Uncategorized

Colorado man gets life for killing pregnant wife, 2 girls

DENVER — A Colorado man was sentenced Monday to life in prison for killing his pregnant wife and their two young daughters and dumping their bodies on an oil work site.

Prosecutors have said they agreed not to seek the death penalty in exchange for Christopher Watts’ guilty plea, after seeking approval from Shanann Watts’ family.

Watts had pleaded guilty to three charges of murder in the deaths of his wife, Shanann Watts, and their young daughters. He also pleaded guilty on Nov. 6 to two counts of killing a child, one count of unlawful termination of a pregnancy and three counts of tampering with a deceased human body.

The 33-year-old will not be eligible for parole.

A friend asked police to check on Shanann Watts on Aug. 13 after not being able to reach her and growing concerned that the 34-year-old expectant mother had missed a doctor’s appointment. Officers initially handled the search and soon sought support from Colorado investigators and the FBI.

Meanwhile, Christopher Watts spoke to local television reporters from the front porch of the family’s home in Frederick, a small town on the plains north of Denver where drilling rigs and oil wells surround booming subdivisions. Watts pleaded for his family safe return, telling reporters their house felt empty without 4-year-old Bella and 3-year-old Celeste watching cartoons or running to greet him at the door.

Within days, he was arrested and charged with killing his family.

Court records revealed that Watts acknowledged to police that he killed his wife. Watts told investigators that he strangled her in “a rage” when he discovered she had killed their daughters after he sought a separation.

Prosecutors have since called his account “a flat-out lie.”

Police learned that Christopher Watts was having an affair with a co-worker. He had denied that before being arrested.

Authorities have not released autopsy reports or any information about how the mother and daughters died. Prosecutors have said the reports would be released after Watts was sentenced.

The girls’ bodies were found submerged in an oil tank, on property owned by the company Watts worked for until his arrest. Shanann Watts’ body was found buried nearby in a shallow grave.

The killings captured the attention of media across the country and became the focus of true crime blogs and online video channels, aided by dozens of family photos and videos that Shanann Watts shared on social media showing the smiling couple spending time with their children.

But courts records showed the couple’s lifestyle caused financial strain at times. They filed for bankruptcy in June 2015, six months after Christopher Watts was hired as an operator for the large oil and gas driller Anadarko Petroleum at an annual salary of about $61,500. At the time, Shanann Watts was working in a children’s hospital call

They reported total earnings of $90,000 in 2014 but $70,000 in unsecured claims along with a mortgage of nearly $3,000. The claims included thousands of dollars in credit card debt, some student loans and medical bills.

Kathleen Foody, The Associated Press

Uncategorized

Cost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

The cost of the bureaucracy increased by $6 billion last year, according to newly released numbers in Public Accounts disclosures. The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to immediately shrink the bureaucracy.

“The Public Accounts show the cost of the federal bureaucracy is out of control,” said Franco Terrazzano, CTF Federal Director. “Tinkering around the edges won’t cut it, Carney needs to take urgent action to shrink the bloated federal bureaucracy.”

The federal bureaucracy cost taxpayers $71.4 billion in 2024-25, according to the Public Accounts. The cost of the federal bureaucracy increased by $6 billion, or more than nine per cent, over the last year.

The federal bureaucracy cost taxpayers $39.6 billion in 2015-16, according to the Public Accounts. That means the cost of the federal bureaucracy increased 80 per cent over the last 10 years. The government added 99,000 extra bureaucrats between 2015-16 and 2024-25.

Half of Canadians say federal services have gotten worse since 2016, despite the massive increase in the federal bureaucracy, according to a Leger poll.

Not only has the size of the bureaucracy increased, the cost of consultants, contractors and outsourcing has increased as well. The government spent $23.1 billion on “professional and special services” last year, according to the Public Accounts. That’s an 11 per cent increase over the previous year. The government’s spending on professional and special services more than doubled since 2015-16.

“Taxpayers should not be paying way more for in-house government bureaucrats and way more for outside help,” Terrazzano said. “Mere promises to find minor savings in the federal bureaucracy won’t fix Canada’s finances.

“Taxpayers need Carney to take urgent action and significantly cut the number of bureaucrats now.”

Table: Cost of bureaucracy and professional and special services, Public Accounts

| Year | Bureaucracy | Professional and special services |

|

$71,369,677,000 |

$23,145,218,000 |

|

|

$65,326,643,000 |

$20,771,477,000 |

|

|

$56,467,851,000 |

$18,591,373,000 |

|

|

$60,676,243,000 |

$17,511,078,000 |

|

|

$52,984,272,000 |

$14,720,455,000 |

|

|

$46,349,166,000 |

$13,334,341,000 |

|

|

$46,131,628,000 |

$12,940,395,000 |

|

|

$45,262,821,000 |

$12,950,619,000 |

|

|

$38,909,594,000 |

$11,910,257,000 |

|

|

$39,616,656,000 |

$11,082,974,000 |

Uncategorized

Trump Admin Establishing Council To Make Buildings Beautiful Again

From the Daily Caller News Foundation

By Jason Hopkins

The Trump administration is creating a first-of-its-kind task force aimed at ushering in a new “Golden Age” of beautiful infrastructure across the U.S.

The Department of Transportation (DOT) will announce the establishment of the Beautifying Transportation Infrastructure Council (BTIC) on Thursday, the Daily Caller News Foundation exclusively learned. The BTIC seeks to advise Transportation Secretary Sean Duffy on design and policy ideas for key infrastructure projects, including highways, bridges and transit hubs.

“What happened to our country’s proud tradition of building great, big, beautiful things?” Duffy said in a statement shared with the DCNF. “It’s time the design for America’s latest infrastructure projects reflects our nation’s strength, pride, and promise.”

“We’re engaging the best and brightest minds in architectural design and engineering to make beautiful structures that move you and bring about a new Golden Age of Transportation,” Duffy continued.

Mini scoop – here is the DOT’s rollout of its Beautifying Transportation Infrastructure Council, which will be tasked with making our buildings beautiful again. pic.twitter.com/

9iV2xSxdJM — Jason Hopkins (@jasonhopkinsdc) October 23, 2025

The DOT is encouraging nominations of the country’s best architects, urban planners, artists and others to serve on the council, according to the department. While ensuring that efficiency and safety remain a top priority, the BTIC will provide guidance on projects that “enhance” public areas and develop aesthetic performance metrics.

The new council aligns with an executive order signed by President Donald Trump in August 2025 regarding infrastructure. The “Making Federal Architecture Beautiful Again” order calls for federal public buildings in the country to “respect regional architectural heritage” and aims to prevent federal construction projects from using modernist and brutalist architecture styles, instead returning to a classical style.

“The Founders, in line with great societies before them, attached great importance to Federal civic architecture,” Trump’s order stated. “They wanted America’s public buildings to inspire the American people and encourage civic virtue.”

“President George Washington and Secretary of State Thomas Jefferson consciously modeled the most important buildings in Washington, D.C., on the classical architecture of ancient Athens and Rome,” the order continued. “Because of their proven ability to meet these requirements, classical and traditional architecture are preferred modes of architectural design.”

The DOT invested millions in major infrastructure projects since Trump’s return to the White House. Duffy announced in August a $43 million transformation initiative of the New York Penn Station in New York City and in September unveiledmajor progress in the rehabilitation and modernization of Washington Union Station in Washington, D.C.

The BTIC will comprise up to 11 members who will serve two-year terms, with the chance to be reappointed, according to the DOT. The task force will meet biannually. The deadline for nominations will end Nov. 21.

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Energy2 days ago

Energy2 days agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Energy2 days ago

Energy2 days agoEnergy security matters more than political rhetoric

-

Business7 hours ago

Business7 hours agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

armed forces1 day ago

armed forces1 day agoOttawa’s Newly Released Defence Plan Crosses a Dangerous Line

-

Energy7 hours ago

Energy7 hours agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex5 hours ago

Censorship Industrial Complex5 hours agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

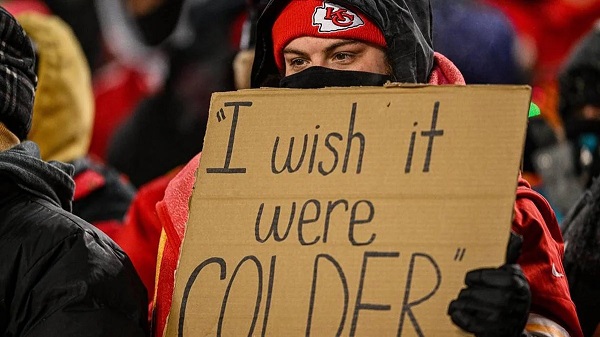

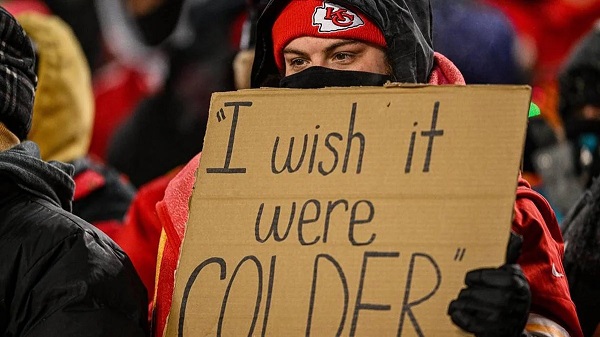

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria