Alberta

Clear Answers Required

Of all the discouraging messages inundating the worldwide sports arena these days, it’s entirely likely that the most lamentable — about Canadian football, at least — was issued this week by Alberta Golden Bears head coach Chris Morris. “The CFL’s probably not going to have a season,” he said.

Alberta

Canada’s heavy oil finds new fans as global demand rises

From the Canadian Energy Centre

By Will Gibson

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices”

Once priced at a steep discount to its lighter, sweeter counterparts, Canadian oil has earned growing admiration—and market share—among new customers in Asia.

Canada’s oil exports are primarily “heavy” oil from the Alberta oil sands, compared to oil from more conventional “light” plays like the Permian Basin in the U.S.

One way to think of it is that heavy oil is thick and does not flow easily, while light oil is thin and flows freely, like fudge compared to apple juice.

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices,” said Susan Bell, senior vice-president of downstream research with Rystad Energy.

A narrowing price gap

Alberta’s heavy oil producers generally receive a lower price than light oil producers, partly a result of different crude quality but mainly because of the cost of transportation, according to S&P Global.

The “differential” between Western Canadian Select (WCS) and West Texas Intermediate (WTI) blew out to nearly US$50 per barrel in 2018 because of pipeline bottlenecks, forcing Alberta to step in and cut production.

So far this year, the differential has narrowed to as little as US$10 per barrel, averaging around US$12, according to GLJ Petroleum Consultants.

“The differential between WCS and WTI is the narrowest I’ve seen in three decades working in the industry,” Bell said.

Trans Mountain Expansion opens the door to Asia

Oil tanker docked at the Westridge Marine Terminal in Burnaby, B.C. Photo courtesy Trans Mountain Corporation

The price boost is thanks to the Trans Mountain expansion, which opened a new gateway to Asia in May 2024 by nearly tripling the pipeline’s capacity.

This helps fill the supply void left by other major regions that export heavy oil – Venezuela and Mexico – where production is declining or unsteady.

Canadian oil exports outside the United States reached a record 525,000 barrels per day in July 2025, the latest month of data available from the Canada Energy Regulator.

China leads Asian buyers since the expansion went into service, along with Japan, Brunei and Singapore, Bloomberg reports.

Asian refineries see opportunity in heavy oil

“What we are seeing now is a lot of refineries in the Asian market have been exposed long enough to WCS and now are comfortable with taking on regular shipments,” Bell said.

Kevin Birn, chief analyst for Canadian oil markets at S&P Global, said rising demand for heavier crude in Asia comes from refineries expanding capacity to process it and capture more value from lower-cost feedstocks.

“They’ve invested in capital improvements on the front end to convert heavier oils into more valuable refined products,” said Birn, who also heads S&P’s Center of Emissions Excellence.

Refiners in the U.S. Gulf Coast and Midwest made similar investments over the past 40 years to capitalize on supply from Latin America and the oil sands, he said.

While oil sands output has grown, supplies from Latin America have declined.

Mexico’s state oil company, Pemex, reports it produced roughly 1.6 million barrels per day in the second quarter of 2025, a steep drop from 2.3 million in 2015 and 2.6 million in 2010.

Meanwhile, Venezuela’s oil production, which was nearly 2.9 million barrels per day in 2010, was just 965,000 barrels per day this September, according to OPEC.

The case for more Canadian pipelines

Worker at an oil sands SAGD processing facility in northern Alberta. Photo courtesy Strathcona Resources

“The growth in heavy demand, and decline of other sources of heavy supply has contributed to a tighter market for heavy oil and narrower spreads,” Birn said.

Even the International Energy Agency, known for its bearish projections of future oil demand, sees rising global use of extra-heavy oil through 2050.

The chief impediments to Canada building new pipelines to meet the demand are political rather than market-based, said both Bell and Birn.

“There is absolutely a business case for a second pipeline to tidewater,” Bell said.

“The challenge is other hurdles limiting the growth in the industry, including legislation such as the tanker ban or the oil and gas emissions cap.”

A strategic choice for Canada

Because Alberta’s oil sands will continue a steady, reliable and low-cost supply of heavy oil into the future, Birn said policymakers and Canadians have options.

“Canada needs to ask itself whether to continue to expand pipeline capacity south to the United States or to access global markets itself, which would bring more competition for its products.”

Alberta

Gondek’s exit as mayor marks a turning point for Calgary

This article supplied by Troy Media.

The mayor’s controversial term is over, but a divided conservative base may struggle to take the city in a new direction

Calgary’s mayoral election went to a recount. Independent candidate Jeromy Farkas won with 91,112 votes (26.1 per cent). Communities First candidate Sonya Sharp was a very close second with 90,496 votes (26 per cent) and controversial incumbent mayor Jyoti Gondek finished third with 71,502 votes (20.5 per cent).

Gondek’s embarrassing tenure as mayor is finally over.

Gondek’s list of political and economic failures in just a single four-year term could easily fill a few book chapters—and most likely will at some point. She declared a climate emergency on her first day as Calgary’s mayor that virtually no one in the city asked for. She supported a four per cent tax increase during the COVID-19 pandemic, when many individuals and families were struggling to make ends meet. She snubbed the Dec. 2023 menorah lighting during Hanukkah because speakers were going to voice support for Israel a mere two months after the country was attacked by the bloodthirsty terrorist organization Hamas. The

Calgary Party even accused her last month of spending over $112,000 in taxpayers’ money for an “image makeover and brand redevelopment” that could have benefited her re-election campaign.

How did Gondek get elected mayor of Calgary with 176,344 votes in 2021, which is over 45 per cent of the electorate?

“Calgary may be a historically right-of-centre city,” I wrote in a recent National Post column, “but it’s experienced some unusual voting behaviour when it comes to mayoral elections. Its last three mayors, Dave Bronconnier, Naheed Nenshi and Gondek, have all been Liberal or left-leaning. There have also been an assortment of other Liberal mayors in recent decades like Al Duerr and, before he had a political epiphany, Ralph Klein.”

In fairness, many Canadians used to support the concept of balancing their votes in federal, provincial and municipal politics. I knew of some colleagues, friends and family members, including my father, who used to vote for the federal Liberals and Ontario PCs. There were a couple who supported the federal PCs and Ontario Liberals in several instances. In the case of one of my late

grandfathers, he gave a stray vote for Brian Mulroney’s federal PCs, the NDP and even its predecessor, the Co-operative Commonwealth Federation.

That’s not the case any longer. The more typical voting pattern in modern Canada is one of ideological consistency. Conservatives vote for Conservative candidates, Liberals vote for Liberal candidates, and so forth. There are some rare exceptions in municipal politics, such as the late Toronto mayor Rob Ford’s populistconservative agenda winning over a very Liberal city in 2010. It doesn’t happen very often these days, however.

I’ve always been a proponent of ideological consistency. It’s a more logical way of voting instead of throwing away one vote (so to speak) for some perceived model of political balance. There will always be people who straddle the political fence and vote for different parties and candidates during an election. That’s their right in a democratic society, but it often creates a type of ideological inconsistency that doesn’t benefit voters, parties or the political process in general.

Calgary goes against the grain in municipal politics. The city’s political dynamics are very different today due to migration, immigration and the like. Support for fiscal and social conservatism may still exist in Alberta, but the urban-rural split has become more profound and meaningful than the historic left-right divide. This makes the task of winning Calgary in elections more difficult for today’s provincial and federal Conservatives, as well as right-leaning mayoral candidates.

That’s what we witnessed during the Oct. 20 municipal election. Some Calgary Conservatives believed that Farkas was a more progressive-oriented conservative or centrist with a less fiscally conservative plan and outlook for the city. They viewed Sharp, the leader of a right-leaning municipal party founded last December, as a small “c” conservative and much closer to their ideology. Conversely, some Calgary Conservatives felt that Farkas, and not Sharp, would be a better Conservative option for mayor because he seemed less ideological in his outlook.

When you put it all together, Conservatives in what used to be one of the most right-leaning cities in a historically right-leaning province couldn’t decide who was the best political option available to replace the left-wing incumbent mayor. Time will tell if they chose wisely.

Fortunately, the razor-thin vote split didn’t save Gondek’s political hide. Maybe ideological consistency will finally win the day in Calgary municipal politics once the recount has ended and the city’s next mayor has been certified.

Michael Taube is a political commentator, Troy Media syndicated columnist and former speechwriter for Prime Minister Stephen Harper. He holds a master’s degree in comparative politics from the London School of Economics, lending academic rigour to his political insights.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

Business1 day ago

Business1 day agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

Business1 day ago

Business1 day agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

-

Environment1 day ago

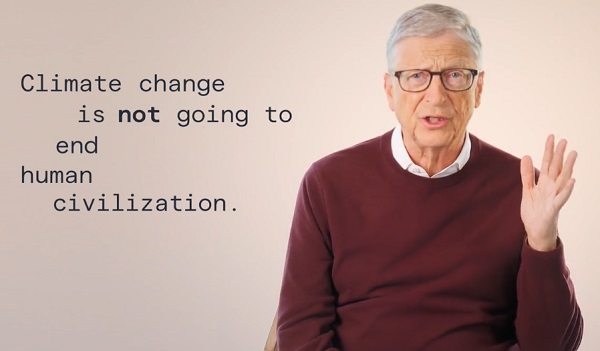

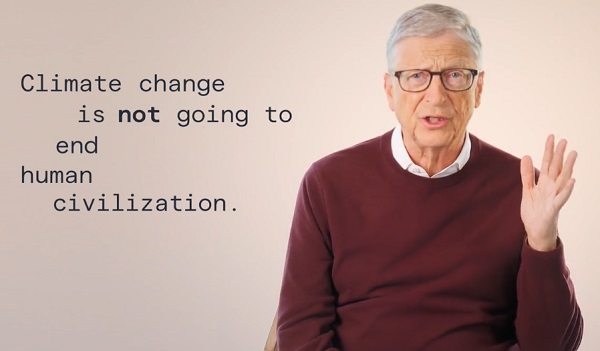

Environment1 day agoThe era of Climate Change Alarmism is over

-

Automotive1 day ago

Automotive1 day agoCarney’s Budget Risks Another Costly EV Bet

-

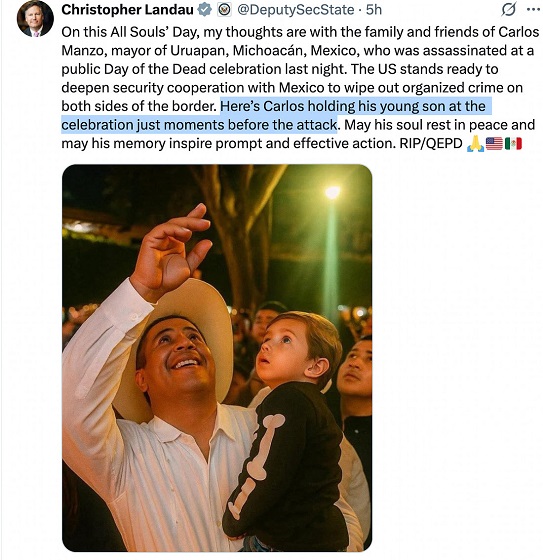

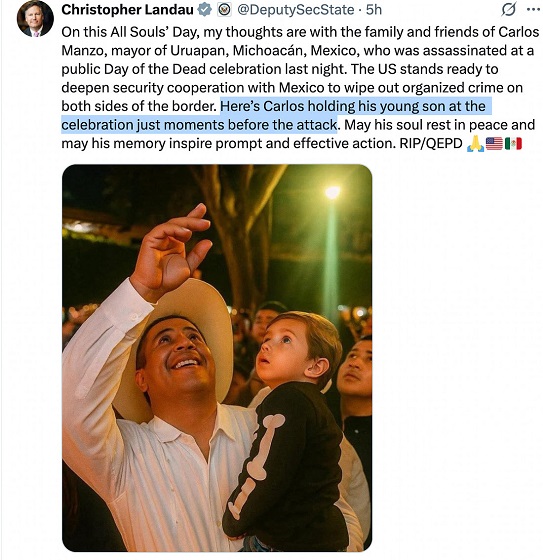

Crime22 hours ago

Crime22 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Aristotle Foundation22 hours ago

Aristotle Foundation22 hours agoB.C. government laid groundwork for turning private property into Aboriginal land

-

Justice21 hours ago

Justice21 hours agoA Justice System That Hates Punishment Can’t Protect the Innocent