Housing

Conservative leader Pierre Poilievre’s video on Canada’s housing crisis under Trudeau gov’t goes viral

From LifeSiteNews

‘Housing hell: How we got here and how we get out’ has been viewed more than four million times.

A video by Conservative Party of Canada (CPC) leader Pierre Poilievre exposing the country’s housing prices and supply crisis, which a taxpayer watchdog said is being fueled by high-interest rates from bad fiscal policy by Prime Minister Justin Trudeau’s government, has reached over 4 million views.

“Something new and strange has happened in Canada. Canada is sitting on probably one of the largest housing bubbles of all times, something we haven’t seen before,” Poilievre said in his 15-minute video titled Housing hell: How we got here and how we get out.

“An entire generation of youth now say they will never be able to afford a home. This is not normal for Canada.”

Housing hell: How we got here and how we get out. pic.twitter.com/vVLsXMVM35

— Pierre Poilievre (@PierrePoilievre) December 2, 2023

The video goes deep into Canada’s housing market and includes statistics on why it is in such a dire state. It currently has 4.2 million views on X (formerly Twitter) after it was released on December 2.

Poilievre documents in his video, using facts to back him up, that in the coming months and years “tens of thousands of Canadians could default on their mortgages” due to skyrocketing interest rates.

He noted how the “nightmare scenario” after “generations of affordable and stable Canadian home prices” means that 66% of a person’s average monthly income is to simply “make payments on the average single detached Canadian house.”

“Given that most of the remaining 34 percent of the family paycheck is taken out by taxes, there’s literally nothing left for food and recreation,” Poilievre noted.

Taxpayer watchdog says high house prices due to Trudeau’s out of ‘control’ government

Franco Terrazzano, federal director for the Canadian Taxpayers Federation (CTF), told LifeSiteNews that the reason house prices, along with everything else, are more expensive is due to Trudeau’s “out of control” governmental spending.

“Trudeau’s never-ending deficits and the hundreds of billions of dollars the Bank of Canada printed during the pandemic are driving up the cost of everything,” Terrazzano told LifeSiteNews.

“Life is more expensive because the cost of government is out of control.”

Terrazzano noted that governmental fiscal policy is making home prices more expensive and thus out of reach for most. He said what needs to happen is a reduction in red tape.

“Taxes and onerous government regulations are making homes more expensive,” Terrazzano told LifeSiteNews.

“If governments want to make homes more affordable, they would cut taxes and the red tape that makes it harder and more expensive to build homes.”

Terrazzano highlighted a report from the C.D. Howe Institute that shows the cost of excessive government regulations on home building.

As for Poilievre, he observed how it now would take a staggering 25 years just to save enough money to make a downpayment for a simple home in Toronto.

He continued, noting how newlyweds now on average pay $1,000 per month to rent a “single room in a townhouse that they share with two other couples.”

He also raised the issue of how 35-year-olds “live in their parent’s basements” and “rents are so high in Toronto that students live in homeless shelters.”

When it comes to middle-class workers, Poilievre emphasized how “people like nurses and carpenters now live in their vehicles.”

While housing falls primarily under provincial and municipal jurisdiction, some areas, such as interest rates, are directly influenced by the federal government.

House prices have shot up in Canada due to short supply in the market, and speculative buying and interest rates have risen to highs not seen for decades. As it stands, Canada’s interest rate sits at 5%. At this same time in 2021, interest rates were 0.25%.

This past Wednesday, the Bank of Canada decided to keep rates at 5% but did not rule out future rate increases, as it “is still concerned about risks to the outlook for inflation and remains prepared to raise the policy rate further if needed.”

Interestingly, Trudeau put out a video the same day as Poilievre that he said was to address housing challenges. This video only has 264,000 views, however.

Curiously, Poilievre made no mention of Canada’s high immigration levels, which critics say has put a strain on an already tight supply.

Maxime Bernier, leader of the People’s Party of Canada, has been one of the only party leaders to call out high immigration levels and their effects on housing.

Trudeau’s ‘money printing’ pouring fuel on ‘inflationary fire’

According to Poilievre in his video, in the past one could save enough to buy a house by their mid-20s but said this “changed” about “eight years ago” when Trudeau came to power.

“When the government borrows and spends, it builds up the goods we buy and the interest we pay. The Trudeau government has doubled Canada’s debt, adding more debt than all prime ministers combined. Our finance minister has conceded that this deficit spending pours fuel on the inflationary fire,” Poilievre said.

He observed how excessive money printing through a banking scheme called “quantitative easing” has only benefited well-connected banking insiders and financial institutions that are awash with money.

“In recent years, the Trudeau government spending has exploded, and they’ve been borrowing more than lenders will lend. So, the Bank of Canada has started creating the cash. The money supply has therefore grown eight times faster than the economy over the last three years,” Poilievre said.

“More money bidding on fewer goods, including fewer houses, equals higher prices.”

Poilievre ended his video by stating that the “good news is housing costs were not like this before Justin Trudeau.”

“And they won’t be like this after he’s gone,” he added.

He said that the solution, besides a change in leadership, is for all levels of government to work together to cut red tape and taxes to encourage the construction of new homes.

Under Trudeau, mainly due to excessive COVID money printing, inflation has skyrocketed.

A recent report from September 5 by Statistics Canada shows food prices are rising faster than headline inflation at a rate of between 10% and 18% per year.

Earlier this year, the Bank of Canada acknowledged that Trudeau’s federal “climate change” programs, which have been deemed “extreme” by some provincial leaders, are indeed helping to fuel inflation.

2025 Federal Election

Voters should remember Canada has other problems beyond Trump’s tariffs

From the Fraser Institute

By Jake Fuss and Grady Munro

Canadians will head to the polls on April 28 after Prime Minister Mark Carney called a snap federal election on Sunday. As the candidates make their pitch to try and convince Canadians why they’re best-suited to lead the country, Trump’s tariffs will take centre stage. But while the tariff issue is important, let’s not forget the other important issues Canadians face.

High Taxes: As many Canadians struggle to make ends meet, taxes remain the largest single expense. In 2023, the latest year of available data, the average Canadian family spent 43.0 per cent of its income on taxes compared to 35.6 per cent on food, shelter and clothing combined. High personal income tax rates also make it harder to attract and retain doctors, engineers and other high-skilled workers that contribute to the economy. Tax relief, which delivers savings for families across the income spectrum while also improving Canada’s competitiveness on the world stage, is long overdue.

Government Debt: At the end of March, Canada’s total federal debt will reach a projected $2.2 trillion or $52,094 for every man, woman and child in Canada. The federal government expects to pay $53.7 billion in debt interest costs in fiscal year 2024/25, diverting taxpayer dollars away from programs including health care and social services. The next federal government should rein in spending and stop racking up debt.

Red Tape: Smart regulation is necessary, but the Canadian economy is plagued by a costly and excessive regulatory burden imposed by governments. Regulatory compliance costs the economy approximately $12.2 billion each year, and the average business dedicates an estimated 85 days towards compliance. The next federal government should cut undue red tape and make Canada an easier place to do business.

Housing Affordability: Canadians across the country are struggling with the cost of housing. Indeed, Canada has the largest gap between home prices and incomes among G7 countries, and rents have spiked in recent years in many cities. In short, there’s not enough housing to meet demand. The next federal government should avoid policies that stoke further demand while working with the provinces and municipalities to remove impediments to homebuilding across Canada.

Collapsing Business Investment: Business investment is necessary to equip workers with the tools, technology and training they need to be more productive, yet business investment has collapsed. Specifically, from 2014 to 2021, inflation-adjusted business investment per worker fell from $18,363 to $14,687. Declining investment has helped create Canada’s productivity crisis, which has led to a decline in Canadian living standards. Clearly, Ottawa needs a new policy approach to address this crisis.

Declining Living Standards: According to Statistics Canada, inflation-adjusted per-person GDP—a broad measure of living standards—dropped from the post-pandemic peak of $60,718 in mid-2022 to $58,951 by the end of 2024. The next government should swiftly reverse this trend by enacting meaningful policy reforms that will help promote prosperity. The status quo simply will not suffice.

Tariffs are a clear threat to the Canadian economy and should be discussed at length during this election. But we shouldn’t forget other important issues that arose long before President Trump began this trade war and will continue to hurt Canadians if not addressed.

Business

CMHC dished out $30 million in bonuses in 2024

By Ryan Thorpe

The Canada Mortgage and Housing Corporation rubberstamped $30.8 million in bonuses in 2024, according to government records obtained by the Canadian Taxpayers Federation.

That pushes total bonuses at the CMHC up to $132 million since the beginning of 2020.

“Why are Canada’s housing bureaucrats showering themselves with bonuses when countless Canadians can’t afford homes?” said Franco Terrazzano, CTF Federal Director. “Canadians need more homes, not more highly paid pencil pushers rubberstamping bonuses for each other.”

A total of 2,398 CMHC staff (91 per cent of its employees) took $30.8 million in bonuses in 2024 – for an average of $12,865 each.

The records show that 12 CMHC executives took a combined $1 million in bonuses last year – for an average of $83,859 each.

The CMHC also issued 2,190 pay raises to staff in 2024, costing taxpayers $9.3 million. No employees took a pay cut, according to the records.

The CMHC has repeatedly claimed it’s “driven by one goal: housing affordability for all.”

In 2024, the Royal Bank of Canada said it was the “toughest time ever to afford a home.”

Last year, polling from Ipsos found 72 per cent of Canadians who do not own a home say “they have given up on ever owning” one.

Eighty per cent of respondents to that poll also said home ownership in Canada is now “only for the rich.”

The Canadian Real Estate Association, in its latest housing outlook report, predicted the average home price will “climb by 4.7 per cent on an annual basis to $722,221 in 2025.”

“The CMHC’s c-suite deserve pink slips more than huge bonuses,” Terrazzano said. “The federal government must stop rewarding failure with taxpayer-funded bonuses.”

Undeserved bonuses are a longstanding tradition in Ottawa.

The federal government has awarded $1.5 billion in bonuses since 2015, despite the fact that “less than 50 per cent of [performance] targets are consistently met within the same year,” according to the Parliamentary Budget Officer.

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre To Create ‘Canada First’ National Energy Corridor

-

2025 Federal Election1 day ago

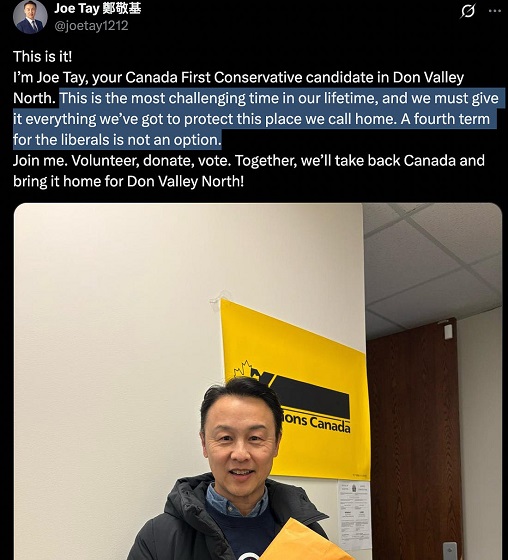

2025 Federal Election1 day agoJoe Tay Says He Contacted RCMP for Protection, Demands Carney Fire MP Over “Bounty” Remark

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoChinese Election Interference – NDP reaction to bounty on Conservative candidate

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHong Kong-Canadian Groups Demand PM Carney Drop Liberal Candidate Over “Bounty” Remark Supporting CCP Repression

-

Daily Caller17 hours ago

Daily Caller17 hours agoBiden Administration Was Secretly More Involved In Ukraine Than It Let On, Investigation Reveals

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoLondon-Based Human Rights Group Urges RCMP to Investigate Liberal MP for Possible Counselling of Kidnapping

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoAlcohol tax and MP pay hike tomorrow (April 1)

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoFixing Canada’s immigration system should be next government’s top priority