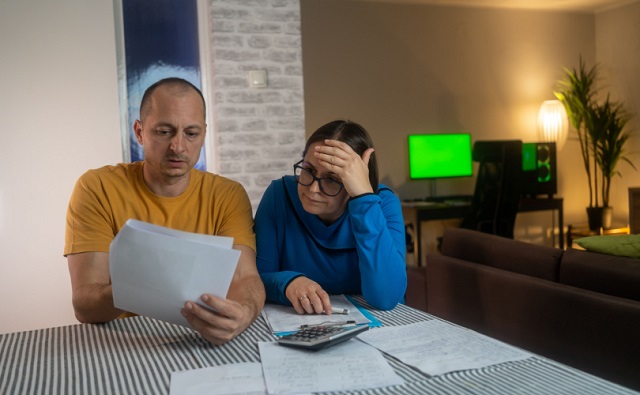

Economy

Canadians experiencing second-longest and third steepest decline in living standards in last 40 years

From the Fraser Institute

From 2019 to 2023, Canadian living standards declined—and as of the end of 2023, the decline had not yet ended, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Despite claims to the contrary, living standards are declining in Canada,” said Grady Munro, policy analyst at the Fraser Institute and co-author of Changes in Per-Person GDP (Income): 1985 to 2023.

Specifically, from April 2019 to the end of 2023, inflation-adjusted per-person GDP, a broad measure of living standards, declined from $59,905 to $58,111 or by 3.0 per cent. This decline is exceeded only by the decline in 1989 to 1992 (-5.3 per cent) and 2008 to 2009 (-5.2 per cent). In other words, it’s the third-steepest decline in 40 years.

Moreover, the latest decline (which comprises 18 fiscal quarters) is already the second-longest in the last 40 years, surpassed only by the decline from 1989 to 1994 (which lasted 21 quarters). And if not stabilized in 2024, this decline could be the steepest and longest in four decades.

“The severity of the decline in living standards should be a wake-up call for policymakers across Canada to immediately enact fundamental policy reforms to help spur economic growth and productivity,” said Jason Clemens, study co-author and executive vice-president at the Fraser Institute.

- Real GDP per person is a broad measure of incomes (and consequently living standards). This paper analyzes changes in quarterly per-person GDP, adjusted for inflation from 1985 through to the end of 2023, the most recent data available at the time of writing.

- The study assesses the length (number of quarters) as well the percentage decline and the length of time required to recover the income lost during the decline.

- Over the period covered (1985 to 2023), Canada experienced nine periods of decline and recovery in real GDP per person.

- Of those nine periods, three (Q2 1989 to Q3 1994, Q3 2008 to Q4 2011, and Q2 2019 to Q2 2022) were most severe when comparing the length and depth of the declines along with number of quarters required for real GDP per person to recover.

- The experience following Q2 2019 is unlike any decline and recovery since 1985 because, though per person GDP recovered for one quarter in Q2 2022, it immediately began declining again and by Q4 2023 remains below the level in Q2 2019.

- This lack of meaningful recovery suggests that since mid-2019, Canada has experienced one of the longest and deepest declines in real GDP per person since 1985, exceeded only by the decline and recovery from Q2 1989 to Q3 1994.

- If per-capita GDP does not recover in 2024, this period may be the longest and largest decline in per-person GDP over the last four decades.

Read the Full Report

Read the Full Report

Authors:

Business

Carney government needs stronger ‘fiscal anchors’ and greater accountability

From the Fraser Institute

By Tegan Hill and Grady Munro

Following the recent release of the Carney government’s first budget, Fitch Ratings (one of the big three global credit rating agencies) issued a warning that the “persistent fiscal expansion” outlined in the budget—characterized by high levels of spending, borrowing and debt accumulation—will erode the health of Canada’s finances and could lead to a downgrade in Canada’s credit rating.

Here’s why this matters. Canada’s credit rating impacts the federal government’s cost of borrowing money. If the government’s rating gets downgraded—meaning Canadian federal debt is viewed as an increasingly risky investment due to fiscal mismanagement—it will likely become more expensive for the government to borrow money, which ultimately costs taxpayers.

The cost of borrowing (i.e. the interest paid on government debt) is a significant part of the overall budget. This year, the federal government will spend a projected $55.6 billion on debt interest, which is more than one in every 10 dollars of federal revenue, and more than the government will spend on health-care transfers to the provinces. By 2029/30, interest costs will rise to a projected $76.1 billion or more than one in every eight dollars of revenue. That’s taxpayer money unavailable for programs and services.

Again, if Canada’s credit rating gets downgraded, these costs will grow even larger.

To maintain a good credit rating, the government must prevent the deterioration of its finances. To do this, governments establish and follow “fiscal anchors,” which are fiscal guardrails meant to guide decisions regarding spending, taxes and borrowing.

Effective fiscal anchors ensure governments manage their finances so the debt burden remains sustainable for future generations. Anchors should be easily understood and broadly applied so that government cannot get creative with its accounting to only technically abide by the rule, but still give the government the flexibility to respond to changing circumstances. For example, a commonly-used rule by many countries (including Canada in the past) is a ceiling/target for debt as a share of the economy.

The Carney government’s budget establishes two new fiscal anchors: balancing the federal operating budget (which includes spending on day-to-day operations such as government employee compensation) by 2028/29, and maintaining a declining deficit-to-GDP ratio over the years to come, which means gradually reducing the size of the deficit relative to the economy. Unfortunately, these anchors will fail to keep federal finances from deteriorating.

For instance, the government’s plan to balance the “operating budget” is an example of creative accounting that won’t stop the government from borrowing money each year. Simply put, the government plans to split spending into two categories: “operating spending” and “capital investment” —which includes any spending or tax expenditures (e.g. credits and deductions) that relates to the production of an asset (e.g. machinery and equipment)—and will only balance operating spending against revenues. As a result, when the government balances its operating budget in 2028/29, it will still incur a projected deficit of $57.9 billion when spending on capital is included.

Similarly, the government’s plan to reduce the size of the annual deficit relative to the economy each year does little to prevent debt accumulation. This year’s deficit is expected to equal 2.5 per cent of the overall economy—which, since 2000, is the largest deficit (as a share of the economy) outside of those run during the 2008/09 financial crisis and the pandemic. By measuring its progress off of this inflated baseline, the government will technically abide by its anchor even as it runs relatively large deficits each and every year.

Moreover, according to the budget, total federal debt will grow faster than the economy, rising from a projected 73.9 per cent of GDP in 2025/26 to 79.0 per cent by 2029/30, reaching a staggering $2.9 trillion that year. Simply put, even the government’s own fiscal plan shows that its fiscal anchors are unable to prevent an unsustainable rise in government debt. And that’s assuming the government can even stick to these anchors—which, according to a new report by the Parliamentary Budget Officer, is highly unlikely.

Unfortunately, a federal government that can’t stick to its own fiscal anchors is nothing new. The Trudeau government made a habit of abandoning its fiscal anchors whenever the going got tough. Indeed, Fitch Ratings highlighted this poor track record as yet another reason to expect federal finances to continue deteriorating, and why a credit downgrade may be on the horizon. Again, should that happen, Canadian taxpayers will pay the price.

Much is riding on the Carney government’s ability to restore Canada’s credibility as a responsible fiscal manager. To do this, it must implement stronger fiscal rules than those presented in the budget, and remain accountable to those rules even when it’s challenging.

Business

Sluggish homebuilding will have far-reaching effects on Canada’s economy

From the Fraser Institute

At a time when Canadians are grappling with epic housing supply and affordability challenges, the data show that homebuilding continues to come up short in some parts of the country including in several metro regions where most newcomers to Canada settle.

In both the Greater Toronto area and Metro Vancouver, housing starts have languished below levels needed to close the supply gaps that have opened up since 2019. In fact, the last 12-18 months have seen many planned development projects in Ontario and British Columbia delayed or cancelled outright amid a glut of new unsold condominium units and a sharp drop in population growth stemming from shifts in federal immigration policy.

At the same time, residential real estate sales have also been sluggish in some parts of the country. A fall-off in real estate transactions tends to have a lagged negative effect on construction investment—declining home sales today translate into fewer housing starts in the future.

While Prime Minister Carney’s Liberal government has pledged to double the pace of homebuilding, the on-the-ground reality points to stagnant or dwindling housing starts in many communities, particularly in Ontario and B.C. In July, the Canada Mortgage and Housing Corporation (CMHC) revised down its national forecast for housing starts over 2025/26, notwithstanding the intense political focus on boosting supply.

A slowdown in residential construction not only affects demand for services provided by homebuilders, it also has wider economic consequences owing to the size and reach of residential construction and the closely linked real estate sector. Overall, construction represents almost 8 per cent of Canada’s economy. If we exclude government-driven industries such as education, health care and social services, construction provides employment for more than one in 10 private-sector workers. Most of these jobs involve homebuilding, home renovation, and real estate sales and development.

As such, the economic consequences of declining housing starts are far-reaching and include reduced demand for goods and services produced by suppliers to the homebuilding industry, lower tax revenues for all levels of government, and slower economic growth. The weakness in residential investment has been a key factor pushing the Canadian economy close to recession in 2025.

Moreover, according to Statistics Canada, the value of GDP (in current dollars) directly attributable to housing reached $238 billion last year, up slightly from 2023 but less than in 2021 and 2022. Among the provinces, Ontario and B.C. have seen significant declines in residential construction GDP since 2022. This pattern is likely to persist into 2026.

Statistics Canada also estimates housing-related activity supported some 1.2 million jobs in 2024. This figure captures both the direct and indirect employment effects of residential construction and housing-related real estate activity. Approximately three-fifths of jobs tied to housing are “direct,” with the rest found in sectors—such as architecture, engineering, hardware and furniture stores, and lumber manufacturing—which supply the construction business or are otherwise affected by activity in the residential building and real estate industries.

Spending on homebuilding, home renovation and residential real estate transactions (added together) represents a substantial slice of Canada’s $3.3 trillion economy. This important sector sustains more than one million jobs, a figure that partly reflects the relatively labour-intensive nature of construction and some of the other industries related to homebuilding. Clearly, Canada’s economy will struggle to rebound from the doldrums of 2025 without a meaningful turnaround in homebuilding.

-

Daily Caller2 days ago

Daily Caller2 days agoLaura Ingraham’s Viral Clash With Trump Prompts Her To Tell Real Reasons China Sends Students To US

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

National2 days ago

National2 days agoConservative bill would increase penalties for attacks on places of worship in Canada

-

armed forces2 days ago

armed forces2 days agoCanadian veteran says she knows at least 20 service members who were offered euthanasia

-

Alberta2 days ago

Alberta2 days agoHow economic corridors could shape a stronger Canadian future

-

Business2 days ago

Business2 days agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

Business1 day ago

Business1 day agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

Censorship Industrial Complex21 hours ago

Censorship Industrial Complex21 hours agoEU’s “Democracy Shield” Centralizes Control Over Online Speech