Business

Canadians largely ignore them and their funding bleeds their competition dry: How the CBC Spends its Public Funding

If we want to intelligently assess the value CBC delivers to Canadians in exchange for their tax-funded investment, we’ll need to understand two things:

- How CBC spends the money we give them

- What impact their product has on Canadians

The answer to question #2 depends on which Canadians we’re discussing. Your average young family from suburban Toronto is probably only vaguely aware there is a CBC. But Canadian broadcasters? They know all about the corporation, but just wish it would lift its crushing hobnailed boots from their faces.

Stick around and I’ll explain.

For the purposes of this discussion I’m not interested in the possibility that there’s been reckless or negligent corruption or waste, so I won’t address the recent controversy over paying out millions of dollars in executive benefits. Instead, I want to know how the CBC is designed to operate. This will allow us to judge the corporation on its own terms.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

CBC’s Financial Structure

We’ll begin with the basics. According to the CBC’s 2023-24 projections in their most recent corporate plan strategy, the company will receive $1.17 billion from Parliament; $292 million from advertising; and $209 million from subscriber fees, financing, and other income. Company filings note that revenue from both advertising and legacy subscription pools are dropping. Advertising is trending downwards because of ongoing changes in industry ad models, and the decline in subscriptions can be blamed on competition from “cord-cutting” internet services. The Financing and other income category includes revenue from rent and lease-generating use of CBC’s many real estate assets.

The projected combined television, radio, and digital services spending is $1.68 billion. For important context, 2022-23 data from the 2022-2023 annual report break that down to $996 million for English services, and $816 million for French services. 2022-23 also saw $60 million in costs for transmission, distribution, and collection. Corporate management and finance costs came to around $33 million. Overall, the company reported a net loss of $125 million in 2022-23.

The corporation estimates that their English-language digital platforms attract 17.4 million unique visitors each month and that the average visitor engages with content for 28 minutes a month. In terms of market relevance, those are pretty good numbers. But, among Canadian internet users, cbc.ca still ranked only 43rd for total web destinations (which include sites like google.com and amazon.ca). French-language Radio-Canada’s numbers were 5.2 million unique visitors who each hung around for 50 minutes a month.

Monthly engagement with digital English-language news and regional services was 20 minutes. Although we’re given no visitor numbers, the report does admit that “interest in news was lower than expected.”

CBC content production

All that’s not very helpful for understanding what’s actually going on inside CBC. We need to get a feel for how the corporation divides its spending between programming categories and what’s driving the revenue.

The CRTC provides annual financial filings for all Canadian broadcasters, including the CBC. I could describe what’s happening by throwing columns and rows of dollar figures at you. In fact, should you be so disposed, you can view the spreadsheet here. But it turns out that my colorful graph will do a much better job:

As you can see for yourself, CBC spends a large chunk of its money producing news for all three video platforms (CBC and Radio-Canada conventional TV and the cable/VOD platforms they refer to as “discretionary TV”). The two conventional networks also invest significant funds in drama and comedy production.

The chart doesn’t cover CBC radio, so I’ll fill you in. English-language production costs $143 million (roughly the equivalent of the costs of English TV drama/comedy) while the bill for French-language radio production came in at $94 million (more or less equal to discretionary TV news production).

CBC Content Consumption

Who’s watching? The CBC itself reported that viewers of CBC English television represented only 5.1 percent of the total Canadian audience, and only 2.0 percent tuned in to CBC news. By “total Canadian audience”, I mean all Canadians viewing all available TV programming at a given time. So when the CBC tells us that their News Network got a 2.0 percent “share”, they don’t mean that they attracted 2.0 percent of all Canadians. Rather, they got 2.0 percent of whoever happened to be watching any TV network – which could easily come to just a half of one percent of all Canadians. After all, how many people still watch TV?

According to CRTC data, between the 2014–15 and 2022–23 seasons, English language CBC TV weekly viewing hours dropped from 35 million to 16 million. That total would amount to less than six minutes a day per anglophone Canadian. Specifically, news viewing fell by 52 percent, sports by 66 percent, and drama and comedy by 51 percent.

CBC Radio One and CBC Music only managed to attract 14.3 percent of the Canadian market. What does that actually mean? I’ve seen estimates suggesting that between 15 and 25 percent of all Canadians listen to radio during the popular daily commute slots. So at its peak, CBC radio’s share of that audience is possibly no higher than 3.5 percent of all Canadians.

A recent survey found that only 41 percent of Canadians agreed the CBC “is important and should continue doing what it’s doing.” The remaining 59 percent were split between thinking the CBC requires “a lot of changes” and was “no longer useful.” Those numbers remained largely consistent across all age groups.

It seems that while some Canadian’s might support the CBC in principle, for the most part, they’re not actually consuming a lot of content.

CBC Revenue sources

CBC’s primary income is from government funding through parliamentary allocations. Here’s what those look like:

Advertising (or, “time sales” as they refer to it) is another major revenue source. That channel brought in more than $200 million in 2023:

But here’s the thing: the broadcast industry in Canada is currently engaged in a bitter struggle for existence. Every single dollar from that shrinking pool of advertising revenue is desperately needed. And most broadcasters are – perhaps misguidedly – fighting for more government funding. So why should the CBC, with its billion dollar subsidies, be allowed to also compete for limited ad revenue?

Or, to put it differently, what vital and unique services does the CBC provide that might justify their special treatment?

It’s possible that CBC does target rural and underserved audiences missed by the commercial networks. But those are clearly not what’s consuming the vast majority of the corporation’s budget. Perhaps people are watching CBC’s “big tent” drama and comedy productions, but are those measurably better or more important than what’s coming from the private sector? And we’ve already seen how, for all intents and purposes, no one’s watching their TV news or listening to their radio broadcasts.

Perhaps there’s an argument to be made for maintaining or even increasing funding for CBC. But I haven’t yet seen anyone convincingly articulate it.

Subscribe to The Audit.

Business

Dallas mayor invites NYers to first ‘sanctuary city from socialism’

From The Center Square

By

After the self-described socialist Zohran Mamdani won the Democratic primary for mayor in New York, Dallas Mayor Eric Johnson invited New Yorkers and others to move to Dallas.

Mamdani has vowed to implement a wide range of tax increases on corporations and property and to “shift the tax burden” to “richer and whiter neighborhoods.”

New York businesses and individuals have already been relocating to states like Texas, which has no corporate or personal income taxes.

Johnson, a Black mayor and former Democrat, switched parties to become a Republican in 2023 after opposing a city council tax hike, The Center Square reported.

“Dear Concerned New York City Resident or Business Owner: Don’t panic,” Johnson said. “Just move to Dallas, where we strongly support our police, value our partners in the business community, embrace free markets, shun excessive regulation, and protect the American Dream!”

Fortune 500 companies and others in recent years continue to relocate their headquarters to Dallas; it’s also home to the new Texas Stock Exchange (TXSE). The TXSE will provide an alternative to the New York Stock Exchange and Nasdaq and there are already more finance professionals in Texas than in New York, TXSE Group Inc. founder and CEO James Lee argues.

From 2020-2023, the Dallas-Fort Worth-Arlington MSA reported the greatest percentage of growth in the country of 34%, The Center Square reported.

Johnson on Thursday continued his invitation to New Yorkers and others living in “socialist” sanctuary cities, saying on social media, “If your city is (or is about to be) a sanctuary for criminals, mayhem, job-killing regulations, and failed socialist experiments, I have a modest invitation for you: MOVE TO DALLAS. You can call us the nation’s first official ‘Sanctuary City from Socialism.’”

“We value free enterprise, law and order, and our first responders. Common sense and the American Dream still reside here. We have all your big-city comforts and conveniences without the suffocating vice grip of government bureaucrats.”

As many Democratic-led cities joined a movement to defund their police departments, Johnson prioritized police funding and supporting law and order.

“Back in the 1800s, people moving to Texas for greater opportunities would etch ‘GTT’ for ‘Gone to Texas’ on their doors moving to the Mexican colony of Tejas,” Johnson continued, referring to Americans who moved to the Mexican colony of Tejas to acquire land grants from the Mexican government.

“If you’re a New Yorker heading to Dallas, maybe try ‘GTD’ to let fellow lovers of law and order know where you’ve gone,” Johnson said.

Modern-day GTT movers, including a large number of New Yorkers, cite high personal income taxes, high property taxes, high costs of living, high crime, and other factors as their reasons for leaving their states and moving to Texas, according to multiple reports over the last few years.

In response to Johnson’s invitation, Gov. Greg Abbott said, “Dallas is the first self-declared “Sanctuary City from Socialism. The State of Texas will provide whatever support is needed to fulfill that mission.”

The governor has already been doing this by signing pro-business bills into law and awarding Texas Enterprise Grants to businesses that relocate or expand operations in Texas, many of which are doing so in the Dallas area.

“Texas truly is the Best State for Business and stands as a model for the nation,” Abbott said. “Freedom is a magnet, and Texas offers entrepreneurs and hardworking Texans the freedom to succeed. When choosing where to relocate or expand their businesses, more innovative industry leaders recognize the competitive advantages found only in Texas. The nation’s leading CEOs continually cite our pro-growth economic policies – with no corporate income tax and no personal income tax – along with our young, skilled, diverse, and growing workforce, easy access to global markets, robust infrastructure, and predictable business-friendly regulations.”

Business

National dental program likely more costly than advertised

From the Fraser Institute

By Matthew Lau

At the beginning of June, the Canadian Dental Care Plan expanded to include all eligible adults. To be eligible, you must: not have access to dental insurance, have filed your 2024 tax return in Canada, have an adjusted family net income under $90,000, and be a Canadian resident for tax purposes.

As a result, millions more Canadians will be able to access certain dental services at reduced—or no—out-of-pocket costs, as government shoves the costs onto the backs of taxpayers. The first half of the proposition, accessing services at reduced or no out-of-pocket costs, is always popular; the second half, paying higher taxes, is less so.

A Leger poll conducted in 2022 found 72 per cent of Canadians supported a national dental program for Canadians with family incomes up to $90,000—but when asked whether they would support the program if it’s paid for by an increase in the sales tax, support fell to 42 per cent. The taxpayer burden is considerable; when first announced two years ago, the estimated price tag was $13 billion over five years, and then $4.4 billion ongoing.

Already, there are signs the final cost to taxpayers will far exceed these estimates. Dr. Maneesh Jain, the immediate past-president of the Ontario Dental Association, has pointed out that according to Health Canada the average patient saved more than $850 in out-of-pocket costs in the program’s first year. However, the Trudeau government’s initial projections in the 2023 federal budget amounted to $280 per eligible Canadian per year.

Not all eligible Canadians will necessarily access dental services every year, but the massive gap between $850 and $280 suggests the initial price tag may well have understated taxpayer costs—a habit of the federal government, which over the past decade has routinely spent above its initial projections and consistently revises its spending estimates higher with each fiscal update.

To make matters worse there are also significant administrative costs. According to a story in Canadian Affairs, “Dental associations across Canada are flagging concerns with the plan’s structure and sustainability. They say the Canadian Dental Care Plan imposes significant administrative burdens on dentists, and that the majority of eligible patients are being denied care for complex dental treatments.”

Determining eligibility and coverage is a huge burden. Canadians must first apply through the government portal, then wait weeks for Sun Life (the insurer selected by the federal government) to confirm their eligibility and coverage. Unless dentists refuse to provide treatment until they have that confirmation, they or their staff must sometimes chase down patients after the fact for any co-pay or fees not covered.

Moreover, family income determines coverage eligibility, but even if patients are enrolled in the government program, dentists may not be able to access this information quickly. This leaves dentists in what Dr. Hans Herchen, president of the Alberta Dental Association, describes as the “very awkward spot” of having to verify their patients’ family income.

Dentists must also try to explain the program, which features high rejection rates, to patients. According to Dr. Anita Gartner, president of the British Columbia Dental Association, more than half of applications for complex treatment are rejected without explanation. This reduces trust in the government program.

Finally, the program creates “moral hazard” where people are encouraged to take riskier behaviour because they do not bear the full costs. For example, while we can significantly curtail tooth decay by diligent toothbrushing and flossing, people might be encouraged to neglect these activities if their dental services are paid by taxpayers instead of out-of-pocket. It’s a principle of basic economics that socializing costs will encourage people to incur higher costs than is really appropriate (see Canada’s health-care system).

At a projected ongoing cost of $4.4 billion to taxpayers, the newly expanded national dental program is already not cheap. Alas, not only may the true taxpayer cost be much higher than this initial projection, but like many other government initiatives, the dental program already seems to be more costly than initially advertised.

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

armed forces1 day ago

armed forces1 day agoCanada’s Military Can’t Be Fixed With Cash Alone

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

Alberta1 day ago

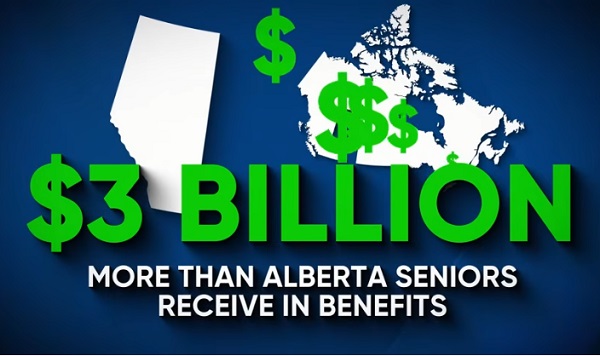

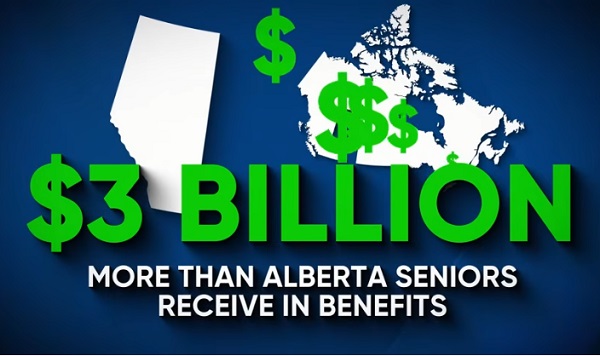

Alberta1 day agoAlberta Next: Alberta Pension Plan

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

C2C Journal24 hours ago

C2C Journal24 hours agoCanada Desperately Needs a Baby Bump