Fraser Institute

Cost of Ottawa’s gun ban fiasco may reach $6 billion

From the Fraser Institute

By Gary Mauser

According to the government, it has already spent $67.2 million, which includes compensation for 60 federal employees working on the “buyback,” which still doesn’t exist.

Four years ago, the Trudeau government banned “1,500 types” of “assault-style firearms.” It’s time to ask if public safety has improved as promised.

This ban instantly made it a crime for federally-licensed firearms owners to buy, sell, transport, import, export or use hundreds of thousands formerly legal rifles and shotguns. According to the government, the ban targets “assault-style weapons,” which are actually classic semi-automatic rifles and shotguns that have been popular with hunters and sport shooters for more than 100 years. When announcing the ban, the prime minister said the government would confiscate the banned firearms and their legal owners would be “grandfathered” or receive “fair compensation.” That hasn’t happened.

As of October 2024, the government has revealed no plans about how it will collect the newly-banned firearms nor has it made any provisions for compensation in any federal budget since the announcement in 2020. Originally, the government enacted a two-year amnesty period to allow compliance with the ban. This amnesty expired in April 2022 and has been twice extended, first to Oct. 30, 2023, then to Oct. 30, 2025.

Clearly, the ban—which the government calls a “buyback”—has been a gong show from the beginning. Since Trudeau’s announcement four years ago, virtually none of the banned firearms have been surrendered. The Ontario government refuses to divert police resources to cooperate with this federal “buyback” scheme. The RCMP’s labour union has said it’s a “misdirected effort when it comes to public safety.” The Canadian Sporting Arms & Ammunition Association, which represents firearms retailers, said it will have “zero involvement” in helping confiscate these firearms. Even Canada Post wants nothing to do with Trudeau’s “buyback” plan. And again, the government has revealed no plan for compensation—fair or otherwise.

And yet, according to the government, it has already spent $67.2 million, which includes compensation for 60 federal employees working on the “buyback,” which still doesn’t exist.

It remains unclear just how many firearms the 2020 ban includes. The Parliamentary Budget Officer estimates range between 150,000 to more than 500,000, with an estimated total value between $47 million and $756 million. These costs only include the value of the confiscated firearms and exclude the administrative costs to collect them and the costs of destroying the collected firearms. The total cost of this ban to taxpayers will be more than $4 billion and possibly more than $6 billion.

Nevertheless, while the ban of remains a confusing mess, after four years we should be able to answer one key question. Has the ban made Canadians safer?

According to Statistics Canada, firearm-related violent crime swelled by 10 per cent from 2020 to 2022 (the latest year of comparable data), from 12,614 incidents to 13,937 incidents. And in “2022, the rate of firearm-related violent crime was 36.7 incidents per 100,000 population, an 8.9% increase from 2021 (33.7 incidents per 100,000 population). This is the highest rate recorded since comparable data were first collected in 2009.”

Nor have firearm homicides decreased since 2020. Perhaps this is because lawfully-held firearms are not the problem. According to StatsCan, “the firearms used in homicides were rarely legal firearms used by their legal owners.” However, crimes committed by organized crime have increased by more than 170 per cent since 2016 (from 4,810 to 13,056 crimes).

Meanwhile, the banned firearms remain locked in the safes of their legal owners who have been vetted by the RCMP and are monitored nightly for any infractions that might endanger public safety.

Indeed, hunters and sport shooters are among the most law-abiding people in Canada. Many Canadian families and Indigenous peoples depend on hunting to provide food for the family dinner table through legal harvesting, with the added benefit of getting out in the wilderness and spending time with family and friends. In 2015, hunting and firearm businesses alone contributed more than $5.9 billion to Canada’s economy and supported more than 45,000 jobs. Hunters are the largest contributors to conservation efforts, contributing hundreds of millions of dollars to secure conservation lands and manage wildlife. The number of licensed firearms owners has increased 17 per cent since 2015 (from 2.026 million to 2.365 million) in 2023.

If policymakers in Ottawa and across the country want to reduce crime and increase public safety, they should enact policies that actually target criminals and use our scarce tax dollars wisely to achieve these goals.

Author:

Alberta

Falling resource revenue fuels Alberta government’s red ink

From the Fraser Institute

By Tegan Hill

According to this week’s fiscal update, amid falling oil prices, the Alberta government will run a projected $6.4 billion budget deficit in 2025/26—higher than the $5.2 billion deficit projected earlier this year and a massive swing from the $8.3 billion surplus recorded in 2024/25.

Overall, that’s a $14.8 billion deterioration in Alberta’s budgetary balance year over year. Resource revenue, including oil and gas royalties, comprises 44.5 per cent of that decline, falling by a projected $6.6 billion.

Albertans shouldn’t be surprised—the good times never last forever. It’s all part of the boom-and-bust cycle where the Alberta government enjoys budget surpluses when resource revenue is high, but inevitably falls back into deficits when resource revenue declines. Indeed, if resource revenue was at the same level as last year, Alberta’s budget would be balanced.

Instead, the Alberta government will return to a period of debt accumulation with projected net debt (total debt minus financial assets) reaching $42.0 billion this fiscal year. That comes with real costs for Albertans in the form of high debt interest payments ($3.0 billion) and potentially higher taxes in the future. That’s why Albertans need a new path forward. The key? Saving during good times to prepare for the bad.

The Smith government has made some strides in this direction by saving a share of budget surpluses, recorded over the last few years, in the Heritage Fund (Alberta’s long-term savings fund). But long-term savings is different than a designated rainy-day account to deal with short-term volatility.

Here’s how it’d work. The provincial government should determine a stable amount of resource revenue to be included in the budget annually. Any resource revenue above that amount would be automatically deposited in the rainy-day account to be withdrawn to support the budget (i.e. maintain that stable amount) in years when resource revenue falls below that set amount.

It wouldn’t be Alberta’s first rainy-day account. Back in 2003, the province established the Alberta Sustainability Fund (ASF), which was intended to operate this way. Unfortunately, it was based in statutory law, which meant the Alberta government could unilaterally change the rules governing the fund. Consequently, by 2007 nearly all resource revenue was used for annual spending. The rainy-day account was eventually drained and eliminated entirely in 2013. This time, the government should make the fund’s rules constitutional, which would make them much more difficult to change or ignore in the future.

According to this week’s fiscal update, the Alberta government’s resource revenue rollercoaster has turned from boom to bust. A rainy-day account would improve predictability and stability in the future by mitigating the impact of volatile resource revenue on the budget.

Energy

Mistakes and misinformation by experts cloud discussions on energy

From the Fraser Institute

By Jason Clemens and Elmira Aliakbari

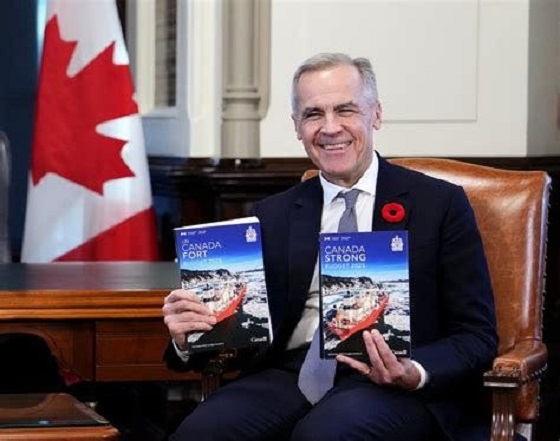

The new agreement (MOU) between the Carney and Alberta governments sets the foundation for a pipeline from Alberta to the British Columbia coast, at least conceptually. Unfortunately, many politicians and commentators, including the bureau chiefs for the Globe and Mail and Toronto Star, continue to get many energy facts wrong, which impairs the discussions of how best the country can and should move forward to capitalize on our natural resources.

For example, commentors often wrongly describe the tanker ban on the west coast (C-48) as a general ban on oil tankers. But in reality, the law only applies to tankers docking at Canadian ports. It does not and cannot prevent tankers from travelling the west coast so long as they’re not stationing at Canadian ports. This explains the continued oil tanker traffic in the northwest region for tankers docking in U.S. ports in Alaska. Simply put, there is not a general tanker ban on the west coast.

Commentators also continue to misrepresent the current capacity on the expanded Trans Mountain pipeline (TMX). According to the Canada Energy Regulator (CER), the average utilization of the TMX since it came online in June 2024 is 82 per cent (reaching as high as 89 per cent in March 2025). So, while there’s some room for additional oil transportation via TMX, it’s nowhere close to the “doubling” being discussed in central Canada. Critically, though, according to the CER, from “June 2024 to June 2025, committed capacity was effectively fully utilized each month, averaging 99% utilization.”

Similarly, there’s a misunderstanding by many in central Canada regarding the potential restart of the Keystone XL pipeline, which apparently President Trump is keen on. Keystone would not diversify Canada’s exports because while oil does make its way down to the southern U.S. where it can be exported, the actual sale of Canadian oil is to U.S. refineries, so our reliance on the U.S. as our near-sole export market would continue unless a west and/or east coast pipeline is developed.

There also continues to be an artificial and costly connection made between Ottawa removing the arbitrary emissions cap on greenhouse gases by the oil and gas sector and the approval of a new pipeline with the proposed Pathways carbon capture project, which is a collaboration between five of Canada’s largest oil producers. This connection was galvanized in the MOU.

The idea behind the project is to reduce (conceptually) the amount of greenhouse gas (GHG) emitted from oil extraction and transportation projects linked with Pathways. The Pathways project produces no economic value or product—it simply collects and stores GHG emissions—and reports suggest the total cost for the first phase of the project will reach $16.5 billion.

Should Canadians care about adding costs related to GHG mitigation? There are several factors to consider. First, Canada is already a low-GHG emitting producer of oil. According to the Carney government’s first budget (page 105, chart 1.5 which ranks the world’s 20 top oil producers based on their GHG emissions per unit of output), Canada already ranks 7th-lowest in terms of emissions. And more importantly, it’s lower than every country—Venezuela, Russia, Iraq and Mexico—that produces a similar type of oil as Canada. Any resources spent further reducing GHG emissions via carbon capture will result in small incremental gains contrasted with large costs (again, at least $16.5 billion). A number of analysts have already raised concerns about the investment and competitiveness implications of increasing the cost structures for Alberta producers.

Second, according to the federal government, in 2022 Canada produced 1.4 per cent of global GHG emissions, and the oil and gas sector produced roughly one-quarter of those emissions. In other words, if Canada eliminated all GHG emissions from the oil sector via carbon capture, the process would consume vast amounts of scarce resources (i.e. money) and result in a nearly undetectable change in global GHG emissions. One can only conclude that this is much more about international virtue-signalling than the actual economics and environmental implications of Canada’s potential energy projects.

At a time when Canada is struggling with crisis levels of private business investment, falling living standards and as the Bank of Canada described, a break-the-glass crisis in productivity growth, it’s clearly not wise to spend tens of billions of dollars on projects that might make politicians and bureaucrats feel better and enable them to use near Orwellian language like “zero-emissions oil” but that actually deliver almost no detectable environmental benefits.

To borrow our prime minister’s favourite phrase, kickstarting Canada’s oil and gas sector is the easiest way to catalyze economic growth given our vast energy reserves, know-how in the sector, and high productivity. To do so, we need a national dialogue rooted in facts.

-

Alberta2 days ago

Alberta2 days agoFrom Underdog to Top Broodmare

-

Business2 days ago

Business2 days agoMan overboard as HMCS Carney lists to the right

-

Business2 days ago

Business2 days agoHigher carbon taxes in pipeline MOU are a bad deal for taxpayers

-

Alberta2 days ago

Alberta2 days agoREAD IT HERE – Canada-Alberta Memorandum of Understanding – From the Prime Minister’s Office

-

Daily Caller2 days ago

Daily Caller2 days agoZelenskyy Under Siege As Top Aide Resigns After Home Raided In Major Corruption Scandal

-

Alberta2 days ago

Alberta2 days agoIEA peak-oil reversal gives Alberta long-term leverage

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoHealthcare And Pipelines Are The Front Lines of Canada’s Struggle To Stay United

-

Alberta1 day ago

Alberta1 day agoAlberta can’t fix its deficits with oil money: Lennie Kaplan