Alberta

Canopy Growth reports $648 million net loss in Q4 as it parts way with BioSteel staff

Canopy Growth Corp.’s chief executive said the company has made management changes and parted ways with some staff as it continues to review its BioSteel business after uncovering “material misstatements” in the sports drink unit’s previous financial filings.

“Based on the results of the review, we’ll be implementing several remedial actions to strengthen our controls for the BioSteel business,” David Klein, chief executive of the Smiths Falls, Ont.-based cannabis company, said on a Thursday call with analysts.

“We felt it was important to act swiftly to provide stability to the business at this pivotal time, so to this effect, we have exited several members of the BioSteel leadership team and are considering all legal remedies available to us including litigation to recover damages and costs associated with and resulting from the findings of the BioSteel review.”

His remarks came after Canopy promised in May to refile three of its past quarterly financial statements because of misstatements linked to BioSteel, a brand of dietary supplement products targeting athletes.

The misstatements were in its first-, second- and third-quarter filings from 2022 and included sales information from that period which Canopy said in regulatory filings “should no longer be relied upon.”

It discovered the misstatements when it was preparing its financial results for the financial year ended March 31, and determined on May 4 that there were errors in its filings after a review of BioSteel results with independent external counsel and forensic accountants.

Canopy now says the sales misstatements found are linked to BioSteel’s “timing and amount of revenue recognition.”

The company revealed new details about the misstatements as it released its fourth-quarter and full-year results Thursday. Canopy’s fourth-quarter net loss amounted to $648 million, $59 million more than the loss it incurred a year earlier.

It attributed much of the loss to $164 million in asset impairment and restructuring costs, but says those costs were partially offset by improved gross margins.

The corrected numbers for BioSteel resulted in a decrease of roughly $10 million in net revenue for the company’s 2022 financial year, or about two per cent of its total net revenue.

For the nine months ended December 31, 2022, Canopy said the correction resulted in a decrease of about $14 million in net revenue or four per cent of total consolidated revenue.

“Despite this, we have great confidence in the BioSteel brand, which saw a 101 per cent revenue increase in fiscal (2023),” Klein said.

Canopy also noted that BioSteel is continuing to gain market share in Canada, especially through NHL partnerships.

Meanwhile, Canopy is continuing with a transformation plan for its overall business that included the departure of 800 workers — roughly 35 per cent of its workforce — in February.

At the time, it also planned to wind down 1 Hershey Dr. in Smiths Falls, Ont., its flagship facility where chocolate company Hershey once had a factory, and move post-production flower activity to a building across the street.

Canopy said it would cease to source flower from its Mirabel, Que., facility, which is owned and operated through Les Serres Vert Cannabis Inc., a joint venture partnership between the company and Les Serres Stephane Bertrand Inc., a tomato greenhouse operator.

Canopy previously purchased pot from the joint venture, but will cease that activity and now move to a more flexible sourcing strategy to ensure Quebec-grown products are brought to consumers in the province.

Consolidation was also planned for its Kincardine, Ont. and Kelowna, B.C. sites.

Canopy’s net revenue for the period ended March 31 totalled $88 million, 14 per cent lower than the revenue reported a year prior.

Canopy’s adjusted loss for the quarter was $96 million, a $36 million improvement from its negative adjusted earnings before interest, taxes, depreciation, and amortization a year earlier.

This report by The Canadian Press was first published June 22, 2023.

Companies in this story: (TSX:WEED)

Tara Deschamps, The Canadian Press

Alberta

CPP another example of Albertans’ outsized contribution to Canada

From the Fraser Institute

By Tegan Hill

Amid the economic uncertainty fuelled by Trump’s trade war, its perhaps more important than ever to understand Alberta’s crucial role in the federation and its outsized contribution to programs such as the Canada Pension Plan (CPP).

From 1981 to 2022, Albertan’s net contribution to the CPP—meaning the amount Albertans paid into the program over and above what retirees in Alberta received in CPP payments—was $53.6 billion. In 2022 (the latest year of available data), Albertans’ net contribution to the CPP was $3.0 billion.

During that same period (1981 to 2022), British Columbia was the only other province where residents paid more into the CPP than retirees received in benefits—and Alberta’s contribution was six times greater than B.C.’s contribution. Put differently, residents in seven out of the nine provinces that participate in the CPP (Quebec has its own plan) receive more back in benefits than they contribute to the program.

Albertans pay an outsized contribution to federal and national programs, including the CPP because of the province’s relatively high rates of employment, higher average incomes and younger population (i.e. more workers pay into the CPP and less retirees take from it).

Put simply, Albertan workers have been helping fund the retirement of Canadians from coast to coast for decades, and without Alberta, the CPP would look much different.

How different?

If Alberta withdrew from the CPP and established its own standalone provincial pension plan, Alberta workers would receive the same retirement benefits but at a lower cost (i.e. lower CPP contribution rate deducted from our paycheques) than other Canadians, while the contribution rate—essentially the CPP tax rate—to fund the program would likely need to increase for the rest of the country to maintain the same benefits.

And given current demographic projections, immigration patterns and Alberta’s long history of leading the provinces in economic growth, Albertan workers will likely continue to pay more into the CPP than Albertan retirees get back from it.

Therefore, considering Alberta’s crucial role in national programs, the next federal government—whoever that may be—should undo and prevent policies that negatively impact the province and Albertans ability to contribute to Canada. Think of Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48 (which bans large oil tankers off B.C.’s northern coast and limits access to Asian markets), an arbitrary cap on oil and gas emissions, numerous other “net-zero” targets, and so on.

Canada faces serious economic challenges, including a trade war with the United States. In times like this, it’s important to remember Alberta’s crucial role in the federation and the outsized contributions of Alberta workers to the wellbeing of Canadians across the country.

Alberta

Made in Alberta! Province makes it easier to support local products with Buy Local program

Show your Alberta side. Buy Local. |

When the going gets tough, Albertans stick together. That’s why Alberta’s government is launching a new campaign to benefit hard-working Albertans.

Global uncertainty is threatening the livelihoods of hard-working Alberta farmers, ranchers, processors and their families. The ‘Buy Local’ campaign, recently launched by Alberta’s government, encourages consumers to eat, drink and buy local to show our unified support for the province’s agriculture and food industry.

The government’s ‘Buy Local’ campaign encourages consumers to buy products from Alberta’s hard-working farmers, ranchers and food processors that produce safe, nutritious food for Albertans, Canadians and the world.

“It’s time to let these hard-working Albertans know we have their back. Now, more than ever, we need to shop local and buy made-in-Alberta products. The next time you are grocery shopping or go out for dinner or a drink with your friends or family, support local to demonstrate your Alberta pride. We are pleased tariffs don’t impact the ag industry right now and will keep advocating for our ag industry.”

Alberta’s government supports consumer choice. We are providing tools to help folks easily identify Alberta- and Canadian-made foods and products. Choosing local products keeps Albertans’ hard-earned dollars in our province. Whether it is farm-fresh vegetables, potatoes, honey, craft beer, frozen food or our world-renowned beef, Alberta has an abundance of fresh foods produced right on our doorstep.

Quick facts

- This summer, Albertans can support local at more than 150 farmers’ markets across the province and meet the folks who make, bake and grow our food.

- In March 2023, the Alberta government launched the ‘Made in Alberta’ voluntary food and beverage labelling program to support local agriculture and food sectors.

- Through direct connections with processors, the program has created the momentum to continue expanding consumer awareness about the ‘Made in Alberta’ label to help shoppers quickly identify foods and beverages produced in our province.

- Made in Alberta product catalogue website

Related information

-

International2 days ago

International2 days agoPope Francis has died aged 88

-

International2 days ago

International2 days agoJD Vance was one of the last people to meet Pope Francis

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoOttawa Confirms China interfering with 2025 federal election: Beijing Seeks to Block Joe Tay’s Election

-

Business2 days ago

Business2 days agoCanada Urgently Needs A Watchdog For Government Waste

-

2025 Federal Election16 hours ago

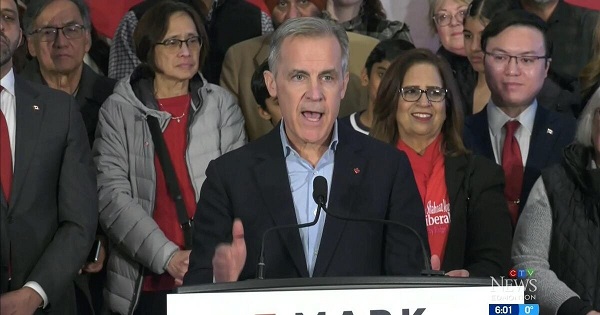

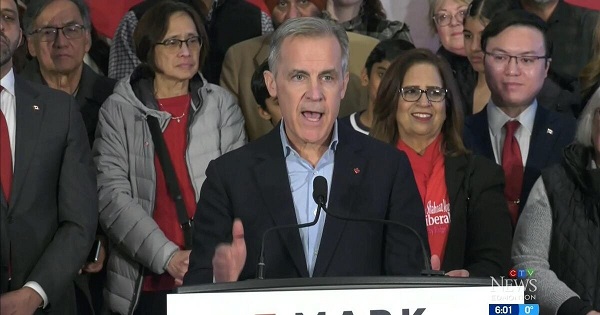

2025 Federal Election16 hours agoBREAKING: THE FEDERAL BRIEF THAT SHOULD SINK CARNEY

-

International2 days ago

International2 days agoPope Francis Dies on Day after Easter

-

COVID-191 day ago

COVID-191 day agoNearly Half of “COVID-19 Deaths” Were Not Due to COVID-19 – Scientific Reports Journal

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoHow Canada’s Mainstream Media Lost the Public Trust