Business

Carbon tax, not carve out, Trudeau’s real failure

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

Prime Minister Justin Trudeau stepped in it when he removed the carbon tax from furnace oil, while leaving 97 per cent of Canadians out in the cold.

Even in Atlantic Canada, where Trudeau tried to buy off MPs with the carve out, 77 per cent of people in the region support carbon tax relief for everyone.

But Trudeau’s mistake wasn’t providing relief. The real lesson here is Trudeau never won the hearts and minds of Canadians. And he lost credibility early on.

Months before the 2019 election, the former environment minister said the government had “no intention” of raising the carbon tax beyond 11 cents per litre of gas.

After the election, Trudeau announced he would keep cranking up his carbon tax until it reached 37 cents per litre.

Trudeau and his ministers repeat the myth that eight-out-of-ten families get more money in rebates than they pay in carbon taxes.

Their favourite talking point limps on despite the obvious reality that a government can’t raise taxes, skim money off the top to pay for hundreds of administration bureaucrats and still make everyone better off.

In fact, the carbon tax will cost the average family up to $710 more than they get back in rebates this year, according to the Parliamentary Budget Officer.

The government said carbon taxes reduce emissions.

But even in British Columbia, which had the first and (for years) costliest carbon tax, emissions rose. B.C. imposed its carbon tax in 2008. B.C.’s emissions have increased between 2007 and 2019 – the last year before the pandemic brought economic activity to a screeching halt.

And even if the carbon tax cut emissions at home, “Canada’s own emissions are not large enough to materially impact climate change,” as the PBO explains.

Making it more expensive to live in Canada won’t reduce emissions in China, Russia, India or the United States. And this leads to Trudeau’s diplomatic failure.

At the United Nations, the Trudeau government launched the Global Carbon Pricing Challenge to get more countries to impose carbon taxes.

“The impact and effectiveness of carbon pricing increases as more countries adopt pricing solutions,” the Trudeau government acknowledged.

The world’s largest economy, the United States, rejects carbon taxes.

President Joe Biden, a Democrat, hasn’t imposed a carbon tax. Good luck convincing a Republican president to impose one.

The U.S. is the rule, not the exception.

About three-quarters of countries don’t have a national carbon tax, according to the World Bank’s Carbon Pricing Dashboard.

And while Trudeau raised taxes, peers like the United Kingdom, Sweden, Australia, South Korea, the Netherlands, Germany, Norway, Ireland, India, Israel, Italy, New Zealand and Portugal, among others, cut fuel taxes.

If Canada’s carbon tax is essential for the environment, shouldn’t all taxpayers pay the same rate?

A driver in Alberta pays a carbon tax of 14 cent per litre of gas. In Quebec, the carbon tax is about 12 cents. By 2030, that gap will grow to more than 14 cents per litre.

Quebec’s special deal proves Trudeau’s carbon tax is about politics, not the environment.

When crafting the carbon tax, the government never truly asked the people what they thought. Everyone wants a better environment. You won’t find opposition to that.

But did anyone ask Canadians if they support a carbon tax even if it means average families will lose hundreds of dollars every year? Did anyone ask Canadians if they support a carbon tax even though most countries don’t?

Trudeau is displaying rank regional favouritism. But his real mistake wasn’t the carve out that favoured Atlantic Canada. It’s that he never won the hearts and minds of the people and failed to acknowledge carbon taxes cause real pain.

Automotive

Trump warns U.S. automakers: Do not raise prices in response to tariffs

MxM News

MxM News

Quick Hit:

Former President Donald Trump warned automakers not to raise car prices in response to newly imposed tariffs, arguing that the move would ultimately benefit the industry by strengthening American manufacturing. However, automakers are signaling that price increases may be unavoidable.

Key Details:

- Trump told auto executives on a recent call that his administration would look unfavorably on price hikes due to tariffs.

- A 25% tariff on imported vehicles and parts is set to take effect on April 2, likely driving up costs for U.S. automakers.

- Industry analysts predict vehicle prices could rise 11% to 12% in response, despite Trump’s insistence that tariffs will benefit American manufacturing.

Diving Deeper:

In a conference call with leading automakers earlier this month, former President Donald Trump issued a stern warning: do not use his new tariffs as an excuse to raise car prices. While Trump presented the tariffs as a boon for American manufacturing, industry leaders remain unconvinced, arguing that the financial burden will inevitably lead to higher costs for consumers.

Trump’s administration is pressing ahead with a 25% tariff on all imported vehicles and parts, set to take effect on April 2. The move is aimed at reshaping trade dynamics in the auto industry, encouraging domestic manufacturing, and reversing what Trump calls the damaging effects of President Joe Biden’s electric vehicle mandates. Despite this, automakers say that rising costs on foreign parts—which many depend on—will leave them little choice but to pass expenses onto consumers.

“You’re going to see prices going down, but going to go down specifically because they’re going to buy what we’re doing, incentivizing companies to—and even countries—companies to come into America,” Trump stated at a recent event, reinforcing his stance that the tariffs will ultimately lower costs in the long run.

However, industry insiders are pushing back, warning that a rapid shift to domestic production is unrealistic. “Tariffs, at any level, cannot be offset or absorbed,” said Ray Scott, CEO of Lear, a major automotive parts supplier. His concern reflects broader anxieties within the industry, as automakers calculate the financial strain of the tariffs. Analysts at Morgan Stanley estimate that vehicle prices could increase between 11% and 12% in the coming months as the new tariffs take effect.

Automakers have been bracing for the fallout. Detroit’s major manufacturers and industry suppliers have voiced their concerns, emphasizing that transitioning supply chains and manufacturing operations back to the U.S. will take years. Meanwhile, auto retailers have stocked up on inventory, temporarily shielding consumers from price hikes. But once that supply runs low—likely by May—the full impact of the tariffs could hit.

Within the Trump administration, inflation remains a pressing concern, though Trump himself rarely discusses it publicly. His economic team is aware of the potential for tariffs to drive up costs, yet the administration’s stance remains firm: automakers must adapt without raising prices. It remains unclear, however, what actions Trump might take should automakers defy his warning.

The auto industry isn’t alone in its concerns. Executives across multiple sectors, from oil and gas to food manufacturing, have been lobbying against major tariffs, arguing that they will inevitably result in higher prices for American consumers. While Trump has largely dismissed these warnings, some analysts suggest that public dissatisfaction with rising costs played a key role in shaping the outcome of the 2024 election.

With the tariffs set to take effect in just weeks, automakers are left grappling with a difficult reality: absorb billions in new costs or risk the ire of a White House determined to remake America’s trade policies.

Business

Labor Department cancels “America Last” spending spree spanning five continents

MxM News

MxM News

Quick Hit:

The U.S. Department of Labor has scrapped nearly $600 million in foreign aid grants, including $10 million aimed at promoting “gender equity in the Mexican workplace.”

Key Details:

-

Labor Secretary Lori Chavez-DeRemer and Deputy Secretary Keith Sonderling were credited with delivering $237 million in savings through the latest round of canceled programs.

-

Among the defunded initiatives: $12.2 million for “worker empowerment” efforts in South America, $6.25 million to improve labor rights in Central American agriculture, and $5 million to promote women’s workplace participation in West Africa.

-

The Department of Government Efficiency described the cuts as necessary to realign U.S. labor policy with national interests and applauded the elimination of all 69 international grants managed by the Bureau of International Labor Affairs.

Diving Deeper:

The U.S. Department of Labor on Wednesday canceled $577 million in foreign aid grants, including a controversial $10 million program aimed at promoting “gender equity in the Mexican workplace,” according to documents obtained by The Washington Post. The sweeping decision to terminate all 69 active international labor grants comes as part of a larger restructuring effort led by John Clark, a senior DOL official appointed during the Trump administration.

Clark directed the department’s Bureau of International Labor Affairs (ILAB) to shut down its entire grant portfolio, citing a “lack of alignment with agency priorities and national interest.” The memo explaining the cancellations was first reported by The Washington Post and highlights a broader shift in federal labor policy toward domestic-focused initiatives.

Among the eliminated grants were high-dollar projects that had drawn criticism from watchdog groups for years. These included $12.2 million designated for “worker empowerment in South America,” $6.25 million targeting labor conditions in Honduras, Guatemala, and El Salvador, and $5 million to elevate women’s workplace participation in West Africa. Other defunded programs involved $4.3 million to support foreign migrant workers in Malaysia, $3 million to improve social protections for internal migrants in Bangladesh, and $3 million to promote “safe and inclusive work environments” in Lesotho.

The Department of Government Efficiency, also involved in the review, labeled the grants as “America Last” initiatives, and pointed to the lack of measurable outcomes and limited benefits to American workers. The agency commended the leadership of Labor Secretary Lori Chavez-DeRemer and Deputy Secretary Keith Sonderling for securing $237 million in savings during this round alone.

The cuts mark the second major cost-saving move under Chavez-DeRemer’s leadership in as many weeks. Just days earlier, she canceled an additional $33 million in funding, including a $1.5 million grant focused on increasing transparency in Uzbekistan’s cotton sector. Chavez-DeRemer, a former Republican congresswoman from Oregon, was confirmed as Labor Secretary on March 11th by a bipartisan Senate vote of 67-32.

-

Health2 days ago

Health2 days agoHow the once-blacklisted Dr. Jay Bhattacharya could help save healthcare

-

Alberta2 days ago

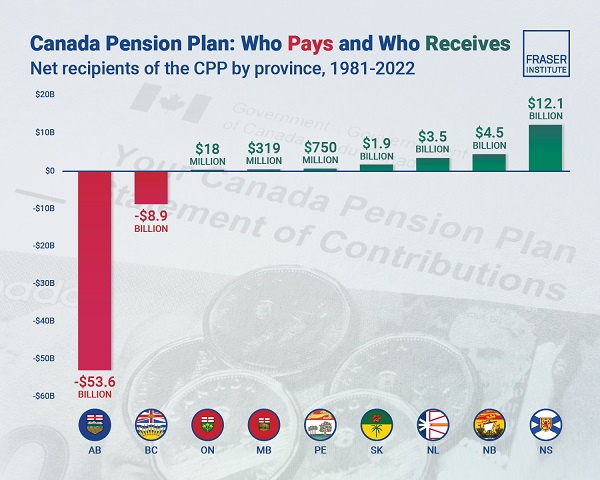

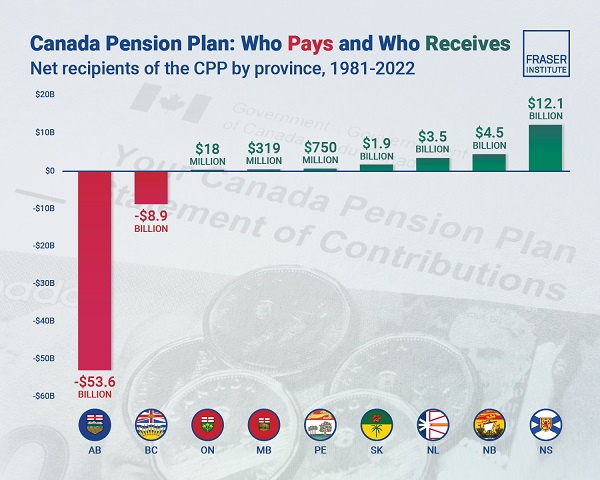

Alberta2 days agoAlbertans have contributed $53.6 billion to the retirement of Canadians in other provinces

-

Alberta2 days ago

Alberta2 days agoAlberta Institute urging Premier Smith to follow Saskatchewan and drop Industrial Carbon Tax

-

Alberta17 hours ago

Alberta17 hours agoProvince announces plans for nine new ‘urgent care centres’ – redirecting 200,000 hospital visits

-

Energy2 days ago

Energy2 days agoPoll: Majority says energy independence more important than fighting climate change

-

Business1 day ago

Business1 day agoFeds Spent Roughly $1 Billion To Conduct Survey That Could’ve Been Done For $10,000, Musk Says

-

Alberta22 hours ago

Alberta22 hours agoProvince pumping $100 million into Collegiates and Dual-Credit hands-on learning programs

-

Fraser Institute22 hours ago

Fraser Institute22 hours agoPremier Eby seeks to suspend democracy in B.C.