Energy

Canada Has All the Elements to be a Winner in Global Energy — Now Let’s Do It

Mike Rose is Chair, President and CEO of Tourmaline Oil Corp.

From EnergyNow.ca

By Mike Rose of Tourmaline Oil Corp.

There has never been a more urgent time to aggressively develop Canada’s massive resource wealth

There has never been a more urgent time to aggressively develop Canada’s massive resource wealth. An increasingly competitive world is organizing into new alliances that are threatening our traditional Western democracies.

Weaker or underperforming countries may be left behind economically and, in some cases, their sovereignty may be compromised. We cannot let either scenario happen to Canada.

Looking inward, our country has posted among the weakest economic growth of all G20 nations over the past decade — we are at real risk of delivering a materially diminished standard of living to our children and subsequent future generations.

Canada is blessed with one of the largest and most diverse natural resource endowments in the world. It’s not just oil and gas; it’s uranium, precious metals, rare earth elements, enormous renewable forests, a vast fertile agricultural land base and, of course, the single-largest freshwater reserve on the planet.

This is nothing new; Canada has been regarded as a resource-extraction economy for a long time, but over the past two decades we’ve been slowing down and finding reasons to not advance new projects. While looking ahead to an exciting new future economy is enticing, the majority of our easily accessible resource wealth remains largely untapped. Our Canadian resource sectors are the most capital-efficient, technologically advanced and environmentally responsible in the world. We’ve got the winning combination.

Canada has among the largest, lowest-cost natural gas reserves in the world — we’re already the fourth-largest producer. With consistent regulatory support, we can rapidly evolve into a leader in the growing global LNG business.

This country produces among the lowest-emission natural gas in the world and technology adaptation is widening the gap. A 10 bcf/day Canadian LNG industry targeted to displace coal-fired electrical generation in Asia would offset the vast majority of emissions from the entire domestic oil and gas industry. Contemplating a cap on the Canadian natural gas industry is actually damaging to the global environment, as growing demand will be met by jurisdictions with higher associated emissions.

As developed economies look at electrification to accelerate emissions reduction, nuclear power is becoming increasingly attractive. Canada is already one of the largest uranium producers in the world and has long possessed one of the most efficient and safest reactor designs. This is an advantage we created for ourselves several decades ago; it’s time to harvest this opportunity.

The rare earth elements required for a growing solar industry and battery requirements associated with electrification are abundant in certain regions in Canada — for example, a large new mining opportunity is emerging in Ontario. We should make that happen. One of the great outcomes of accelerating our multi-sector resource opportunity is that the economic benefits will be enjoyed across the country; all Canadians will share in it.

The Canadian agricultural industry has been long regarded as a world leader in efficiency, yield and technical innovation. Global food security and affordability are rapidly emerging issues, and Canada has a role to play here, as well. Not only could we make it more attractive for Canadian producers to grow output and explore novel new transportation corridors to feed more of the world, we have a large, well-established, globally competitive fertilizer industry.

There are many more future resource wealth opportunities we could be capitalizing on. The list is as long as the imagination of our well-educated and entrepreneurial resource sector workforce.

Enormous amounts of capital are required for these projects, and that global capital is most certainly available. These pools of capital will flow into Canada if we demonstrate a willingness to consistently support the Canadian resource sector at provincial and federal government levels.

Accelerating domestic multi-sector resource development provides solutions to many of the problems currently facing Canada. We’ll be playing to strengths that we have established and evolved over many decades. We are the most efficient and technologically advanced in the full spectrum of resource development. Adoption and innovative adaptation of the continuous march of technology advancements will only make us better.

To paraphrase: We can take advantage of what’s between our ears to do an even better job of developing what’s beneath our feet.

Mike Rose is Chair, President and CEO of Tourmaline Oil Corp.

In an ongoing monthly series presented by the Calgary Herald and Financial Post, Canadian business leaders share their thoughts on the country’s economic challenges and opportunities.

Alberta

Low oil prices could have big consequences for Alberta’s finances

From the Fraser Institute

By Tegan Hill

Amid the tariff war, the price of West Texas Intermediate oil—a common benchmark—recently dropped below US$60 per barrel. Given every $1 drop in oil prices is an estimated $750 million hit to provincial revenues, if oil prices remain low for long, there could be big implications for Alberta’s budget.

The Smith government already projects a $5.2 billion budget deficit in 2025/26 with continued deficits over the following two years. This year’s deficit is based on oil prices averaging US$68.00 per barrel. While the budget does include a $4 billion “contingency” for unforeseen events, given the economic and fiscal impact of Trump’s tariffs, it could quickly be eaten up.

Budget deficits come with costs for Albertans, who will already pay a projected $600 each in provincial government debt interest in 2025/26. That’s money that could have gone towards health care and education, or even tax relief.

Unfortunately, this is all part of the resource revenue rollercoaster that’s are all too familiar to Albertans.

Resource revenue (including oil and gas royalties) is inherently volatile. In the last 10 years alone, it has been as high as $25.2 billion in 2022/23 and as low as $2.8 billion in 2015/16. The provincial government typically enjoys budget surpluses—and increases government spending—when oil prices and resource revenue is relatively high, but is thrown into deficits when resource revenues inevitably fall.

Fortunately, the Smith government can mitigate this volatility.

The key is limiting the level of resource revenue included in the budget to a set stable amount. Any resource revenue above that stable amount is automatically saved in a rainy-day fund to be withdrawn to maintain that stable amount in the budget during years of relatively low resource revenue. The logic is simple: save during the good times so you can weather the storm during bad times.

Indeed, if the Smith government had created a rainy-day account in 2023, for example, it could have already built up a sizeable fund to help stabilize the budget when resource revenue declines. While the Smith government has deposited some money in the Heritage Fund in recent years, it has not created a dedicated rainy-day account or introduced a similar mechanism to help stabilize provincial finances.

Limiting the amount of resource revenue in the budget, particularly during times of relatively high resource revenue, also tempers demand for higher spending, which is only fiscally sustainable with permanently high resource revenues. In other words, if the government creates a rainy-day account, spending would become more closely align with stable ongoing levels of revenue.

And it’s not too late. To end the boom-bust cycle and finally help stabilize provincial finances, the Smith government should create a rainy-day account.

2025 Federal Election

Poilievre Campaigning To Build A Canadian Economic Fortress

FULL 2025 Federal Election Conservative Party Plan Including Energy Corridor & Unleashing Canadian Resources

My plan for the Canadian economy could not be more different from the Carney Liberals. I have spent every day of this election campaign setting out my ambitious and detailed plan to build a Canadian economic fortress so we can stand up to Trump from a position of strength.

It is time for Canada to think big again. It is time to challenge ourselves to build. Because decline is a choice, but it’s not my choice. I choose to grow. I choose to meet this moment with ambition worthy of the men and women who built this great country.

We know the last ten years have been about the Liberals. But the next ten years? They will be about you.

We will cut your taxes, reward your hard work, build homes, and unleash our resources. We will be a nation that rewards strivers, builders, entrepreneurs, and workers. It’s time to restore the Canadian promise that anyone from anywhere can do anything; that hard work gets you a great life in a beautiful house on a safe street under a proud flag.

A PLAN FOR CHANGE

Cut Income Tax

You deserve to keep more of your paycheque.

Conservatives will reduce the lowest income tax bracket from 15% to 12.75%.

This will save the average worker $900 and the average family $1800 every year.

Everyone who pays income tax will pay less, but because Conservatives will cut the rate on the lowest income bracket, average hard working Canadians will save the most in percentage terms.

Tax Cuts will create jobs for Canadians and help build Canada’s economic fortress against American threats.

That’s how we will put Canada First, for a Change.

Axe the Sales Tax on Homes

Canada First Conservatives have a strong plan to build more homes.

We will axe the sales tax on new homes, saving families up to $65,000 on the purchase of a home and $3000 on yearly mortgage payments while spurring a massive new homebuilding boom.

We will sell off 6000 federal buildings and thousands of acres of federal land to build new homes.

We will incentivize municipalities to speed up permits, free up land, and cut housing taxes so homes can be built faster.

We will bring more Boots, not Suits, backing 350,000 positions for trade schools and union halls to train red-seal apprentices to build homes, and we will bring back the $4000 apprenticeship grant that the Liberals plan to eliminate.

We will unlock billions of dollars in the private sector by allowing anyone who reinvests in Canada to defer tax on capital gains to invest more in home building.

Only a new Conservative government will axe the sales tax on new homes for everyone, remove the gatekeepers who block home building and build homes that Canadians can afford, for a change.

Canada first Reinvestment Tax Cut

With the Canada First Reinvestment Tax Cut any person or business will pay no capital gains tax when they reinvest the proceeds in Canada.

These gains will still be taxed later when investors cash out or move the money out of Canada.

This tax cut will be available for any capital gains reinvested between July 1, 2025 and December 31, 2026. But, if it causes a major economic boom, Conservatives will make it permanent.

The Canada First Reinvestment Tax Cut will be like rocket fuel for our economy.

It will incentivize investors—from small business owners, to farmers, to homebuilders—to reinvest and build things here in Canada.

These investments will rebuild our industry, restart our economy and allow us to become self-reliant and sovereign from the Americans, and stand up to Trump’s threats from a position of strength.

That’s how we will put Canada First, for a Change.

Lower Taxes, Secure Retirement for our Seniors

Canada First Conservatives will put seniors back in control of their retirement by lowering taxes and reducing clawbacks.

We will:

- Allow working seniors to earn up to $34,000 tax free—$10k more than now.

- Allow seniors the option of keeping savings growing in RRSPs until age 73, up from 71.

- Protect OAS, GIS & CPP by keeping the retirement age at 65.

Our seniors should not have to work, but they should not be punished with clawbacks and taxes if they choose to. We should reward rather than punish work and those who choose to grow their savings for longer should have the chance.

Conservatives will restore the Canadian promise, protect seniors’ savings and build a Canada where a lifetime of hard work means a secure retirement.

That’s putting Canada’s seniors First, for a Change.

Boots Not Suits

Conservatives will boost training for the next generation of workers. “More boots, Less Suits” is part of our Bring it Home Economic Plan that will train 350,000 new trades workers. Conservatives will:

- Reinstate apprenticeship grants of up to $4,000. The previous Conservative government created these grants, but the Carney-Trudeau Liberals will cancel it at the end of this month, leaving Canadian workers behind.

- Fund training halls that will skill up 350,000 young workers over 5 years by expanding the Union Training and Innovation Program (UTIP). Conservatives will make sure the actual buildings and centres where these people get trained are also eligible for UTIP funding. Smaller unions will also have equal access to funding that covers as much as 75% of the costs of building and running these programs.

- Create a special class of rapid EI payout for skilled tradespeople by allowing union training centers and colleges to pre-register apprentices for EI. Trades workers will now quickly get support they are entitled to.

- Work with the provinces to harmonize health and safety regulations so our tradespeople can work anywhere in Canada without redundant retraining.

- Pass the Travelling Fairness Tradesworkers Act which allows our tradesworkers to write off the full cost of their food, transportation, and accommodation.

Conservatives are ready to fight for Canada’s workers. With Donald Trump’s tariffs on our economy, we must bring home our paycheques and production, and take back control of our economy from the Americans.

Canada First TFSA Top-Up

Conservatives will create a Canada First TFSA Top-Up allowing Canadians to contribute an extra $5,000 a year to Tax-Free Savings Accounts for investments in Canadian companies. The existing $7,000 limit would remain, but Canadians will now be able to contribute up to an additional $5,000 a year if that money supports Canadian companies that employ Canadian workers and pay Canadian taxes.

The tax system already defines Canadian investments. A Poilievre government will create a definition that lets financial institutions and advisors label which stocks, mutual funds and other investments can go into your Canada First TFSA Top-Up.

The Canada First TFSA Top-Up will reward patriotic Canadians who invest in Canadian businesses and help grow our economy.

Unleash Canadian Resources

Canada’s energy sector has made a list of 5 policy recommendations to make Canada less reliant on the USA. Canada First Conservatives are committed to meeting all of the recommendations. We will:

- Repeal the “No-New Pipelines” Law, Bill C-69, and the Tanker ban so we can build new pipelines and LNG terminals to export our energy overseas, ending our economic dependency on the United States.

- Set a six-month approval target for decisions on resource projects.

- Scrap the job-killing energy cap on Canadian growth and approve and build new major projects fast.

- Axe the industrial carbon tax to take the tax off Canadian steel, aluminum, natural gas, food production, concrete, and all other major industries.

- Provide Indigenous loan guarantees by establishing the Canadian Indigenous Opportunities Corporation, led by Indigenous people to offer loan guarantees for Indigenous communities.

Mark Carney has committed to exactly none of these recommendations. His radical anti-energy plan will make us more dependant on the United States.

Conservatives will unleash our resources so we can be strong, self-reliant, stand on our own two feet, and stand up to the Americans.

Canada Shovel Ready Zones

Conservatives will create ‘Canada Shovel Ready Zones.’ These zones will be areas already permitted for construction, meaning the permits will not just take less time, but will already be completed when a company decides to build a mine, LNG terminal or pipeline, bringing home thousands of jobs for Canadian workers and taking back control of our economy from the Americans.

To create these zones we will:

- Identify a location that makes sense for a power station, LNG plant, pipeline, or another major project.

- Make sure it is safe for Canadians and the environment.

- Work with other levels of government to lock down zoning and permits in advance of construction.

- Offer pre-permitting before even getting an application so that permits could be published online with a checklist that businesses would have to complete in order to protect nature and people.

This means businesses could buy the land, move in, hire people and build, knowing they already have the permits. This will unleash 100s of billions of dollars in power plants, nuclear energy, mines, pipelines, data centres, and much more. Canada Shovel Ready Zones will bring home powerful paycheques for our workers.

Canada Energy Corridor

Conservatives will create a Canada First National Energy Corridor to fast-track approvals for transmission lines, railways, pipelines, and other critical infrastructure across Canada in pre-approved transport corridors entirely within Canada, transporting our resources within Canada and to the world while bypassing the United States.

It will bring billions of dollars of new investment into Canada’s economy, create powerful paycheques for Canadian workers, and restore our economic independence.

Axe The Carbon Tax

Conservatives will axe the entire carbon tax law.

For everyone.

For real.

For good.

This includes the federal backstop and the industrial carbon tax. We will take the tax off Canadian steel, aluminum, natural gas, food production, concrete, and all major industries. This will lower prices and bring home powerful paycheques for Canadians.

Unlock The Ring Of Fire

Conservatives will green-light all federal permits for the Ring of Fire in Northern Ontario to harvest chromite, cobalt, nickel, copper, and platinum.

Conservatives also committed $1 billion over three years to the construction of the long-overdue road connecting First Nations communities and the critical mineral deposits in the Ring of Fire to the Ontario highway network.

The Ring of Fire will boost our economy with billions of dollars allowing us to become less dependent on the Americans, while our allies overseas would no longer have to rely on Beijing for these metals, turning dollars for dictators into paycheques for our people.

Life Sentences For The Worst Offenders

Conservatives will lock up the worst criminals for life.

Conservatives will impose life sentences for anyone who is convicted of:

- 5 or more counts of human trafficking

- Importing or exporting ten or more illegal firearms

- Fentanyl trafficking.

Canada First Conservatives will stop the crime to bring home safe streets.

Secure The Border

Conservatives have a common sense plan to protect the border and put Canada First–For a Change.

We will:

- Immediately deploy military helicopters and surveillance to the border to spot and intercept risks.

- Expand the powers of the CBSA Border Agents to patrol anywhere along the border, not just at official crossings.

- Hire 2000 new CBSA agents to intercept illegal crossers, drugs, guns, and other dangerous law-breaking.

- Install high-powered scanners at all major land crossings and shipping ports. These scanners can see through walls of containers or vehicles to spot drugs, guns, and stolen cars.

- Build border surveillance towers and deploy truck-mounted drones systems that can spot border incursions.

Secure our Arctic

Canada First Conservatives have a plan to take back control of the Canadian Arctic.

We will:

- Double the size of the 1st Patrol Group of the Canadian Rangers from 2000 to 4000 Rangers.

- Acquire two additional Polar Icebreakers for the Royal Canadian Navy. These icebreakers will be on top of the current polar icebreakers that are being built for the Coast Guard.

- Build Canada’s first permanent Arctic military base since the Cold War: CFB Iqaluit. This base will host the new F-35 fighter jets and Poseidon P-8s.

- Upgrade the Forward Operating Location in Inuvik to full base status (CFB Inuvik) to host fighter jets and Husky tankers—enabling quick interceptions of Russian and Chinese incursions and securing the eastern entrance to the Northwest Passage.

- Procure a fleet of Airborne Early Warning and Control (AWACS) aircraft to increase radar surveillance and command capabilities in Arctic skies.

- Build the Arctic Security Corridor, a 600 km all-season road from Yellowknife to Grays Bay, including a strategic upgrade to the Port of Grays Bay.

- Establish a new Canadian Army reserve unit in Whitehorse and restore Operation NANOOK to its full strength, as under the previous Conservative government.

- Construct a new Arctic Naval Base in Churchill, Manitoba, to support Canada’s growing fleet of polar icebreakers and secure Arctic shipping routes.

Launch Interprovincial Free Trade

With President Trump’s tariffs it is reckless to rely on the United States alone to buy our goods. We need to trade more with ourselves, but governments impose massive trade barriers on us that cost $5100/person.

Canada First Conservatives will bring home free trade within Canada. Conservatives will:

- Within 30 days of forming government, bring together the Premiers to agree on removing as many trade barriers as possible.

- Create one standard set of trucking rules.

- Create a blue seal professional licensing standard so workers can work in all provinces.

- To get the deal done, I will offer the provinces a Free Trade Bonus. Every time a provincial government removes a barrier, my government will calculate the resulting boost in GDP and give the increased federal tax revenue to that province for schools, hospitals or whatever else Premiers choose.

Axe the Escalator Tax on Alcohol

Conservatives will axe the automatic annual tax increases on alcohol that the Mark Carney Liberals hiked again on April 1st. Conservatives will bring the tax rate back down to 2017 levels so Canadians pay less and businesses earn more.

Automatic annual Liberal tax hikes are an affront to our democracy because they allow the government to raise taxes without Parliament’s approval. The Conservative plan will cancel all future automatic Liberal tax hikes, providing relief to restaurants still recovering from the pandemic, as well as to brewers, wineries, distillers, and exporters, bringing home lower prices for Canadians.

When you buy a beer today, you might think that the $10 goes to the brewer or the bar. In fact, more than half goes to the government, and every year it gets more expensive. A new Conservative government will axe the punishing Liberal taxes, deliver lower prices for Canadians and make our businesses more competitive.

Axe The Sales Tax On Made In Canada Cars

President Trump’s decision to slap a 25% tariff on Canadian-made vehicles is a direct attack on our workers and our automotive industry, jeopardizing thousands of jobs. To counter this unjustified attack, Conservatives will temporarily remove the Goods and Services Tax (GST) on purchases of all new Canadian-manufactured vehicles. The GST will be removed as long as Trump’s tariffs remain in place.

On a Canadian-made vehicle priced at $50,000, axing the GST will save consumers $2,500. This immediate relief will help consumers under financial strain caused by Trump’s tariffs and support Canadian auto workers by making it easier for Canadians to buy vehicles made here at home. Conservatives also called on Canada’s Premiers to axe their provincial sales taxes on new made-in-Canada cars, saving Canadians between $6,000 and $7,500 on that same new $50,000 car.

Keep Workers Working

The Keep Canadians Working Fund is a targeted, temporary liquidity program designed to help businesses affected by sudden tariffs keep workers on the job. It will provide up to $3 billion in short-term credit lines and low-interest loans to ensure companies can maintain operations and keep employees working in industries affected by Trump tariffs.

The Fund is modelled on the Business Credit Availability Program (BCAP) that the Harper government created during the 2008 recession to successfully protect affected businesses and jobs. The program will be administered through three existing federal entities: the Business Development Bank of Canada (BDC), Export Development Canada (EDC) and Farm Credit Canada (FCC).

We must rebuild our economy so that we can stand up to Trump from a position of strength, and never be in a position of weakness again.

Tougher Sentencing For Intimate Partner Violence

Conservatives will address the epidemic of intimate partner violence. Poilievre will keep abusers off the street and behind bars to protect the most vulnerable Canadians.

We will:

- Create a new offence of “assault of an intimate partner” to deliver tougher sentences for anyone who abuses an intimate partner.

- Require the strictest bail conditions for anyone accused of intimate partner violence, including GPS ankle bracelet monitoring, with any breach of conditions resulting in immediate imprisonment.

- End the senseless practice of downgrading the murder of an intimate partner to manslaughter, simply because the murderer claims it was a so-called “crime of passion”. A Conservative government will make sure that the murder of an intimate partner, one’s own child, or a partner’s child will be treated as first-degree murder.

Government has failed the most vulnerable Canadians. Those who abuse their partners or their children should be off the streets and behind bars where they can’t harm their victims or anyone else. A new Conservative Government will make sure our justice system always puts victims, not criminals, first.

Cut Regulations by 25%

Conservatives will eliminate 25 percent of all red tape within their first two years of government. This will significantly ease the administrative burden on taxpayers and businesses, waking up our economy from the red tape-induced slumber it has been in after a Lost Liberal Decade. Conservatives will introduce a ‘two-for-one’ law mandating that two regulations be repealed for every new one imposed.

A Pierre Poilievre Conservative Government will also require that for every $1 in new administrative costs, $2 must be cut elsewhere to relieve the government burden that makes it harder for Canadian businesses to compete globally. And to ensure the reductions happen, a new Conservative government will pass a law requiring the Auditor General to verify them every year.

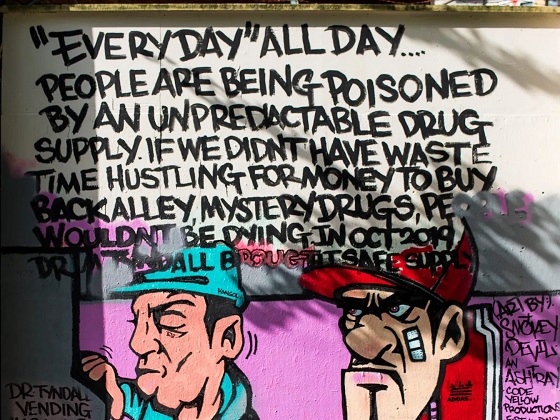

Bring Our Loved Ones Home Drug Free

We have lost 50,000 Canadians to opioid overdoses over the last decade. That’s more Canadians than died fighting in the Second World War.

Conservatives will bring our loved ones home, drug free. We will fund life saving drug treatment and recovery for 50,000 people to help them get off drugs for good.

We will fund recovery by cutting taxpayer-funded unsafe drug supply programs and suing opioid manufacturers that caused the crisis in the first place.

We will treat fentanyl traffickers like the murderers they are. Anyone caught trafficking over 40 mg of fentanyl – enough to kill 20 people – will face life in prison.

We will stop the flow of drugs with 2000 new CBSA agents, container scanners at ports, and expanded patrols using drones and surveillance towers.

One and Done

Conservatives will create a new One and Done rule for resource projects with one application, one environmental review, and a maximum one year waiting time.

Conservatives will also rapidly approve 10 new energy projects that have been stuck for years due to the Liberal’s slow federal approval process.

Some of the projects a Conservative government will work with First Nations to approve:

- LNG Canada Phase II Expansion Project (BC): Aims to double LNG output but faces power supply challenges and output limitations related to the emissions cap.

- Suncor Base Mine Extension (Alberta): Expansion of an existing mine anticipated to produce 225,000 barrels per day of bitumen froth. Under assessment with the IAAC since 2020.

- Rook 1 Uranium Mine (Saskatchewan): A development-stage uranium project expected to be a major source of low-cost uranium. Approval process started in 2019 with the Canadian Nuclear Safety Commission.

- Springpole Lake Gold (Ontario): A proposed gold and silver mine with an on-site metal mill. Under assessment with the IAAC since 2018.

- Upper Beaver Gold Mine (Ontario): A proposed underground and gold and copper mine. Under assessment with the IAAC since 2021.

- Northern Road Link (Ontario): A proposed all-season, multi-use road in northern Ontario. Under assessment with the IAAC since 2023.

- Crawford Nickel Project (Ontario): A proposed nickel-cobalt mine with an on-site metal mill. Under assessment with the IAAC since 2022.

- Troilus Gold and Copper Mine (Quebec): A proposed gold and copper mine. Under assessment with the IAAC since 2022.

- Sorel-Tracy Port Terminal (Quebec): A proposed new port terminal in the industrial-port area of Sorel-Tracy. Under assessment with the IAAC since 2022.

- Cape Ray Gold and Silver Mine (Newfoundland): A proposed gold and silver mine with a milling complex. Under assessment with the IAAC since 2017.

Crack Down on Tax Cheats

While Canadians struggle to make ends meet, Carney stashed his Brookfield funds above a bike shop in Bermuda—one of the world’s most notorious tax havens. According to KPMG, Bermuda has no capital gains tax, dividend tax, or withholding tax, making it one of the most attractive tax havens for the global rich like Carney who want to avoid the taxes they impose on the rest of us.

While Carney advised Trudeau to hike taxes on working Canadians, he made sure his company’s profits stayed offshore, beyond the reach of the CRA. These were calculated decisions to dodge Canadian taxes while the Trudeau government squeezed small businesses and middle-class families to pay for their skyrocketing spending.

Conservatives will end Carney’s two-tier tax system, where elites get loopholes and working people get audited.

- Close Carney’s offshore tax loopholes. Poilievre has already announced that he will appoint a Bring It Home Tax Task Force to make tax rules fairer, simpler and easier to administer. The same task force will also ensure that we close all the loopholes that allow companies like Brookfield to stash their money in offshore tax havens to avoid paying their fair share here in Canada.

- Redirect CRA resources away from auditing and harassing small business owners and charities towards cracking down on offshore tax havens — collecting at least $1 billion more every year from those who try to hide their wealth overseas.

- Create a name-and-shame website to expose all the wealthy multinational corporations that are dodging taxes and refusing to pay their fair share.

- Expand the Offshore Tax Informant Program, giving whistleblowers up to 20% of recovered funds when they help expose illegal tax schemes.

Three Strikes and You’re Out Law

Conservatives will stop criminals convicted of three serious offences from getting bail, probation, parole, or house arrest, and keep violent criminals behind bars longer to protect victims and our communities.

We will make sure that three-time serious criminals get a minimum prison term of 10 years and up to a life sentence. They will also be designated as Dangerous Offenders, meaning they cannot be released until they prove they are no longer a danger. The only way for these repeat serious criminals to obtain their freedom will be through spotless behaviour and clean drug tests during a lengthy minimum prison sentence, with earned release dependent on improving themselves and their life opportunities, such as by learning a trade or upgrading their education.

Cut taxes by $100,000 per home

On top of axing the sales tax on new homes, a Conservative government will incentivize municipalities to cut building taxes, for a total savings of $100,000 on an average home in Canada’s cities.

For every dollar of relief a municipality offers in development charges, a Conservative government will reimburse 50%, up to a maximum of $50,000 in savings for new homebuyers.

Put Veterans First

The Conservative plan for Veterans starts with ensuring their benefits are in place before they leave the military and will:

- Automatically approve disability applications if they are not processed within 16 weeks.

- Give Veterans full control over their medical records.

- Let military doctors assess injuries using one standardized system.

- Ensure PTSD service dogs are available to Veterans who need them, with a consistent national standard for support.

- Make the Education and Training Benefit available to Veterans immediately upon receiving their release date.

Veterans shouldn’t have to fight their own government for the benefits they earned, but right now they face endless delays and denials — waiting months or even years for disability claims. This is wrong and Conservatives will fix it.

Conservatives will prioritize Veterans for jobs in the public service, give preference to veteran-owned businesses in federal contracts, double the hiring target at Veterans Affairs and fast-track the renewal of security clearances for those who already have them and need them for a new job. We will also add spouses of Veterans and Canadian Armed Forces Members who want to work for Canada into the Veterans Hiring Act.

Conservatives will help Veterans transitioning back to civilian life by:

- Providing Veterans the documentation they need to have their skills recognized by civilian employers upon release through a red-seal system.

- Ensuring Veterans get post-secondary course credits for skills and knowledge they gained while serving in the CAF, such as credit for courses on leadership if they already have a background in leadership positions.

- Reviewing and removing clawbacks of military pensions for Veterans who get jobs, ensuring their new income is on top of their pension, not in place of it.

A new Conservative government will also make sure that our military Veterans get the recognition they deserve for putting their lives on the line, and country before self. This includes recognizing Veteran Service Cards as valid government ID nationwide. We will also immediately complete the National Monument to Canada’s Mission in Afghanistan and officially recognize Persian Gulf War veterans and their wartime service.

Accountability Act 2.0

Conservatives will strengthen the Accountability Act to end the Lost Liberal Decade of corruption and insider dealings in Ottawa. The new rules will close loopholes like the one that Mark Carney used to be appointed as an ‘unpaid advisor’ and set government policy while he lined his own pockets.

Conservatives will:

- Ban shadow lobbyists and close the Carney loophole by requiring anyone advising the government directly or indirectly, who stands to gain financially from their advice, to register as a lobbyist.

- Ban politicians from making decisions that benefit themselves or their families disproportionately, and require Ethics Commissioner approval and full public disclosure of all personal interests.

- Increase fines for ethics violations to $10,000.

- Tax transparency. Require anyone running for public office to disclose where they paid taxes for the last seven years.

- Require cabinet ministers to divest fully from tax havens and disclose assets to the Office of the Conflict of Interest Commissioner, with penalties for non-compliance. No more so-called blind trusts that only blind the public.

- Require party leaders to disclose their assets within 30 days of becoming leader and require Prime Ministers to divest their assets within 30 days of assuming office.

Consecutive Sentences for Mass Murderers

Conservatives will put victims first– for a change– by giving judges back the power to sentence mass murderers to consecutive prison sentences without parole eligibility beyond 25 years.

Conservatives will reintroduce the Protecting Canadians by Ending Sentence Discounts for Multiple Murders Act, which the Supreme Court of Canada struck down in 2022 because, in their opinion, it was too hard on mass murderers. Poilievre will restore this legislation using Section 33 of the Charter of Rights and Freedoms.

The Supreme Court’s decision resulted in the sentences of some of Canada’s most notorious killers being reduced, giving them a chance to walk free early. Alexandre Bissonnette, who shot and killed six people in an act of vile hatred in a Quebec mosque in 2017, had been sentenced to life in prison with no chance of parole for 40 years. But after the Supreme Court’s decision, Bissonnette is now eligible for release 15 years sooner.

Justin Bourque was convicted for his horrific shooting spree that killed three RCMP officers and injured two others in Moncton in 2014. The judge in his case deemed his crimes worthy of consecutive sentences with no eligibility for parole for 75 years. But after the Supreme Court’s decision, his parole eligibility was also reduced to just 25 years, which will give him the opportunity to walk free just in time for his 50th birthday.

The Supreme Court’s opinion was shockingly out of touch with the sentences the Canadian public expects for the worst killers. A new Conservative government will use its constitutional powers under the Charter of Rights and Freedoms to bring justice back to the criminal justice system and end discounts for mass murderers.

Stop Scammers – Protect Seniors

Conservatives will protect seniors by cracking down on scammers that target them. We will ensure Canadian banks and telecom companies do a better job detecting scams, alerting victims before they are scammed, and reporting and blocking suspected fraud in real-time. We will also increase fines and prison sentences for criminals who defraud vulnerable Canadians.

To do this, Conservatives will,

- Require mandatory scam detection systems for banks and cell phone companies, especially for high-risk accounts such as seniors over 65.

- Require real-time flagging and blocking of suspicious activity, including unusual or suspicious money transfers, repeated phishing text patterns, and robocall patterns—backed by heavy penalties for non-compliance.

- Create a Senior Transaction Shielding Protocol (STSP): a mandatory 24-hour transaction delay for high-risk transactions on seniors’ accounts–or on the accounts of anyone else who requests such protection–during which time a verification call and fraud check must occur.

- Mandate public reporting by banks and telcos on fraud prevention statistics, volume of scam data blocked, and customer reimbursements made.

- Impose a mandatory minimum one-year jail sentence for fraud over $5,000, three years for fraud over $100,000, five years for fraud over $1 million and minimum fines of ten times the amount defrauded.

- Impose penalties of up to $5 million per violation for willful neglect for failure to implement adequate scam prevention tools.

- Create a new Criminal Code offence of “willful blind profiteering from fraud,” targeting executives who ignore red flags and knowingly allow scam traffic or activity to continue.

Axe the Food Packaging Tax

Conservatives will stop Mark Carney’s proposed Liberal food tax and scrap the existing Liberal plastic ban. Conservatives will:

To do this, Conservatives will,

- Stop proposed new labelling and packaging requirements that will raise the cost of fresh produce by as much as 34% and cost the average Canadian household an additional $400 each year.

- Scrap the Liberal plastics ban, including the ban on straws, grocery bags, food containers and cutlery, and other single-use plastics, letting consumers and businesses choose what works for them.

- Protect restaurants, grocers, and low-income Canadians from one-size-fits-all packaging rules that disproportionately affect those who can least afford it.

This will save the average family $400 / year and up to 60,000 jobs.

Compassionate Intervention

Conservatives will give judges the power to mandate treatment for people struggling with severe addiction. This compassionate change will save lives and help people escape the destructive cycle of addiction.

Addiction robs the most vulnerable Canadians’ ability to choose recovery. We will help them take back control of their lives with care, compassion, and a commitment to bringing them home drug-free.

To do this, a new Conservative Government will:

- Allow judges to sentence offenders to mandatory treatment for addiction, giving courts the power to order treatment as an alternative to prison when people are too sick to choose it themselves and the offender’s only crimes involve small quantities of drugs for their own use and other minor non-violent infractions, where provincial legislation allows it.

- Require recovery-oriented rehabilitation in prisons, ensuring that more serious offenders struggling with addiction participate in evidence-based therapeutic living programs in prison, where such treatment is available.

- End the failed Liberal so-called “safe supply” experiment that has flooded streets with taxpayer-funded addictive opioids, keeping people hooked instead of helping them heal.

- Impose life sentences on fentanyl traffickers and criminal organizations profiting off the opioid crisis.

Under the Conservative plan, those struggling with addiction will be given a real path off the streets with safe housing, medical detox, evidence-based medication, and structured rehabilitation that helps them rebuild their lives.

Build 2.3 Million Homes

Conservatives will build 2.3 million homes over the next five years. And unlike Mark Carney, who followed the old Trudeau playbook and just plucked a number out of thin air, Conservatives have an actual plan to get it done. We will get gatekeepers out of the way to speed up homebuilding, cut taxes on homebuilding to lower costs, and free up federal land to build homes on.

Since 2015, the Liberal government has put in place costly government programs that build bureaucracy, not homes. As a result, Canada has the second-slowest building permit approval time out of 35 countries, as measured by the OECD. And when compared to the United States, Canada’s approval times are over 3x longer. Poilievre’s plan to fix this will:

- Reward cities that permit over 15% more homebuilding each year with additional federal funding, while reducing infrastructure funding proportionally for cities that miss their targets.

- Require cities to permit high-density housing around federally funded transit stations as a condition of receiving federal funding.

- Require cities to pre-permit housing as a part of getting federal funds for related roads, bridges & transit.

In Canada’s largest provinces, government taxes now make up more than 30% of the cost of a new home. The Liberals gave billions to cities with no requirement to lower housing taxes. As a result, many cities took the Liberal funds and raised taxes instead. Conservatives will axe homebuilding taxes to build more homes and bring down costs. We will:

- Axe the GST on new homes under $1.3 million, saving Canadians $65,000 on the price of a new home.

- Incentivize municipalities to cut building taxes by reimbursing municipalities with 50% of every dollar spent up to $50,000 in savings for new homebuyers.

- Axe the GST on new rental housing construction to build thousands of affordable rental units.

After three Liberal terms, the Liberal government has only marked 90 federal properties to convert to housing, even though The Globe and Mail managed to identify hundreds of unused or underutilized sites that could unlock 288,000 more homes. The federal government owns over 11,000 federal properties, many of them in prime urban locations near transit and jobs. A Conservative Government will sell these federal lands in cities to developers who will build affordable homes quickly. We will:

- Identify 15% of federal land and buildings to sell in cities within the first 100 days of a new Conservative Government.

- Work with municipalities to pre-zone that land so builders can break ground immediately.

- Prioritize home builders who will build affordable homes, especially for young Canadians priced out by the Liberals.

Poilievre also pledged that his government will fix Canada’s broken building code. After three Liberal terms, Canada’s National Model Building Code has ballooned to over 1,500 pages, loaded with costly, excessive rules that do little to improve safety but dramatically increase costs. This red tape has paralyzed homebuilding and has caused housing starts to collapse. To fix this, Conservatives will:

- Simplify the National Building Code, making it more affordable to safely build homes, while giving maximum flexibility for new materials and building methods.

- Cut red tape for builders and tradespeople, working with provinces to harmonize building code regulations.

This plan is based on real numbers and achievable reforms.

Canada started building 245,000 homes in 2024. A Poilievre government will add 36,000 more each year by axing the GST on new homes under $1.3 million, and another 25,000 by encouraging cities to lower development charges, totalling 306,000 homes in year one.

We will tie infrastructure dollars to cities permitting 15% more homes annually. More building will mean more funds—less building will mean less. We’ll also unlock at least 288,000 new homes by selling federal land, using estimates from The Globe and Mail, which reviewed only a portion of federal sites. This adds up to over 2.3 million homes built in five years.

-

conflict2 days ago

conflict2 days agoTrump tells Zelensky: Accept peace or risk ‘losing the whole country’

-

2025 Federal Election1 day ago

2025 Federal Election1 day agoPoilievre Campaigning To Build A Canadian Economic Fortress

-

Automotive1 day ago

Automotive1 day agoCanadians’ Interest in Buying an EV Falls for Third Year in a Row

-

armed forces18 hours ago

armed forces18 hours agoYet another struggling soldier says Veteran Affairs Canada offered him euthanasia

-

conflict18 hours ago

conflict18 hours agoWhy are the globalists so opposed to Trump’s efforts to make peace in Ukraine?

-

Alberta8 hours ago

Alberta8 hours agoGovernments in Alberta should spur homebuilding amid population explosion

-

Entertainment2 days ago

Entertainment2 days agoPedro Pascal launches attack on J.K. Rowling over biological sex views

-

International7 hours ago

International7 hours agoHistory in the making? Trump, Zelensky hold meeting about Ukraine war in Vatican ahead of Francis’ funeral