands projects that are operating, and in general, expectations in terms of recovery are higher than they were a decade ago.

Oil sands production has grown substantially in the past decade, up 70 per cent, from two million to 3.4 million barrels per day. The growth of several projects has increased confidence in the commercial viability of developing additional lands.

CEC: What are the implications of Alberta’s reserves in terms of the province’s position as a world energy supplier?

Verney: We’re seeing LNG take off in the United States, and we’re seeing lots of demand from data centers. Our estimate is that North America will need at least 30 billion cubic feet per day of more gas supply in the next few years, based on everything that’s been announced. That is a very material number, considering the United States’ total natural gas production is a little over 100 billion cubic feet per day.

In terms of oil, since the shale revolution in 2008 there’s been massive growth from North America, and the rest of the world hasn’t grown oil production. We’re now seeing that the tight plays in the U.S. aren’t infinite and are showing signs of plateauing.

Specifically, when we look at the United States’ largest oil play, the Permian, it has essentially been flat at 5.5 million barrels per day since December 2023. Flat production from the Permian is contrary to the previous decade, where we saw tight oil production grow by half a million barrels per day per year.

Oil demand has gone up by about a million barrels a day per year for the past several decades, and at this point we do expect that to continue, at the very least in the near term.

Given the growing demand for oil and the stagnation in supply growth since the shale revolution, it’s expected that Alberta’s oil sands reserves will become increasingly critical. As global oil demand continues to rise, and with limited growth in production from other sources, oil sands reserves will be relied upon more heavily.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election1 day ago

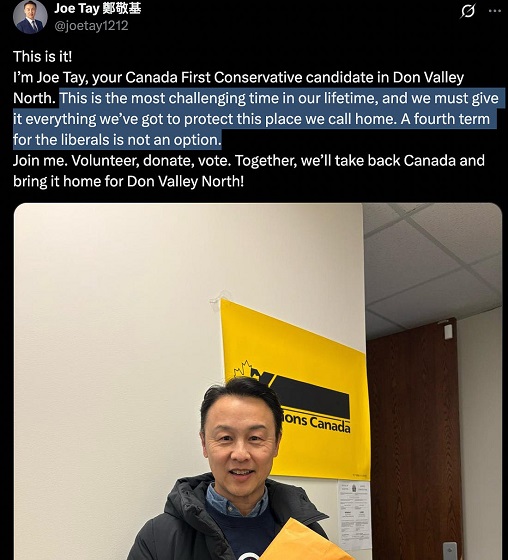

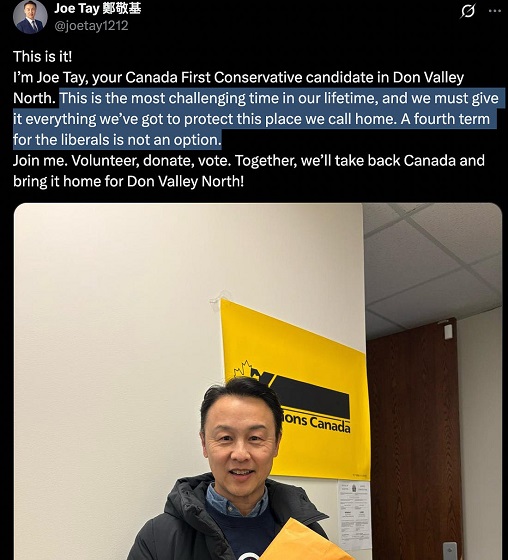

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

Daily Caller18 hours ago

Daily Caller18 hours agoBiden Administration Was Secretly More Involved In Ukraine Than It Let On, Investigation Reveals

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority